ID: PMRREP34404| 197 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

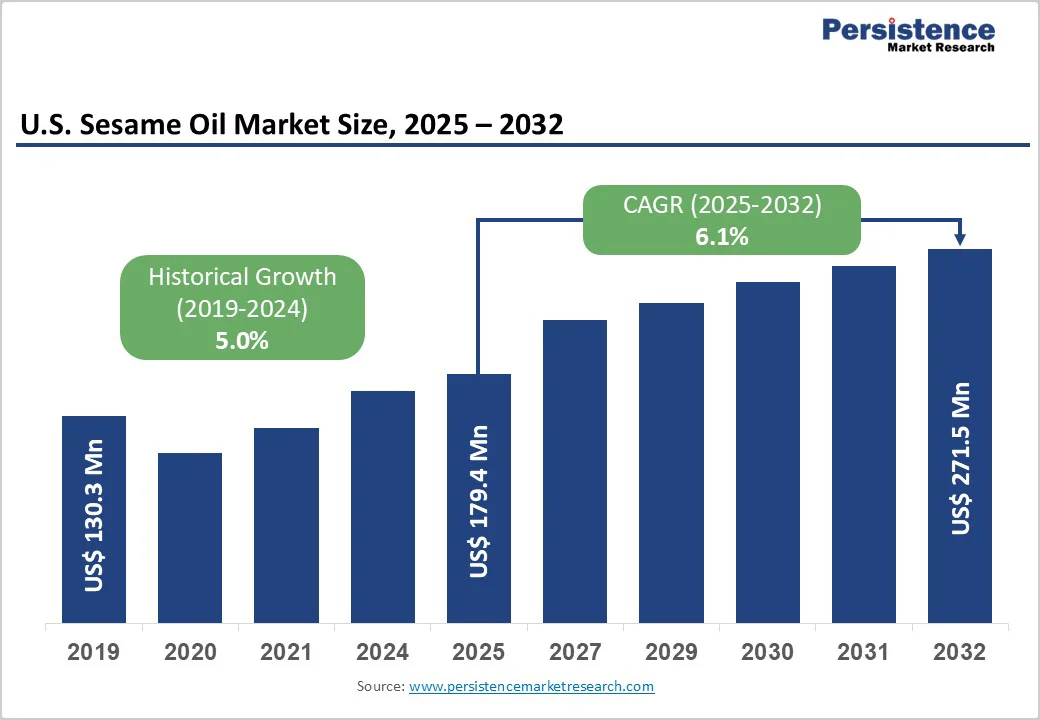

The U.S. sesame oil market size is likely to be valued at US$179.4 Million in 2025 and is expected to reach US$271.5 Million by 2032, growing at a CAGR of 6.1% during the forecast period from 2025 to 2032, driven by rising demand for natural, healthy cooking oils and increasing adoption in gourmet and Asian cuisines.

Consumers are shifting toward cold-pressed, organic, and unrefined variants for their nutritional benefits. Expanding retail availability, clean-label trends, and health-conscious lifestyles are further propelling market growth.

| Key Insights | Details |

|---|---|

| U.S. Sesame Oil Market Size (2025E) | US$179.4 Mn |

| Market Value Forecast (2032F) | US$271.5 Mn |

| Projected Growth (CAGR 2025 to 2032) | 6.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.0% |

As more U.S. consumers focus on dietary quality and healthful fats, the demand for oils with favorable fatty-acid profiles is increasing. For example, the United States Department of Agriculture (USDA) acknowledges that vegetable oils available for consumption serve as one of the main indicators for changing fat and oil use in the U.S. food supply.

Specific to sesame oil, research from the Oklahoma State University highlights that sesame seed oil contains ~40 %-50% linoleic acid (a polyunsaturated essential fatty acid) and ~33-44% oleic acid (a monounsaturated fatty acid), both considered “healthier” fat types.

As more people aim to reduce saturated fat, avoid overly processed oils, and seek oils with natural extraction (cold-pressed) or rich in good fats, they are shifting their buying patterns. That means the sesame oil segment benefits as it aligns with this “better-fat” trend. The combination of dietary guidance (USDA recommending more unsaturated fats) and the nutritional profile of sesame oil together drives the upward momentum in its market demand.

The raw material cost for sesame oil production is highly exposed to the volatility of sesame seed prices, a significant restraint for the market. For instance, import price data show that the price of sesame seeds into India ranged from about US$1.50 to US$2.35 per kg in 2023 and 2024, reflecting wide fluctuations.

In the U.S., export-price data for sesame seeds show an average of about US$1,910 per metric ton (≈ US$1.91/kg) in May 2025, having risen 5.3% from the previous month and with a strong monthly jump of 11% in February 2025.

These swings in seed costs make the downstream oil industry vulnerable; producers of sesame oil face margin pressure when seed prices spike and may hesitate to invest when they anticipate instability. This unpredictability complicates budgeting, pricing strategies, and securing a consistent supply for oil processing.

The expansion of plant-based and vegan foods offers a significant opportunity for the sesame oil market, as oils derived from seeds are increasingly used in plant-based formulations. In the U.S., retail sales of plant-based foods reached US$8 Billion in 2022, up 6.6% from the previous year. By 2021, about 62% of U.S. households were purchasing plant-based foods.

Oils such as sesame, being plant-derived, high in healthy unsaturated fats, and suitable for vegan/clean-label positioning, align well with this trend. As companies develop more plant-based sauces, dressings, and meal components, the demand for specialty oils such as sesame is likely to rise.

From a supply-chain perspective, sesame oil’s “plant-based” credentials make it a strategic ingredient in vegan product innovation, enabling producers and retailers to capture a growing health- and sustainability-oriented consumer segment.

Refined sesame oil is anticipated to lead the market with 73.4% share in 2025, as it offers distinct functional advantages for large-scale food manufacturing and high-heat cooking. Unlike unrefined varieties, refined sesame oil has a significantly higher smoke point (~450°F or ~232°C), making it more suitable for frying, deep-frying, and industrial food processing.

The refining process removes impurities and stabilizes the oil, giving it a longer shelf life and more neutral taste and color attributes favored by food service, snack makers, and restaurant kitchens. These properties make refined sesame oil the preferred product type.

White sesame oil dominates the sesame oil market due to its mild flavor, light color, and high suitability for diverse culinary and industrial uses. According to the USDA Plant Guide, white sesame seeds are preferred for oil extraction because they contain fewer hulls and yield cleaner, lighter oil ideal for cooking and food manufacturing.

Their neutral taste makes them widely used in processed foods, snacks, and salad dressings. Data from NCDEX (India) show that natural whitish sesame seeds account for nearly 75% of total oilseed use, highlighting their dominance in global supply chains. These seeds also provide higher extraction efficiency and consistent quality, making white sesame oil the preferred source for both commercial and household applications.

The U.S. sesame oil market is competitive, led by players such as La Tourangelle, Kadoya, Eden Foods, Aromaland, and ADM. These companies focus on product purity, sustainable sourcing, cold-press technology, and premium packaging, while emerging brands emphasize affordability, organic certification, flavor innovation, and e-commerce expansion to target both retail consumers and foodservice industries.

The U.S. sesame oil market is projected to be valued at US$179.4 Million in 2025.

Rising cardiac arrests, aging population, EMS adoption, technological advancements, and regulatory support drive the U.S. Sesame Oil market growth.

The U.S. sesame oil market is poised to witness a CAGR of 6.1% between 2025 and 2032.

Integration with monitoring systems, portable devices, AI feedback, non-hospital deployment, and enhanced training programs offer growth opportunities.

The key players in the U.S. sesame oil market include SIO-ADM, Chee Seng Oil Factory Pte Ltd., Aromaland, Kadoya Sesame Mills Incorporated, La Tourangelle, and Eden Organic.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Power Source

By Distribution Channel

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author