ID: PMRREP18490| 226 Pages | 7 Feb 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

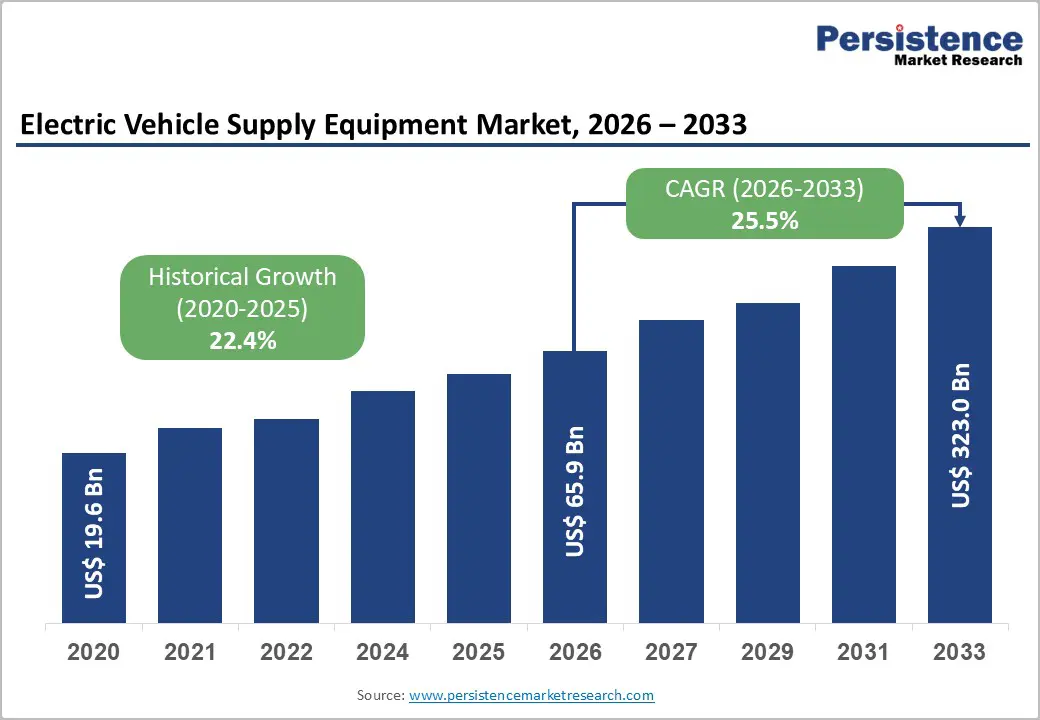

The global electric vehicle supply equipment market size is likely to be valued at US$ 65.9 billion in 2026 and is projected to reach US$ 323.0 billion by 2033, growing at a CAGR of 25.5% between 2026 and 2033.

This market expansion is driven by accelerating electric vehicle adoption, surging government investments in charging infrastructure, exceeding US$120 billion globally between 2022 and 2026, and the widespread implementation of stringent environmental regulations mandating low-global-warming-potential (GWP) refrigerants and advanced thermal management systems.

| Key Insights | Details |

|---|---|

| Electric Vehicle Supply Equipment Market Size (2026E) | US$ 65.9 Bn |

| Market Value Forecast (2033F) | US$ 323.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 25.5% |

| Historical Market Growth (CAGR 2020 to 2024) | 22.4% |

Government commitment to electric vehicle infrastructure development represents the most significant market expansion driver, with coordinated global investment initiatives fundamentally reshaping market dynamics. The United States Bipartisan Infrastructure Law allocated US$ 2.5 billion through the Charging and Fueling Infrastructure (CFI) Discretionary Grant Program and US$ 5 billion through the NEVI Formula Program, resulting in public EV charger deployment acceleration from approximately 120,000 publicly available charging ports in 2020 to over 192,000 ports by August 2024, representing approximately 60% growth supporting 1,000 new chargers deployed weekly. The Biden-Harris Administration awarded US$521 billion in grants in August 2024 alone to deploy more than 9,200 additional EV charging ports across 29 states and eight Federally Recognized Tribes, exemplifying a sustained policy commitment to prioritizing equity in rural, suburban, and urban charging networks.

Global electric vehicle adoption is accelerating, with EVSE market demand expanding and worldwide EV sales surging to 18.78 million units in 2024, representing approximately 20% of total global automotive production. Electric vehicle supply equipment development increasingly emphasizes advanced features, including intelligent charging management systems, heat pump integration, improving energy efficiency by 15-20% compared to traditional positive temperature coefficient (PTC) heaters, and sophisticated thermal management addressing battery cooling and motor heat dissipation complexities. Asia-Pacific electric vehicle penetration reached a critical mass, with China's new energy vehicle production exceeding 12 billion units in 2024, India's electric vehicle market expanding from 50,000 vehicles in 2016 to 2.08 billion vehicles in 2024, and Japan and South Korea advancing autonomous vehicle and connected mobility platforms that require specialized thermal infrastructure.

Elevated infrastructure investment requirements represent substantial market expansion constraints, with public EV charging station installation costs varying substantially between US$ 30,000 to US$ 100,000 per Level 2 charger and US$ 100,000 to US$ 300,000 per DC fast charger, depending on site-specific electrical grid capacity, construction requirements, and equipment specifications. Grid reinforcement costs associated with accommodating concentrated charging loads impose additional financial burdens, particularly in densely populated urban environments and in geographically dispersed rural regions where infrastructure deficiencies necessitate substantial utility investment. Charging infrastructure utilization rates remain suboptimal across multiple markets with Chinese charging networks including StarCharge experiencing average utilization rates substantially below 30% despite massive infrastructure deployment, creating profitability pressures undermining continued capital investment.

Infrastructure deployment imbalances create market growth constraints, with advanced markets experiencing saturated charging networks, while emerging markets confront critical infrastructure gaps limiting electric vehicle adoption acceleration. United States and United Kingdom market dynamics demonstrate concerning trends with EV population to public charger ratios deteriorating to approximately 10 electric vehicles per public charger in late 2024, up from more favorable 8 to 1 ratios in prior years, indicating infrastructure deployment lagging demand acceleration. Grid capacity constraints in multiple jurisdictions restrict charging deployment with Northern European and Scandinavian regions experiencing interconnection queue delays extending 18-36 months as utilities address electrical system limitations.

Commercial vehicle electrification represents an exceptional market opportunity with bus rapid transit programs, last-mile delivery fleet expansion, and corporate electrification commitments driving specialized heavy-duty vehicle charging equipment demand. Public transit agencies implementing electric bus procurement require depot charging systems, optimizing overnight charging protocols, and enabling rapid mid-day operational supplementation, establishing fleet charging station market segments expanding at accelerating rates exceeding 25% annually. Destination charging stations serving hotels, restaurants, retail centers, and workplace facilities represent rapidly expanding commercial application opportunities, with corporate sustainability initiatives compelling employers to prioritize employee electric vehicle adoption through convenient workplace charging access. Highway charging corridor expansion driven by EU AFIR regulation mandating fast chargers every 60 kilometers on major transport routes, and the United States pursuing distributed corridor charging deployment, creates destination charging station market opportunities with premium pricing justification based on travel convenience value proposition.

Environmental regulatory compliance and the adoption of emerging thermal management technologies represent transformative market opportunities that enable equipment manufacturers to pursue technology differentiation and premium pricing strategies. European Union's F-Gas Regulation phasing down hydrofluorocarbon (HFC) refrigerants by 2030 and United States EPA regulations mandating low-GWP alternatives including R-1234yf and CO2-based refrigerants (R-744) establish structural demand for advanced EVSE systems incorporating sophisticated refrigerant management. Microchannel condenser technology and heat pump integration, which improve thermal efficiency by 35-40% compared to traditional designs, create premium market positioning opportunities for vehicle manufacturers willing to sustain elevated equipment costs, justified by extended driving range and operational cost-reduction benefits. Smart charging infrastructure integration, incorporating artificial intelligence (AI) and Internet of Things (IoT) technologies, enables real-time performance monitoring, predictive maintenance analytics, and renewable energy integration, thereby establishing emerging software-differentiated market opportunities.

Commercial application segments include destination charging stations, highway charging stations, fleet charging stations, and bus charging stations, which command the highest growth trajectory within the electric vehicle supply equipment market, expanding at accelerating rates driven by corporate fleet electrification, public transit system conversions, and e-commerce logistics vehicle electrification. Commercial charging applications represent the fastest-growing market segment, capturing approximately 58% of emerging deployment expansion, with ride-sharing platforms, including Uber, Lyft, and regional counterparts, investing heavily in charging infrastructure supporting vehicle fleet electrification and operational range extension. Enterprise commitment to sustainability objectives and government mandates requiring fleet emission reduction compliance drives substantial commercial charging station procurement with Fortune 500 companies and logistics providers implementing workplace charging systems supporting employee vehicle adoption and corporate environmental stewardship positioning.

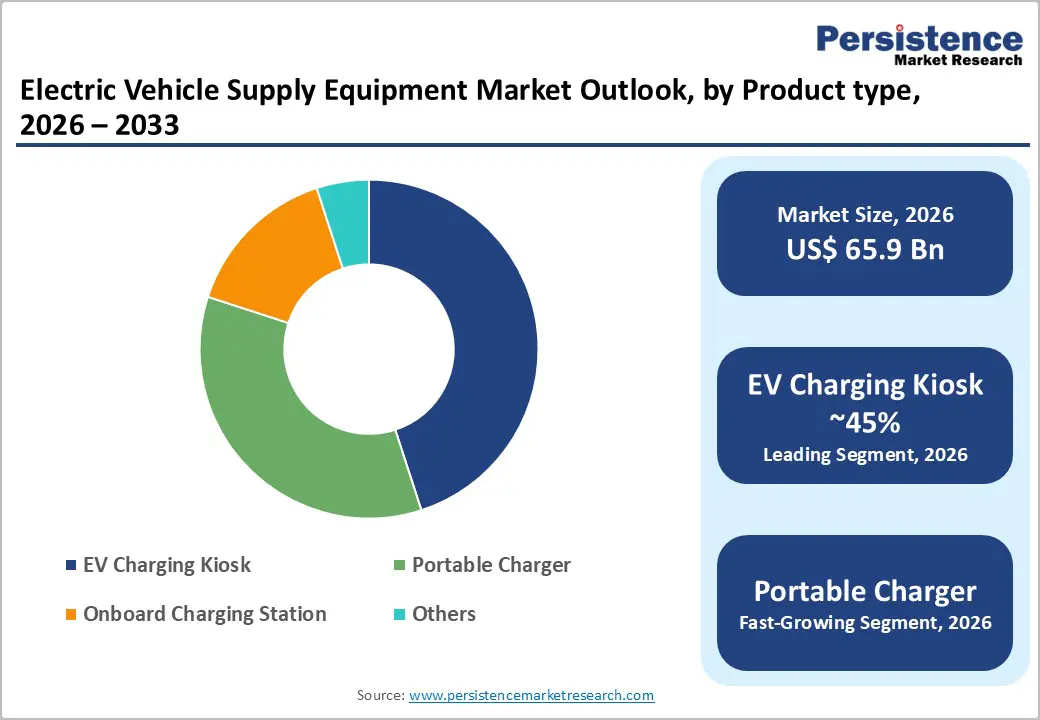

EV charging kiosk systems represent the dominant product category commanding approximately 47% of the electric vehicle supply equipment market, reflecting growing preference for self-service charging infrastructure, payment automation, and smart charging technology integration supporting user convenience and operational efficiency. EV charging kiosks incorporate radio-frequency identification (RFID) and near-field communication (NFC) technologies, enabling contactless payment capabilities, real-time charge monitoring, and remote diagnostics, supporting infrastructure operators prioritizing operational automation and customer experience optimization. Onboard charging stations capturing approximately 35% market share demonstrate accelerating adoption rates supported by city government prioritization for long-term charging station contracts and fleet operator demand for rapid-charge vehicle applications.

Normal charging systems utilizing alternating current (AC) technologies command approximately 64% of the electric vehicle supply equipment market, reflecting widespread home and workplace deployment supporting daily charging requirements with 3.7 kW to 22 kW power capabilities, enabling sufficient overnight range extension for typical commuting patterns. AC charging infrastructure dominance reflects cost-effectiveness, with Level 2 chargers representing one-third the capital investment compared to direct current (DC) fast-charging alternatives, while delivering satisfactory performance for approximately 80% of user charging scenarios. Super-charging systems utilizing DC fast-charging technologies capture approximately 28% of the market, expanding at accelerating rates supported by commercial fleet requirements, highway corridor development, and urban rapid-charging demand, with power capacities ranging from 50 kW to 350 kW, enabling approximately 20-minute charging intervals supporting extended range vehicle operations.

Level 2 charging systems dominate the electric vehicle supply equipment market, commanding approximately 61% of the aggregate market share, reflecting widespread residential and commercial deployment and supporting daily charging requirements with 3.7 kW to 22 kW operating power ratings. Level 2 charger prevalence reflects cost-effectiveness, simplified electrical infrastructure requirements, and performance sufficiency for approximately 85% of consumer charging applications with overnight charging intervals enabling convenient home and workplace implementations. Level 1 charging utilizing standard 120-volt household outlets maintains approximately 24% market representation serving emergency-use and consumer flexibility requirements despite extended charging intervals and limited power delivery capabilities.

North America maintains substantial market position driven by United States leadership in electric vehicle adoption with domestic EV sales reaching 1.4 billion vehicles in 2024 and comprehensive federal support through the Bipartisan Infrastructure Law establishing US$ 7.5 billion in total charging and alternative fueling infrastructure funding. The NEVI Formula Program deployment establishing federally funded charging corridors along designated Alternative Fuel Corridors creates structural demand for specialized highway charging stations with ultra-fast charging capabilities supporting interstate vehicle travel.

North American charging infrastructure requirements emphasize equity-focused deployment with 40% of federal funding directed to disadvantaged communities supporting underserved populations and reducing charging access disparities. Private sector participation including oil and gas companies, utility providers, and automotive manufacturers substantially augments public investment with Tesla Supercharger network commanding approximately 50% of DC fast-charging infrastructure, ChargePoint operating approximately 50,000+ charging locations, and Shell Recharge maintaining extensive deployment networks.

Europe accounts for approximately 26% of the global electric vehicle supply equipment market, with stringent environmental regulations and advanced technology adoption driving the development of sophisticated thermal management systems. The European Union's AFIR regulation mandating fast chargers every 60 kilometers on major transport routes establishes synchronized regional infrastructure deployment requirements, with member states implementing complementary national charging programs supporting policy objectives.

Leading European markets, including the Netherlands with 180,000 public charging points, Germany with 160,000 chargers, and France with 155,000 charging locations, exemplify infrastructure development sophistication supporting emerging electric vehicle adoption acceleration and competitive transportation market positioning. European Investment Bank support channeling €25 billion for charging infrastructure projects across member states and establishes enduring financial commitment supporting sustained deployment expansion.

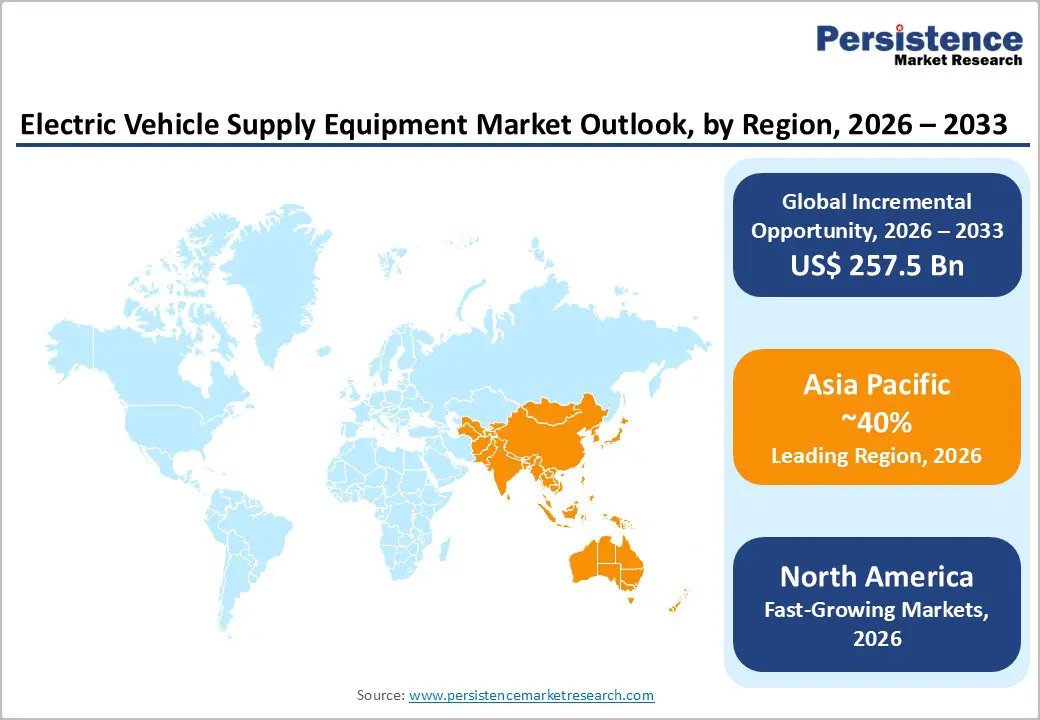

Asia-Pacific dominates the global electric vehicle supply equipment market, commanding approximately 40% of the market, driven by rapid electric vehicle adoption and systematic government infrastructure investment initiatives. China maintains regional leadership with new energy vehicle production exceeding 12 billion units in 2024 and government mandates establishing 40% electrification targets by 2033, creating massive equipment procurement demand supporting regional supplier dominance.

India's emerging electric vehicle market, which grew from 50,000 vehicles in 2016 to 2.08 million in 2024, presents exceptional growth opportunities, supported by government charging infrastructure mandates and Ministry of Power initiatives that drive residential and commercial charging deployment. Japan and South Korea advance technology differentiation with advanced thermal management systems, wireless charging integration, and smart charging technologies supporting autonomous vehicle and connected mobility platforms establishing regional competitiveness.

The electric vehicle supply equipment market exhibits significant consolidation among global manufacturers including Tesla, Siemens AG, Schneider Electric, ABB Ltd, Delta Electronics, Eaton Corporation, ChargePoint Holdings, and BP Chargemaster collectively commanding substantial market share through comprehensive charging solution portfolios, established commercial relationships, and continuous innovation emphasis.

Market leaders pursue expansion through strategic partnerships with automotive manufacturers, utility providers, and fleet operators, integration of artificial intelligence and Internet of Things technologies enabling predictive maintenance and real-time optimization, and research initiatives advancing thermal management innovation supporting electric vehicle performance enhancement.

The global electric vehicle supply equipment market was valued at US$ 65.9 billion in 2026 and is projected to reach US$ 323.0 billion by 2033, representing a 25.5% CAGR expansion through the forecast period.

Primary growth drivers include unprecedented government charging infrastructure investment initiatives including the United States' Bipartisan Infrastructure Law allocating US$ 7.5 billion, European Union's €25 billion European Investment Bank support, and China's systematic government procurement supporting structural market expansion.

Commercial destination charging stations dominate approximately 58% market share expansion driven by corporate fleet electrification, hospitality industry charging amenity prioritization, and retail sector customer experience enhancement initiatives.

Asia Pacific maintains market dominance with approximately 40% global market share driven by China's new energy vehicle production exceeding 12 billion units in 2024, government infrastructure mandates establishing 40% electrification targets by 2033, and India's emerging electric vehicle market expanding from 50,000 vehicles in 2016 to 2.08 billion vehicles in 2024.

Market leaders include Tesla Inc., Siemens AG, ChargePoint Holdings, and Schneider Electric emphasizing interoperability standards and cybersecurity integration.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Application

By Product Type

By Charging Station Type

By Charging Type

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author