ID: PMRREP33060| 196 Pages | 17 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

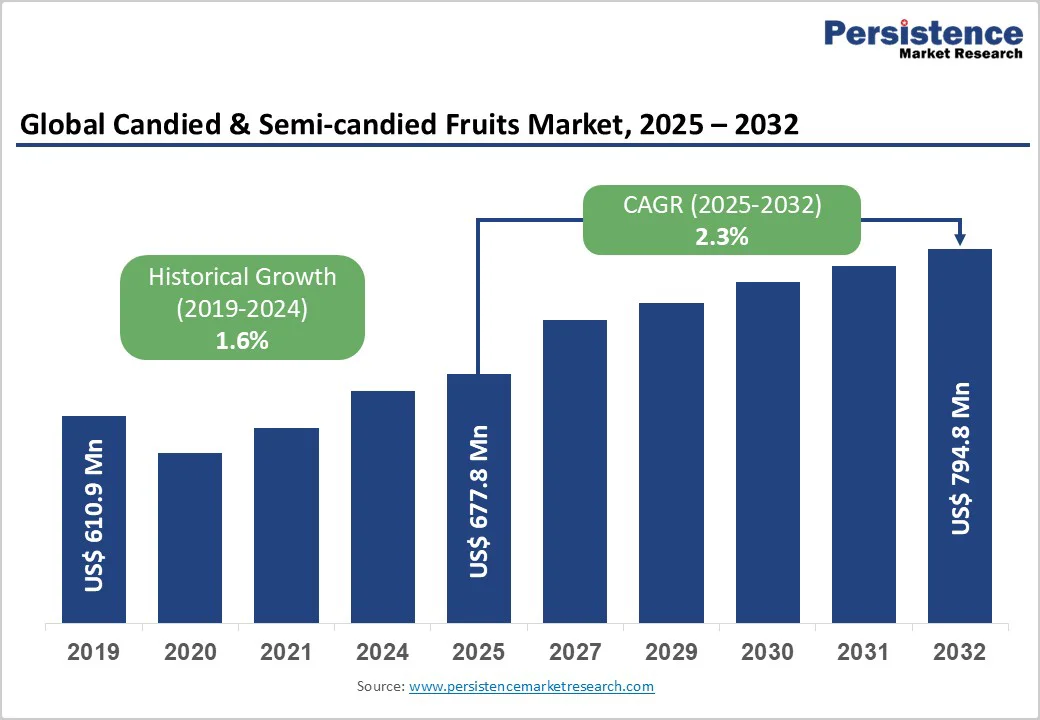

The global candied & semi-candied fruits market size is likely to be valued at US$677.8 Million in 2025 and is expected to reach US$794.8 Million by 2032, growing at a CAGR of 2.3% during the forecast period from 2025 to 2032, driven by increasing demand from the bakery and confectionery sectors, festive consumption, and preference for natural, artisanal ingredients.

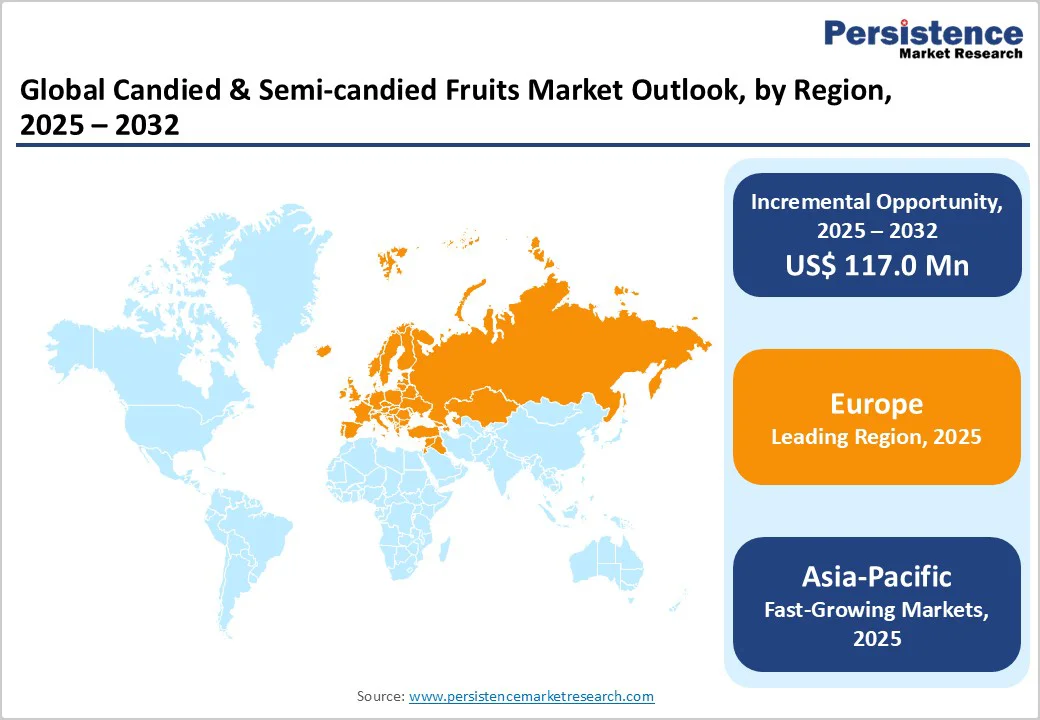

Asia Pacific leads the market due to expanding bakery industries, while Europe and North America focus on premium, organic, and reduced-sugar candied fruit offerings.

| Key Insights | Details |

|---|---|

| Candied & Semi-candied Fruits Market Size (2025E) | US$677.8 Mn |

| Market Value Forecast (2032F) | US$794.8 Mn |

| Projected Growth (CAGR 2025 to 2032) | 2.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 1.6% |

The growing popularity of premium desserts, bakery items, and festive menus in the global foodservice sector is driving the demand for candied and semi-candied fruits. According to the U.S. Department of Agriculture (USDA), spending on “food away from home” surpassed home-prepared food for the first time in recent years, reflecting a cultural shift toward dining out and convenience.

In India, the National Restaurant Association of India (NRAI) highlights an expansion of cafés, patisseries, and quick-service outlets across urban centers, increasing the use of decorative and natural fruit-based ingredients.

The European Commission’s reports on foodservice consumption indicate that hotels and restaurants are emphasizing locally sourced and natural components in desserts and confectionery. This trend boosts the use of whole and chopped candied fruits as versatile, shelf-stable, and visually appealing ingredients that enhance flavor, color, and presentation in bakery, pastry, and frozen dessert applications.

High sugar content in the candied & semi-candied fruits sector poses a significant restraint in today’s market environment. According to the World Health Organization (WHO), free sugars should make up less than 10% of total energy intake, with a further reduction to below 5% (~25 g or ~6 teaspoons per day) offering additional health benefits.

Roughly 43% of adults globally were overweight in 2022, with 16% living with obesity, reflecting growing public health concerns over sugar-rich foods. For producers of candied and semi-candied fruits, typically high in added sugar, this means increasing consumer resistance, stricter regulatory scrutiny, and pressure to reformulate. The rising emphasis on reduced-sugar, clean-label, and functional snacking represents a headwind for traditional high-sugar variants in this market.

The push for product innovation with reduced sugar and functional benefits presents a strong opportunity for the candied & semi-candied fruits market. Government dietary guidance is clear: the World Health Organization recommends that free sugars be less than 10% of total energy intake, and ideally below 5% (~25 g) per day for adults and children.

The U.S. data show a mean added sugar intake of around 17 teaspoons (~68 g) per day for adults, with only about 42 % of Americans meeting the recommendation. Against this backdrop, manufacturers of candied and semi-candied fruits can innovate by offering low-sugar or no-added-sugar options, incorporating natural sweeteners, and adding functional components such as fiber or antioxidants.

These reformulated products cater to health-aware consumers, align with regulatory guidelines, and help differentiate in a market increasingly shaped by clean-label, wellness-oriented trends.

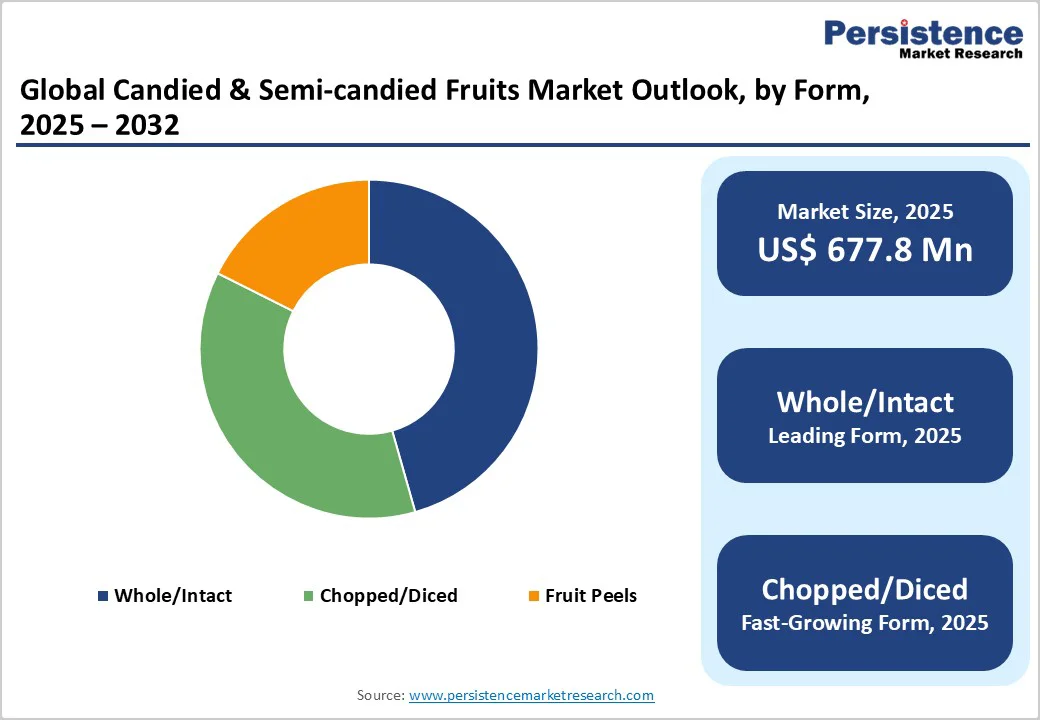

Whole/Intact form dominates the market with a 45.6% share in 2025, due to its premium visual appeal and industrial application. Whole fruits such as cherries or apricots maintain size, color, and shape after processing, making them ideal for festive cakes (panettone) and artisan bakery items. Exhibitions show that whole fruit decorations in bakery products can represent over 30-40% of ingredient visuals in premium European baked goods.

Whole fruits’ ease of handling, minimal blending, and high perceived value drive usage in food-service and gifting segments. Consumers associate intact fruit items with “whole fruit” health cues, which support premium positioning. Whole/intact forms continue to command a substantial share in the market.

The dominance of the bakery application in the candied & semi-candied fruits market is largely owing to the scale and consistency of baked goods consumption. For example, in the European Bread & Bakery Federation data-set, the EU-27 consumed approximately 39 million tonnes of bread, viennoiserie, and patisserie products in 2020.

Fresh bread and bakery products alone accounted for 82% of total volume in the EU’s bakery segment in 2024. Bakery applications require large volumes of ingredients that offer stability, versatility, and visual appeal, exactly the properties offered by whole, intact candied fruits or chopped inclusions. The continuous demand from industrial bakeries, patisseries, and food-service channels, therefore, drives usage of candied fruits within bakery formulations more than other applications.

Europe region dominates the global market with a 35.6% share in 2025; its bakery and confectionery sectors are deeply rooted in culture and consumption volumes. For instance, consumer data show that the EU region consumes about 26 million tons of bread and bakery products in 2024 alone, with Germany (≈4.5 M tons), Italy (≈3.7 M tons), and France (≈3.4 M tons) accounting for nearly 44% of that total.

The high level of baked goods demand means inputs such as candied and semi-candied fruits, particularly for cakes, pastries, and festive desserts, are more widely used. Per capita bread and bakery product consumption in countries such as the Netherlands (≈116 kg/person) and Belgium (≈74 kg/person) highlights the region’s strong ingredient demand.

Asia Pacific is the fastest-growing region in the candied & semi-candied fruits market due to rising urbanization, growing middle-class incomes, and an increasing appetite for bakery and confectionery products. According to the Food and Agriculture Organization (FAO), Asia accounts for over 60% of global fruit production, ensuring abundant raw material availability for candied fruit processing.

In India, the bakery sector produces around 6.8 million metric tons of products annually, reflecting expanding consumption of cakes and pastries that use candied fruits. Rapid growth of modern retail chains, cafés, and foodservice outlets in China, Japan, and Indonesia further accelerates product use in desserts and festive foods. This combination of supply strength and evolving consumer tastes makes Asia-Pacific the region’s strongest growth hub.

North America is an important growing region in the candied & semi-candied fruits market due to its strong bakery, confectionery, and foodservice industries. According to the USDA, per capita spending on “food away from home” in the U.S. reached about US$4,306 in 2024, reflecting a high demand for desserts and sweet bakery items that often use candied fruits.

In Canada, the bakery and tortilla manufacturing industry employs over 23,000 people, highlighting the region’s well-established processing and ingredient use network. Rising consumer interest in premium, artisanal baked goods and festive confectionery products supports the inclusion of candied fruits in recipes. The trend toward indulgent yet clean-label desserts continues to make North America a key contributor to global market expansion.

The global candied & semi-candied fruits market is expanding as producers adopt sustainable sourcing, advanced processing, and eco-friendly packaging. Leading brands focus on quality, traceability, and clean-label ingredients, while emerging players emphasize organic and low-sugar variants. Rising demand from the bakery, confectionery, and foodservice sectors, along with evolving consumer preference for natural ingredients, drives steady global growth.

The candied & semi-candied fruits market is projected to be valued at US$677.8 Million in 2025.

Rising bakery and confectionery demand, festive consumption, natural ingredient preference, and expanding foodservice sectors drive the global market.

The candied & semi-candied fruits market is poised to witness a CAGR of 2.3% between 2025 and 2032.

The growing demand for clean-label, low-sugar variants, export potential, and product innovation in bakery and confectionery applications create opportunities.

Andros Chef, AZIENDA AGRIMONTANA S.P.A., Cesarin S.p.A., Cruzilles, F. Moreno Candied Fruits S.L., and FRUITS ROUGES & Co.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author