ID: PMRREP35899| 194 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

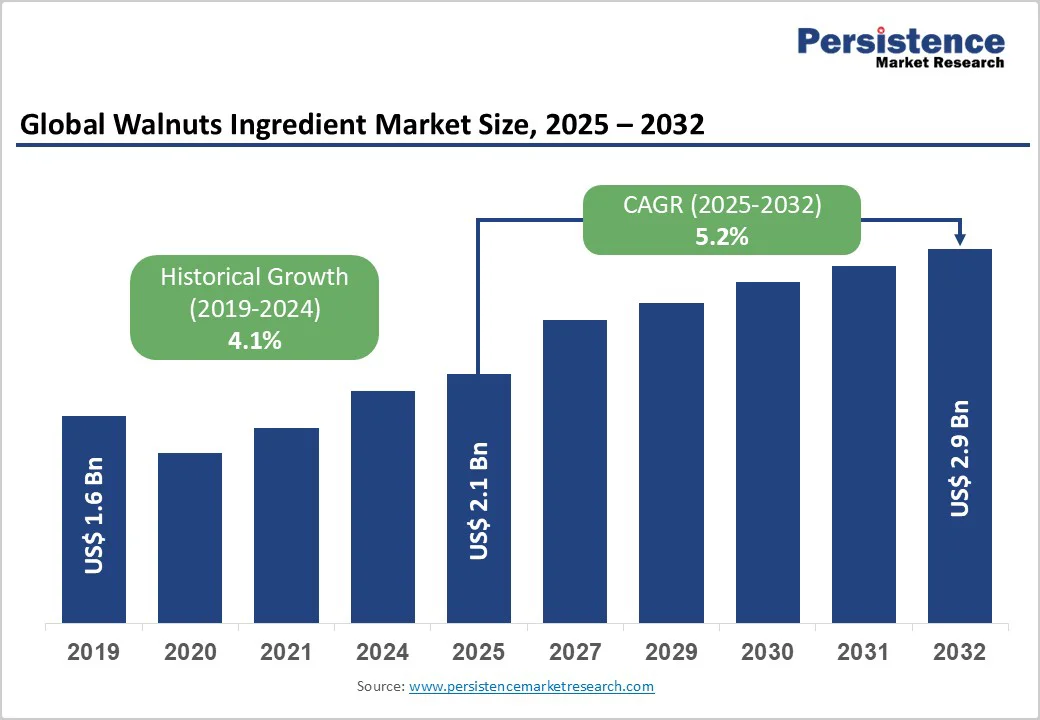

The global walnuts ingredient market size is likely to be valued at US$2.1 billion in 2025. It is expected to reach US$2.9 billion by 2032, growing at a CAGR of approximately 5.2% during the forecast period from 2025 to 2032, driven by rising consumer preference for plant-based nutrition, the incorporation of walnuts for omega-3 and antioxidant claims in F&B formulations, and growing uptake in personal-care applications such as shell powder and walnut oil.

Supply dynamics are shaped by concentrated growing regions (China, the U.S., and Turkey), weather volatility, and recent trade/tariff shifts. Manufacturers are expanding into upcycled derivatives, such as defatted flour and polyphenol extracts, to capture higher-margin adjacencies.

| Key Insights | Details |

|---|---|

| Walnuts Ingredient Market Size (2025E) | US$2.1 Bn |

| Market Value Forecast (2032F) | US$2.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.1% |

Consumers’ shift toward plant-based diets and functional ingredients has driven strong demand for walnut ingredients as sources of alpha-linolenic acid (ALA) and polyunsaturated fats. Forecasts for 2025 - 2032 indicate a 5-6% CAGR as formulators adopt walnut kernel, oil, and protein flours in dairy alternatives, snacks, and nutraceuticals.

The market is expected to expand from US$2.00 billion in 2025 to US$3.08 billion in 2032 due to innovation in plant milks and fortified snacks. This driver supports higher per-unit ingredient values as brands prioritize nutrition-led claims.

Regulatory action restricting microplastics in cosmetic exfoliants and the growing corporate focus on circularity are strengthening demand for walnut shell powders, press-cake flours, and antioxidant extracts. These shifts are creating new high-margin opportunities in cosmetics and nutraceutical applications.

The combination of policy pressures and consumer willingness to pay premiums for traceable, upcycled ingredients expands the value recovered per tonne of raw walnuts and encourages investment in integrated processing.

Retail assortment expansion, growth of specialty and premium supermarket formats, and strong e-commerce penetration are increasing the availability and visibility of walnut-based products. Foodservice adoption, including the use of walnut milk in barista channels, further accelerates trial and uptake.

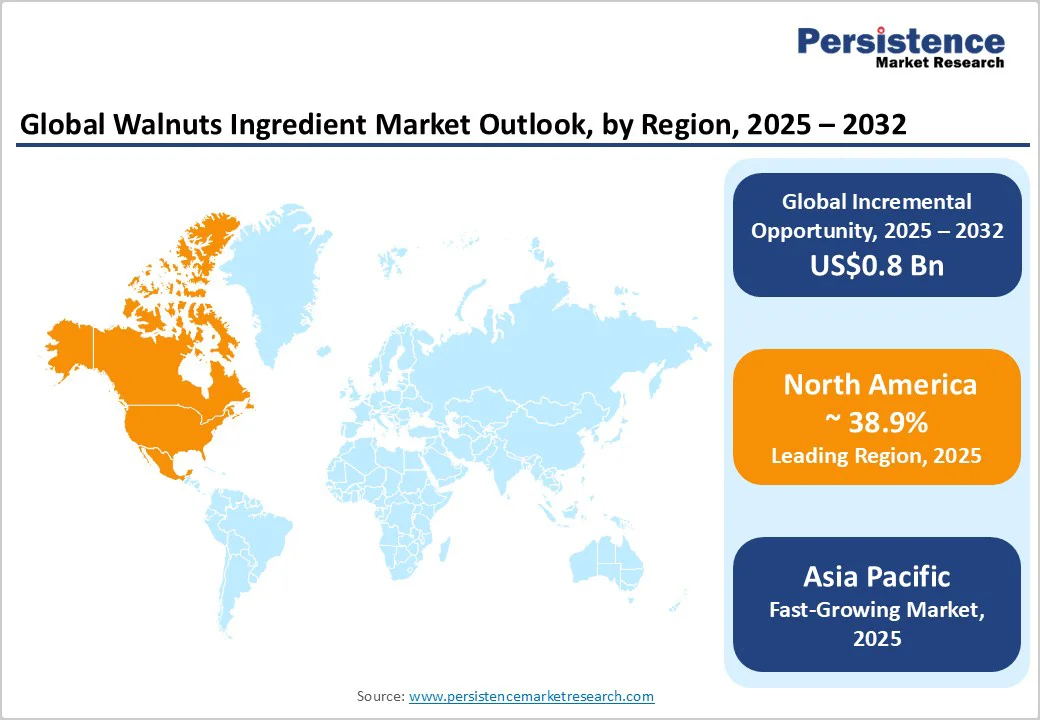

North America accounts for about 39% of the market value, while the Asia Pacific is the fastest-growing region. This channel diversification enables quicker product launches and greater adoption of high-value walnut ingredients.

Global walnut production is concentrated in a few regions, including China, the U.S., and Turkey. This concentration exposes the supply chain to significant volatility in climate and weather.

A notable example is the 19% drop in California walnut production in 2024 compared with 2023, highlighting how single-origin disruptions affect global ingredient availability and pricing. Long orchard maturation cycles of four to seven years limit rapid supply expansion and reinforce price instability for kernel and oil processors.

Walnut kernels command a premium relative to other nut and seed ingredients, prompting cost-sensitive manufacturers to shift to cheaper alternatives such as almond meal or seed flours during periods of margin pressure.

Upcycling low-value by-products into ingredient-grade materials requires capital-intensive processing equipment, making it difficult for smaller processors to participate. Kernel price spikes of 20-50% during tight seasons have been reported in key producing regions, challenging food manufacturers' cost structures.

Processing walnut press-cake into defatted flour unlocks a protein-rich, gluten-free ingredient for bakery, snacks, and plant-based meat formulations. Capturing even five to eight percent of the existing global walnut-ingredients base through upcycled flours and extracts represents a potential US$100-160 Million incremental opportunity within five years. This segment aligns waste-reduction economics with a growing B2B market for clean-label, high-protein inputs.

Walnut oil and shell powder are gaining traction in clean-beauty and natural personal-care formulations. Walnut oil offers moisturizing and antioxidant benefits, while shell powder functions as a biodegradable exfoliant that replaces microplastics. Achieving even a 10% penetration of walnut derivatives in the global natural exfoliant segment would deliver meaningful margin expansion and diversify revenue streams beyond traditional food uses.

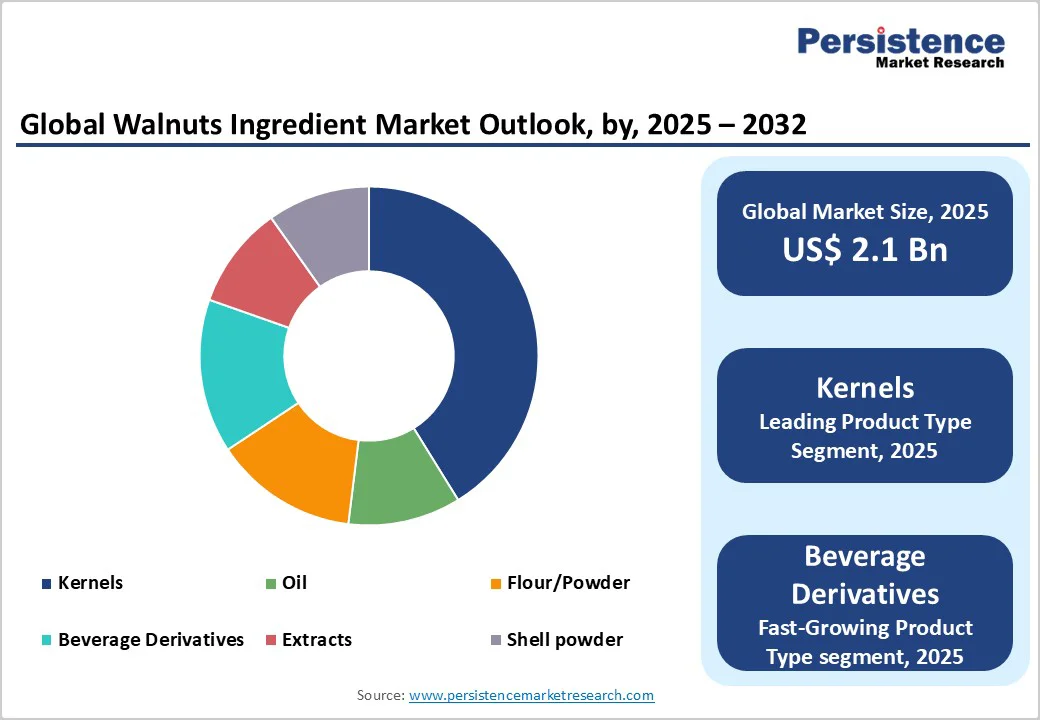

Kernels represent approximately 42.3% of the global walnut-ingredient value in 2025, making them the largest product-type category. Their relevance is sustained by strong demand for snacking, bakery inclusions, cereal fortification, and confectionery applications.

The segment benefits from minimal processing requirements, preservation of nutritional claims, and broad acceptance across retail and B2B channels. Kernel suppliers rely on origin-sourcing programs across major producing countries to maintain quality and ensure year-round availability. The segment’s scale supports stable margins for vertically integrated processors.

Beverage derivatives are the fastest-growing product-type segment through 2032. Growth is driven by consumer interest in new plant-based milks with distinctive flavors and strong fatty-acid profiles. Foodservice adoption and increased shelf space in mainstream retail support rapid scale-up.

Innovations in emulsification and stabilization technologies enable shelf-stable formulations that carry heart-health and antioxidant claims. The segment benefits from premium pricing and strong private-label participation.

Food & beverages represent the dominant end-use category with an estimated 48.2% market share in 2025. The segment includes direct retail kernels, bakery inclusions, snacks, cereals, and plant-based dairy alternatives.

Walnut ingredients deliver both functional and sensory benefits, including omega-3 claims, texture enhancement, and flavor. Defatted walnut flour is increasingly used in gluten-free formulations, while walnut pieces remain popular in premium bakery and snack products.

Personal care & cosmetics is the fastest-growing application area through 2032. Walnut oil is used as a botanical moisturizer and antioxidant component, while finely milled shell powder replaces microplastics in exfoliants.

Natural and clean-beauty brands favor walnut-derived actives to meet biodegradability and sustainability expectations. The category offers higher margins compared with bulk food channels and benefits from rapid innovation cycles in beauty and skincare products.

North America accounts for roughly 38.9% of the global walnut-ingredient market value in 2025, with the U.S. holding the majority share due to its integrated value chain. The region benefits from extensive orchard production concentrated in California, advanced processing infrastructure, and a strong food-innovation ecosystem.

These factors position North America as the leading market in both supply and consumption. California remains the core production hub, though output is sensitive to weather and acreage cycles.

In 2024, production fell by about 19% compared with 2023, underscoring the vulnerability of the supply chain. Such fluctuations affect global availability, export volumes, and pricing, as California is a major export origin for kernels and processed derivatives. Growth in the region is driven by widespread consumer adoption of plant-based diets, rising interest in omega-3-rich foods, and ongoing innovation in walnut-based dairy alternatives.

North America’s regulatory framework supports the use of food ingredients with clear safety and labeling standards. In cosmetics, state initiatives and retailer sustainability programs drive the adoption of biodegradable exfoliants, such as walnut shell powder. Investments focus on cold-press extraction, milling, protein-concentration upgrades, and orchard traceability pilot programs.

Development efforts target stable market access, global diversification, and enhanced sustainability credentials across the supply chain.

Strong adoption of premium, organic, and clean-label food products drives Europe. The region’s regulatory rigor and high consumer expectations for provenance and sustainability strengthen demand for certified walnut ingredients. Germany, the U.K., France, and Spain lead regional consumption due to their strong bakery industries, sophisticated health-food retail channels, and well-developed cosmetics sectors.

Imports from major producing nations meet much of the demand, supported by efficient distribution networks across Western Europe. Premiumization trends fuel growth, as consumers increasingly prefer organic, traceable, and sustainably produced ingredients. Walnut oil and shell powder are increasingly used in natural beauty products, especially in Germany and France.

Europe’s regulatory environment, covering food safety, labeling, claims substantiation, and cosmetic ingredient approvals, elevates compliance requirements for manufacturers while ensuring consistent product quality. Microplastic restrictions in the region significantly accelerate the adoption of biodegradable exfoliants derived from walnut shells.

Investment opportunities include expanding certified organic processing capacity in Southern Europe, scaling up facilities for botanical oil extraction, and co-development partnerships with European cosmetics brands seeking natural actives. Retailers continue to increase shelf space for premium plant-based milks and bakery ingredients containing walnut derivatives, supporting steady market expansion.

Asia Pacific is the fastest-growing market for walnut ingredients through 2032, driven by urbanization, rising middle-class incomes, and growing interest in plant-based, functional nutrition. China leads as the largest producer and a rapidly expanding consumer market, with harvests nearing 1.5 million tonnes, supporting domestic processing and exports.

India’s demand has surged after tariff adjustments, enhancing import competitiveness. Japan and South Korea represent high-value markets that emphasize premiumization in food and cosmetic applications, further boosting regional growth opportunities.

Key growth drivers include increased demand for plant-based milks, functional snacks, and natural personal-care products. E-commerce platforms across China, India, Southeast Asia, and Japan enable accelerated product trials and brand visibility, compressing innovation cycles and lowering go-to-market barriers. China’s extensive processing infrastructure supports large-scale production of kernels, oils, and flours.

Regional investments in packaging, milling, and cold-chain logistics strengthen cross-border distribution. Investment opportunities include establishing regional production hubs for walnut-milk brands, expanding cosmetic-grade extraction facilities and scaling kernel-fractionation technologies for protein isolates. Production growth in China and shifting tariff policies across South Asia are reshaping trade flows and supporting broader adoption of walnut ingredients.

The global walnut-ingredients market is moderately concentrated, with leading processors and traders controlling significant value through integrated sourcing, processing, packaging, and distribution. High concentration exists in value-added segments such as oils and specialty flours due to technical and capital barriers, while commodity kernel trading remains fragmented. Scale advantages enable investment in traceability, upcycling, and innovation.

Export-promotion programs support stability amid crop variability. Key strategies include vertical integration, premiumization with organic and fully traceable products, and diversification into walnut milk, protein-enriched flours, and cosmetic-grade derivatives. Strengthening quality assurance and digital traceability enhances margins and mitigates supply volatility.

The walnuts ingredient market size in 2025 is US$2.1 Billion.

By 2032, the walnuts ingredient market is projected to reach US$2.9 Billion.

Key trends include rising use of walnuts in plant-based foods, omega-3-rich ingredients, walnut milk and beverages, upcycled shells in cosmetics, and a shift toward organic, certified-traceable products.

Kernels remain the leading segment by value due to strong use in snacks, bakery, confectionery, and packaged food applications.

The walnuts ingredient market is expected to grow at a 5.2% CAGR from 2025 to 2032.

Major players include Olam Group (ofi), Mariani Packing Company, Poindexter Nut Company, Diamond Foods, and Hammons Products Company.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Form

By End-use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author