ID: PMRREP35851| 183 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

The global sustainable aviation fuel market size is likely to value at US$ 2.1 billion in 2025 and is projected to reach US$ 25.2 billion by 2032, growing at a CAGR of 42.6% between 2025 and 2032.

This remarkable growth trajectory is driven by stringent aviation decarbonization mandates and the aviation industry’s commitment to achieve net-zero carbon emissions by 2050, as endorsed by the International Civil Aviation Organization (ICAO) and International Air Transport Association (IATA).

The ReFuelEU Aviation regulation in the European Union, requiring a minimum 2% SAF blend starting in 2025 and escalating to 6% by 2030, alongside aggressive targets in the United Kingdom mandating 9.5% SAF by 2030, are creating unprecedented demand for sustainable aviation fuels.

| Key Insights | Details |

|---|---|

| Sustainable Aviation Fuel Market Size (2025E) | US$ 2.1 Bn |

| Market Value Forecast (2032F) | US$ 25.2 Bn |

| Projected Growth CAGR (2025 - 2032) | 42.6% |

| Historical Market Growth (2019 - 2024) | 52.0% |

Aviation decarbonization policies worldwide are compelling airlines and fuel suppliers to integrate SAF into their operations at an unprecedented pace. The ReFuelEU Aviation regulation mandates progressive SAF blending requirements starting at 2% in 2025, rising to 6% by 2030, 20% by 2035, and ultimately reaching 70% by 2050, with a specific sub-mandate for synthetic aviation fuels comprising 1.2% by 2030.

In the United States, the Sustainable Aviation Fuel Grand Challenge aims to produce at least 3 billion gallons by 2030 and 35 billion gallons by 2050, supported by federal tax credits under the Inflation Reduction Act providing up to US$1.75 per gallon for qualifying SAF.

According to the European Union Aviation Safety Agency (EASA), implementation of ReFuelEU aviation has already stimulated increased SAF production capacity within the EU, with almost all SAF used in 2024 being biofuel produced from used cooking oil and waste animal fats, confirming that the EU is on track to meet the overall mandatory SAF blending target in 2030.

The global aviation sector’s commitment to achieving net-zero carbon emissions by 2050, as formalized by ICAO’s Long-Term Aspirational Goal (LTAG) during the 41st Assembly, is propelling massive investments across the SAF value chain. IATA estimates that SAF will contribute approximately 65% of the emissions reduction needed to reach net-zero, necessitating a substantial scale-up from the current 0.3% of global jet fuel production in 2024 to significantly higher penetration rates.

Major airlines including Air France-KLM, United Airlines, Delta Air Lines, and Cathay Pacific have entered into substantial offtake agreements exceeding billions of liters, securing long-term SAF supply and providing crucial demand certainty for producers.

Since the first commercial SAF offtake in 2013, 81 airlines worldwide have publicly announced 170 deals, with nearly 40% of these airlines announcing more than one agreement, demonstrating sustained commitment beyond initial pilots to scale SAF adoption across their fleets and operations.

The substantial price differential between SAF and conventional jet fuel remains the most significant barrier to widespread market adoption, with SAF typically costing 3 to 5 times more than petroleum-based kerosene.

Airlines and trade bodies consistently highlight that policy mandates expose carriers to elevated near-term procurement costs when supply markets remain constrained and suppliers add compliance surcharges. The aviation sector’s fuel costs already account for up to 25% of operational expenses, and incorporating mandated SAF volumes without sufficient cost reduction mechanisms threatens airline profitability and competitiveness.

While government incentives such as the Inflation Reduction Act tax credits and the EU Emissions Trading System allowances totaling approximately €125 million for 2024 SAF usage provide some relief, analysts project that achieving price parity with fossil jet fuel will require continued technological advancement, feedstock diversification beyond waste oils, and production volumes reaching tens of billions of gallons annually to unlock manufacturing efficiencies.

The scalability of SAF production is fundamentally limited by the availability of sustainable feedstocks that meet stringent certification criteria without competing with food production or causing indirect land-use change emissions. Current SAF production relies predominantly on second-generation feedstock. However, these waste-based feedstocks face inherent supply constraints and intense competition from the renewable diesel sector, which often offers more attractive economics for producers.

The HEFA pathway, representing approximately 85% of announced 2030 capacity, is approaching its feedstock ceiling as global supplies of used cooking oil and animal tallow are finite and already heavily utilized across multiple industries.

Advanced pathways including Fischer-Tropsch (FT) synthesis from municipal solid waste and agricultural residues, along with Alcohol-to-Jet (AtJ) from cellulosic ethanol, remain at lower technology readiness levels with minimal commercial-scale deployment.

Power-to-Liquid eFuels require massive renewable electricity infrastructure and green hydrogen production at scales that compete with other decarbonization priorities, presenting both technical and resource allocation challenges that constrain near-term supply growth trajectories.

The aviation industry’s long-term SAF requirements cannot be met solely through conventional HEFA production due to feedstock limitations, creating substantial market opportunities for developers of advanced conversion technologies and novel feedstock sources.

Fischer-Tropsch synthesis combined with gasification of municipal solid waste, agricultural residues, and forestry byproducts offers a pathway to produce SAF from abundant, geographically diverse feedstocks without competing with food systems.

The Alcohol-to-Jet pathway using ethanol from corn, sugarcane, or cellulosic sources has gained momentum with LanzaJet operating the world’s first commercial-scale ethanol-to-jet facility and partnering with LanzaTech on the CirculAir solution that converts waste carbon and renewable power into SAF.

Additionally, eFuels produced through Power-to-Liquid processes combining green hydrogen and captured carbon dioxide represent a transformative long-term opportunity, with the EU’s ReFuelEU mandate specifically requiring 0.7% eSAF by 2030, rising to 35% by 2050, creating guaranteed demand for this nascent technology category.

Second Generation Feedstock commands approximately 85% market share in 2025, establishing clear dominance in the SAF production landscape. This category encompasses waste fats, oils, and greases including used cooking oil, animal fat, industrial grease, and palm oil mill effluent, all of which offer high emission reduction potential typically ranging from 70 to 84% lifecycle greenhouse gas savings compared to conventional jet fuel.

According to EASA implementation reports, used cooking oil accounted for 81% and waste animal fats represented 17% of all SAF produced in 2024 within the European Union, demonstrating the near-complete reliance on these waste streams.

The established supply chains for collecting and processing these materials, coupled with the technological maturity of HEFA processing which directly converts these feedstocks into drop-in aviation fuel, have enabled rapid commercial deployment.

Hydrotreated Esters and Fatty Acids (HEFA) technology dominates with approximately 70% market share in 2025. Major producers including Neste, World Energy, TotalEnergies, and Montana Renewables have established commercial-scale HEFA operations with Neste operating 1.5 million tons of annual SAF production capability across facilities in Rotterdam, Singapore, and Finland, with expansion plans to reach 2.2 million tons by 2027.

The HEFA pathway’s ability to achieve up to 84% lifecycle carbon dioxide emissions reductions when using waste-based feedstocks, combined with its compatibility with existing aircraft engines through approved blending ratios up to 50% with conventional jet fuel per ASTM D7566 Annex 2 certification, has driven its widespread adoption.

HEFA will continue dominating SAF production through 2032, though its long-term growth trajectory faces constraints from feedstock availability limitations, necessitating complementary development of Fischer-Tropsch, Alcohol-to-Jet, and Power-to-Liquid pathways to diversify the technology mix and unlock additional sustainable feedstock resources beyond waste oils and fats.

Commercial aviation represents the dominant application segment for SAF, reflecting both the sector’s substantial fuel consumption and its leadership role in driving decarbonization initiatives. Commercial airlines operate the vast majority of global flights and consumed approximately 300 million tonnes of jet fuel annually before the pandemic, making them the primary target for SAF deployment to achieve meaningful emissions reductions.

Leading carriers including United Airlines, Delta Air Lines, American Airlines, Air France-KLM, British Airways, Lufthansa, and Cathay Pacific have established ambitious SAF adoption targets and secured multi-year offtake agreements with producers totaling billions of gallons.

Major aerospace manufacturers have responded with Airbus committing to make all commercial aircraft capable of operating with 100% SAF by 2030, while Boeing has similarly certified its commercial fleet for up to 50% SAF blends and is actively testing neat SAF formulations.

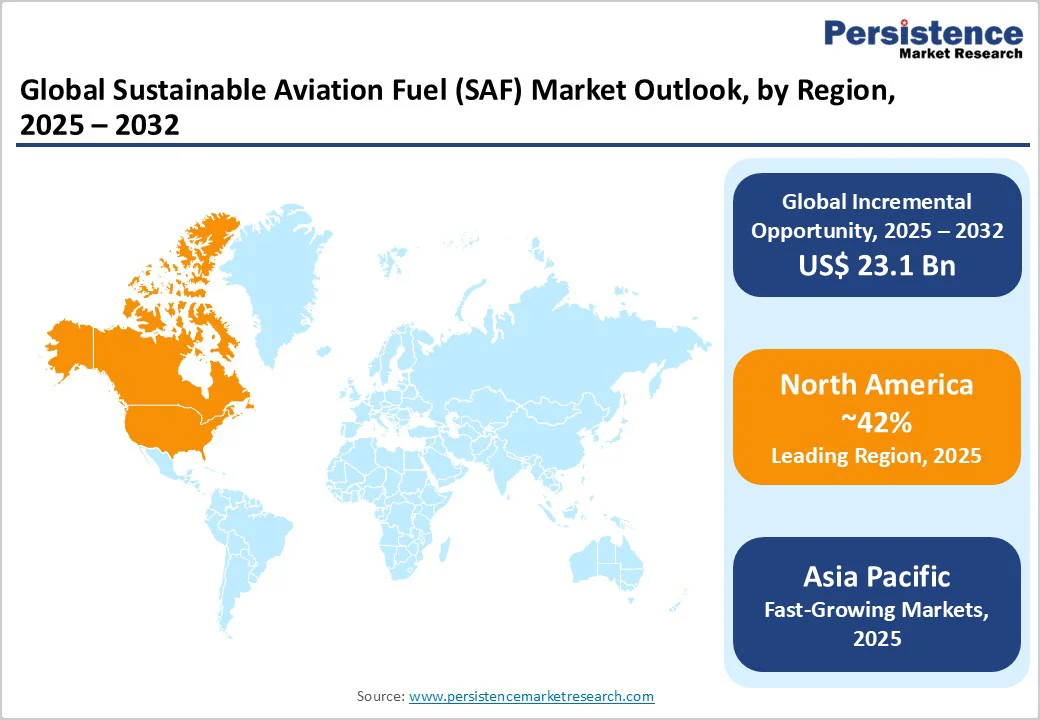

North America commands approximately 42% market share in 2025, establishing the region as the global leader in SAF production and deployment. The United States dominates with robust policy support through the Inflation Reduction Act, providing tax credits up to US$1.75 per gallon for qualifying SAF, alongside the Sustainable Aviation Fuel Grand Challenge targeting 3 billion gallons of annual production by 2030 and 35 billion gallons by 2050.

State-level incentives further accelerate growth with California, Washington, Illinois, Minnesota, Oregon, New Mexico, Colorado, and New York implementing programs that incentivize low-carbon SAF production through tax credits often tied to carbon-intensity reductions or use of local feedstocks.

The region benefits from established aviation fuel infrastructure, proximity to major airline hubs, access to diverse feedstocks ranging from waste oils to agricultural residues, and a robust innovation ecosystem driving next-generation technologies, including LanzaJet’s alcohol-to-jet process and Alder Fuels’ proprietary biomass conversion technology partnering with Boeing and backed by the U.S. Department of Energy and National Renewable Energy Laboratory.

Europe serves as the regulatory frontrunner with the ReFuelEU Aviation mandate creating the world’s most comprehensive SAF deployment framework, requiring 2% SAF in 2025, escalating to 6% by 2030, 20% by 2035, and reaching 70% by 2050, with specific sub-mandates for synthetic aviation fuels.

The United Kingdom has implemented even more stringent requirements with a 9.5% mandate by 2030 including a 0.5% Power-to-Liquid sub-target and restrictions on HEFA feedstocks to drive advanced technology development.

Major European producers are responding with substantial capacity investments led by Neste which started SAF production at its Rotterdam renewables refinery in 2025, adding 500,000 tons of annual capacity and bringing global capability to 1.5 million tons, with further expansion scheduled for 2027 to reach 2.7 million tons, making Rotterdam the world’s largest renewable diesel and SAF facility.

The European Union’s complementary policies, including €100 million in ETS allowances allocated to airlines for 2024 SAF usage, anti-tankering provisions preventing fuel arbitrage, and sustainability criteria under the Renewable Energy Directive, ensure a coordinated regulatory framework driving both supply development and demand certainty across the region’s aviation sector.

Asia Pacific emerges as the fastest-growing regional market driven by robust aviation demand projected to grow at 4-5% CAGR through 2030, supported by rising middle-class incomes, urbanization, and economic expansion across major economies. China represents a transformational opportunity with the 14th Five-Year Plan targeting 50,000 tonnes of SAF by 2025 and peak carbon emissions by 2030.

Japan has set ambitious targets for 10% SAF by 2030, backed by the Green Innovation Fund allocating over JPY 2 trillion for research, development, and scaling of future SAF technologies. Singapore implements a 1% SAF mandate from 2026, rising to 3-5% by 2030, funded through passenger levies creating a sustainable financial model. South Korea established a 1% blend mandate from 2027.

Similarly, India is developing a comprehensive SAF roadmap with carriers like Vistara operating SAF test flights, while ASEAN nations are working toward unified frameworks though facing fragmented policy maturity across member states.

The region’s manufacturing advantage, diverse feedstock resources including palm oil byproducts and agricultural residues, and major aviation hubs undergoing infrastructure upgrades, position the Asia Pacific for accelerated SAF adoption throughout the forecast period.

The Sustainable Aviation Fuel market exhibits a moderately consolidated structure characterized by a mix of established energy majors, specialized biofuel producers, and emerging technology companies. Market leaders, including Neste, TotalEnergies, World Energy, and Shell, leverage their extensive refining infrastructure, established feedstock supply chains, and financial resources to dominate current production volumes.

Strategic partnerships between fuel producers, airlines, and technology providers have become essential competitive tools, exemplified by LanzaTech and LanzaJet’s CirculAir joint offering, Boeing’s investments in Alder Fuels, and Airbus anchoring the Sustainable Aviation Fuel Financing Alliance (SAFFA) with over $200 million in committed capital.

Research and development intensity is accelerating as companies pursue next-generation feedstocks, including algae, energy crops on marginal land, and captured carbon dioxide, while also working to reduce production costs through process optimization and facility scale-up to approach price parity with conventional jet fuel and capture expanding market share as regulatory mandates progressively tighten across major aviation markets worldwide.

The global Sustainable Aviation Fuel market is projected to reach US$ 25.2 billion by 2032, growing from US$ 2.1 billion in 2025 at a CAGR of 42.6% during the forecast period 2025 - 2032.

Stringent decarbonization mandates such as the ReFuelEU Aviation regulation mandating 2% SAF in 2025 rising to 6% by 2030, the UK’s 9.5% requirement by 2030, and the U.S. Sustainable Aviation Fuel Grand Challenge targeting 3 billion gallons by 2030 are the key primary driver for the market growth.

Second Generation Feedstock dominates with approximately 85% market share in 2025.

North America commands approximately 42% market share in 2025.

The Asia Pacific region presents exceptional growth opportunities sue to rising middle-class incomes and urbanization.

Leading market participants include Neste Oyj, TotalEnergies, World Energy, Shell Plc, BP Plc, etc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Feedstock

By Technology

By Aircraft Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author