ID: PMRREP34613| 191 Pages | 27 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

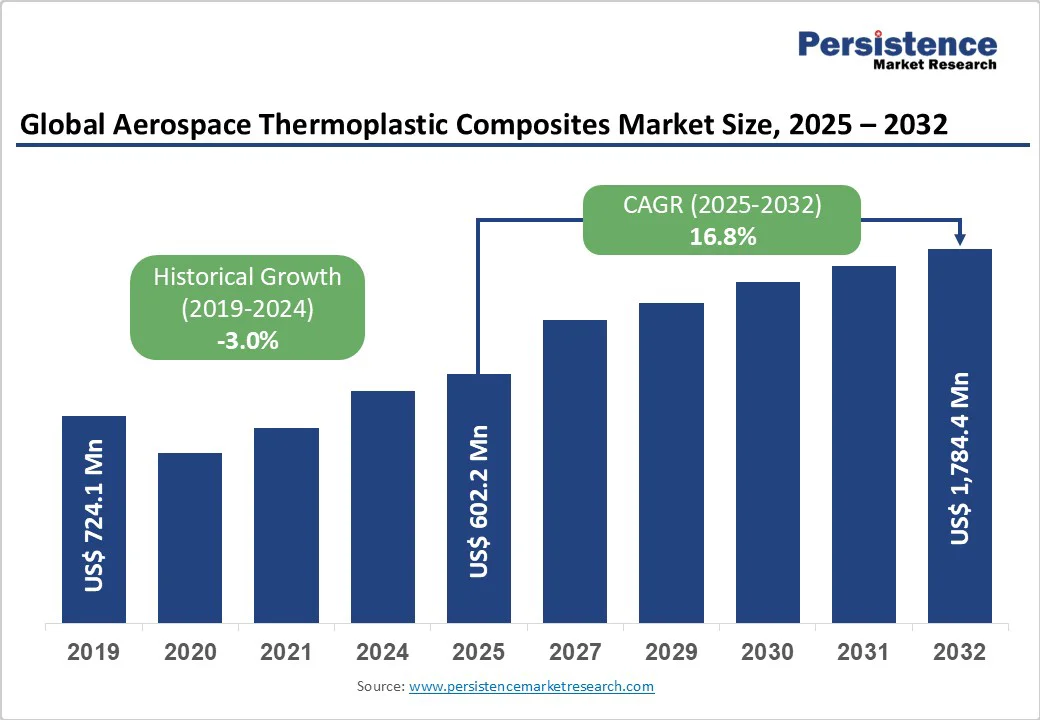

The global aerospace thermoplastic composites market size is likely to be valued at US$602.2 Million in 2025 and is expected to reach US$1,784.4 Million by 2032, growing at a CAGR of 16.8% during the forecast period from 2025 to 2032, driven by increasing demand for lightweight, fuel-efficient aerospace components, advanced manufacturing technologies (AFP/ATL processes), and growing emphasis on sustainable, recyclable composite materials.

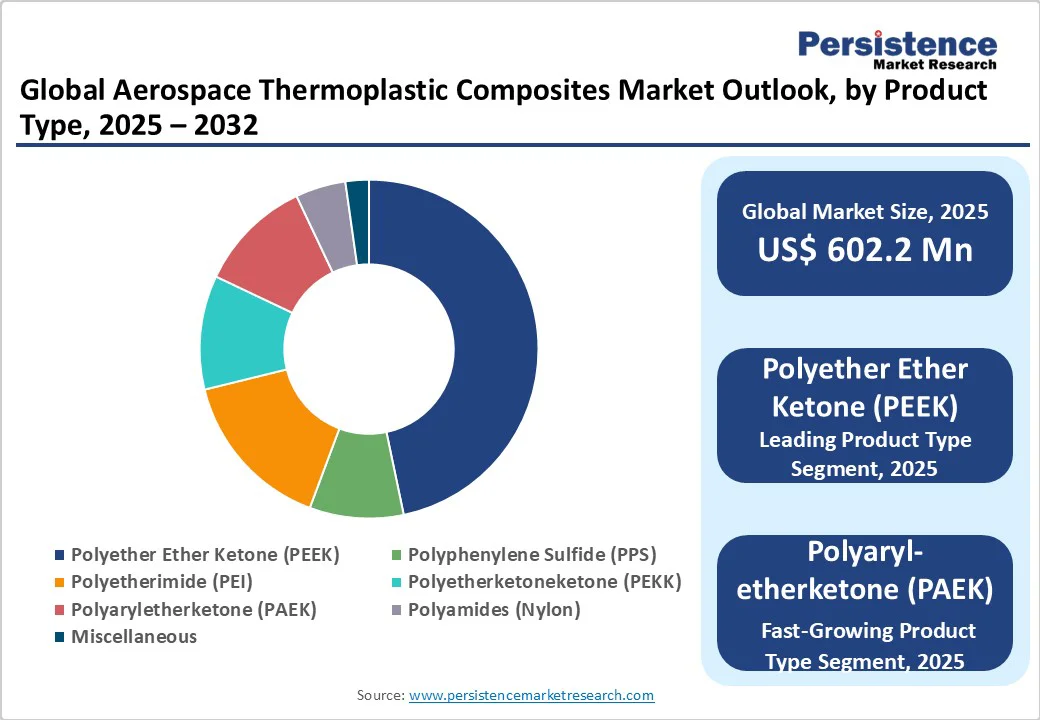

PEEK-based composites' dominance and application demand in commercial aircraft highlight the sector's focus on next-generation aircraft programs requiring high-performance thermoplastic solutions.

| Key Insights | Details |

|---|---|

| Aerospace Thermoplastic Composites Market Size (2025E) | US$602.2 Mn |

| Market Value Forecast (2032F) | US$1,784.4 Mn |

| Projected Growth CAGR (2025-2032) | 16.8% |

| Historical Market Growth (2019-2024) | -3.0% |

The aerospace industry’s drive to reduce aircraft weight without compromising strength is a key growth driver for thermoplastic composites. A 100 kg airframe weight reduction can save about 19,000 liters of fuel annually, significantly lowering operational costs. Composites enable up to 20% weight savings and improved fuel efficiency, with modern aircraft such as the Boeing 787 containing over 50% composite materials.

Aviation contributes 2-3% of global CO? emissions, prompting stricter environmental regulations and demand for sustainable materials. The FAA projects that the global aircraft fleet to exceed 39,000 by 2038, underscoring the growing need for lightweight, high-performance thermoplastic composites in next-generation aircraft.

Rising environmental awareness and sustainability mandates are accelerating the shift from thermoset to thermoplastic composites in aerospace. Unlike thermosets, thermoplastics are fully recyclable, allowing repeated remelting and reuse without major property loss, aligning with industry sustainability goals. Driven by the European Green Deal and net-zero targets, adoption is increasing across civil and military aviation.

Thermoplastic composites support Out-of-Autoclave (OoA) manufacturing via In-Situ Consolidation (ISC), reducing reliance on energy-intensive processes. They also offer unlimited shelf life and rapid, cost-effective production, enhancing efficiency and minimizing environmental impact across the material lifecycle.

High manufacturing and assembly costs hinder the widespread use of thermoplastic composites in primary aircraft structures. These materials are significantly more expensive than aluminum alloys and require specialized high-temperature equipment exceeding 300°C, driving up capital and processing expenses.

Complex manufacturing demands precise temperature control and advanced machinery, further increasing setup costs. Stringent aerospace certification processes involving extensive testing and validation add time and expense, limiting faster adoption of thermoplastic composites in large-scale applications.

Thermoplastic composite processing faces challenges such as high processing temperatures, complex layup and consolidation methods, and stricter quality control. Achieving flawless in-situ consolidation during AFP/ATL requires precise control of heat, cooling, and pressure.

Limited qualified suppliers and immature supply chains leading to price volatility. Extensive testing and certification prolong development, while transitioning from thermoset methods demands significant workforce retraining and new manufacturing protocols, slowing large-scale adoption.

The emergence of Urban Air Mobility (UAM) markets demands manufacturing rates that traditional thermoset processing struggles to achieve, creating substantial opportunities for thermoplastic composites. Next-generation aircraft programs, including electric vertical takeoff and landing (eVTOL) vehicles, require rapid production capabilities and lightweight structures that thermoplastics can provide.

Military modernization programs across the U.S., China, India, and NATO countries are allocating significant defense budgets toward advanced aircraft development incorporating high-performance composite materials.

The ongoing Clean Sky 2 OUTCOME project has tested and validated sustainable manufacturing processes for thermoplastic composite wing structures, demonstrating commercial viability for large-scale applications. Space-launch commercialization is boosting demand for lightweight composite structures, with thermoplastics offering advantages in reusable launch systems.

Integration of additive manufacturing with AFP processes enables complex 3D thermoplastic composite fabrication without traditional tooling requirements. Hybrid manufacturing cells combining AFP, filament winding, and additive manufacturing in single production units represent significant technological advancement opportunities.

Development of rapid-cure resins and advanced thermoplastic bonding technologies can increase production rates and reduce processing complexity.

Multi-material AFP capabilities, enabling rapid switching between different fiber types, create opportunities for hybrid composites with optimized performance and cost characteristics. The convergence of digital technologies, including AI-driven inspection, digital twins, and real-time monitoring systems, offers opportunities for enhanced quality control and process optimization.

Polyether Ether Ketone (PEEK) maintains dominant market leadership with 47% market share, attributed to its exceptional combination of high strength, stiffness, and fatigue resistance essential for structural aerospace components. PEEK exhibits excellent thermal stability with continuous operating temperatures up to 250°C and short-term exposures up to 300°C, crucial for aerospace applications facing extreme temperature variations.

The material's ability to replace metals while maintaining performance standards makes it particularly valuable for weight-sensitive applications. PEEK is frequently combined with carbon fiber to manufacture clips, cleats, brackets, clamps, and connectors that are used extensively in modern aircraft programs.

Polyaryletherketone (PAEK) represents the fastest-growing segment with a CAGR of 18.8%, driven by advancing material science and expanding application possibilities in next-generation aircraft programs. PAEK offers superior chemical resistance and mechanical properties compared to conventional thermoplastics, enabling use in more demanding aerospace environments.

The Clean Sky 2 OUTCOME project's validation of PAEK-based composites for wing box applications demonstrates growing confidence in advanced polyaryletherketone materials. Growing research investments and technological partnerships are expanding PAEK processing capabilities and reducing manufacturing costs, supporting accelerated market adoption.

Automated Fiber Placement/Automated Tape Laying (AFP/ATL) dominates with 59% market share, reflecting the aerospace industry's commitment to precision manufacturing and material optimization. AFP/ATL technologies enable consistent quality while eliminating defects associated with manual layup processes, supporting complex lightweight structures with exceptional strength-to-weight proportions.

These automated techniques align with industry sustainability goals by minimizing material waste and energy consumption while supporting next-generation aerospace manufacturing requirements. Ongoing advancements in robotic automation, software integration, and in-situ monitoring continue to optimize AFP/ATL processes.

Compression molding has emerged as the fastest-growing processing method with a CAGR of 17.9%, driven by its compatibility with high-volume production requirements and cost-effective manufacturing capabilities. This method enables rapid cycle times essential for emerging aerospace applications, including urban air mobility vehicles, requiring higher production rates.

Compression molding offers advantages for complex geometry parts and enables integration with automated manufacturing systems. The process supports both thermoset and thermoplastic materials while providing design flexibility for optimized component manufacturing.

Interior applications command 67% market share, reflecting the aerospace industry's focus on cabin components, passenger comfort systems, and weight reduction in non-structural elements. Interior applications benefit from thermoplastic composites' fire, smoke, and toxicity (FST) compliance capabilities essential for passenger safety requirements.

These applications include seat assemblies, cabin panels, overhead bins, galley components, and lavatory structures where weight reduction directly impacts fuel efficiency. The growing emphasis on passenger experience and cabin customization drives demand for advanced thermoplastic composite interior solutions.

Airframe applications represent the fastest-growing segment with a CAGR of 17.5%, driven by expanding use in primary and secondary structural components, including fuselage panels, wing structures, and control surfaces. Boeing's concerted effort to convert structural parts, including brackets, clips, and fasteners, from thermoset to thermoplastic composites demonstrates growing confidence in structural applications.

The A350XWB's extensive use of thermoplastic composite parts in fuselage construction validates large-scale structural implementation. Advanced airframe applications benefit from thermoplastics' damage tolerance, repairability, and joining capabilities essential for critical structural performance.

Commercial Aircraft dominate with 89% market share, reflecting the substantial scale of global airline operations and fleet modernization programs. Boeing 787 and Airbus A350 programs extensively utilize thermoplastic composites for localized reinforcement, with approximately 8,000-15,000 clips and cleats per aircraft.

Both manufacturers have transformed their material compositions with modern aircraft incorporating over 50% composite materials by weight. Commercial aviation's focus on fuel efficiency, operational cost reduction, and environmental compliance drives thermoplastic composite adoption for weight-sensitive applications..

Civil Helicopter represents the fastest-growing aircraft segment with a CAGR of 18.5%, driven by expanding roles in urban transportation, emergency services, and offshore operations requiring lightweight, durable components. Helicopter applications benefit from thermoplastics' vibration-damping properties, damage tolerance, and repair capabilities essential for rotorcraft operational requirements.

The growing emphasis on electric and hybrid helicopter propulsion systems creates opportunities for advanced thermoplastic composite structural solutions. Military helicopter modernization programs and emerging commercial helicopter services support accelerated market growth in this segment.

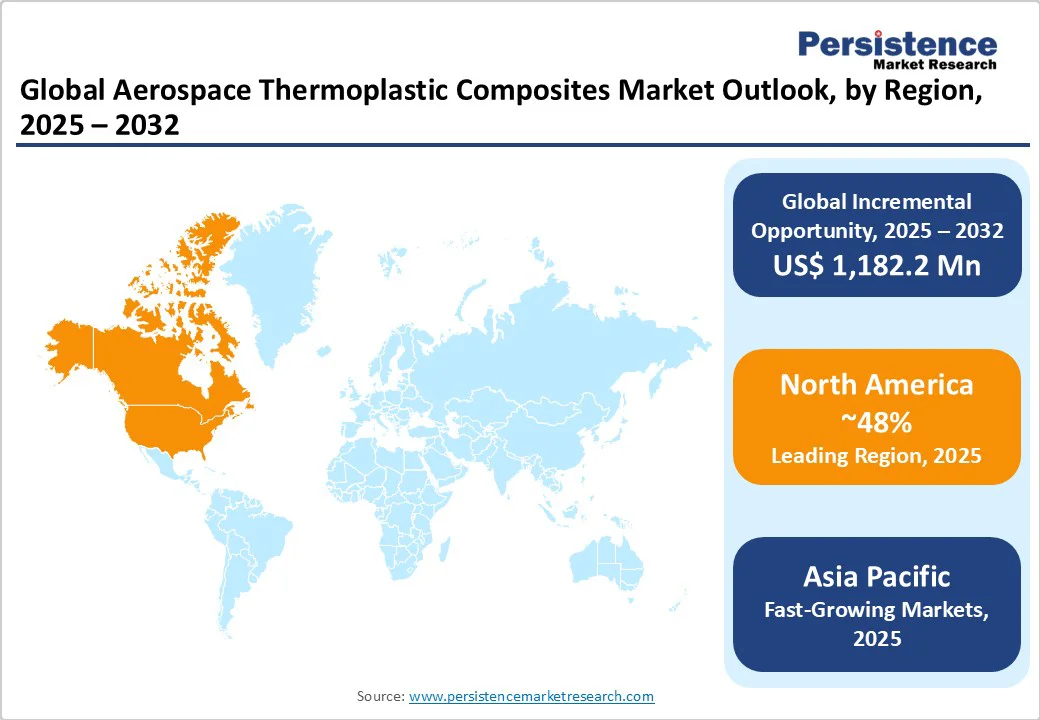

North America dominates the aerospace thermoplastic composites market with 48% global market share, driven by strong aerospace manufacturing infrastructure and the presence of leading OEMs, including Boeing, Lockheed Martin, and Raytheon Technologies. The region benefits from extensive R&D funding, established composite supply chains, and advanced manufacturing capabilities supporting next-generation aircraft programs.

Boeing's concerted effort to convert smaller structural parts from thermoset to thermoplastic composites demonstrates regional leadership in material transition strategies. The U.S. Department of Defense's increased investment in aerospace technology promotes high-performance composite material utilization for defense applications. Collins Aerospace's development of 80% faster production cycles through thermoplastic aerostructures showcases regional technological innovation.

Regulatory framework advantages and innovation ecosystem positioning support North America's market leadership through established certification processes and collaborative research initiatives. The region's focus on space-launch commercialization creates additional demand for lightweight composite structures, with thermoplastics offering advantages in reusable systems.

NASA's investment in advanced composite design tools, including the Design Tool for Advanced Tailorable Composites (DATC), demonstrates the government's commitment to composite technology advancement. Strategic partnerships between aerospace OEMs and composite manufacturers strengthen regional supply chain resilience and technological capabilities.

Europe holds 33% global market share with strong positioning in commercial aviation and advanced materials research, led by Airbus's extensive thermoplastic composite implementation in A350 programs. Airbus has outperformed Boeing in deliveries for five consecutive years, significantly bolstering European market positioning and thermoplastic composite demand.

Key regional players, including GKN Aerospace, Premium AEROTEC, and Daher, maintain a strong market presence with specialized thermoplastic composite capabilities. The A350XWB incorporates substantial thermoplastic composite components, particularly in fuselage applications, validating large-scale commercial implementation.

Regulatory harmonization through European Green Deal initiatives and net-zero emissions targets accelerates thermoplastic composite integration across civil and military aviation sectors. The Clean Sky 2 OUTCOME project's successful validation of thermoplastic composite wing box manufacturing demonstrates European leadership in sustainable aerospace technologies.

German, French, and UK investments in sustainable aviation technologies emphasize lightweight component development and environmental responsibility. European companies' expanding presence in North American markets, exemplified by Daher's partnerships with Gulfstream Aerospace, demonstrates successful international market expansion strategies.

Asia Pacific exhibits the highest regional growth potential with a significant CAGR of 17.2%, driven by expanding aerospace manufacturing capabilities and indigenous aircraft development programs. China's COMAC C919 and India's HAL Tejas programs create substantial opportunities for thermoplastic composite integration in domestic aircraft manufacturing.

Japan's advanced materials research capabilities and established aerospace supply chain infrastructure support regional market development. ASEAN countries' growing aviation markets and manufacturing investments create additional demand for lightweight composite solutions. Government-supported investments and strategic joint ventures are developing comprehensive regional supply chains and manufacturing capabilities.

Manufacturing cost advantages and growing air travel demand position the Asia Pacific as a critical growth region for thermoplastic composite adoption. The region's focus on technology transfer and indigenous manufacturing capabilities supports long-term market development. China and India's substantial defense modernization programs create opportunities for advanced composite materials in military applications.

Regional emphasis on sustainable manufacturing practices and environmental compliance aligns with thermoplastic composites' recyclability advantages. Strategic partnerships between global OEMs and regional manufacturers facilitate technology transfer and market penetration.

The global aerospace thermoplastic composites market demonstrates high consolidation with fewer than 50 players globally, creating a concentrated competitive environment where major players maintain 70-75% combined market share. Market leadership is distributed among established aerospace suppliers with specialized capabilities in thermoplastic composite manufacturing and processing technologies.

GKN Aerospace, Toray Advanced Composites, LANXESS, Solvay, and Mitsubishi Chemical Group represent the dominant market players, competing on price, service offerings, regional presence, and technological capabilities. The consolidated structure shows high barriers to entry, such as significant capital requirements, specialized expertise, and strict aerospace certifications. Major players operate across multiple points in the supply chain, from material development to final component manufacturing.

The aerospace thermoplastic composites market is valued at US$602.2 Million in 2025 and projected to reach US$1,784.4 Million by 2032.

Primary drivers include stringent weight reduction mandates enabling 19,000 liters of annual fuel savings per 100kg weight reduction, advanced AFP/ATL automation cutting production cycles by 80%, and sustainability requirements driving 100% recyclable material adoption over traditional thermosets.

The aerospace thermoplastic composites market is anticipated to witness a CAGR of 16.8% from 2025 to 2032.

Key opportunities include the rising demand from urban air mobility for rapid, scalable production, Asia Pacific’s 17.2% CAGR growth led by programs such as COMAC C919, and hybrid manufacturing that merges AFP with additive processes for complex, lightweight designs.

Key players include GKN Aerospace, Toray Advanced Composites, LANXESS, Solvay, and Mitsubishi Chemical Group.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Processing Method

By Application

By Aircraft Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author