ID: PMRREP34741| 173 Pages | 12 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

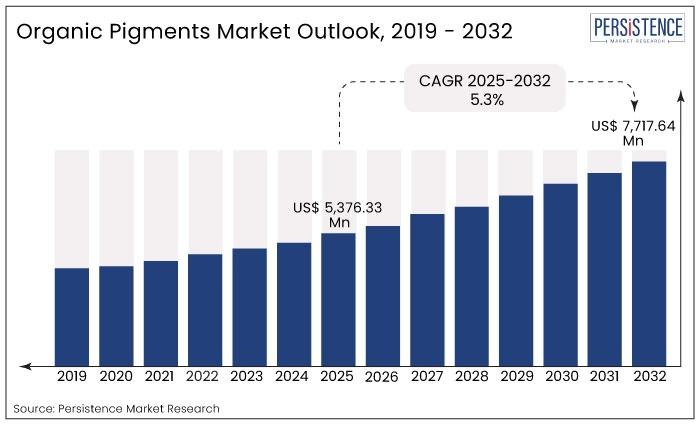

The global organic pigments market is anticipated to reach a value of US$ 7,717.64 Mn by the end of 2032 up from US$ 5,376.33 Mn in 2025. This growth reflects an expected CAGR of 5.3% from 2025 to 2032.

The global organic pigments market is experiencing a shift, shaped by changing consumer preferences towards organic products, environmental regulations, and technological innovation from manufacturers. This robust expansion is fueled by surging demand in end-use industries such as paints and coatings, printing inks, and plastics, with high-performance pigments emerging as a particularly vibrant growth segment.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2025E) |

US$5,376.33 Mn |

|

Projected Market Value (2032F) |

US$7,717.64 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.4% |

The global organic pigments market is rising with moderate growth rate of 5.3% CAGR. This growth is primarily driven by the increasing applications of organic pigments in the printing ink and paints & coatings industries.

Organic pigments, sourced from natural materials like plants and microorganisms, are increasingly favored for their reduced environmental impact compared to synthetic alternatives. They offer excellent color strength and durability while supporting sustainability goals, making them popular in industries such as automotive, construction, and textiles.

The expanding use of these pigments across various coating applications such as decorative, industrial, construction, automotive, and packaging fuels the market's expansion. The emerging regions such as Asia Pacific and Africa are demanding for organic pigments due to increasing construction and textile market.

Organic pigments, known for their brightness, quality, and strength, are gaining traction in the textile sector as colorants. These pigments, composed of both organic and inorganic substances utilize technologies such as absorption and light scattering to alter the appearance of substrates to which they are applied.

Produced from natural sources like plants and animals and from carbon compounds, organic pigments are typically available in powdered form. This form is used for coloring a wide range of products including those in the performing arts.

Several growing end use industries such as consumer goods, automotive, and construction prefer the environmentally sustainable pigment solutions. These industries rely on pigments for various applications, including vibrant and durable automotive finishes, high-performance coatings for buildings, and visually appealing packaging materials. As these sectors grow, they drive the need for advanced pigment solutions that can meet their evolving requirements.

Consumers are also becoming more environmentally conscious and are increasingly favoring products made from sustainable and non-toxic materials. This shift is mirrored by stringent environmental regulations that mandate lower levels of harmful substances in products.

Driven due to the consumer preferences, the market players are actively seeking organic pigments as they have lower environmental impact compared to synthetic options. For instance,

The emphasis on sustainability has spurred significant innovation within the pigment industry.

The growing focus on visual appeal among consumers and industries has significantly increased the demand for high-quality pigments that offer enhanced aesthetic attributes. Industries such as fashion, electronics, and packaging are experiencing a rise in demand for products with vibrant and rich colors.

Emphasis on aesthetics drives the need for advanced organic pigments that can provide enhanced color saturation and intricate design details. Sectors such as automotive and architecture are increasingly adopting enhanced aesthetics as designers and manufacturers pursue innovative color solutions.

Government across most of the regions are actively promoting eco-friendly solutions to reduce the heavy metal content and VOCs in the pigments. For instance, the European Union’s REACH regulation and the Packaging and Packaging Waste Regulation (PPWR) has driven the manufacturers to shift toward organic pigments, following the environmental safety norms.

Furthermore, in emerging regions the governments are focusing on reducing the carbon footprint aligning with their own regulation standards. In India, initiatives like the “Make in India” program are supporting local pigment production while aligning with global sustainability standards. In China, the government’s push toward green manufacturing under the “14th Five-Year Plan” has stimulated investments in clean technologies, including organic colorants.

The organic pigments are often manufactured in small quantities, especially those that are specialized or high-performance, compared to more widely used pigments. These pigments involve complex production processes that require advanced technology and high-quality raw materials.

The cost per unit is higher compared to pigments produced in larger quantities due to costs associated with production such as equipment and facility maintenance. These factors contribute to higher manufacturing costs. The limited scale of production further exacerbates the cost issue.

The high cost of organic pigments can impact pricing strategies and profit margins for manufacturers. Increased production expenses might force them to pass on high costs to consumers, potentially making their products less competitive in the market, especially in price-sensitive segments. Consumers, on the other hand, face higher costs when using these pigments, which can limit their adoption, particularly when more affordable alternatives are available.

The growing demand for bio-based pigments with color filters represent an opportunity in market. This demand reflects a shift of both consumers and market players towards sustainability. As these concerns becomes widespread, the companies are significantly seeking for eco-friendly solutions to traditional pigment production process.

Bio-based pigments are derived from natural sources like plants and microorganisms offering more sustainable options. These pigments are biodegradable, renewable and have low impact. This growing emphasis on environmental responsibility creates a significant market opportunity for pigments that align with these values.

The color filter technologies, in combination with sustainability, adds a layer of innovation in bio-based pigments with enhanced appeal. The color filters are used to produce visual effects, and combined with bio-based pigments, they can improve the performance of the pigments by enhancing color richness, brightness, and stability. The manufacturers are also focusing on investing in the trend. For instance,

|

Category |

Projected CAGR through 2032 |

|

Source- Natural |

6.4% |

Natural organic pigments category is anticipated to exhibit the annual growth of 6.4% through 2032. These pigments are favorable for environment sustainability which makes it an important market driver. These pigments are gaining traction due to increasing consumer and industry preference for sustainable and environment-friendly products.

Natural pigments, sourced from fruits, vegetables, flowers, and other natural elements, are celebrated for their eco-friendly credentials. Natural pigments are often biodegradable and have a smaller environmental footprint. This shift toward natural pigments aligns with global trends towards reducing chemical pollution and supporting environmentally responsible practices.

As consumers and businesses become environmentally conscious, the demand for natural pigments has increased making them a popular choice across several industries including textiles, food and beverages, and cosmetics.

|

Category |

Projected CAGR through 2032 |

|

Type - HPP |

6.2% |

The high-performance pigment segment holds a prominent position in the organic pigments market due to its advanced characteristics compared to traditional pigments. HPPs provide exceptional color strength and intensity even in small quantities, making them ideal for applications requiring high visual impact, such as premium automotive coatings and packaging.

HPPs are also known for their superior durability, including enhanced lightfastness to resist fading from sunlight, and increased resistance to heat, chemicals, and solvents. These properties render HPPs particularly suitable for demanding environments, such as outdoor coatings and industrial products that require long-lasting performance and stability.

The development and use of HPPs involve advanced research and technological innovation. Manufacturers invest significantly in research and development to create pigments with specific performance properties that meet the needs of specialized applications. For instance,

in January 2024, Evonik introduced a phosphate methacrylate monomer named as TEGO Dispers 780 W. It is known for its transparent flame resistance and enhanced adhesion properties. This innovative monomer also offers reduced corrosion, serves as an effective adhesion promoter, and functions as an anti-corrosive agent.

|

Category |

Projected CAGR through 2032 |

|

Application - Paints and Coatings |

6.0% |

The paint and coating application segment contributes with a major share of 35% to the organic pigments market. This segment encompasses a wide range of applications, from residential and commercial paints to industrial coatings and automotive finishes.

Organic pigments are favored for their vibrant color range, high tinting strength, and compatibility with water-based and low-VOC formulations, aligning with the industry’s shift toward sustainability. This shift drives the manufacturers to invest in the product expansion of organic pigment sector. For instance,

|

Region |

Projected CAGR through 2032 |

|

North America |

5.5% |

North America organic pigment market is a mature yet steadily growing, driven by technological innovation and growing demand for sustainable solutions. The strong regulatory frameworks such as the U.S. EPA's Safer Choice Program and Canada’s Chemicals Management Plan, are promoting the use of non-toxic and environmentally friendly colorants in consumer products. Such initiatives are favoring the market in the region.

The shift toward low-VOC and heavy-metal-free formulations is driving the adoption of organic pigments, especially in coatings, inks, and packaging. The region's advanced manufacturing base, particularly in the United States, is focusing on high-performance pigments for automotive coatings, construction materials, and digital printing applications.

Furthermore, government initiatives such as the Infrastructure Investment and Jobs Act in the U.S. are fueling growth in the construction sector, boosting the demand for decorative and protective coatings.

|

Region |

Projected CAGR through 2032 |

|

Europe |

5.9% |

The organic pigments market in Europe is the second largest globally, holding around 20% of the market share. This significant market position is largely driven by key industries in the region, including automotive, building and construction, and packaging. These sectors are leading plastic consumers, which drives the demand for organic pigments used in various applications.

The paints and coatings sectors within the building and construction and automotive industries are significant consumers of organic pigments. The demand for high-quality pigments is substantial in these areas due to their critical role in providing vibrant and durable finishes.

Key countries within Europe, such as Germany and the United Kingdom, are leading players in the market. These nations exhibit strong growth potential, primarily due to the increasing application of organic pigments in automotive paints and coatings. As these industries continue to expand and innovate, the demand for advanced organic pigments drives the manufacturers to invest in the market. For instance,

|

Region |

Projected CAGR through 2032 |

|

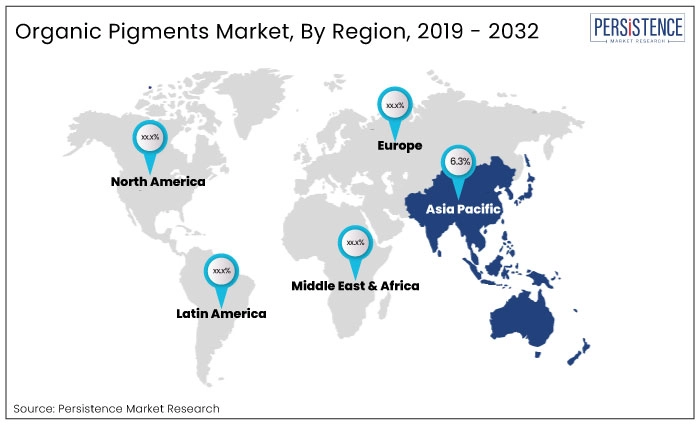

Asia Pacific |

6.3% |

Asia Pacific stands as the fastest-growing region in the organic pigments market, driven by rapid industrialization, urbanization, and expanding end-use sectors such as packaging, automotive, and construction. Countries like China, India, Japan, and South Korea are at the forefront of this growth, supported by favorable government initiatives.

China and India account for more than 35% of global pigment demand, driven by rising construction and automotive production in the region. China’s “14th Five-Year Plan” emphasizes green development and sustainable manufacturing, encouraging the shift toward eco-friendly pigments. Similarly, India’s “Make in India” and “Swachh Bharat Abhiyan” programs are fostering domestic production of non-toxic, biodegradable colorants, especially in packaging and consumer goods.

The relocation of global manufacturing to low-cost Asian economies, combined with rising domestic demand for high-performance and regulatory-compliant pigments. For instance,

The global market is dominated by large companies that shape industry trends through strategic actions. These leading firms focus on innovation, frequently introducing new pigment formulations to meet the evolving needs of industries like paints, coatings, plastics, and textiles.

Maintaining high product quality is crucial for these companies, ensuring that their pigments meet stringent industry standards and enhance customer satisfaction. The companies such as DIC Corporation and BASF SE are expanding their product lines and entering new markets to reduce the market risk and to seize the new opportunities.

Recent Industry Developments in the Organic Pigments Market

By Source

By Type

By Application

By Region

The organic pigments market is valued at US$ 5,376.33 Mn in 2025.

The market is projected to expand at a with CAGR of 5.3% during 2025 to 2032.

The market is expected to reach US$ 7,717.64 Mn by the end of 2031.

Heubach GmbH, DIC Corporation, and Clariant, etc. are the top players in the market.

Paints and Coatings applications sector is the rapidly growing application in the market.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author