ID: PMRREP35849| 193 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

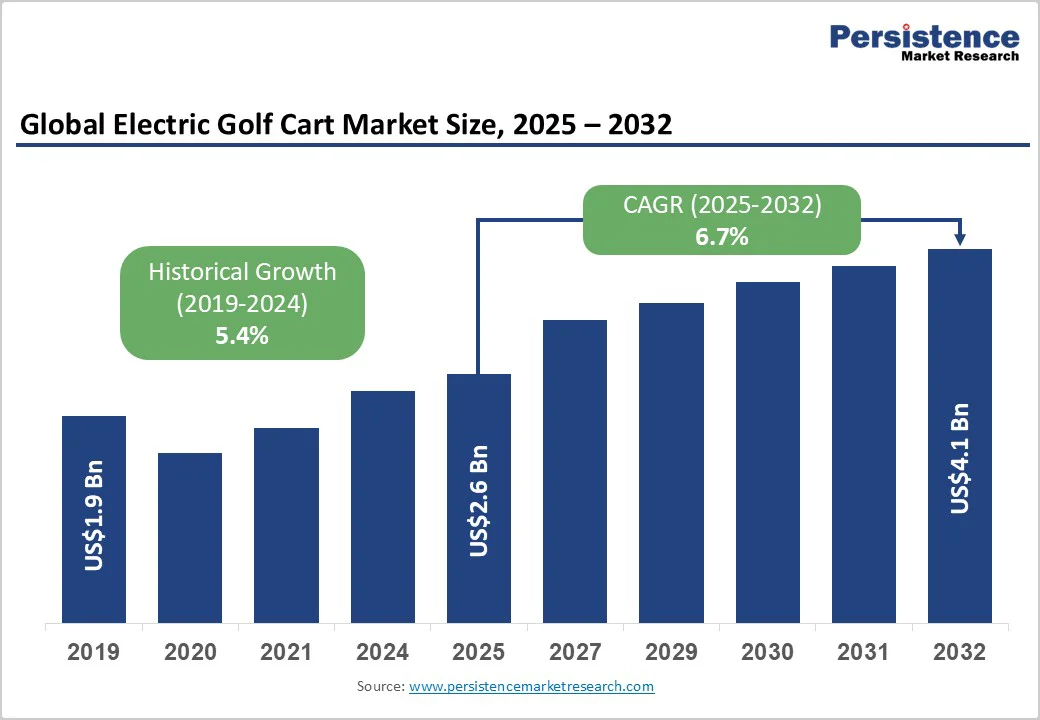

The electric golf cart market size is likely to be valued at US$2.6 billion in 2025. It is estimated to reach US$4.1 billion in 2032, growing at a CAGR of 6.7% during the forecast period 2025 - 2032, boosted by the global shift toward clean mobility, which is supported by developments in battery technology and sustainable tourism practices.

| Key Insights | Details |

|---|---|

| Electric Golf Cart Market Size (2025E) | US$2.6 Bn |

| Market Value Forecast (2032F) | US$4.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 6.7% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.4% |

Resorts, hotels, and tourist attractions are constantly shifting to electric golf carts to improve visitor comfort while meeting sustainability goals. These carts are widely used for guest transfers, guided tours, and luggage movement in large hospitality premises. Destinations such as Bali, Dubai, and the Maldives have adopted electric fleets for eco-tourism initiatives, replacing conventional petrol vehicles.

For instance, several luxury resorts in the Maldives, such as Soneva Fushi, now operate fully electric cart fleets powered by solar energy. The tourism industry’s rising emphasis on green operations and quiet mobility has made electric carts a preferred choice for both luxury and eco-friendly travel experiences.

Electric golf carts are increasingly becoming a preferred mode of mobility within gated townships, senior living communities, and large residential complexes. Residents value them for their quiet operation, low maintenance, and suitability for short-distance travel. Developers are also promoting electric carts as part of eco-friendly infrastructure, providing dedicated charging spots and parking zones.

In Florida’s The Villages, residents commonly use electric carts for local errands and community commuting. The trend is further supported by the rising popularity of Neighborhood Electric Vehicles (NEVs) in the U.S., where cities are allowing limited on-road use, making electric carts a practical and sustainable alternative for daily mobility.

One of the main challenges for electric golf carts is their restricted travel range, which depends heavily on battery capacity. Most models can cover only 15 to 50 miles per charge, which limits their use for long routes or extended operations in resorts and industrial areas. This issue becomes more prominent in aging fleets still using lead-acid batteries, which drain faster and require long charging times.

Although lithium-ion upgrades deliver better endurance, their high cost deters widespread adoption. For instance, various U.S. resorts using aging fleets have to maintain backup carts to ensure continuous service, reflecting how a limited range can affect operational efficiency.

Electric golf carts often struggle with power loss when climbing steep slopes or carrying heavy passengers and cargo. Their torque output can decline noticeably on hilly golf courses or rugged industrial sites, reducing speed and efficiency. This makes them less suitable for uneven terrains or areas requiring frequent uphill travel.

For example, in hilly resorts across Bali and Himachal Pradesh, operators report requiring specialized high-torque or dual-motor variants to maintain consistent performance. Such limitations increase operational costs and narrow the range of environments where standard electric carts can function effectively.

The integration of GPS and IoT technologies is opening new avenues for electric golf cart manufacturers and fleet operators. Smart tracking systems enable real-time monitoring of location, battery status, and performance, helping operators improve efficiency and reduce downtime. These features are mainly valuable for golf courses, resorts, and airports managing large fleets.

For instance, Club Car’s Connected platform allows remote diagnostics and predictive maintenance, reducing unexpected breakdowns. Fleet managers can also use geofencing to restrict cart movement to specific areas, improving safety and asset control. As smart mobility becomes mainstream, such digital integrations are anticipated to redefine how electric carts are operated and maintained.

The addition of touchscreen interfaces and digital dashboards is transforming electric golf carts into more engaging and user-friendly vehicles. Modern models now include infotainment systems, navigation tools, and branding options customized for clubs or corporate fleets. For example, E-Z-GO’s newer cart series includes high-definition displays that show course maps, score tracking, and sponsor logos during tournaments.

Sports venues and resorts are extensively using these interactive systems to improve guest experience and create branding opportunities. This technological personalization not only improves user convenience but also adds value for businesses looking to merge luxury with digital engagement.

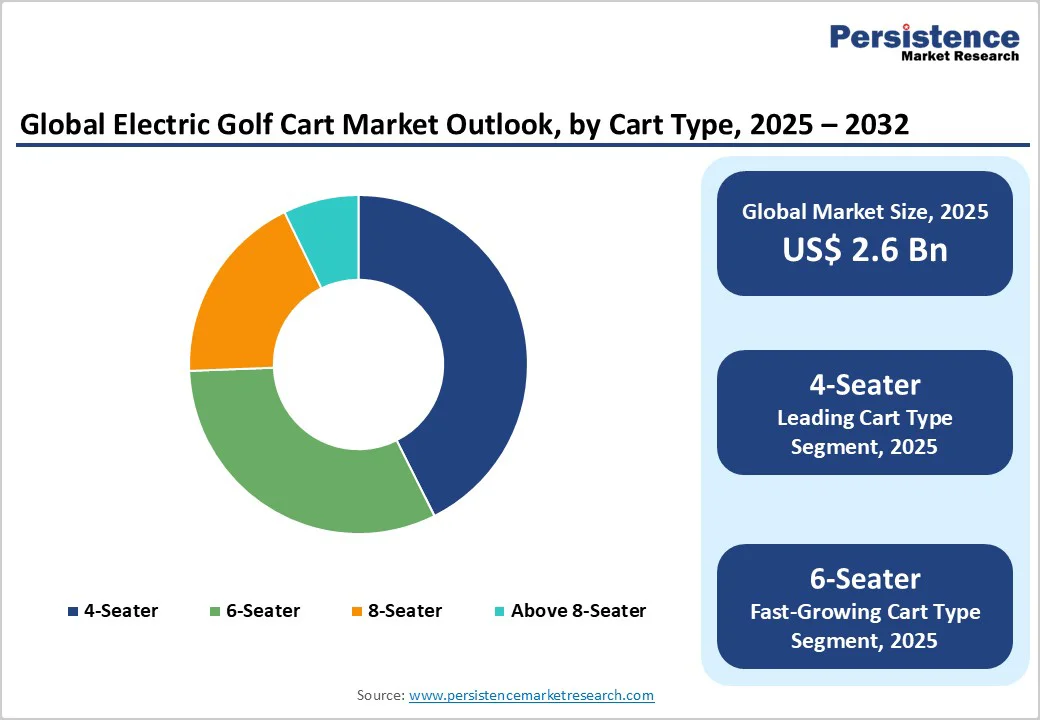

Four-seater golf carts are speculated to capture around 42.6% of the market share in 2025, as they deliver the ideal balance between capacity and maneuverability. They comfortably accommodate small groups such as families, golf buddies, or resort guests, while remaining compact enough to navigate narrow golf paths or residential lanes.

Various retirement communities and resorts in the U.S. and Thailand now rely on 4-seater electric carts for daily transport. Manufacturers, including Yamaha and Club Car, have also introduced lithium-powered 4-seater models with extended range and smooth acceleration, making them popular for leisure and short-distance commuting.

Six-seater models are seeing steady demand, especially in tourism and hospitality sectors where group transport is frequent. Resorts in Southeast Asia and the Middle East use them for shuttling guests across large properties, while airports and event venues prefer them for internal logistics.

The rising trend of corporate campuses and smart industrial zones has further boosted their use for employee movement. For instance, large facilities, including India’s Infosys campuses and Dubai Expo pavilions, employed multi-seater carts for staff transport.

Rented golf carts are poised to account for nearly 71.2% of the share in 2025, as they reduce maintenance responsibilities and upfront costs. Golf courses, resorts, and event organizers typically lease carts in bulk to meet seasonal or short-term demand.

Rental fleets can also be upgraded easily to the latest models, helping operators access the new lithium-ion or connected carts without major capital investment. In tourist destinations such as Florida, Bali, and Phuket, electric golf cart rentals have also become a popular eco-friendly travel option for visitors exploring local attractions.

Fully owned golf carts are gaining traction as their applications expand beyond golf courses. Homeowners in gated communities, security agencies, and universities are increasingly purchasing carts for daily use. The low running costs of electric models and improvements in battery life make ownership more economical in the long run.

Some buyers are also personalizing carts with luxury interiors or solar charging kits, turning them into lifestyle accessories. The rise of street-legal neighborhood Electric Vehicles (NEVs) in the U.S. and Europe has further encouraged private ownership among residents seeking short-distance, zero-emission transport.

Golf courses continue to be the leading application with approximately 39.3% of share in 2025 as carts remain an integral part of the golfing experience. Modern golf courses are investing in electric fleets to reduce noise, improve efficiency, and comply with sustainability goals.

Fleet operators are also adopting GPS-enabled carts that allow players to track distance, pace of play, and order refreshments mid-game. Prestigious clubs such as Pebble Beach and St Andrews have upgraded to lithium-powered fleets to improve reliability and reduce downtime, reinforcing their reliance on electric mobility for player convenience.

Industrial applications are becoming a key growth area for golf carts as factories, warehouses, and manufacturing plants adopt them for in-facility transport. They are used to move workers, tools, and light cargo across large sites efficiently without emissions or noise.

The shift toward electric mobility in industrial operations is supported by companies seeking green logistics solutions. For instance, Tesla’s Gigafactory and Tata Motors’ Pune facility use electric carts for internal mobility and parts movement. Their low maintenance, customizable design, and adaptability for towing make them ideal for industrial use cases.

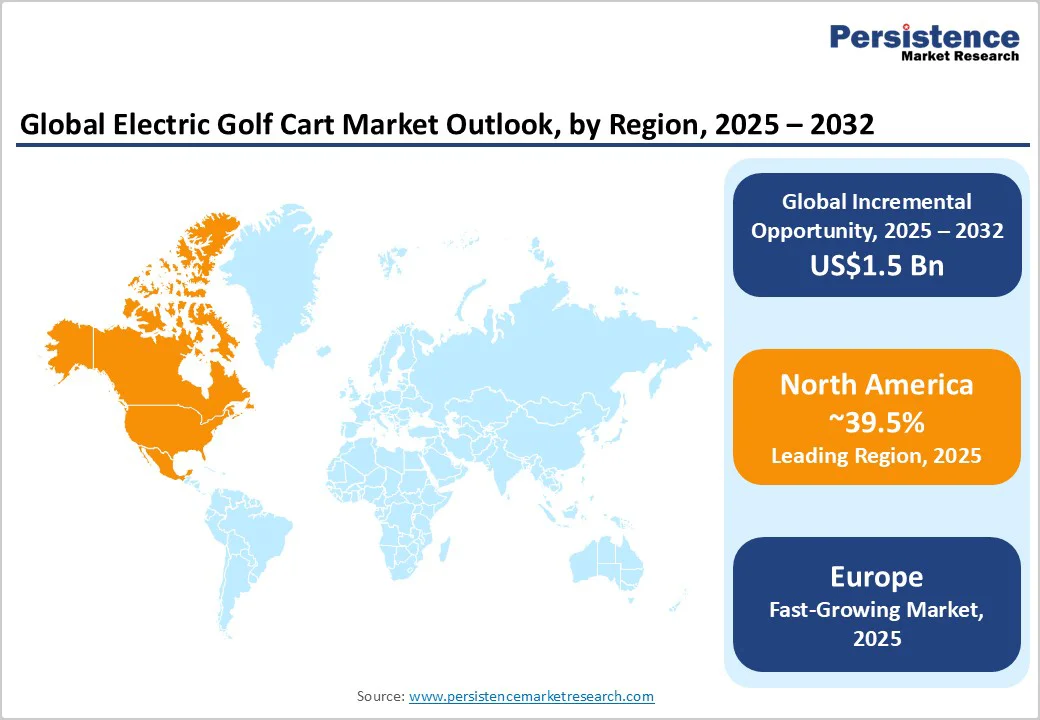

In 2025, North America is predicted to account for approximately 39.5% of the share, as electric golf carts have become the preferred choice across golf courses, gated communities, and commercial areas. The region’s emphasis on sustainability and emission reduction has accelerated the shift from gas-powered to electric models. Lithium-ion carts are gaining immense popularity due to long battery life, fast charging, and low maintenance costs.

The U.S. remains the prominent adopter, with electric carts now being common in retirement communities and college campuses where low-speed mobility is essential. Leading brands such as Club Car and E-Z-GO are focusing on telematics and connected fleet systems to strengthen their hold in the market. In addition, several municipalities in Florida and Arizona have begun allowing golf carts on public roads under local ordinances, extending their use beyond traditional golf settings.

In Europe, electric golf carts are being extensively used beyond golf courses, finding applications in resorts, airports, and business parks. Strict emission norms under the EU’s Green Deal and rising eco-tourism have pushed resorts and leisure destinations to adopt battery-powered models. Countries such as Germany, Spain, and the U.K. are seeing high demand for street-legal low-speed vehicles that can be used in mixed-traffic environments.

Luxury electric cart makers such as Denmark-based Garia are gaining popularity among high-end golf resorts and private estates due to their stylish designs and compliance with EU safety standards. The trend toward lithium battery adoption is also visible here, as modern buyers prioritize energy efficiency and reduced carbon footprints in their mobility solutions.

Asia Pacific is witnessing ongoing expansion in electric golf cart adoption, mainly pushed by tourism growth and infrastructure development. China, India, Thailand, and Japan are using these carts not only on golf courses but also in smart cities, tech parks, and airport terminals. In China, local manufacturers such as Marshell Electric Vehicle and Lvtong Electric Vehicle are leading development with affordable lithium-based models and solar charging options.

India’s Kinetic Green has also entered the premium segment through its collaboration with Tonino Lamborghini, introducing luxury electric carts for resorts and export markets. Despite considerable growth, challenges such as limited charging infrastructure and inconsistent regulations on low-speed electric vehicles still affect widespread adoption across emerging economies in Asia Pacific.

The electric golf cart market is highly competitive, with leading players such as Club Car, Yamaha, and E-Z-GO dominating the global space. These brands have superior dealer networks, novel product lines, and long-term contracts with golf courses, resorts, and communities.

However, the market has recently seen the rise of small-scale manufacturers and start-ups focusing on customized and affordable carts. Companies such as Garia (Denmark) and Marshell Electric Vehicle (China) are gaining traction with luxury and utility-focused designs.

The electric golf cart market is projected to reach US$2.6 Billion in 2025.

Increasing demand for eco-friendly transport in golf courses and a shift toward lithium-ion batteries are the key market drivers.

The electric golf cart market is poised to witness a CAGR of 6.7% from 2025 to 2032.

The integration of IoT-based fleet management and demand for touchscreen-enabled customization are the key market opportunities.

Textron Specialized Vehicles Inc., Xiamen Dalle Electric Car Co., Ltd., and Cruise Car, Inc. are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Cart Type

By Ownership

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author