ID: PMRREP34731| 200 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

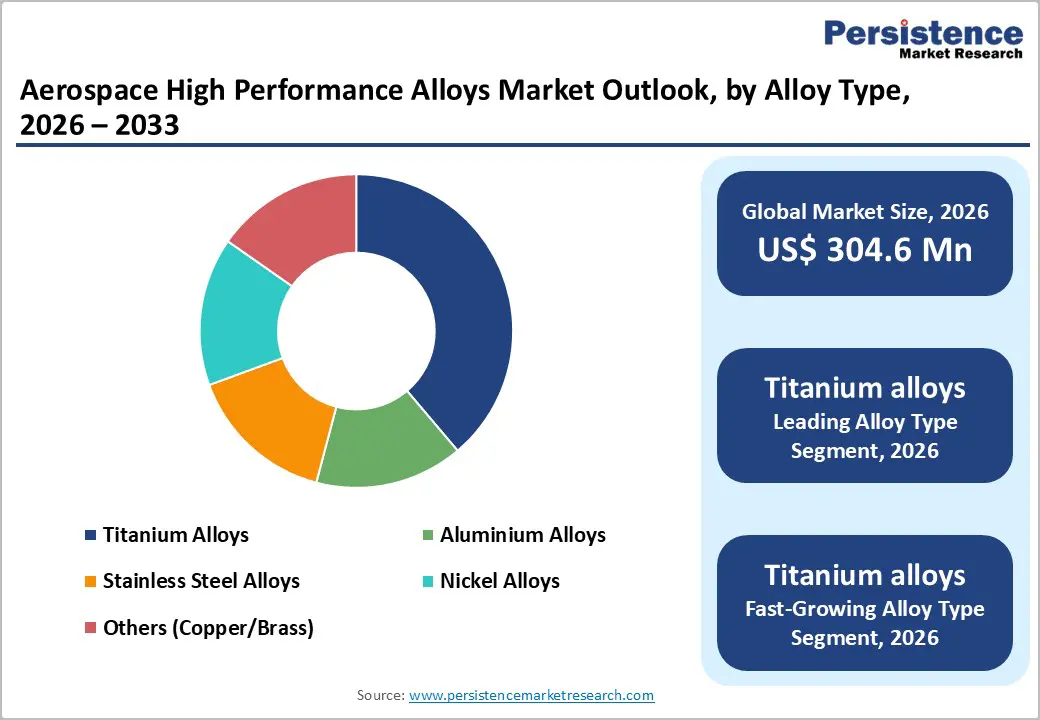

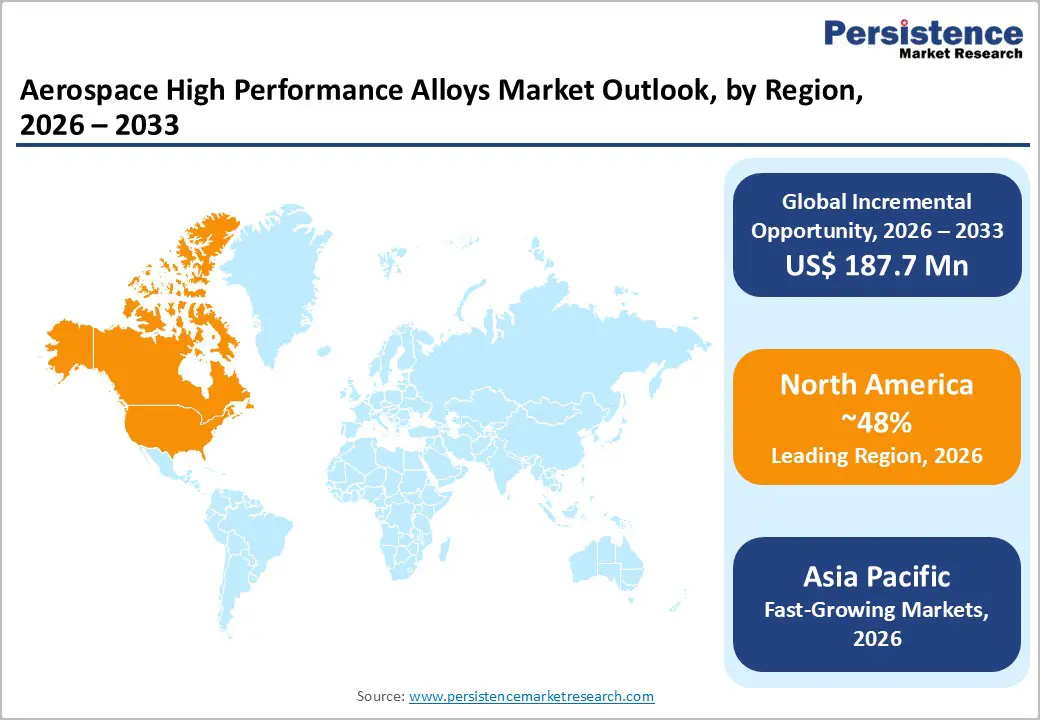

The global aerospace high performance alloys market is expected to be valued at US$ 304.6 million in 2026 and projected to reach US$ 492.3 million by 2033, growing at a CAGR of 7.1% between 2026 and 2033.

The aerospace high-performance alloys market continues to expand, supported by accelerating commercial aircraft production and sustained military aviation investment. Boeing projects demand for 44,000 new aircraft by 2044, while elevated global defense spending is expected to exceed US$ 1.19 trillion for new and upgraded military aircraft over the next decade. Long production backlogs, modernization initiatives such as the F-35, and extended delivery schedules reinforce long-term demand visibility for advanced alloy manufacturers.

| Key Insights | Details |

|---|---|

|

Aerospace High Performance Alloys Market Size (2026E) |

US$ 304.6 million |

|

Market Value Forecast (2033F) |

US$ 492.3 million |

|

Projected Growth CAGR (2026-2033) |

7.1% |

|

Historical Market Growth (2020-2025) |

5.8% |

Global commercial aviation demand has exceeded industry supply capacity, creating unprecedented production requirements for aircraft manufacturers. Boeing’s Commercial Market Outlook forecasts demand for 44,000 new airplanes through 2044, while Airbus and Boeing order backlogs extend delivery windows into the 2040s, providing multi-decade production visibility. Air travel has recovered to 95-97% of pre-pandemic levels globally, with U.S. domestic air travel exceeding pre-pandemic levels by 9%, according to IATA data. Industry production constraints result in aircraft delivery slot delays stretching into the 2030s-2040s for narrowbody platforms, creating acute component supply pressures including high-performance alloys.

Modern commercial aircraft platforms including Boeing 787 Dreamliner and Airbus A350 utilize titanium alloys comprising 15% of airframe weight, with aluminum alloys representing 80-90% of aircraft components, requiring continuous alloy supply to support production rate expansion from current 20-30 aircraft per month toward industry targets of 50+ monthly deliveries by 2026-2027. The convergence of expanding aircraft production, technical specifications demanding advanced materials, and extended production backlogs translates directly into sustained demand for high-performance alloys throughout the forecast period.

Global defense spending on military aerospace platforms represents significant market driver, with international air force budgets exceeding US$ 90 billion annually. The F-35 program represents the largest defense procurement initiative globally, with partner nations planning to acquire 3,100+ fighter jets through 2035 at costs exceeding US$ 200 billion total. India’s aeronautical modernization initiative allocates US$ 7 billion for indigenous fighter jet development and procurement, while European nations pursue next-generation fighter programs including FCAS (Future Combat Air System) with projected investments exceeding US$ 100 billion.

Military aircraft specifications require nickel-based superalloys capable of sustained 1,200+ degrees Celsius turbine blade operation, creep resistance exceeding 26% compared to legacy alloys, and fatigue strength improvements of 15%+ over prior formulations. VSMPO-AVISMA, the largest titanium producer, secured contracts providing titanium alloys for F-35 production, while Precision Castparts received US$ 2+ billion in defense contracts for precision-cast superalloy components. Military modernization programs provide guaranteed demand visibility and premium pricing supporting specialized high-performance alloy supplier revenue expansion.

High-performance alloy manufacturers face significant supply chain constraints, particularly for nickel and titanium sourcing. Russia historically supplied approximately 13% of global titanium, with recent geopolitical tensions creating supply disruption risks and alternative sourcing requirements increasing material costs by 15-25%. Nickel mining concentration in Indonesia, Philippines, and Australia creates geographic dependencies, with supply disruptions potentially triggering 10-20% price increases across the aerospace sector.

The complexity of specialty alloy manufacturing, including vacuum induction melting, hot isostatic pressing, and precision casting processes, requires significant capital investment and technical expertise, creating barriers to new entrant competition. Long lead times spanning 6-12 months for custom alloy formulations and certifications delay supplier responsiveness to demand fluctuations, creating inventory management challenges and working capital pressures.

Aerospace high-performance alloy manufacturing involves extraordinary cost burdens, with virgin material costs exceeding US$ 50-100 per kilogram compared to conventional aluminum at US$ 2-3 per kilogram. AS9100 aerospace quality certification, NADCAP (National Aerospace and Defense Contractors Accreditation Program) compliance**, and regulatory approval processes through organizations including Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) extend product development timelines spanning 3-5 years and require capital investments exceeding US$ 10-50 million.

The stringent performance requirements for turbine blade superalloys including creep strength at 1,200+ degrees Celsius, fatigue resistance across 10+ million flight cycles, and corrosion resistance in salt-fog environments mandate advanced metallurgical development and extensive testing protocols, substantially increasing R&D costs. Margins in commodity alloy segments remain compressed at 8-12%, while specialty formulations achieve 15-25% margins, creating market segmentation with limited pricing flexibility for cost-sensitive customer segments.

Additive manufacturing (3D printing) represents exceptional growth opportunity, with aerospace sector investigating titanium and nickel alloy 3D printing for complex component production, potentially reducing material waste by 40-60% compared to traditional machining. General Electric Aviation successfully demonstrated ceramic matrix composite (CMC) turbine blades for the F414 jet engine, capable of sustaining operating temperatures 200-300 degrees Fahrenheit higher than conventional nickel superalloys, potentially expanding operating windows and demand for advanced alloy variants.

GE Additive and Siemens collaboration developed high-strength titanium alloys optimized for laser powder bed fusion, enabling production of previously impossible component geometries. The convergence of digital manufacturing, AI-optimized alloy design, and advanced characterization techniques creates opportunities for manufacturers developing next-generation formulations combining reduced density (enabling 20-30% weight savings), enhanced thermal stability, and improved damage tolerance. Defense contractors including Rolls-Royce and Pratt & Whitney invest US$ 500+ million annually in advanced alloy R&D, creating supply opportunities for specialty alloy feedstock and intermediate materials.

Electric and hybrid-electric propulsion systems for regional aircraft and vertical takeoff/landing (eVTOL aircrafts) platforms require specialized aluminum and titanium alloy variants with enhanced electrical conductivity and thermal management capabilities. Regional aircraft electrification initiatives including Pipistrel (Textron), Eviation, and Bye Aerospace development programs target 2025-2030 certification, creating emerging alloy specification demand. Sustainable Aviation Fuel (SAF) compatibility requirements mandate alloys demonstrating sulfur and aromatic compound resistance without conventional additive package modifications, creating product development opportunities for metallurgists.

The International Civil Aviation Organization (ICAO) established Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) driving airline procurement toward fuel-efficient aircraft platforms, which require advanced lightweight alloys reducing aircraft weight by 10-15% and enabling fuel burn improvements of 15-20%. The convergence of decarbonization mandates, emerging propulsion technologies, and performance requirements creates sustained innovation demand throughout the aerospace supply chain.

Titanium alloys account for around 32% of market share in 2025, reflecting their critical role in modern aerospace systems. Their exceptional strength-to-weight ratio and ability to withstand 600°C+ operating temperatures make them ideal for turbine blades, landing gear, and structural airframe components requiring fatigue resistance. Aircraft platforms such as the Boeing 787 and Airbus A350 typically incorporate 20–40 metric tons of titanium alloys, underscoring the material’s value in weight reduction and corrosion resistance.

The widely used Ti-6Al-4V formulation delivers tensile strengths near 1,000 MPa, enabling long service cycles and lower maintenance costs. With aircraft build rates rising and hypersonic systems advancing material requirements, titanium alloy demand is projected to expand at 7.8% CAGR, consolidating its leadership position.

Jet engine manufacturing represents the most demanding application segment, commanding roughly 28% of overall alloy consumption due to extreme thermal and mechanical stresses. Turbine components experience 1,200–1,400°C sustained temperatures and rotational speeds exceeding 100,000 RPM, necessitating advanced nickel-based superalloys such as Inconel 718 and Haynes 282, which deliver 15–26% improvements in fatigue and creep resistance over legacy alloys.

Engine OEMs like GE Aviation and Pratt & Whitney leverage single-crystal superalloys formed through directed solidification to achieve improved efficiency, enabling 5% fuel savings per engine generation and supporting next-generation, high bypass ratio turbofan architectures. As jet engines contribute 8–10% of global aerospace revenues, alloy demand is forecast to grow at 8.3% CAGR, supported by fleet modernization and new propulsion platforms.

North America remains the largest regional market for aerospace high-performance alloys, accounting for roughly 48% of global consumption, supported by dominant commercial aircraft manufacturing and extensive defense procurement. Boeing Commercial Airplanes and the F-35 fighter jet program distributed across Connecticut, Texas, and California generate sustained demand for nickel- and titanium-based alloys for fuselage, turbine, and landing gear components. Regional manufacturers, including major superalloy forgers and casting specialists, operate AS9100-certified production facilities enabling precision turbine blade, disc, and structural part manufacturing.

Strong university-industry collaboration accelerates alloy innovation for next-generation propulsion, light weighting, and thermal resistance improvements. However, supply chain constraints, rising labor and energy costs, and exposure to rare-earth metal dependencies linked to U.S.–China trade tensions present persistent risks. Domestic reshoring and near-shoring initiatives aim to mitigate supply risk and strengthen regional alloy independence, yet capacity bottlenecks pose challenges as production rates increase through 2025–2027 to meet commercial aircraft backlog recovery.

Europe represents a strategically significant market for aerospace high-performance alloys, anchored by Airbus manufacturing and Rolls-Royce engine production across France, Germany, Spain, and the UK. The region consumes large volumes of titanium and nickel superalloys for A350 and Trent engine platforms, offering strong long-term demand visibility across OEM, Tier-1, and Tier-2 supplier networks. Integrated European alloy producers maintain vertically linked forging, rolling, and finishing capacities that support full-service material supply aligned with aerospace qualification requirements under AS9100 and REACH regulations. Sustainability and circular-economy compliance drive investment in traceable sourcing, recycling infrastructure, and low-carbon alloys.

Defense modernization projects, including FCAS and A400M, reinforce multi-year procurement pipelines. Yet Europe faces several headwinds, including 13% titanium supply reduction resulting from sanctions on Russian producers, Brexit-driven cross-border compliance friction, and high electricity costs affecting alloy smelting. Despite constraints, stable demand and regulatory certainty support continued alloy innovation and localized capacity expansion.

Asia Pacific represents the fastest-growing aerospace high-performance alloys market, forecast to expand at 9.2% CAGR through 2033 driven by commercial aircraft demand, defense modernization, and rising regional manufacturing capacity. China leads regional consumption through COMAC’s C919 and emerging CR929 programs, requiring substantial titanium and aluminum alloy volumes for airframes and powerplants. India accelerates alloy use at 10.5% CAGR, supported by HAL fighter programs, regional aircraft initiatives, and rapid MRO expansion creating domestic supply requirements.

Japan and South Korea reinforce regional supply chain depth through precision casting, rolling, and metallurgical innovation backed by established industrial foundations. China expands titanium smelting capacity to reduce reliance on Russian exports, while suppliers in Thailand and Vietnam scale fabrication to support OEM cost competitiveness. Despite geopolitical pressures, Asia Pacific benefits from cost-competitive labor, strong aircraft demand across ASEAN markets, and increasing supplier qualification under international aerospace material standards, enabling long-term market share gains.

The global aerospace high-performance alloys market is moderately consolidated, with supply concentrated among vertically integrated producers combining raw material extraction, alloy melting, forging, and finished component capabilities. Market leaders emphasize proprietary superalloy formulations, advanced casting and powder metallurgy processes, and long-term qualification with aircraft OEMs, which raises entry barriers and strengthens supplier lock-in. Engine manufacturers increasingly integrate alloy development within propulsion programs to meet extreme thermal and mechanical requirements, shifting competition toward performance-driven innovation rather than commodity pricing.

Titanium supply remains sensitive to geopolitical constraints, reinforcing strategies focused on regionalizing capacity and recycling scrap materials to ensure continuity. Producers pursue multi-year contracts, dual-sourcing arrangements, and sustainability certification as differentiation tools aligned with aerospace decarbonization goals. Consolidation continues through acquisitions of forging houses, additive manufacturing capabilities, and service providers, as OEMs demand reliability, traceability, and end-to-end material solutions capable of supporting rising production rates into the next decade.

It is projected to reach US$ 304.6 million in 2026.

Growth is driven by aircraft production recovery, rising defense spending, and demand for advanced lightweight alloys.

North America leads with about 48% share.

The key opportunity lies in additive manufacturing and next-generation alloy development.

Major players include PCC, Carpenter, ATI, VSMPO-AVISMA, Rolls-Royce, GE Aviation, and Alcoa.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Metric Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Alloy Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author