ID: PMRREP35455| 143 Pages | 4 Jul 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

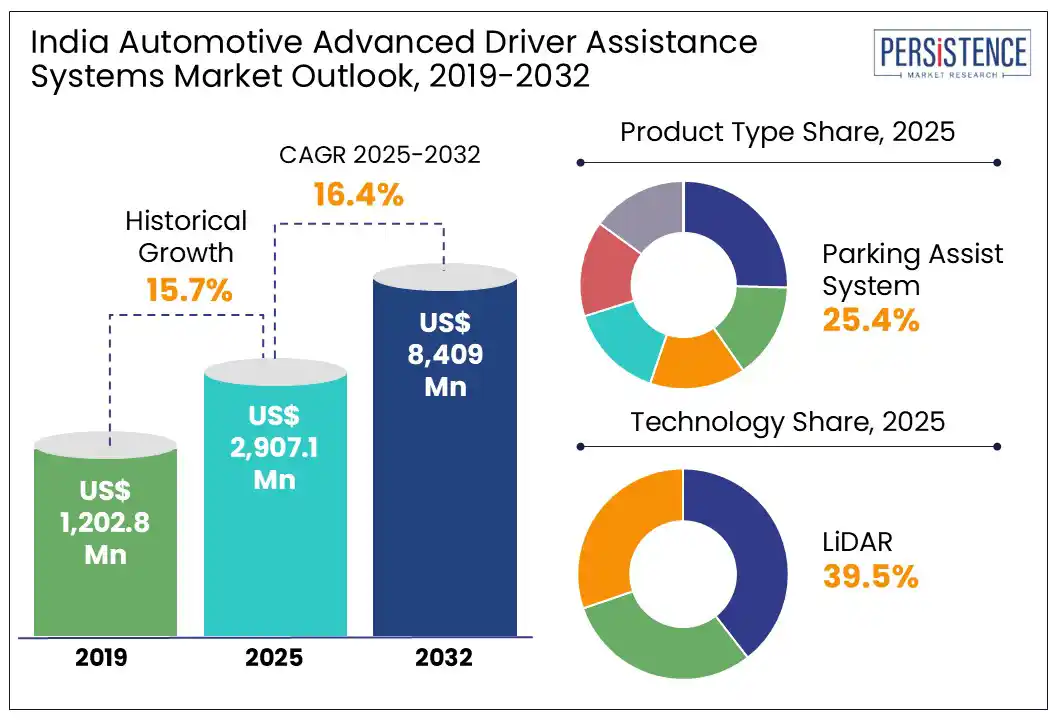

The India automotive advanced driver assistance systems market size is likely to be valued at US$ 2,907.1 Mn in 2025 and is estimated to reach US$ 8,409.0 Mn in 2032, growing at a CAGR of 16.4% during the forecast period 2025-2032.

India’s automotive industry is undergoing a transformative shift as safety takes center stage in consumer preferences, government regulations, and OEM strategies. At the heart of this evolution lies the rise of Advanced Driver Assistance Systems (ADAS). It is a suite of technologies once reserved for luxury vehicles but now steadily making their way into mid-range and even entry-level segments. From chaotic city intersections to high-speed expressways, India presents one of the most complex driving environments in the world. It is making the deployment of ADAS both challenging and necessary.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

India Automotive Advanced Driver Assistance Systems Market Size (2025E) |

US$ 2,907.1 Mn |

|

Market Value Forecast (2032F) |

US$ 8,409.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

16.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

15.7% |

The sharp rise in road accidents is playing a key role in bolstering the India automotive advanced driver assistance systems market growth, found a Persistence Market Research report. As per the Ministry of Road Transport and Highways (MoRTH), in 2022, the country recorded more than 4.6 lakh road accidents, leading to over 1.68 lakh deaths. A large portion of these accidents were attributed to human errors such as poor lane discipline, speeding, and distracted driving. It has hence pushed private and government agencies to adopt safety technologies that can proactively assist drivers in preventing collisions.

ADAS features such as blind spot detection, lane departure warning, and automatic emergency braking are gaining impetus among OEMs targeting the local market. For example, Honda Elevate and Hyundai Verna have introduced ADAS-enabled variants in the mid-size segment. It highlights a gradual shift toward democratizing these safety features beyond luxury vehicles. This surging emphasis is also being supported by consumer awareness campaigns and media coverage pointing toward the role of technology in reducing accidents.

The adoption of ADAS in India faces notable resistance owing to concerns over potential malfunctions, especially under adverse weather and unpredictable road conditions. Heavy rainfall, dense fog, and poor road markings often impair the performance of camera and sensor-based systems that rely heavily on visual cues for decision-making. Lane departure warning and automatic emergency braking, for instance, can be rendered ineffective or dangerously inaccurate in monsoon-affected areas where visibility is low. A 2023 report by the International Center for Automotive Technology revealed that several Level 2 ADAS features show degraded performance in India’s monsoon conditions.

Over-reliance on ADAS in India is also increasingly raising concerns about driver complacency and reduced situational awareness. While these systems are designed to assist rather than replace drivers, users often misinterpret them as autonomous solutions. This misjudgment is particularly risky on the country’s roads, where unpredictable pedestrian movements, unmarked intersections, and erratic two-wheeler behavior demand constant human vigilance. A 2023 pilot study by the Automotive Research Association of India (ARAI) found that drivers using ADAS-equipped vehicles exhibited delayed response times when the systems were active, particularly in congested traffic conditions.

The adoption of ADAS in India is contributing incrementally to reduced fossil fuel dependence by promoting more efficient driving behavior and optimizing vehicle energy consumption. Features such as traffic jam assist and adaptive cruise control leverage ADAS sensors and algorithms. These help maintain consistent speeds and avoid stop-and-go patterns that typically lead to excessive fuel consumption. A 2023 study by IIT Delhi in partnership with a local OEM found that ADAS-enabled vehicles demonstrated up to 12% better fuel efficiency in urban traffic conditions compared to non-ADAS variants.

Various ADAS-equipped vehicles are also being introduced in tandem with hybrid and electric platforms, which supports India’s fuel transition goals. For example, the Toyota Hyryder and Maruti Suzuki Grand Vitara integrate Level 1 ADAS functionalities that complement their energy-saving design. By assisting with efficient coasting and minimizing aggressive driving, these systems indirectly improve range in hybrid and electric powertrains while reducing fuel dependency in ICE variants.

Based on product type, the market is divided into parking assist system, adaptive cruise control, blind spot detection, intelligent headlights, and autonomous emergency braking. Out of these, the parking assist system segment is predicted to account for nearly 25.4% share in 2025 due to increasing vehicle density, shrinking urban parking spaces, and surging popularity of large vehicles such as SUVs. In Delhi and Mumbai, where parallel parking and tight basement spaces are common, parking assist features, including ultrasonic sensors and rear-view cameras, are now considered practical necessities rather than luxury add-ons.

Adaptive cruise control, on the other hand, will likely exhibit a steady growth in the foreseeable future amid ongoing development of highway infrastructure and increasing trend of long-distance travel among urban vehicle owners. There is also a high demand for features that enhance driving comfort and reduce fatigue with the development of the Delhi-Mumbai Expressway and Bengaluru-Mysuru Access-controlled Highway. Adaptive cruise control is hence seen as a valuable tool for navigating India’s expanding expressway network.

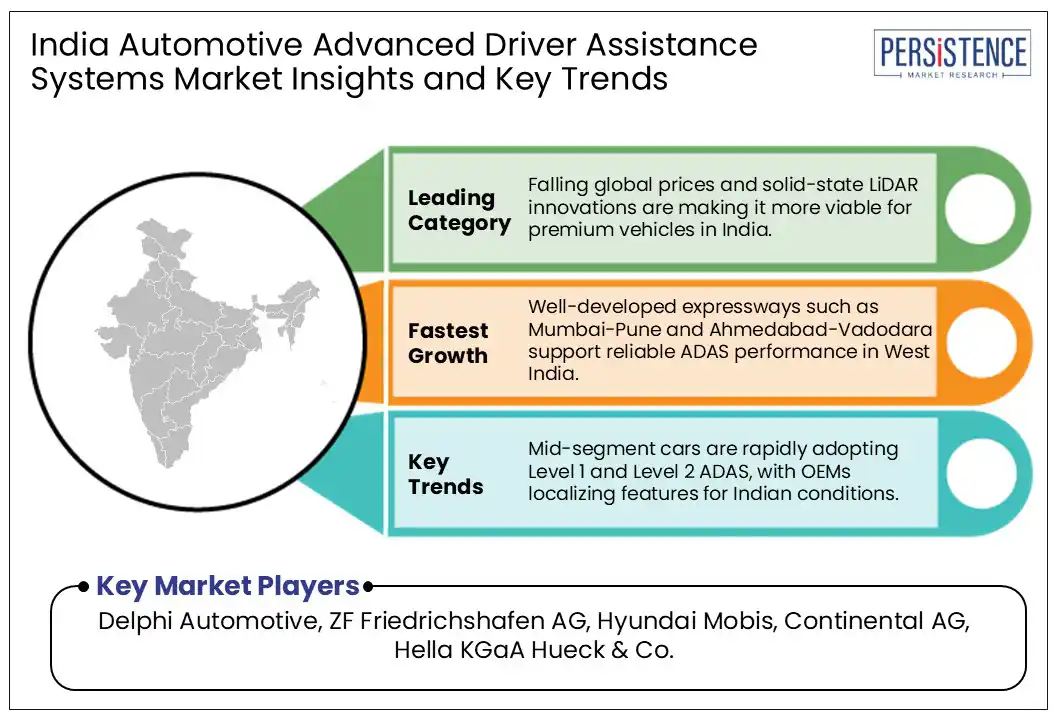

By technology, the market is trifurcated into radar, LiDAR, and camera. Among these, the automotive LiDAR segment is estimated to hold approximately 39.5% of the India automotive advanced driver assistance systems market share in 2025 due to its ability to deliver high-resolution, real-time 3D mapping of a vehicle’s surroundings. It is capable of accurately detecting the size, shape, and distance of objects in dense urban traffic, poorly lit environments, and unstructured roadways. This feature is becoming important for innovative features such as collision avoidance where millisecond-level decisions can significantly impact outcomes.

Radar technology is also gaining momentum in India owing to its reliability in diverse environmental conditions and high affordability. Unlike camera systems that often struggle in low light, fog, or heavy rain, radar offers consistent performance through electromagnetic wave detection. This makes it ideal for key ADAS functionalities, especially on highways and expressways where high-speed driving requires rapid response systems.

West India, particularly the states of Maharashtra and Gujarat, is witnessing a robust uptake of ADAS. It is bolstered by the presence of automotive manufacturing and IT clusters as well as high vehicle penetration in metro cities. Mumbai and Pune are at the forefront, with a strong preference for mid- to high-end vehicles that come with Level 1 and Level 2 ADAS features. Pune’s ecosystem is particularly significant as it houses research and development operations for leading players such as Tata Technologies and Continental. They are actively working on localizing ADAS hardware and software for conditions in India.

Continental’s Pune facility has been involved in developing radar-based systems and camera modules designed to function reliably in India’s congested and often chaotic traffic scenarios. In terms of infrastructure, West India benefits from relatively better-maintained highways and urban road networks. Roadways such as the Mumbai-Pune Expressway provide conditions that allow features such as lane keep assist to perform effectively. Adoption in rural and semi-urban belts, however, still lags due to patchy road infrastructure, limited awareness, and concerns over maintenance costs.

South India is emerging as one of the most receptive regions for ADAS in the country, accelerated by a tech-aware consumer base, superior road infrastructure, and the presence of key automotive research and development hubs. Hyderabad, Chennai, and Bengaluru are leading the demand with an expanding segment of buyers actively seeking safety-focused features. Bengaluru has shown a high adoption rate for mid-range ADAS-equipped vehicles. As per a 2023 online report, Bengaluru and Chennai accounted for nearly 18% of all ADAS-equipped car sales in India, underscoring their early adopter status.

Chennai plays a dual role in this ecosystem, not just as a consumer market but also as a manufacturing and development hub. Global OEMs and Tier 1 suppliers such as Hyundai, Valeo, and Bosch operate large engineering and production facilities in Tamil Nadu. This contributes to the development and localization of ADAS components. In addition, South India’s expanding network of well-maintained expressways provides an environment more conducive to reliable ADAS functioning.

In North India, the adoption of ADAS is gaining relatively stronger momentum compared to other regions. It is mainly propelled by affluent urban demographics, increasing availability of ADAS-equipped models, and dense highway networks. Cities such as Lucknow, Delhi-NCR, Jaipur, and Chandigarh are emerging as hot spots for premium and mid-range vehicles featuring Level 1 and Level 2 ADAS technologies. Delhi-NCR is currently witnessing rising consumer preference for safety-oriented features due to worsening traffic conditions and a surging awareness of road accident fatalities.

The shift is reflected in the popularity of ADAS-equipped vehicles such as the Mahindra XUV700, which has seen strong bookings from Gurgaon and Noida since its launch. Hyundai has also reported a high uptake of the ADAS-enabled Verna and Tucson models in metros across North India, with approximately 25 to 30% of Verna buyers in Delhi opting for the high variants that include Level 2 ADAS. However, rural and semi-urban areas in states such as Haryana and Punjab continue to face adoption barriers. It is because of inconsistent road conditions and a rising preference for rugged utility vehicles over tech-enabled ones.

The India automotive advanced driver assistance systems market is gradually progressing, augmented by rising demand for vehicle safety and regulatory push. Although the market is still in its early stages compared to Europe, Japan, or North America, various global and domestic players are actively laying groundwork to capture early market share. Leading international automotive suppliers, including Valeo and Bosch, are investing in research and development and production facilities to localize ADAS components. Domestic OEMs such as Mahindra & Mahindra and Tata Motors are also integrating ADAS features such as cruise control and lane departure warning into their new models.

India automotive advanced driver assistance systems market is projected to reach US$ 2,907.1 Mn in 2025.

Rising vehicle density in metros and government initiatives to reduce traffic collisions are the key market drivers.

The market is poised to witness a CAGR of 16.4% from 2025 to 2032.

Collaborations between global tech firms and local OEMs are anticipated to be a key market opportunity.

Delphi Automotive, ZF Friedrichshafen AG, and Hyundai Mobis are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By Vehicle Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author