ID: PMRREP19300| 199 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

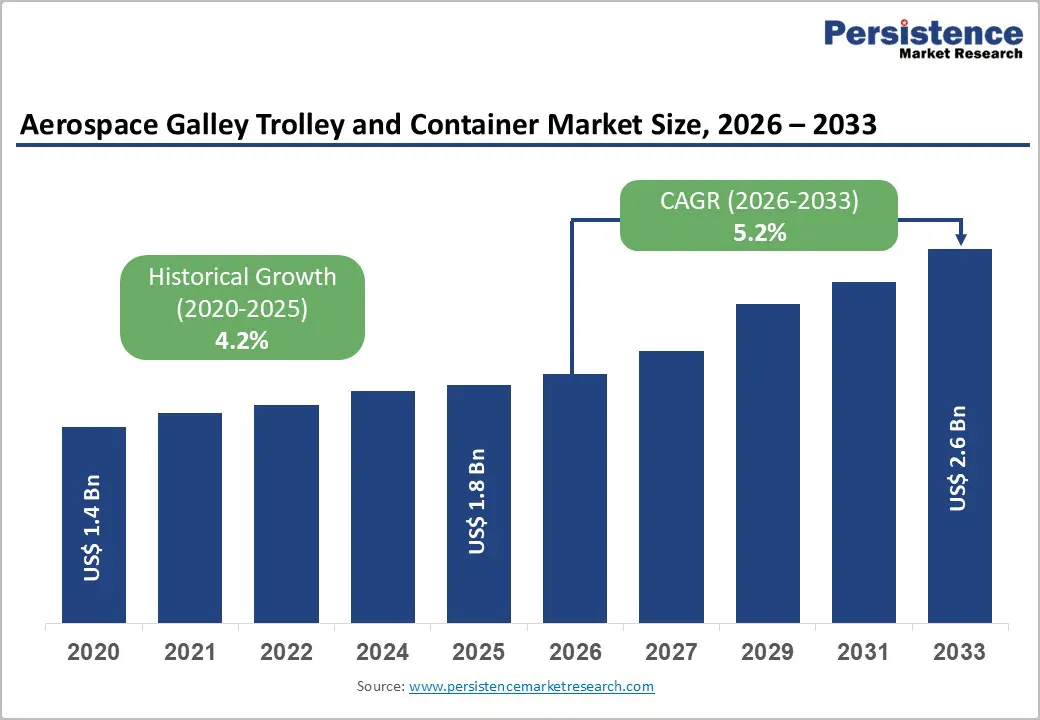

The global aerospace galley trolley and container market size is expected to be valued at US$ 1.8 billion in 2026 and projected to reach US$ 2.6 billion by 2033, growing at a CAGR of 5.2% between 2026 and 2033.

Market growth is primarily driven by the exponential expansion of commercial aviation fleets in emerging markets, particularly in the Asia-Pacific region, where airlines are adding aircraft at unprecedented rates. Airlines are modernizing their cabin interiors with advanced galley and container systems to enhance operational efficiency while maintaining strict aviation safety compliance standards. Additionally, the aviation industry’s renewed focus on lightweight equipment to reduce fuel consumption aligns with the deployment of next-generation aircraft platforms, including the Boeing 787, Airbus A350XWB, and the Airbus A220, all of which require sophisticated galley trolleys and container systems to support premium in-flight catering operations.

| Key Insights | Details |

|---|---|

| Market Size (2026E) | US$ 1.8 billion |

| Market Value Forecast (2033F) | US$ 2.6 billion |

| Projected Growth CAGR (2026 - 2033) | 5.2% |

| Historical Market Growth (2020 - 2025) | 4.2% |

The global commercial aviation sector is experiencing unprecedented growth, with major aircraft manufacturers Airbus and Boeing facing substantial order backlogs spanning several years. Industry forecasts indicate that approximately 43,420 new aircraft will be delivered over the next 20 years, with Asia-Pacific accounting for nearly 19,560 aircraft deliveries. This expansion directly correlates with increased demand for galley trolleys and container systems, as each new aircraft requires fully equipped galley spaces with compliant service equipment.

Airlines including Air India, IndiGo, and China Eastern are simultaneously undertaking massive fleet modernization programs, with Air India alone investing US$ 400 million in legacy fleet retrofitting and cabin upgrades scheduled through 2028. The convergence of new aircraft deliveries and retrofit programs creates sustained demand for both line-fit equipment installations and aftermarket replacement containers, ensuring continuous market momentum throughout the forecast period.

Stringent regulatory requirements from EASA (European Union Aviation Safety Agency), FAA (Federal Aviation Administration), and national aviation authorities mandate that all galley equipment comply with fire-containment standards, weight specifications, and ergonomic safety protocols. These regulations require specialized materials, such as high-strength stainless steel and reinforced plastics, that meet TSO (Technical Standard Order) certifications.

Airlines investing in compliance-certified trolleys and containers experience reduced operational disruptions and maintenance costs while ensuring crew safety and passenger protection. The regulatory environment creates a consistent stream of equipment replacement demand as airlines retire non-compliant or aging systems and upgrade to modern, certified equipment that meets evolving aviation standards.

The aerospace supply chain continues to experience significant disruptions following the pandemic, with aircraft delivery lead times exceeding 7 years for popular platforms such as the A320neo and 737 MAX families. These production delays cascade through the galley equipment supply chain, creating uncertainty in demand forecasting and inventory management. Raw material costs for aluminum alloys, stainless steel, and aerospace composites have shown significant volatility, putting manufacturers under pressure to absorb cost increases rather than pass them on to airline customers operating under tight margins. Supply chain instability particularly impacts smaller manufacturers that lack the capital reserves and long-term supplier contracts of major players like Zodiac Aerospace and Rockwell Collins, potentially consolidating market share among larger, more resilient competitors.

Producing galley trolleys and containers that meet rigorous aviation standards requires substantial investment in fire-resistant materials, advanced manufacturing processes, and extensive certification testing. Compliance with EASA fire-containment test requirements, FAA burn tests, and material certification standards increases production costs by an estimated 15-25% compared to non-certified equipment. Small and mid-sized manufacturers struggle to distribute these fixed compliance costs across limited production volumes, while large-scale producers achieve economies of scale. Additionally, specialized equipment for waste compartments, refrigerated containers, and heated trolleys demands dedicated manufacturing facilities and skilled labor, further constraining production capacity and limiting market entry for new competitors.

Airlines are aggressively pursuing weight-reduction strategies to reduce fuel consumption and operational costs, with each kilogram of weight reduction potentially saving US$100-150 annually per short-range aircraft. Carbon fiber-reinforced polymers (CFRP) and advanced Aerospace High Performance Alloys offer 35-70% weight savings compared to traditional stainless steel and aluminum components while maintaining required strength and safety characteristics.

Manufacturers developing next-generation trolleys and containers utilizing carbon fiber composites or thermoplastic materials can command premium pricing while addressing the aviation industry’s sustainability imperatives. Airlines operating large fleets with hundreds of aircraft recognize that upgrading to lightweight galley equipment represents a cost-effective capital investment with tangible fuel-cost reductions and reduced carbon emissions. The emerging market for sustainable aerospace composites incorporating recycled materials aligns with corporate environmental objectives and provides differentiation opportunities for manufacturers investing in eco-friendly production processes.

Major global airlines are investing billions in cabin refurbishment programs to extend aircraft service life while enhancing passenger experience. Air India’s US$ 400 million fleet modernization initiative includes retrofitting 27 A320neo aircraft, 13 legacy A321 aircraft, and 26 Boeing 787-8 aircraft with new cabin interiors featuring upgraded galley systems and contemporary container standards through 2028. Similarly, airlines in Southeast Asia, India, and the Middle East regions are launching comparable retrofit programs as aircraft production capacity remains insufficient to meet fleet growth demands.

These retrofit initiatives represent a secondary market opportunity for galley and container manufacturers, as replacement equipment must meet modern standards, ergonomic requirements, and operational preferences of contemporary airlines. The retrofit market exhibits higher margins than original equipment manufacturing and provides stable, long-term revenue streams independent of new aircraft production cycles, making it strategically valuable for market participants.

Meal & Beverage Service Trolleys account for the largest share of the aerospace galley trolley market, representing approximately 56% of global demand in 2025. Their scale stems from essential deployment across long-haul and full-service airline fleets, where comprehensive catering remains a key driver of the passenger experience. Full-size trolley variants dominate within this category due to greater storage volume for meal trays, beverages, and duty-free products.

Airlines increasingly emphasize lightweight construction to reduce fuel burn per aircraft cycle, prompting the adoption of optimized frames and improved braking systems. RFID-enabled tracking and anti-theft locking systems support tighter inventory control and lower asset replacement expenses. Demand momentum for this segment remains tied to the recovery in long-haul traffic and premium-cabin bookings.

Line-Fit Equipment remains the dominant fit-type segment, accounting for approximately 61% of the market in 2025, supported by integration into aircraft during initial manufacturing. This procurement pathway aligns with OEM assembly schedules and ensures galley systems are harmonized with electrical, cabin space, and safety requirements prior to delivery. Line-fit installations offer lifecycle cost benefits by eliminating reconfiguration complexity and minimizing fleet downtime.

Demand resilience is further reinforced by multiyear aircraft delivery backlogs, particularly for the A320neo and 737 MAX families, which anchor predictable equipment contracts. Although retrofit demand is projected to grow faster at around 6.8% CAGR from 2026 to 2033, line-fit remains the revenue mainstay for suppliers focused on standardized, certified components for OEM platforms.

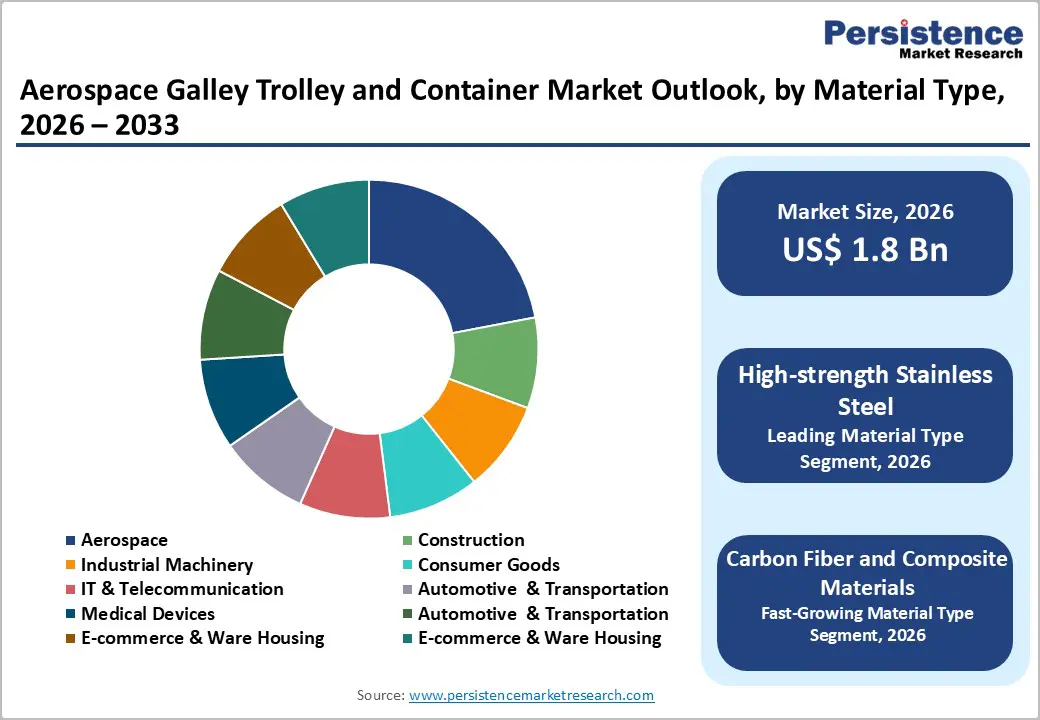

High-strength Stainless Steel maintains a leadership position in the market, accounting for approximately 52% of the market share in 2025 due to its corrosion resistance and structural reliability across repeated cleaning cycles. Grades such as 304 and 316 withstand chemical sanitization and temperature fluctuations better than lighter metals, supporting long service lifespans for galley equipment.

Although composite and carbon-fiber alternatives are gaining traction at an estimated 7.9% CAGR through 2033, stainless steel continues to dominate applications requiring high tensile strength and weight-bearing capacity. Airlines invest in stainless-steel trolley frames and containers to prevent deformation during high-load service on extended routes, reducing long-term maintenance costs. Established supply chains and familiarity with certifications also sustain the material’s competitive advantage.

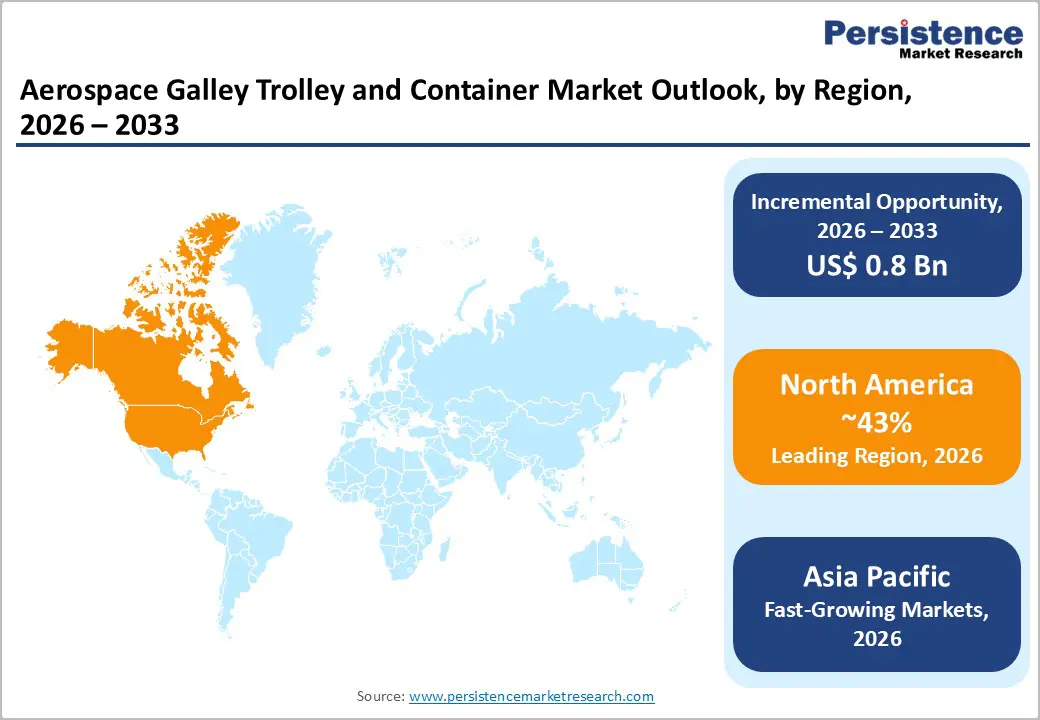

North America maintains market leadership with approximately 43% market share in 2025, driven by its position as the world’s largest commercial aviation market, with major airline hubs concentrated in the United States, including operations by American Airlines, United Airlines, and Southwest Airlines. The region’s market dominance reflects robust aircraft-purchasing programs, with North American carriers operating approximately 9,000 commercial aircraft that require continuous galley equipment maintenance, replacement, and upgrades. Airlines operating from major hubs, including Dallas/Fort Worth, Chicago, Atlanta, and New York, maintain substantial maintenance, repair, and overhaul (MRO) infrastructure demanding compatible galley equipment and spare containers.

Regulatory frameworks established by the FAA create standardized equipment specifications and maintenance protocols that drive consistent demand for certified trolleys and containers meeting TSO standards. Additionally, North American airlines demonstrate a strong commitment to cabin modernization and passenger experience enhancement, justifying investment in premium galley systems, lightweight composite equipment, and technologically advanced trolleys incorporating RFID tags and IoT integration. The region’s mature aviation market is transitioning from volume-based growth toward higher-value retrofit programs and specialty equipment, with airlines investing in premium service differentiation through advanced galley capabilities supporting gourmet catering operations.

Europe is the second-largest market region, with particularly strong performance across Germany, the United Kingdom, France, and Spain, supported by significant commercial aviation activity, premium airline operations, and stringent sustainability regulations. European carriers, including Lufthansa, Air France, British Airways, and Ryanair, maintain diverse fleet compositions requiring tailored galley equipment supporting both full-service operations and low-cost carrier models. The EASA regulatory authority establishes comprehensive safety and environmental standards applicable across member states, creating a harmonized market environment where compliance-certified equipment commands consistent pricing and demand.

European airlines demonstrate particular commitment to sustainability initiatives aligned with EU environmental regulations, driving increased adoption of lightweight composite materials and energy-efficient refrigerated containers that reduce aircraft weight and operational carbon footprints. The region’s strong manufacturing base, with major equipment producers including Bucher Group and Geven S.p.A. headquartered in Europe, facilitates local supply chain integration and responsive customization capabilities. Retrofit programs are particularly prevalent in Europe as older aircraft operate under extended service life extensions, with legacy fleets requiring updated galley equipment meeting contemporary safety standards while maintaining structural compatibility with aging fuselage configurations.

Asia-Pacific emerges as the fastest-growing regional market, anticipated to expand at approximately 8.2% CAGR from 2026 to 2033, driven by exceptional commercial aviation growth in China, India, and Southeast Asia. Airbus forecasts that Asia-Pacific requires approximately 19,560 new aircraft over the next 20 years, representing 45% of global aircraft deliveries and establishing the region as the primary engine of global aviation growth. Chinese carriers, including China Eastern, China Southern, and Air China, operate massive fleets totaling more than 3,000 aircraft, with aggressive expansion programs adding hundreds of aircraft annually and driving proportional demand for galley trolleys and containers.

India’s aviation market is experiencing unprecedented expansion, with domestic carriers Air India and IndiGo adding substantial aircraft capacity to serve rapidly growing middle-class travelers and rising business travel. IndiGo operates over 300 aircraft with ongoing orders for additional aircraft, creating sustained demand for compatible galley equipment and replacement containers. Southeast Asian carriers, including Singapore Airlines, Cathay Pacific, and budget carriers such as AirAsia, maintain strong fleet modernization programs to support premium service offerings and operational efficiency requirements.

The competitive landscape reflects a moderately consolidated market structure, where established aerospace galley equipment manufacturers leverage long-standing material expertise, certified product portfolios, and global supply networks to protect market share. Business strategies emphasize lifecycle value through durable stainless-steel designs that lower maintenance costs and align with airline safety standards, reinforcing customer lock-in.

Competitors targeting growth in lightweight composites pursue differentiation via fuel-saving benefits and advanced materials engineering, supported by higher-margin pricing models. Strategic investments focus on incremental product innovations, compliance-driven engineering, and partnerships with OEMs to secure line-fit contracts and multi-year supply agreements. New entrants face regulatory and certification barriers, favoring incumbents that can provide integrated solutions, global aftermarket support, and flexible customization for retrofit programs.

The market is expected to reach about US$ 1.8 billion by 2026.

Rising aircraft production, fleet expansion, and increasing cabin retrofit programs are accelerating demand.

North America leads the market with an estimated 43% share in 2025.

Fleet retrofit initiatives by airlines represent the biggest growth opportunity.

Major players include Zodiac Aerospace, Jamco, Rockwell Collins, Geven, Bucher, Safran, Diethelm Keller, AVIC, Korita, Egret, and Trenchard.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Fit Type

By Material Type

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author