ID: PMRREP33525| 194 Pages | 27 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

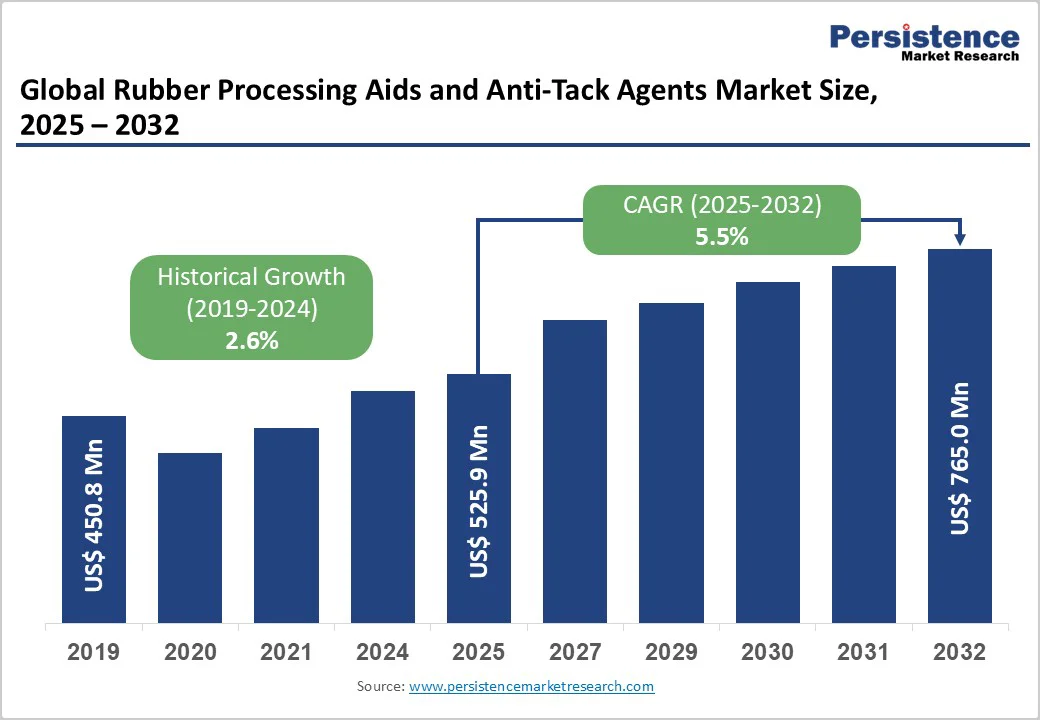

The global rubber processing aids and anti-tack agents market size was valued at US$ 525.9 million in 2025 and is projected to reach US$ 765.0 million, growing at a CAGR of 5.5% between 2025 and 2032.

Rise in tire manufacturing, rising adoption of electric vehicles, and expanding industrial rubber applications across automotive, construction, medical, and electronics sectors. Growing regulatory emphasis on sustainable and bio-based processing aids, along with continuous innovations in high-performance chemical formulations, sustained market growth through enhanced product quality and reduced production costs.

| Key Insights | Details |

|---|---|

| Rubber Processing Aids and Anti-Tack Agents Market Size (2025E) | US$ 525.9 Mn |

| Market Value Forecast (2032F) | US$ 765.0 Mn |

| Projected Growth CAGR (2025 - 2032) | 5.5% |

| Historical Market Growth (2019 - 2024) | 2.6% |

The global Rubber Processing Aids and Anti-Tack Agents Market is witnessing robust growth, primarily propelled by the accelerating expansion of tire manufacturing and automotive production worldwide. In 2024, global vehicle production surpassed 93 million units, with projections nearing 95 million units by 2025, directly boosting the demand for high-performance tire compounds.

The tire and tube application alone represents around 55% of total rubber processing aids and anti-tack agent consumption, as manufacturers increasingly utilize advanced chemical formulations to enhance productivity, compound uniformity, and product consistency.

Rubber processing aids improve polymer flow, reduce mixing time, and minimize energy consumption, thereby optimizing tire production efficiency. Meanwhile, anti-tack agents prevent rubber sheets or green tires from sticking during handling and storage, ensuring seamless processing and high-quality output.

The rise of low rolling resistance (LRR) tires, essential for improving fuel efficiency by up to 15%, has increased the adoption of specialty aids enabling superior dispersion and surface smoothness.

The rapid growth in electric vehicle (EV) production, accounting for 13.6% of new car registrations in Europe in 2024, further stimulates demand for customized rubber formulations that enhance thermal management and battery insulation, underpinning sustained market expansion in the coming years.

Industrial and construction sectors significantly expand rubber processing aids demand through applications including conveyor belts, seals, hoses, gaskets, and specialized components supporting industrial machinery and infrastructure development.

Industrial rubber applications consuming approximately 35% of anti-tack agent demand reflect sustained growth in manufacturing, oil & gas operations, and construction sectors requiring high-performance rubber components. Advanced industrial machinery and construction equipment expansion across emerging markets drives demand for durable rubber products necessitating specialized processing solutions.

Infrastructure modernization projects across Asia Pacific and Middle East regions generate multi-year procurement opportunities for industrial-grade rubber components. Enhanced mechanical properties, improved tensile strength, and extended product lifespan achieved through advanced chemical formulations justify premium processing aid adoption among industrial manufacturers prioritizing operational reliability and cost optimization.

Raw material price volatility, including fluctuations in feedstock chemicals such as butadiene and phenol, directly impacts production costs and manufacturer profitability. Fatty acid ester and amide production is dependent on crude oil-derived precursors exposed to geopolitical tensions and energy price fluctuations, creating margin pressures.

Supply chain disruptions affecting specialty chemical availability and transportation constraints limit regional market expansion. Freight cost inflation, representing 15-20% of total product cost during peak logistics periods constrains margin expansion, particularly among regional and smaller manufacturers lacking vertical integration capabilities.

REACH regulations in Europe and EPA standards in North America mandate phasing of certain widely-used processing aids, requiring expensive reformulation programs and R&D investments. Restrictions on traditional accelerators and antioxidants including 6PPD compounds force market participants toward alternative chemistries potentially compromising performance characteristics.

Compliance costs consuming 8-12% of R&D budgets particularly burden smaller manufacturers lacking dedicated regulatory affairs teams. Environmental monitoring requirements and stringent workplace exposure limits increase operational complexity and compliance expenses.

Sustainable and bio-based processing aids represent an exceptional market opportunity addressing environmental concerns and regulatory requirements. Approximately 40% of manufacturers adopting eco-friendly and water-based anti-tack agents, reflecting growing sustainability commitments and customer preferences.

Bio-based fatty acid esters derived from renewable sources, including palm and coconut oils, offer biodegradable alternatives, reducing environmental impact while maintaining performance characteristics. ISCC Plus-certified sustainable rubber additive solutions are gaining market traction among environmentally-conscious manufacturers seeking compliance alignment and corporate responsibility achievement.

LANXESS introduction of sustainable rubber additive line in March 2024 demonstrates the leading manufacturer commitment to eco-friendly formulation development. Premium pricing support for sustainable solutions justified by environmental credentials and regulatory compliance alignment supporting margin expansion opportunities for innovative manufacturers.

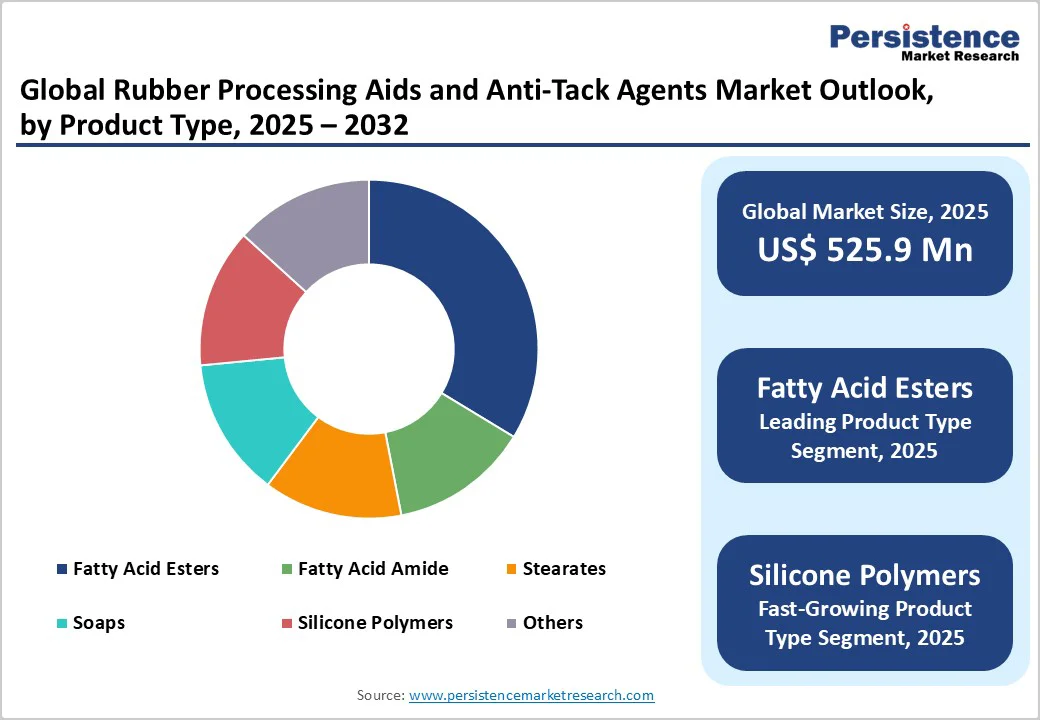

Fatty Acid Esters dominate the global rubber processing aids and anti-tack agents market, accounting for approximately 28% of the total share.

Their superior lubricating efficiency, thermal stability, and excellent compatibility with both natural and synthetic rubber formulations make them the preferred choice across tire, industrial, and automotive rubber applications. These esters enhance compound flowability, reduce mixing torque, and improve dispersion of fillers such as carbon black and silica, resulting in improved surface finish and processing consistency.

Their environmentally friendly profile and non-toxic nature have accelerated adoption amid tightening regulatory frameworks on volatile organic compounds (VOCs). Ongoing product innovations in bio-based fatty acid esters are further reinforcing their position, aligning with global sustainability goals and driving demand from green tire manufacturing and high-performance elastomer applications.

Tires and Tubes represent the largest application segment, capturing approximately 54% of total rubber processing aids and anti-tack agents demand reflecting critical role in tire manufacturing operations.

Anti-tack agent prevention of rubber adhesion to processing equipment including mills, extruders, and calendering equipment, enables smooth production flow and consistent processing. Surface finish improvement achieved through adhesion prevention supports premium tire positioning and customer satisfaction optimization.

Consistent manufacturing quality maintenance and downtime reduction justify widespread processing aid adoption across major tire manufacturers. Replacement tire demand creating predictable recurring market activity ensures stable multi-year demand supporting manufacturing capacity planning and investment decisions.

Automotive and Transportation dominate end-use consumption, accounting for approximately 44% of total rubber processing aids demand, reflecting a critical role in vehicle component manufacturing. Automotive sector rubber consumption, spanning tires, seals, hoses, and specialty components, requires comprehensive chemical support across manufacturing operations.

Global automotive production expansion, particularly in emerging markets, drives sustained demand growth across supply chains. The push for fuel-efficient and low-rolling-resistance tires is prompting manufacturers to adopt specialized rubber processing aids to enhance compound performance and environmental compliance.

North America maintains a significant position through advanced automotive manufacturing capabilities, stringent regulatory frameworks, and an innovation ecosystem supporting product development. EPA and OSHA regulatory standards are driving the adoption of safe, non-toxic processing aids supporting premium formulation development and market differentiation.

U.S. automotive production and replacement tire cycles are creating sustained demand, supporting market expansion. American manufacturers, including Eastman Chemical and Miller-Stephenson driving innovation in advanced processing solutions.

Regulatory emphasis on low-VOC and sustainable chemicals creates opportunities for environmentally-compliant formulation suppliers. Leading manufacturers leverage North American regulatory sophistication as a competitive advantage, supporting export positioning and global market influence.

Europe demonstrates mature market characteristics with 23% global share driven by advanced regulatory frameworks and sustainability emphasis. The region’s growth is primarily driven by stringent environmental regulations, advanced manufacturing standards, and a strong focus on sustainability and circular economy principles.

European manufacturers are increasingly prioritizing the use of bio-based, low-VOC, and REACH-compliant additives to align with the EU’s Green Deal and carbon reduction targets.

The region’s automotive and industrial rubber sectors remain key demand generators, supported by robust tire manufacturing in countries such as Germany, France, and Italy, where premium tire brands continue to invest in innovation and cleaner production technologies.

The shift toward electric mobility and lightweight vehicle components is creating demand for specialized elastomer formulations requiring advanced processing aids for precision molding and improved mechanical properties.

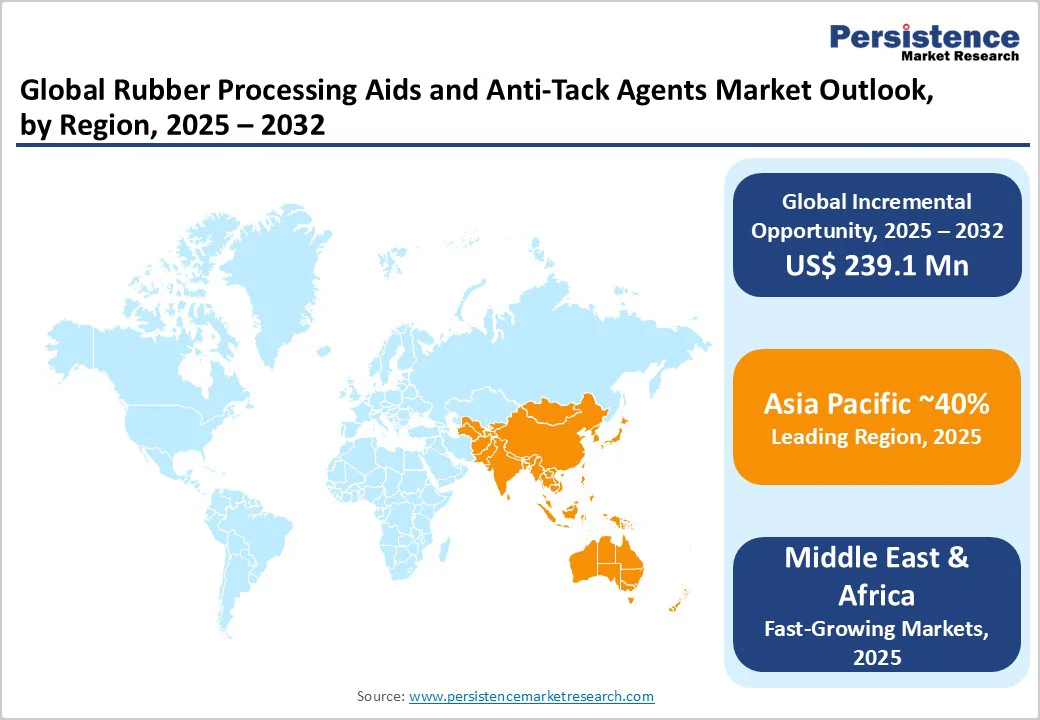

Asia Pacific dominates the global rubber processing aids market with approximately 40% market share driven by exceptional manufacturing scale and automotive sector expansion. China as the world's largest tire manufacturer, consumes substantial processing aids volumes supporting regional dominance. China's tire production capacity and EV leadership creating sustained demand for specialized chemical formulations.

India emerging market demonstrating 7.0% CAGR growth through infrastructure development and automotive expansion. India's rubber processing aids market growing through manufacturing modernization initiatives including government support for rubber industry development.

Government initiatives supporting rubber industry modernization and manufacturing advancement across major hubs, including Mumbai, Chennai, and Pune. Regional manufacturers are establishing production capacity and distribution networks supporting a multi-year growth trajectory exceeding global average expansion rates.

The rubber processing aids and anti-tack agents market exhibits moderate fragmentation, with leading manufacturers Lanxess, Schill + Seilacher GmbH, Lion Specialty Chemicals Co., Ltd, and Baerlocher GmbH collectively commanding approximately 35-40% market share through comprehensive product portfolios and established customer relationships.

Tier-two participants including Peter Greven GmbH & Co. KG, Hallstar, and Performance Additives capture significant market segments through innovation and regional focus.

Strategic capacity expansion, including Performance Additives doubling Malaysia production in March 2024 demonstrates growth investment commitment. Companies emphasize R&D investment, sustainable formulation development, and customized solution creation supporting competitive differentiation. Regional manufacturers are capitalizing on localized requirements and customer relationships supporting diverse market coverage.

The global rubber processing aids and anti-tack agents market was valued at US$ 525.9 million in 2025 and is projected to reach US$ 765.0 million by 2032, representing a CAGR of 5.5% during the forecast period.

Primary demand drivers include accelerating global tire manufacturing, surge in electric vehicle production, industrial rubber application expansion across construction and manufacturing sectors, regulatory emphasis on sustainable formulations, and continuous innovations in high-performance chemical solutions supporting manufacturing efficiency.

Fatty Acid Esters command the dominant segment at approximately 28% market share, driven by superior lubricating properties, renewable source compatibility, biodegradable characteristics, and widespread adoption across tire manufacturing and industrial rubber applications globally.

Asia Pacific dominates with 52% global market share, driven by exceptional manufacturing scale, automotive sector dominance, tire production leadership, and continued industrial expansion supporting sustained demand growth across region.

Sustainable and bio-based processing aids represent exceptional market opportunity addressing environmental concerns and regulatory requirements.

Market leaders include Schill + Seilacher GmbH (Germany) with global market leadership, Peter Greven GmbH & Co. KG (Germany) specializing in stearate and fatty acid amide formulations, and Lion Specialty Chemicals Co., Ltd (Japan) leveraging Asian manufacturing expertise, collectively representing approximately 35-40% market concentration.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Industry

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author