ID: PMRREP3649| 185 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

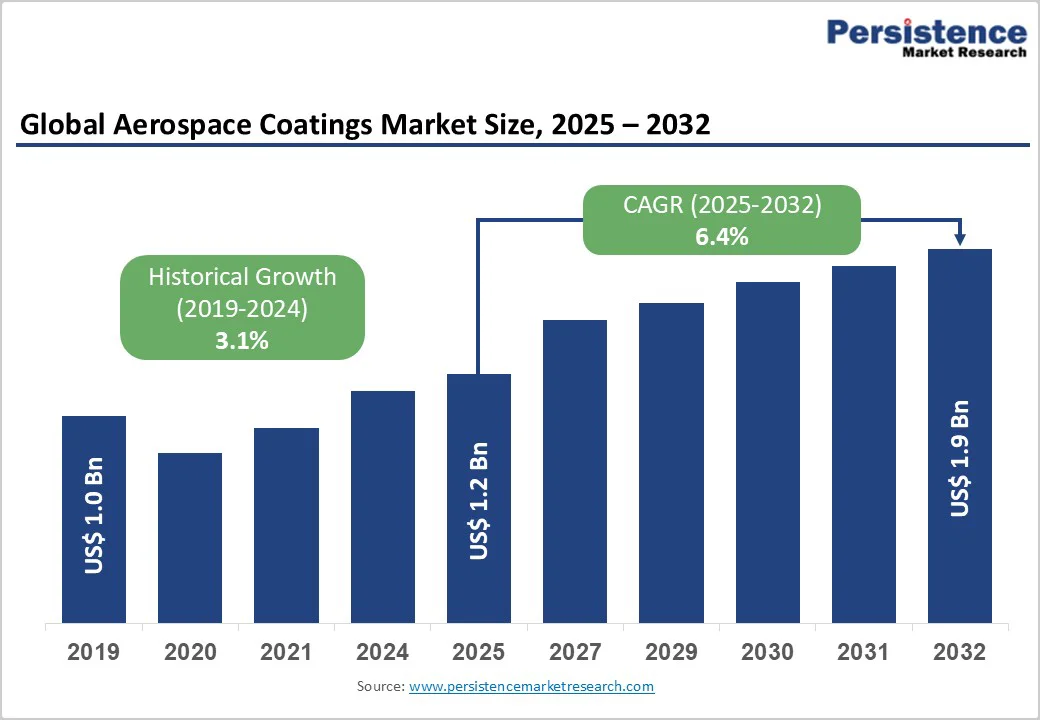

The global aerospace coatings market size was valued at US$ 1.2 billion in 2025 and is projected to reach US$ 1.9 billion by 2032, growing at a CAGR of 6.4% between 2025 and 2032. Aerospace coatings market expansion is primarily driven by accelerating global air passenger traffic and corresponding aircraft fleet modernization initiatives across commercial and military aviation sectors. Stringent environmental regulations mandating low volatile organic compound formulations, coupled with technological advancements in water-borne and chromium-free coating systems, are compelling manufacturers to develop sustainable high-performance solutions that enhance fuel efficiency through weight reduction while providing superior corrosion protection and extended service life.

| Key Insights | Details |

|---|---|

|

Aerospace Coatings Market Size (2025E) |

US$ 1.2 billion |

|

Market Value Forecast (2032F) |

US$ 1.9 billion |

|

Projected Growth CAGR(2025-2032) |

6.4% |

|

Historical Market Growth (2019-2024) |

3.1% |

Rising Aircraft Production and Fleet Expansion

Global aircraft manufacturers are experiencing unprecedented order backlogs, with Boeing maintaining 3,628 outstanding orders for its 737 MAX series and Airbus securing commitments for thousands of A320 family aircraft as of 2024. Commercial aviation production rates are intensifying, with Boeing manufacturing 38 aircraft monthly while pursuing regulatory approval to increase output to 42 units, and Airbus targeting delivery of 770 jetliners in 2025. Each narrow-body aircraft requires approximately 150-200 gallons of primer, topcoat, and specialty finishes, creating substantial coating demand as production scales.

Fleet modernization programs emphasizing fuel-efficient models sustain coating consumption momentum, particularly as airlines replace aging fleets with next-generation aircraft requiring specialized coating systems. The aviation chemicals market is experiencing parallel growth, supporting comprehensive aircraft manufacturing and maintenance requirements through complementary specialty chemical solutions.

Stringent Environmental Regulations Driving Sustainable Coating Technologies

Regulatory frameworks governing volatile organic compound emissions are compelling aerospace coating manufacturers to accelerate the development of environmentally compliant formulations. The U.S. Environmental Protection Agency has established regulations limiting VOC emissions from architectural and industrial coatings, with aerospace applications facing increasingly stringent standards. European REACH regulations mandate the elimination of hexavalent chromium compounds due to their carcinogenic properties, forcing industry-wide transition to chromium-free conversion coatings and primers.

Water-borne polyurethane systems are progressively replacing traditional solvent-borne formulations, offering reduced environmental impact while maintaining performance specifications. These regulatory pressures are catalyzing innovation in sustainable coating technologies, creating opportunities for manufacturers to develop compliant high-performance solutions.

High Raw Material Costs and Supply Chain Volatility

Aerospace coatings manufacturing requires premium-grade raw materials, including titanium dioxide, polyurethane resins, epoxy compounds, and specialized additives sourced from limited global suppliers. Raw material price fluctuations directly impact production costs, with titanium dioxide experiencing 15-20% price increases during recent periods. Supply chain disruptions from geopolitical tensions, pandemic-related manufacturing constraints, and transportation bottlenecks extend lead times and inflate operational expenses. The specialized nature of aerospace-grade materials necessitates rigorous quality control and certification processes, further constraining supply availability and increasing procurement costs for coating manufacturers.

Complex Certification Requirements and Lengthy Approval Processes

Aerospace coatings must satisfy stringent certification standards established by the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) before commercial deployment on aircraft platforms. Certification processes encompass extensive testing protocols evaluating adhesion, corrosion resistance, flammability, chemical resistance, and environmental durability under extreme operational conditions. Achieving OEM approvals from aircraft manufacturers like Boeing and Airbus requires years of testing and validation, creating substantial barriers for new market entrants. The paints and coatings market faces similar regulatory challenges, though aerospace applications demand exceptionally rigorous compliance standards that significantly extend product development timelines and capital requirements.

Expansion of Maintenance, Repair, and Overhaul Services

The global aircraft MRO market is projected to grow to US$ 150 billion by 2032, driven by aging commercial fleets and increasing aircraft utilization rates. Engine shop turnaround times have increased by 35% for legacy engines and over 150% for new generation engines compared to pre-pandemic levels, creating sustained demand for comprehensive maintenance services, including coating applications.

Airlines are prioritizing fleet appearance and protection through regular repainting cycles averaging 6-8 years, generating recurring coating demand. The MRO segment accounts for 68% of aerospace coatings consumption, as airlines and service providers invest in protective coatings to extend aircraft service life, maintain aesthetic standards, and ensure regulatory compliance. The expired aviation chemicals market presents additional opportunities for coating manufacturers offering comprehensive chemical management and disposal solutions for aging aviation materials.

Technological Innovation in Nanotechnology and Smart Coatings

Nanotechnology integration is revolutionizing aerospace coatings through enhanced thermal management, self-healing properties, and superior durability characteristics. The aerospace nanotechnology market is projected to grow to US$ 8 billion by 2032 at a 6.5% CAGR. NASA developed polyurethane coatings containing fluorine groups that reduce insect accumulation on aircraft leading edges, improving aerodynamic efficiency and fuel consumption.

Advanced nanomaterials such as aligned carbon nanotubes and thermal interface materials enhance heat dissipation in aerospace applications, addressing critical thermal management challenges. Carbice Corporation partnered with Blue Canyon Technologies in February 2024 to implement CNT-based thermal interface materials throughout satellite platforms. These innovations position aerospace coatings at the intersection of materials science and performance engineering, creating substantial market opportunities for manufacturers developing next-generation coating technologies.

Polyurethane coatings dominate the aerospace coatings market with approximately 55% market share, attributed to their exceptional ultraviolet resistance, aesthetic qualities, and superior gloss retention properties. Polyurethane-based systems excel in exterior applications where maintaining color and gloss over extended service periods is paramount, often exceeding aircraft operational lifespans of 30+ years. Mankiewicz Coatings’ ALEXIT BaseCoat/ClearCoat system demonstrates over 13 years of monitored performance while maintaining gloss and extending aircraft repaint cycles.

Polyurethane formulations offer higher formulation freedom, enabling adjustments in gloss levels, finish quality, and faster curing times compared to epoxy alternatives. The specialty paints and coatings market recognizes polyurethane systems as premium solutions delivering both structural protection and aesthetic excellence. Water-borne polyurethane topcoats for military aircraft developed in Australia provide extended durability performance suited for harsh climates while substantially reducing VOC content versus high-solids solvent-based aerospace coatings.

Exterior coatings command the largest market share at approximately 70%, driven by critical requirements for corrosion protection, weather resistance, and aesthetic durability on aircraft external surfaces. Exterior coating systems must withstand temperature variations ranging from -44.45°C at altitude to 50°C on ground, while resisting UV radiation exposure at 35,000 feet, air pressure fluctuations, and erosion from airborne particles traveling at 500 mph. These coatings also resist contact with aggressive fluids, including de-icing chemicals and hydraulic liquids.

Commercial airlines prioritize exterior coating quality for brand differentiation and passenger appeal, with livery designs representing substantial marketing investments. Military aircraft utilize specialized exterior coatings incorporating infrared wave reflection, visual camouflage capabilities, thermal image disruption, and chemical agent resistance to protect defense assets globally.

Solvent-borne coatings historically dominated aerospace applications but are experiencing displacement by water-borne technologies driven by environmental regulations and sustainability initiatives. Water-borne systems reduce VOC emissions substantially while maintaining performance characteristics required for aerospace applications. Sherwin-Williams introduced the JetPen in September 2020, a 2K completely reactive paint offering exceptional strength and corrosion resistance for aircraft applications.

Solvent-borne formulations continue serving applications requiring specific performance attributes, including rapid curing, chemical resistance, and compatibility with legacy aircraft platforms. The transition toward water-borne technologies aligns with broader industry sustainability objectives, as airlines pursue net-zero CO2 emissions by 2050 through comprehensive operational improvements, including coating system optimization.

The maintenance, repair, and overhaul (MRO) segment leads the aerospace coatings market with approximately 68% market share, reflecting continuous coating demand from fleet servicing operations versus episodic OEM production applications. MRO providers prioritize coating systems offering rapid turnaround times, simplified application procedures, and proven durability to minimize aircraft downtime during maintenance events.

Sherwin-Williams’ Skyscapes Next Generation system received Textron Aviation approval in October 2021 for Beechcraft, Cessna, and Hawker aircraft, offering faster processing times and easier repair versus competing systems. Air France Industries-KLM Engineering & Maintenance partnered with Donecle in February 2024 to implement drone-based visual inspections, drastically reducing time required for aircraft surface assessments.

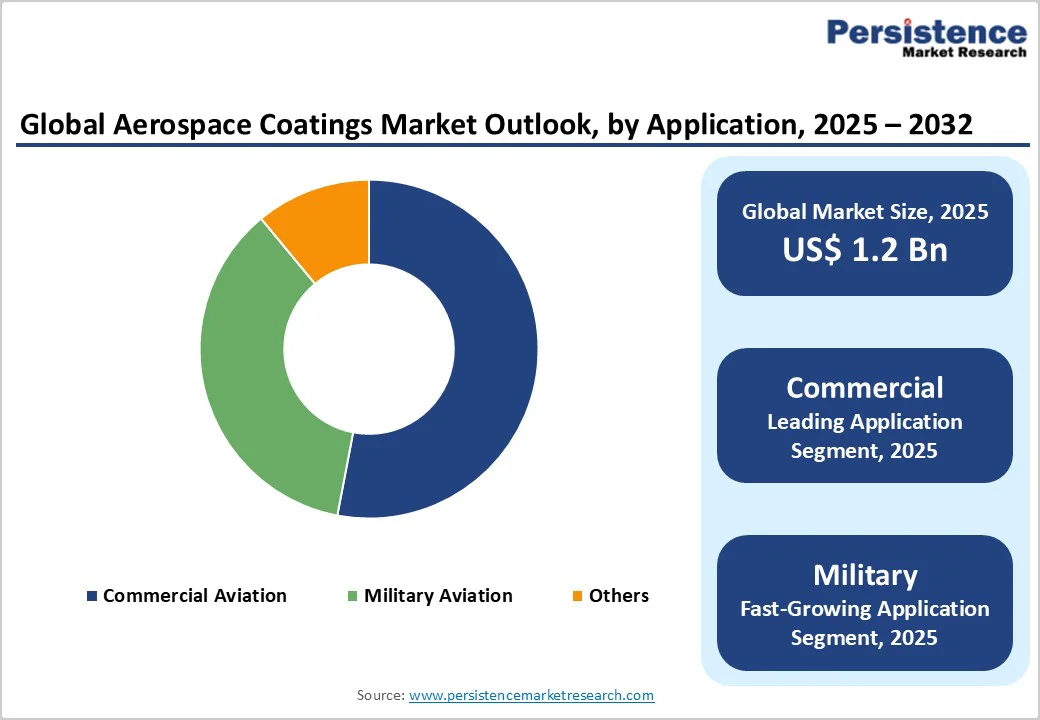

Commercial Aviation represents approximately 53% of the aerospace coatings market share, driven by unprecedented growth in global air passenger traffic and corresponding fleet expansion. The UN Tourism World Tourism Barometer reported approximately 1.1 million international tourist arrivals in January-September 2024, representing 11% growth versus the same period in 2023. Airlines are expanding fleets to accommodate rising passenger volumes and increasing flight frequencies, creating sustained coating demand for new aircraft deliveries and periodic fleet repainting.

Low-cost carriers in the Asia Pacific, Middle East, and Latin America regions accelerate commercial aviation coating consumption as these airlines prioritize cost-effective maintenance solutions. Military aviation maintains substantial coating requirements for defense aircraft modernization programs, with specialized formulations addressing unique operational requirements, including stealth characteristics, environmental extremes, and extended service intervals.

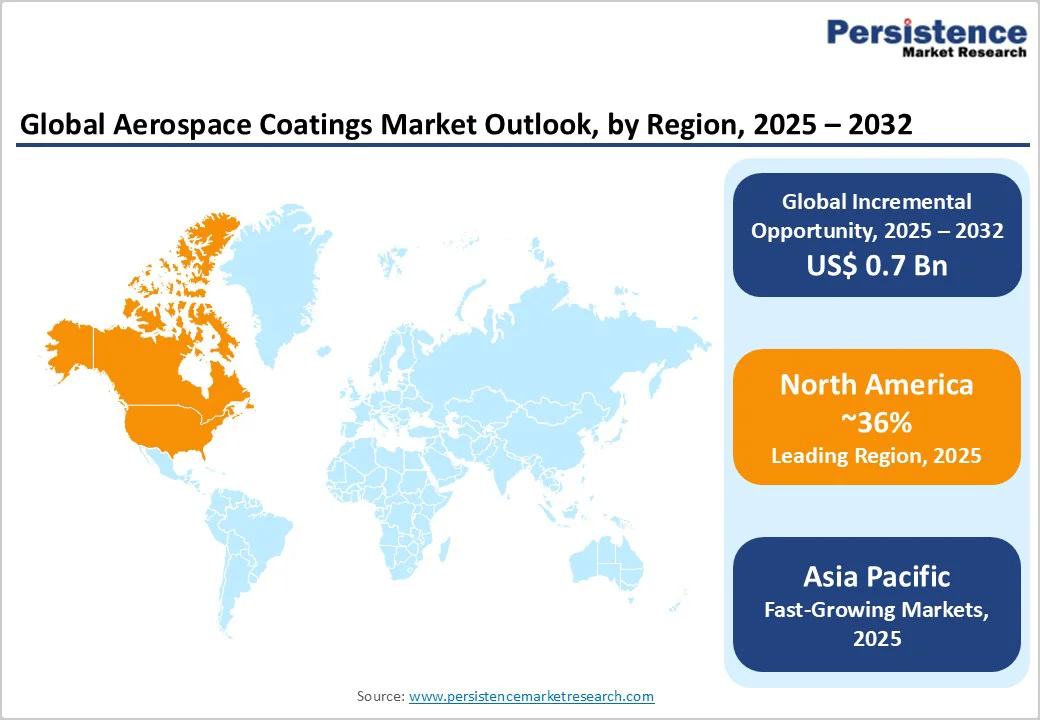

North America commands the largest regional market share at approximately 36%, propelled by the United States’ robust aerospace manufacturing infrastructure and advanced aviation technology ecosystem. The region hosts major aircraft OEMs, including Boeing and Lockheed Martin, along with tier-one suppliers maintaining substantial coating requirements for commercial and military platforms. The U.S. Department of Defense allocates significant budgetary resources toward fleet modernization and maintenance, sustaining military aviation coating demand.

PPG Industries announced a US$ 380 million investment in May 2025 to construct a new aerospace coatings and sealants manufacturing facility in Shelby, North Carolina, with completion expected in the first half of 2027. This 198,000-square-foot facility will employ over 110 people and produce the full line of PPG’s aerospace coatings and sealants, demonstrating industry confidence in North American market growth.

European markets emphasize regulatory harmonization through EASA certification standards and stringent environmental compliance mandates driving sustainable coating development. Germany, the United Kingdom, France, and Spain maintain significant aerospace manufacturing capabilities with companies such as Airbus, headquartered in France, operating extensive production facilities across the region. European REACH regulations mandated the elimination of hexavalent chromium by April 2024, compelling manufacturers to develop chromium-free conversion coatings and primers.

SOCOMORE developed the SOCOSURF TCS/PACS process as a trivalent chromium alternative for aluminum alloys, achieving superior performance across multiple aluminum alloy types according to research by the Toxics Use Reduction Institute at the University of Massachusetts Lowell. European manufacturers prioritize eco-friendly formulations and high-performance characteristics aligned with sustainability commitments and carbon footprint reduction objectives.

Asia Pacific represents the fastest-growing regional market, driven by rapid aviation sector expansion in China, India, Japan, and ASEAN nations. Commercial aviation growth in developing economies stems from rising disposable incomes, urbanization, and globalization, creating unprecedented air travel demand. China and India are ordering thousands of new aircraft to satisfy increasing passenger volumes, with airlines in these markets prioritizing cost-effective coating solutions for fleet expansion and maintenance.

India’s aerospace coating market demonstrates substantial growth potential as domestic airlines modernize fleets and government initiatives promote indigenous manufacturing capabilities. Japan maintains advanced aerospace technology capabilities, with companies such as Asahi Kinzoku Kogyo developing specialized coating solutions for regional and international markets. Manufacturing advantages, including lower labor costs, expanding technical expertise, and supportive government policies, position the Asia Pacific as a critical growth region. Regional airlines are investing in MRO infrastructure to support fleet maintenance requirements, creating sustained coating demand as air traffic continues robust expansion throughout the forecast period.

The aerospace coatings market exhibits a moderately consolidated structure with several global leaders maintaining dominant positions through extensive product portfolios, established OEM relationships, and comprehensive certification approvals. Market leaders, including PPG Industries, AkzoNobel, and Sherwin-Williams invest about 4-6% of revenue in research and development to maintain technological superiority in formulation chemistry, application systems, and environmental compliance.

Companies pursue vertical integration strategies controlling critical raw material supply chains while developing specialized application equipment and technical support services. Strategic partnerships with aircraft manufacturers ensure long-term supply agreements spanning 5-10 years, creating substantial barriers for new market entrants. Emerging players focus on regional markets and specialized applications, developing indigenous capabilities serving local aerospace industries with customized coating solutions addressing specific operational requirements and regulatory frameworks.

The global aerospace coatings market is projected to reach US$ 1.9 billion by 2032, growing at a CAGR of 6.4% from 2025 to 2032.

Key growth drivers include rising aircraft production rates with Boeing and Airbus maintaining substantial order backlogs, stringent environmental regulations mandating sustainable formulations, and expanding MRO activities supporting aging global fleets.

Polyurethane coatings dominate the market with approximately 55% market share, preferred for their exceptional UV resistance, aesthetic qualities, and superior gloss retention properties essential for exterior aircraft applications.

North America leads with approximately 36% global market share, driven by the United States’ advanced aerospace manufacturing infrastructure, major OEMs, and substantial defense sector investments.

Expansion of Maintenance, Repair, and Overhaul services presents the most significant opportunity, with the global aircraft MRO market projected to reach US$ 150 billion by 2032.

Major players include PPG Industries, AkzoNobel, Sherwin-Williams, Hempel, Axalta Coating Systems, BASF, Mankiewicz, Henkel, International Aerospace Coatings, and SOCOMORE.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 – 2024 |

|

Forecast Period |

2025 – 2032 |

|

Market Analysis |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Resin Type

By Application

By Technology

By End-user

Application Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author