ID: PMRREP13234| 229 Pages | 21 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

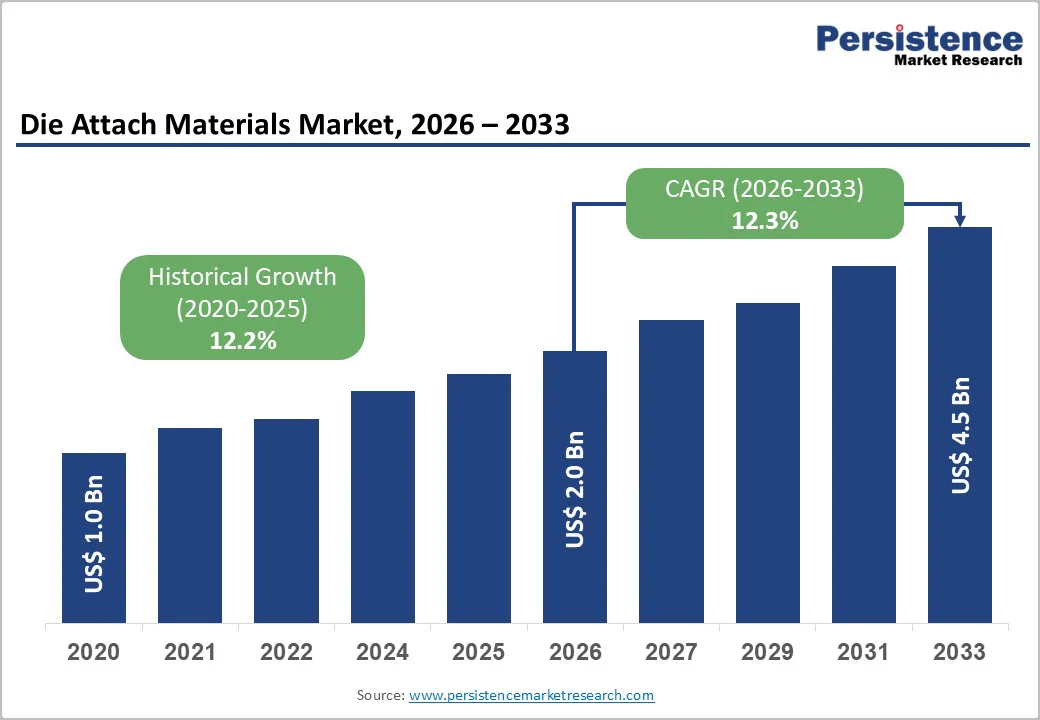

The global die attach materials market size is likely to be valued at US$ 2.0 billion in 2026, and is projected to reach US$ 4.5 billion by 2033, growing at a CAGR of 12.3% during the forecast period 2026-2033. This trajectory aligns with rising semiconductor packaging volumes, as well as growing requirements for high-reliability electronics in segments such as automotive, industrial automation, and power management. As device architectures become more complex, die attach materials play a more critical role in ensuring mechanical integrity, electrical performance, and long-term reliability under demanding operating conditions. The rapid adoption of power semiconductor devices in electric vehicles (EVs), renewable energy systems, and advanced consumer electronics increases the need for attach materials that can handle higher power densities and elevated junction temperatures without performance degradation. At the same time, the shift toward electric mobility and increasingly feature-rich electronic products encourages manufacturers to prioritize materials that offer superior thermal conductivity, robust adhesion, and compatibility with advanced packaging formats.

| Key Insights | Details |

|---|---|

| Die Attach Materials Market Size (2026E) | US$ 2.0 Bn |

| Market Value Forecast (2033F) | US$ 4.5 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 12.2% |

The accelerating growth of global semiconductor production, driven by digitalization, AI integration, and advanced packaging technologies, is increasing the need for high-performance die attach materials. Packaging is shifting toward finer-pitch, higher-density formats such as SiP, 3D ICs, and heterogeneous integration, requiring superior thermal and electrical performance. Rising demand for robust materials in power devices and optoelectronic assemblies reinforces this trend. The German €920?million subsidy to Infineon Technologies for a new Dresden semiconductor plant expands high-power semiconductor output. Similarly, the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI) has been designed to accelerate EV production and power module adoption. These initiatives are likely to directly boost the need for advanced die attach solutions.

Electrification of transportation and industrial automation amplify the demand for thermally conductive, high-temperature-resistant die attach materials. Power electronics in EVs, renewable energy systems, and industrial drives require materials that withstand elevated switching frequencies and thermal loads. Industrial robotics, IoT hardware, and control systems need materials resistant to moisture, vibration, and operational stress. Government incentives and manufacturing expansion further strengthen adoption. Together, these structural shifts support the die attach materials market growth in the long-term.

Advanced die attach materials face slower uptake because they raise both cost and process complexity. High-performance options such as silver-sintering pastes and conductive adhesives often require tight control of temperature, pressure, and curing profiles, which pushes packaging lines to add specialized equipment and stricter in-process inspection. These requirements increase total manufacturing cost and limit feasibility for cost-sensitive programs and smaller outsourced semiconductor assembly and test providers (OSATs) that cannot justify major capital upgrades. A practical route to adoption is to segment usage by value, then deploy premium attach materials first in high-reliability devices where thermal performance and lifetime deliver measurable payback.

Raw material volatility adds a second barrier that disrupts scaling plans and pricing discipline. Key inputs such as silver, gold, and specialty polymers can swing in price due to macroeconomic changes and supply-side disruptions, which increases procurement risk and complicates long-term quoting. Broader semiconductor supply constraints can also create intermittent bottlenecks through inconsistent lead times, logistics delays, and upstream wafer availability, which makes production scheduling less predictable. To reduce exposure, packaging manufacturers can diversify qualified suppliers, lock critical inputs through structured purchasing agreements, and design alternate material sets that preserve performance targets while protecting margin in price-sensitive regions.

The increasing adoption of silicon carbide (SiC) and gallium nitride (GaN) power devices is driving demand for die attach materials that offer exceptional thermal and mechanical reliability. Silver sintering pastes and advanced conductive adhesives are becoming preferred choices for power electronics in EV systems, renewable energy installations, and industrial drives, where performance under high stress is critical. Cost-optimized sintering solutions are also gaining momentum as manufacturers look for scalable, high-efficiency bonding technologies that balance reliability with affordability. These trends are creating significant growth opportunities for suppliers able to provide thermally robust, long-lasting formulations tailored to the evolving needs of high-power applications.

Simultaneously, investment in advanced semiconductor packaging across key Asian markets is accelerating demand for mid- and high-performance die attach materials. In 2025, 13 major advanced packaging facilities in Taiwan, Malaysia, and China expanded capacity to support technologies such as flip-chip, CoWoS/3D packaging, and high-density semiconductor packages. Government incentives, growth in OSAT providers, and ongoing fabrication expansion are reinforcing the region’s leadership in packaging innovation. Niche sectors such as medical and aerospace electronics are further amplifying demand, driven by stringent reliability and certification requirements. As device miniaturization intensifies, suppliers with high-grade, compliant bonding materials are well positioned to capture expanding multi-industry opportunities and support the global shift toward more advanced, reliable semiconductor solutions.

Epoxy adhesives are forecasted to hold around 42% of the die attach materials market revenue share in 2026, dominating due to their versatility in consumer electronics, industrial components, and semiconductor packaging. Their strong adhesive strength, moisture resistance, and cost-effectiveness make them suitable for high-volume applications. Increasing demand in mid-power modules, EV power electronics, and industrial devices maintains steady consumption. Thermally conductive formulations enhance performance under elevated temperatures. Epoxies remain a reliable solution for standard and moderately demanding applications, benefiting from wide availability and ease of processing.

The silver sinter paste segment is projected to rise with a CAGR of around 15.6% from 2026 to 2033, making it the fastest-growing material type. Its superior electrical and thermal performance drives adoption in high-temperature power semiconductors, EV inverters, and industrial drives. In 2025, for instance, Indium Corporation introduced InBAKE 29, a copper sinter paste for high-power SiC MOSFETs and IGBTs, and expanded its InFORCE®MF silver sinter portfolio, engineered for pressure-assisted die attach with strong thermal reliability and shear strength. These innovations reinforce the central role of silver sintering in replacing solder solutions and supporting high-performance power and automotive electronics. Cost-optimized sintering formulations are capturing incremental market share, contributing significantly to total market revenue

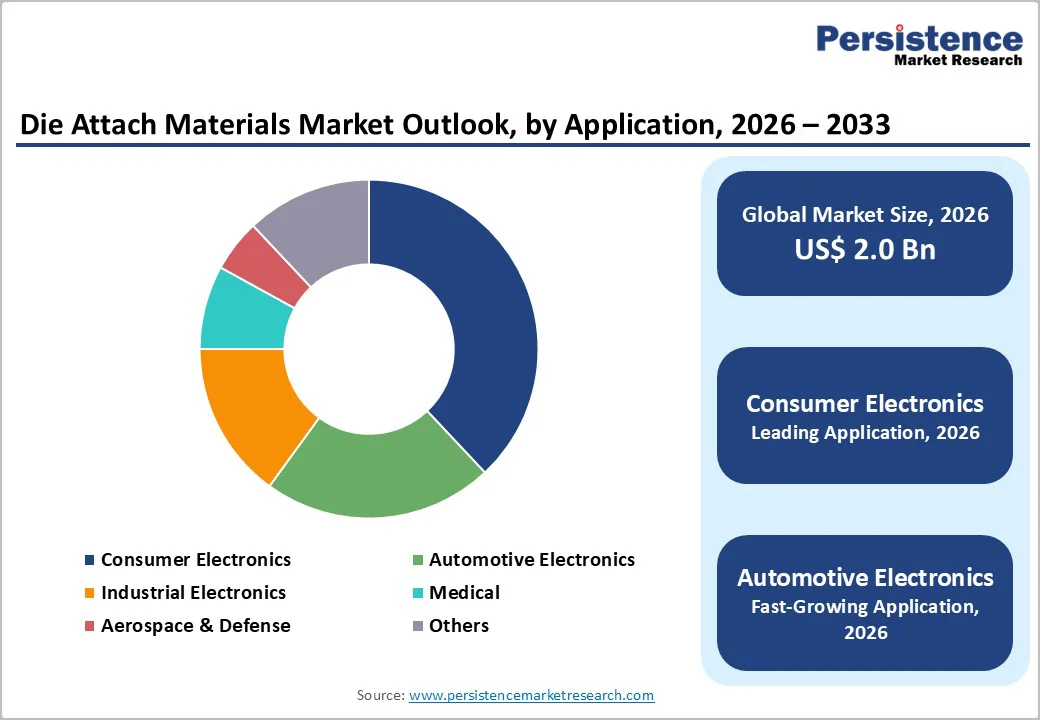

Consumer electronics is projected to claim approximately 38% of the die attach materials market revenues in 2026, fueled by extensive integration of advanced bonding solutions in laptops, wearable devices, and smart home systems. Miniaturization trends, expansion of Internet of Things (IoT) connectivity, and high-density packaging requirements continue to generate consistent demand for reliable attach technologies. Epoxy adhesives maintain their essential role in high-volume production environments where cost efficiency remains paramount. Ongoing innovation in fifth-generation (5G) modules, imaging sensors, and IoT components further sustains robust consumption patterns and encourages suppliers to refine formulations for enhanced performance in compact designs.

Automotive electronics is likely to achieve the fastest growth at an approximate CAGR of 14.8% through 2033, driven by surging semiconductor integration in vehicle platforms. The exponential expansion of the global EV semiconductors market underscores the need for the rapid deployment of SiC and gallium nitride GaN power devices that demand superior thermal management. Rising semiconductor content per vehicle elevates requirements for high-temperature, efficient die attach options such as silver sinter paste and conductive adhesives. Electrification initiatives, regulatory pressures for efficiency, and expansion of industrial motor drives collectively propel this segment forward, creating prime opportunities for materials that deliver proven reliability under extreme operational stresses.

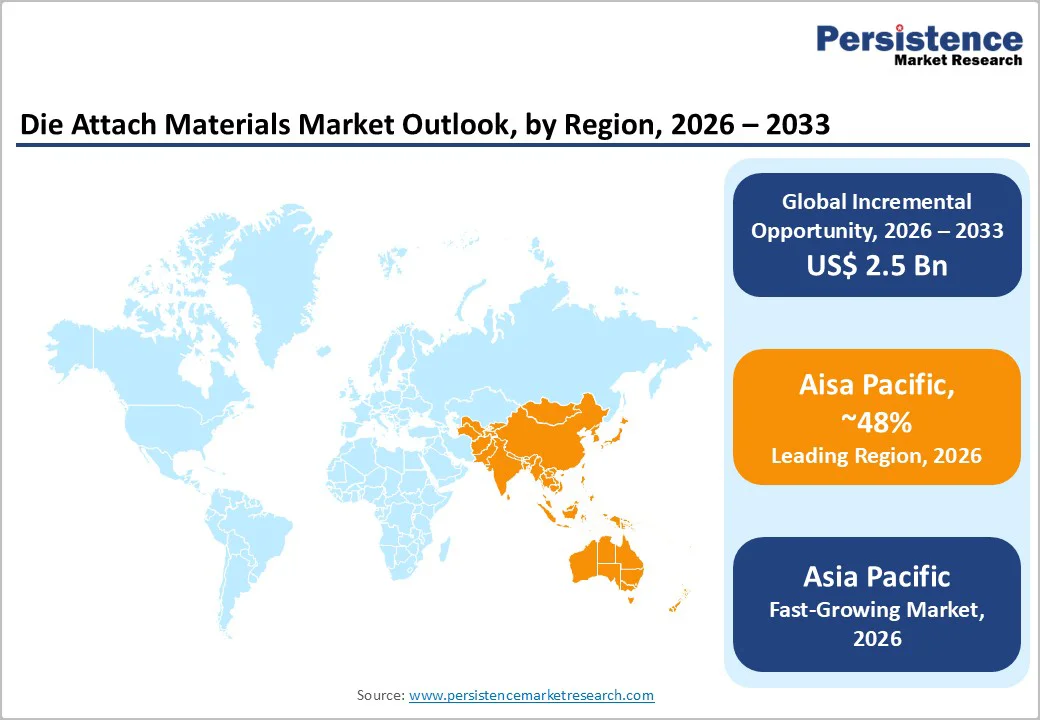

North America is projected to capture 28% of the die attach materials market share in 2026, reinforced by its leadership in advanced semiconductor research and development (R&D) and the substantial presence of integrated device manufacturers (IDMs). Federal initiatives aimed at boosting domestic chip production continue to stimulate investment in packaging infrastructure, while mission-critical sectors such as defense, aerospace, and industrial automation generate sustained demand for high-reliability bonding solutions. Robust regulatory frameworks governing product quality and safety encourage continuous innovation, creating a favorable environment for next-generation material adoption. Strong investment momentum within automotive electronics, AI chipsets, and power semiconductor devices further solidifies the region's strategic importance. Suppliers prioritizing collaboration and material customization are well-positioned to serve these high-value segments effectively.

Regional market dynamics are defined by a strong preference for high-grade epoxy adhesives, advanced conductive formulations, and silver sintering materials that meet rigorous performance standards. Stringent qualification requirements for reliability and longevity ensure that premium die attach solutions remain essential across defense and industrial applications, maintaining stable procurement cycles even during broader market fluctuations. Collaborative R&D initiatives and pilot production programs play a crucial role in validating advanced packaging technologies before high-volume scaling. By leveraging deep local engineering expertise to optimize thermal, electrical, and mechanical properties, North American suppliers foster an ecosystem that supports sustainable, performance-driven adoption of die attach materials across a diverse range of sophisticated end-use applications.

Europe is forecast to secure approximately 14% of the global market share in 2026, with the regional market set to expand at a CAGR of 9.5% between 2026 and 2033. Robust automotive manufacturing clusters in Germany, France, and the United Kingdom, alongside a mature industrial automation sector, generate consistent requirements for reliable bonding solutions. Energy efficiency programs and sustainability mandates actively promote advanced power electronics adoption, while harmonized regulatory standards ensure uniform testing protocols and safety compliance across member states. Investments in EV charging networks, industrial robotics platforms, and renewable energy systems are accelerating semiconductor packaging material consumption. The region's network of specialized suppliers and quality-oriented packaging operations creates a stable foundation for sustained market participation.

Regional demand is likely to receive additional impetus from high-reliability applications in aerospace and industrial electronics, where silver sintering pastes and premium adhesives excel under rigorous certification demands. Growth in EV power modules, high-performance industrial drives, and renewable energy inverters expands addressable opportunities for thermally stable, mechanically durable formulations. Suppliers concentrate on developing adhesives and conductive materials optimized for elevated temperature environments and extended operational lifecycles. This innovation focus aligns with Europe's balanced ecosystem, enabling reliable growth across automotive platforms and aerospace systems while meeting stringent performance benchmarks that prioritize longevity, efficiency, and environmental compatibility.

Asia Pacific is projected to dominate the die attach materials market in 2026, capturing approximately 59% of the market share and exhibiting the highest CAGR of 13.4% through 2033. This leadership is rooted in the region’s strong semiconductor, consumer electronics, and automotive manufacturing base, with China, Japan, South Korea, and Taiwan at the forefront. Expanding OSAT operations, coupled with government-backed semiconductor initiatives, drive robust demand for advanced die attach solutions. The region’s cost-effective manufacturing infrastructure, extensive supply chains, and dynamic original equipment manufacturer (OEM) ecosystem enable rapid adoption of next-generation packaging technologies. Investments in electric vehicle components, industrial automation, and renewable energy projects further amplify market growth.

In the ASEAN bloc, Malaysia and Vietnam are swiftly emerging as key manufacturing hubs for outsourced production. Silver sinter paste and high-performance epoxy adhesives are gaining traction in high-temperature and power-critical applications, reflecting the region’s focus on both innovation and mass-scale production. Regional suppliers excel at balancing advanced material development with large-volume output, enhancing global competitiveness. Continuous expansion in automotive electronics and consumer devices sustains incremental demand for die attach materials. Government incentives and ongoing local fabrication growth provide a stable foundation for long-term market expansion. Asia Pacific’s combination of scale, speed, and technological capability solidifies its position as the leading market for die attach materials worldwide.

The global die attach materials market landscape is moderately competitive, driven by a mix of global suppliers and regional players supporting major electronics and automotive hubs. Leading companies such as Henkel, 3M, Indium Corporation, Kyocera, Panasonic, Heraeus, and Shin-Etsu maintain influence through broad product portfolios and advanced formulation expertise. They offer epoxy adhesives, silver sinter pastes, solder materials, and conductive adhesives for consumer electronics, automotive, industrial, medical, and aerospace applications. Investment in high-reliability, thermally efficient, and electrically conductive solutions strengthens their market position. Advanced packaging and power electronics need further reinforcement to demand for premium materials.

Regional suppliers in Asia Pacific, including firms in China, Taiwan, Japan, and South Korea, are expanding rapidly by leveraging cost-efficient manufacturing and proximity to semiconductor fabrication and OSAT centers. These companies provide both conventional epoxies and advanced silver sinter and conductive materials for high-temperature, high-power applications. EVs, industrial automation, and next-generation consumer electronics drive growing demand and competition. Innovation in thermally robust and high-performance die attach materials is critical for differentiation. Technical support, product certification, and reliability remain key competitive advantages.

The global die attach materials market is projected to reach US$ 2.0 billion in 2026.

Increasing semiconductor and advanced packaging production, electrification of vehicles requiring high-temperature die attach solutions, industrial automation adoption, and rising demand for high-reliability electronics in aerospace, medical, and power applications are driving the market.

The market is poised to witness a CAGR of 12.3% between 2026 and 2033.

Significant opportunities exist in silver sinter paste for SiC and GaN power devices, advanced epoxy formulations for high-density packaging, automotive electronics applications, and niche markets such as medical devices and aerospace electronics.

Henkel AG & Co. KGaA, Indium Corporation, Alpha Assembly Solutions, Kyocera Corporation, Heraeus Holding, NAMICS Corporation, and Dow Inc. are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author