ID: PMRREP33090| 193 Pages | 19 Aug 2025 | Format: PDF, Excel, PPT* | Food and Beverages

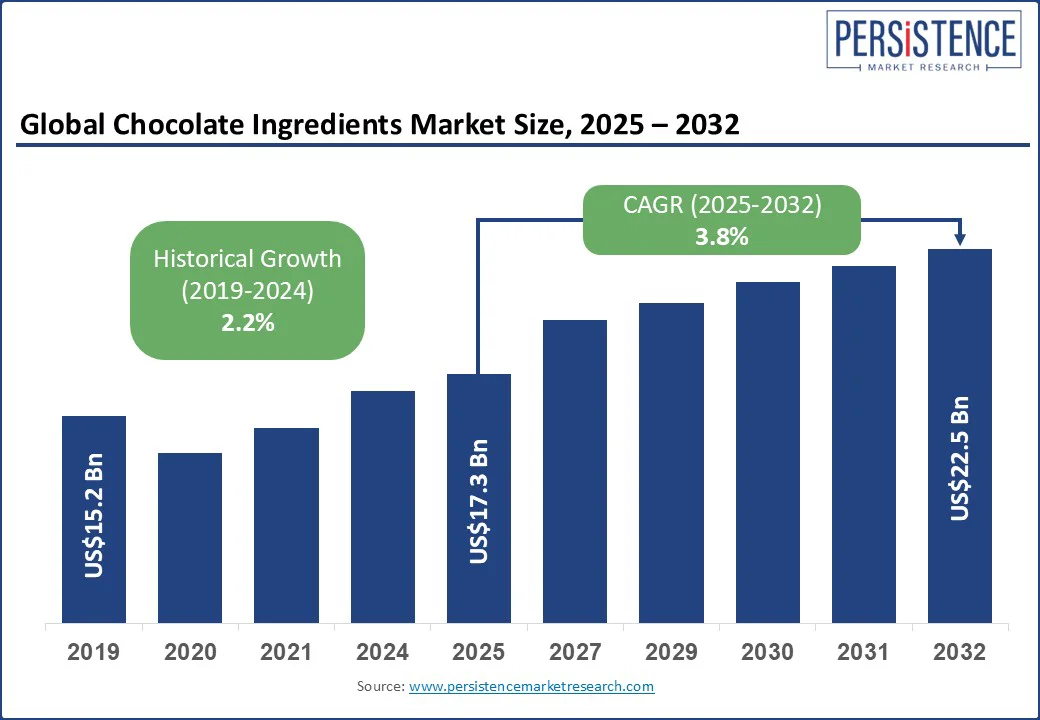

The global chocolate ingredients market size is likely to value at US$ 17.3 Bn in 2025 to US$ 22.5 Bn by 2032. It is anticipated to witness a CAGR of 3.8% during the forecast period from 2025 to 2032.

The chocolate ingredients market growth is driven by developments in fermentation and processing technologies that are enabling manufacturers to fine-tune flavor profiles, improve shelf life, and reduce environmental impact.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Chocolate Ingredients Market Size (2025E) |

US$ 17.3 Bn |

|

Market Value Forecast (2032F) |

US$ 22.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.2% |

The rising trend toward mindful indulgence is augmenting the market for chocolate ingredients. It is boosting demand for products that cater to consumer health and ethical values. A recent survey revealed that in 2025, 81% of consumers seek chocolate that is both delicious and ethically produced, emphasizing the importance of taste alongside sustainability and health considerations. This shift is prompting manufacturers to launch clean-label products, plant-based options, and functional ingredients to meet consumer expectations.

Companies, including Barry Callebaut, are responding by broadening their plant-based chocolate ranges, such as dairy-free organic chocolates and cocoa fruit-based products. They are striving to cater to the rising demand for ethical and health-conscious treats. In addition, brands are incorporating functional ingredients, including adaptogens, fiber-rich inclusions, and antioxidants, to improve the health benefits of chocolate products. The mindful indulgence trend also influences packaging and sourcing practices, thereby bolstering growth.

The ongoing cocoa crisis is hampering demand for chocolate ingredients worldwide. In 2025, the cocoa industry is experiencing its worst production shortage since 1977. It is primarily due to adverse weather conditions and plant diseases in key producing regions, including Côte d'Ivoire and Ghana. This has led to a projected global cocoa supply shortfall exceeding 1 million metric tons, worsening the crisis. The scarcity of cocoa has driven prices to record highs, with cocoa futures surging to over US$ 11,000 per metric ton in early 2024, more than tripling the previous year's average.

Although prices have slightly eased, they remain historically high, creating volatility in the market. This price instability complicates long-term planning for chocolate manufacturers, leading to challenges in pricing strategies and supply chain management. A few chocolate manufacturers are hence exploring alternative ingredients and formulations. Leading players are considering substituting cocoa with palm oil and shea butter. They are also investing in lab-grown cocoa and precision fermentation using oats and sunflower seeds as replacements.

An emerging opportunity in the field of chocolate ingredients is the increasing use of novel biotechnology to strengthen supply chain networks and sustainability. Cocoa, the primary raw material for chocolate, faces several threats from climate change, diseases, and environmental stressors. These have created uncertainty in supply and raised costs. Companies that can adopt unique solutions to mitigate these risks stand to gain a competitive advantage. Mars, for example, recently collaborated with agricultural gene-editing firm Pairwise to develop more resilient cocoa plants using novel CRISPR technology.

The collaboration aims to address challenges such as climate variability, plant diseases, and environmental stresses affecting cocoa production. By accessing Pairwise's proprietary gene-editing tools and trait libraries, Mars seeks to accelerate the development of cocoa varieties that can withstand adverse conditions. It hence focuses on ensuring a stable cocoa supply for its products. This initiative builds on Mars's previous commitment in 2018 to invest US$ 1 Bn over a decade to support the cocoa supply chain.

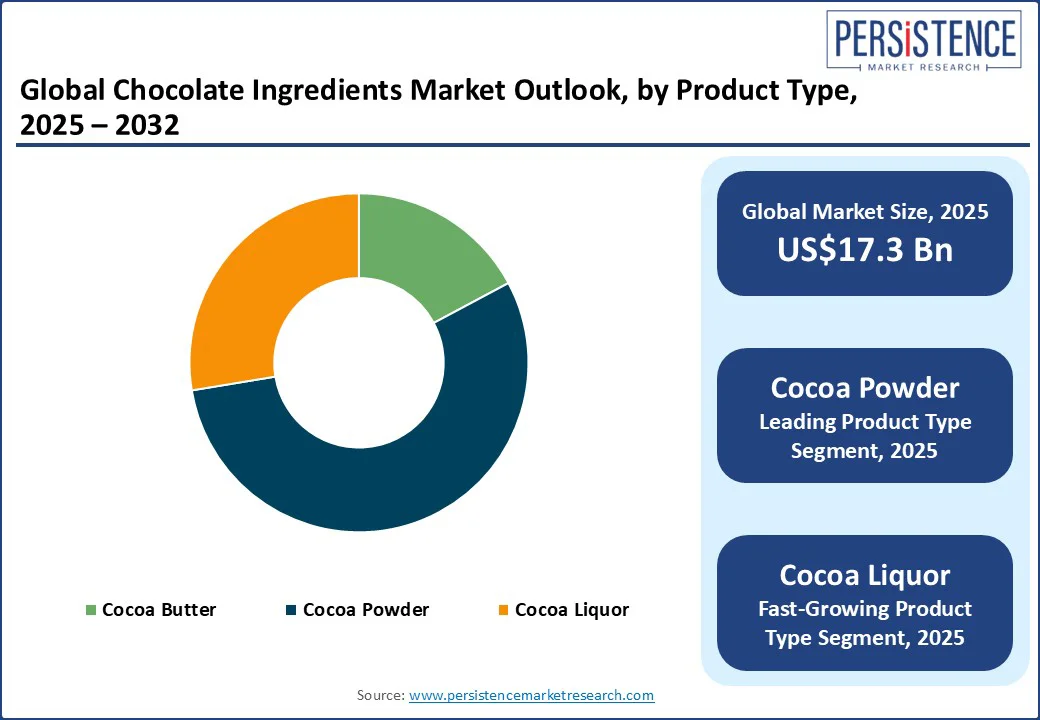

By product type, the market is trifurcated into cocoa butter, cocoa powder, and cocoa liquor. Among these, cocoa powder is predicted to account for approximately 55.2% of the chocolate ingredients market share in 2025, owing to its ability to deliver an intense chocolate flavor without the added fat and processing complexities associated with solid chocolate.

Natural cocoa powder is rich in polyphenols, which are plant compounds linked to anti-inflammatory effects, improved cardiovascular function, and better cognitive performance. While Dutch-processed cocoa loses some antioxidant potency due to alkalization, minimally processed varieties remain a popular choice for brands targeting the functional food segment. This caters to the rising consumer demand for indulgence paired with perceived health benefits.

Cocoa liquor is gaining traction because it serves as the pure and unadulterated base for high-quality chocolate products, combining both cocoa solids and cocoa butter in a single ingredient. This unique composition allows manufacturers to achieve a rich flavor profile and smooth texture without relying on separate ingredient sourcing. In today’s market, where bean-to-bar and artisanal chocolate trends are rising, cocoa liquor’s authenticity and minimal processing appeal to premium and craft chocolate makers.

In terms of application, the market is segmented into food and beverages, pharmaceuticals, nutraceuticals, and cosmetics and personal care. Out of these, food and beverages are estimated to hold nearly 71.6% of the market share in 2025 as the industry provides a wide scope for product development and market penetration.

Chocolate in various forms serves not just as a flavoring agent but also as a texturizer, color enhancer, and even a nutritional fortifier in some fortified products. This multifunctionality makes it valuable across bakery, confectionery, dairy, and beverage categories.

Nutraceuticals have emerged as a key application area as cocoa contains bioactive compounds that are associated with cardiovascular health, improved blood flow, and cognitive benefits. These functional properties make cocoa-based ingredients ideal for dietary supplements and fortified food targeting preventive health.

It also provides a natural source of antioxidants, enabling nutraceutical brands to market products as both effective and clean label. At the same time, nutraceutical products with a chocolate base are easy to integrate into daily routines as they are more palatable than traditional supplements.

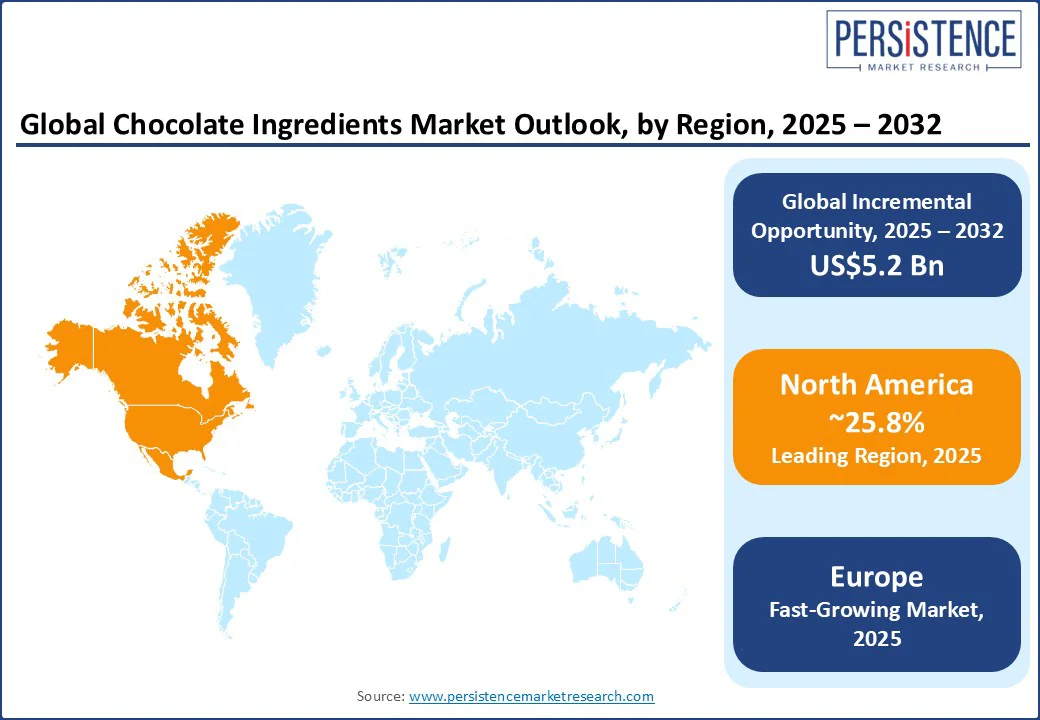

In 2025, North America is speculated to account for around 25.8% of the market share due to the increasing premiumization trend. The U.S. chocolate ingredients market is showing a rising preference for high-cocoa, low-sugar chocolate products. It is compelling manufacturers to source specialty ingredients such as single-origin cocoa liquor and organic cocoa butter. This shift is evident in Hershey’s launch of its Plant-based Extra Creamy Almond & Sea Salt chocolate bar. It uses oat-based milk powder and sustainably sourced cocoa butter to appeal to both vegan and premium chocolate buyers.

North America is, however, grappling with the impact of the ongoing global cocoa crisis, which has propelled cocoa prices to record highs. Local manufacturers are responding by reformulating recipes to use cocoa powder blends, carob powder, or other flavor enhancers to maintain affordability without compromising taste. Mid-sized confectioners have already started promoting limited-edition bars with alternative inclusions such as maple sugar and locally grown berries to offset cocoa cost pressures.

In Europe, the market is being heavily influenced by regulatory changes, premium artisanal trends, and a powerful sustainability mandate. The region’s stringent stance on sugar reduction, augmented by the EU’s ongoing public health campaigns, has prompted chocolate manufacturers to reformulate products. They are using cocoa liquor with naturally higher cocoa solids and alternative sweeteners such as chicory root fiber and monk fruit extract. The premiumization trend is visible in Belgium, Switzerland, and the U.K., where consumers are willing to pay more for single-origin chocolates.

Ingredient suppliers are capitalizing on this by providing micro-lot cocoa powders and cocoa butters that highlight terroir-specific flavor notes. France-based chocolatier Valrhona recently launched its Millésime range, a limited-batch chocolate product made from vintage cocoa harvests. It appeals to the same audience that values fine wine and specialty coffee. Such launches are boosting demand for high-grade cocoa liquor and butter sourced from traceable supply chains. The EU Deforestation Regulation, set to come into effect in December 2025, is further pushing manufacturers to overhaul their sourcing strategies.

The Middle East & Africa is developing steadily, backed by an expanding confectionery sector and rising consumer interest in premium chocolate products. The UAE and Saudi Arabia are experiencing a surging demand for high-quality chocolate, supported by a preference for indulgent treats. Specialty chocolate cafés and artisanal brands are gaining popularity in these countries, which has led to an increased use of premium cocoa ingredients. In addition, tourism-driven demand in the Gulf region is fueling sales of luxury chocolate assortments, which require refined cocoa liquor, cocoa butter, and specialty cocoa powders.

In Africa, the scenario is shaped by both production and consumption trends. Côte d’Ivoire and Ghana play a key role in the global supply chain, but much of their cocoa is exported in raw form. However, local value addition is slowly increasing, with countries investing in processing facilities to produce semi-finished products for regional use. For instance, in 2024, Ghana extended its cocoa processing capacity through partnerships with multinational chocolate manufacturers. This highlighted an intent to capture more value locally.

The global chocolate ingredients market is characterized by a blend of traditional cocoa dominance and emerging developments. Leading companies, including Barry Callebaut, Cargill, and Hershey, continue to dominate due to their established supply chains, extensive research work, and long-term relationships with cocoa producers.

Fluctuating cocoa prices owing to weather volatility in West Africa and geopolitical factors have created cost pressures. Companies are using commodity derivatives to hedge against these fluctuations. But profit margins remain vulnerable, primarily for manufacturers heavily reliant on traditional cocoa.

The chocolate ingredients market is projected to reach US$ 17.3 Bn in 2025.

Rising demand for premium chocolates and increasing preference for exotic flavors are the key market drivers.

The chocolate ingredients market is poised to witness a CAGR of 3.8% from 2025 to 2032.

Penetration into emerging markets and expansion of chocolate-infused functional food are the key market opportunities.

The Hershey Company, Ferrero SPA, and Ecom Cocoa are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author