ID: PMRREP36166| 200 Pages | 17 Feb 2026 | Format: PDF, Excel, PPT* | Packaging

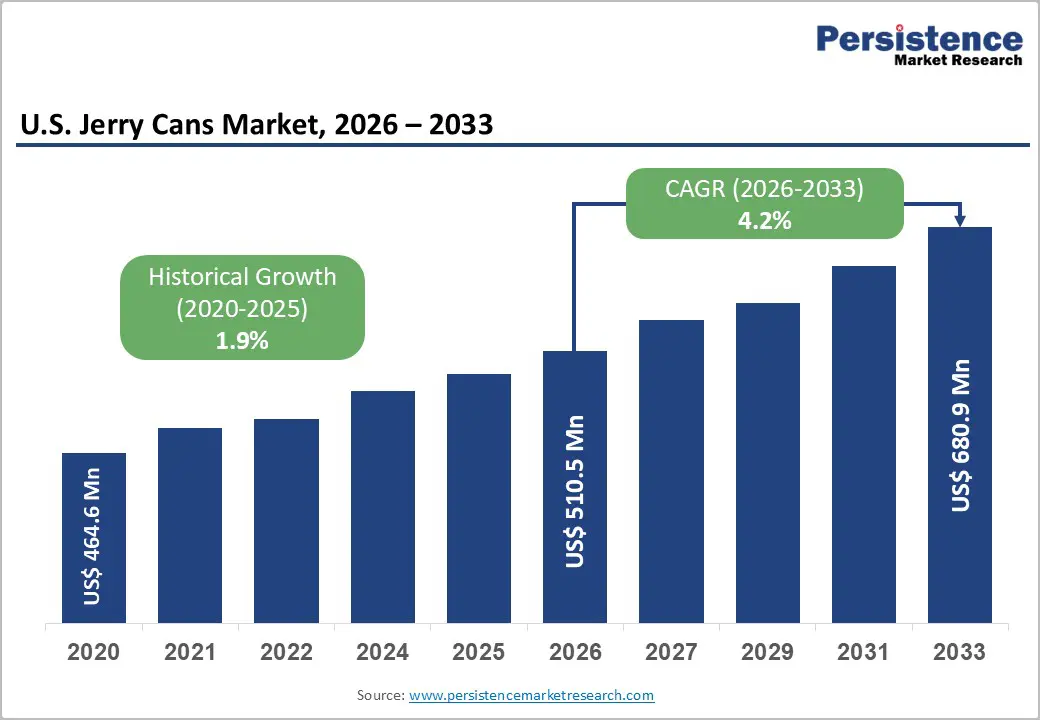

The U.S. jerry cans market size is likely to be valued at US$510.5 million in 2026 and is expected to reach US$680.9 million by 2033, growing at a CAGR of 4.2% during the forecast period from 2026 to 2033, driven by rising demand for safe and durable liquid storage solutions across chemicals, petroleum, food processing, and agrochemical industries, the U.S. Jerry Cans market continues to expand steadily.

Jerry cans, primarily manufactured from high-density polyethylene (HDPE) and steel, are widely used for transporting hazardous and non-hazardous liquids due to their leak-proof design, chemical resistance, and regulatory compliance standards. Growth is supported by stringent U.S. packaging and hazardous material handling regulations, which encourage the adoption of UN-certified containers. Expanding industrial production, increasing fuel storage requirements, and the shift toward lightweight, recyclable packaging formats remain key factors shaping market dynamics.

| Key Insights | Details |

|---|---|

| U.S. Jerry Cans Market Size (2026E) | US$510.5 Mn |

| Market Value Forecast (2033F) | US$680.9 Mn |

| Projected Growth (CAGR 2026 to 2033) | 4.2% |

| Historical Market Growth (CAGR 2020 to 2025) | 1.9% |

Rising enforcement of UN-rated hazardous material packaging compliance in the U.S. industrial chemicals supply chain is significantly strengthening demand for high-performance jerry cans. Chemical manufacturers, lubricant blenders, and agrochemical distributors increasingly require UN-certified HDPE jerry cans for corrosive liquid transport, particularly for Class 3 and Class 8 substances. The growing movement of specialty chemicals within domestic logistics networks has elevated the need for impact-resistant, leak-proof, and stack-optimized designs that meet Department of Transportation (DOT) packaging standards. Manufacturers are responding with multi-layer extrusion technologies that improve barrier protection against solvent permeation, thereby extending product integrity during long-haul transportation.

Expansion in portable fuel storage for construction sites, disaster preparedness, and recreational off-grid applications is creating a distinct demand cycle within the U.S. Jerry Cans market. Growth in outdoor power equipment usage, remote infrastructure projects, and emergency backup fuel storage has accelerated procurement of CARB-compliant spill-proof fuel jerry cans designed to reduce vapor emissions and environmental risk. Regulatory emphasis on evaporative emission control systems, particularly in states such as California, has pushed suppliers to innovate with flame-mitigation devices and child-resistant closures. For example, several U.S. construction contractors have standardized UN-certified HDPE fuel jerry cans across mobile equipment fleets to ensure regulatory compliance while improving on-site fuel handling efficiency.

Ongoing HDPE resin price volatility linked to North American petrochemical feedstock cycles is creating margin instability for U.S. jerry can manufacturers. Most rigid jerry cans rely on blow-molded high-density polyethylene; fluctuations in ethylene and natural gas derivatives directly affect input economics and production planning. Sudden swings in spot polyethylene contract pricing for industrial packaging applications complicate long-term supply agreements with chemical and lubricant customers. Smaller converters, in particular, face difficulty maintaining consistent pricing structures while absorbing short-term procurement shocks, which limits capacity expansion and product innovation cycles.

Shifting buyer preferences toward intermediate bulk containers (IBCs) for bulk liquid logistics, flexible industrial liquid packaging systems, and returnable drum alternatives are gradually reducing volume growth in certain end-use categories. Large chemical distributors and agrochemical suppliers increasingly optimize freight efficiency through higher-capacity formats that lower per-unit transportation and storage costs. In parallel, sustainability-focused procurement teams are evaluating reusable closed-loop packaging models for industrial liquids, which can reduce single-use container turnover. This transition pressures traditional 5-20 liter jerry can demand in high-volume industrial supply chains, particularly where reverse logistics infrastructure is already established.

Rising adoption of post-consumer recycled (PCR) HDPE jerry cans in industrial liquid packaging is opening a high-value growth segment in the U.S. market. Large chemical manufacturers, lubricant brands, and agrochemical suppliers are actively seeking sustainable rigid plastic containers with certified recycled content to meet internal carbon reduction and packaging circularity targets. Demand is particularly strong for multi-layer blow-molded jerry cans with recycled outer layers and virgin inner barriers, ensuring chemical compatibility while reducing overall resin intensity. This creates opportunities for manufacturers that can balance structural performance with environmental positioning. For instance, several U.S.-based lubricant suppliers have begun transitioning select SKUs to PCR-content jerry cans to strengthen ESG disclosures without altering their hazardous material compliance standards.

Integration of smart traceability features in industrial liquid storage containers represents another emerging opportunity. Industrial buyers are increasingly exploring RFID-enabled jerry cans for chemical inventory tracking, along with tamper-evident closures and serialized labeling to improve accountability across distributed supply chains. This is particularly relevant in sectors handling specialty chemicals, fuel additives, and high-value formulations where loss prevention and batch traceability are critical. Manufacturers that incorporate digitally trackable packaging components within UN-certified jerry cans can differentiate their offerings by supporting automated warehouse management and real-time logistics visibility, strengthening long-term supplier relationships in complex industrial environments.

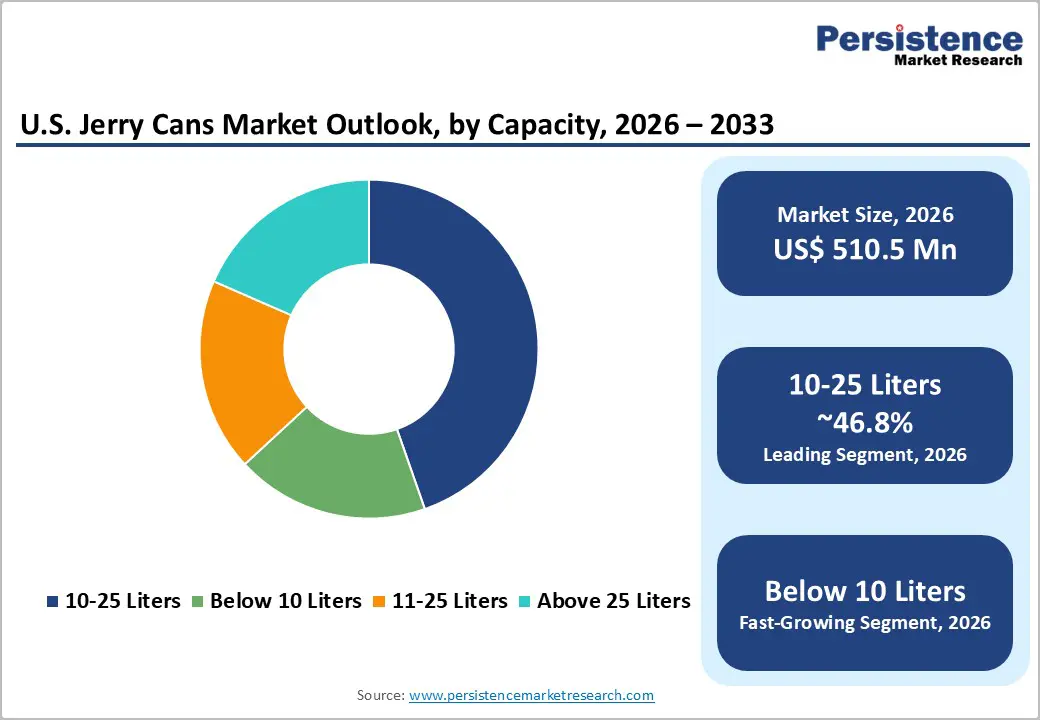

The 10-25 liter capacity range captures the largest share of the market, holding approximately 46.8% of the market share. This segment’s dominance stems from its strong alignment with industrial and commercial liquid handling requirements, particularly in sectors such as chemical processing, lubricant distribution, and construction site operations. Containers in this size are large enough to minimize frequent refilling while still being manageable for manual handling and transport, which is critical for workplace safety protocols and compliance with material handling guidelines. The balance between capacity and portability makes this size a preferred choice for the storage of substances like hydraulic fluids, industrial cleaners, and fuel additives. A practical example of this segment’s prominence can be seen in regional chemical distributors that standardize 20-liter HDPE jerry cans across their supply networks to simplify logistics, reduce SKU complexity, and ensure compatibility with common spill containment and palletization equipment. The result is a scale advantage that reinforces this capacity segment’s leadership.

The below 10-liter capacity segment is currently the fastest-growing, with an estimated 4.5% CAGR over the forecast period. Growth here is driven by expanding retail and household demand, as well as increasing use in specialized industrial applications where smaller volumes are more efficient and cost-effective. Categories such as specialty cleaning chemicals, consumer fuels for gardening equipment, and portable water containers are all contributing to heightened preference for sub-10-liter jerry cans. This segment’s growth is further accelerated by urban end users and small businesses that require safe, compliant storage without the logistical burden of larger containers. For example, maintenance contractors often source 5-liter spill-resistant jerry cans for on-site equipment servicing and smaller fuel deliveries, supporting both operational agility and safety standards.

Plastic jerry cans, predominantly manufactured from high-density polyethylene (HDPE), hold the largest share of 74.6% in the U.S. market due to a combination of performance, cost, and regulatory suitability. Their dominance arises from lightweight construction, excellent chemical resistance, and strong suitability for bulk manufacturing. HDPE jerry cans are inherently resistant to a wide range of industrial substances, ranging from mild detergents to corrosive solvents, without requiring inner coatings or liners, reducing both production complexity and cost. Their comparatively low weight improves transport efficiencies and reduces fuel consumption when shipped in bulk, a factor that appeals strongly to logistics managers. The widespread preference for HDPE is evident in industries such as auto care and industrial fluid suppliers, where standardized plastic jerry cans are used to package and distribute products like engine coolant and heavy-duty degreasers. These containers seamlessly integrate with automated filling lines and pallet racking systems, reinforcing their market leadership.

Plastic jerry cans continue to register the highest growth, outpacing metal alternatives. This rapid expansion reflects the escalating demand for recyclable content packaging and the continuous innovation in HDPE resin formulations that enhance impact performance and barrier resistance. Purchasers are increasingly selecting multi-layer and high-molecular-weight HDPE constructions that support extended shelf life for aggressive formulas while also contributing to sustainability goals, such as recycled content procurement targets. An example in practice involves major lubricant manufacturers adopting PCR-enriched HDPE jerry cans with redesigned ergonomic grips that facilitate easier handling on service bays. These newer plastic designs often outperform metal containers in corrosion resistance and lifecycle cost, while also aligning with corporate environmental commitments.

The U.S. jerry cans market is moderately concentrated, with a mix of established industrial packaging specialists and niche innovators shaping competitive dynamics. Leading players such as Scepter Manufacturing, Eagle Manufacturing Company, Rotomolded Products Inc., and Schutz Container Systems collectively command a significant share of industry shipments through strong HDPE product portfolios, specialized spill-proof designs, and deep distribution networks across industrial, agricultural, and consumer channels. These incumbents compete on material performance, regulatory compliance, and targeted solutions, while mid-tier firms like Chase Plastics and Mauser Packaging Solutions are expanding into emerging segments such as outdoor recreational and customizable industrial containers. The market’s competitive strategies emphasize product differentiation, sustainability initiatives, and operational scale, which influence market positioning and growth prospects.

The U.S. jerry cans market is estimated to be valued at US$510.5 million in 2026.

The U.S. jerry cans market is projected to reach US$680.9 million by 2033.

Key trends include rising adoption of PCR-based HDPE jerry cans, growing demand for 10-25 liter industrial packaging formats, increasing use of spill-proof CARB-compliant fuel containers, and integration of traceability-enhanced packaging for chemical logistics.

By capacity, the 10-25 liter segment leads the market with approximately 46.8% share, driven by its broad commercial and industrial utility. By material, plastic (HDPE) dominates due to lightweight structure, chemical resistance, and operational efficiency.

The U.S. jerry cans market is projected to grow at a 4.2% CAGR from 2026 to 2033.

Major companies include Mauser Packaging Solutions, Greif, Inc., Berry Global Inc., Schütz GmbH & Co. KGaA, and Time Technoplast Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn/Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Capacity

By Material

By End-user

By Zone

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author