ID: PMRREP33065| 250 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | IT and Telecommunication

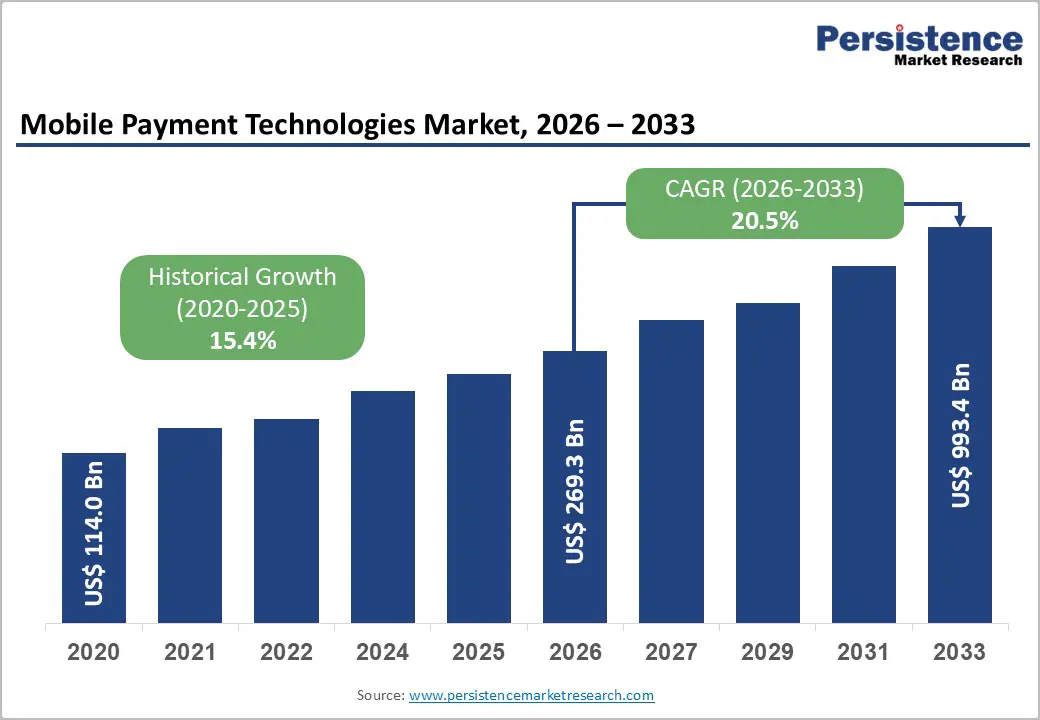

The global mobile payment technologies market size is likely to be valued at US$269.3 billion in 2026 and is projected to reach US$993.45 billion by 2033, growing at a CAGR of 20.5% between 2026 and 2033.

Rapid smartphone penetration, exceeding 7 billion devices globally, and surging e-commerce transactions fuel this expansion, enabling seamless contactless payments worldwide. Government initiatives such as India's UPI, processing 16.58 billion transactions monthly, further accelerate adoption, shifting consumers from cash to digital wallets. The proliferation of advanced security technologies such as tokenization, biometric authentication, and multi-factor authentication has significantly enhanced consumer confidence in mobile payments.

| Key Insights | Details |

|---|---|

|

Mobile Payment Technologies Market Size (2026E) |

US$269.3 Bn |

|

Market Value Forecast (2033F) |

US$993.45 Bn |

|

Projected Growth CAGR (2026-2033) |

20.5% |

|

Historical Market Growth (2020-2025) |

15.4% |

Global smartphone users have surpassed 7 billion, with penetration exceeding 85% in developed regions. This shift has transformed payment behaviors toward mobile-first solutions. By 2024, over 88% of point-of-sale manufacturers will include NFC support, expected to rise to 93% of retail locations by 2026.

This increased connectivity enables instant transactions through apps like Apple Pay and Google Pay, reducing cash dependency and boosting transaction volumes by 30% annually. Wearable payment devices like smartwatches and smart rings further enhance convenience, while NFC-enabled transit projects promote digital wallet usage among urban consumers. The integration with 5G networks reduces latency and drives growth in e-commerce within the Financial Cards and Payments Market.

Government-led digital payment initiatives are driving market adoption through favorable policies and infrastructure investments. India's Unified Payments Interface (UPI) has become the world's leading alternative payment method, processing $964 billion from April to July 2024, a 37% year-on-year increase, outperforming Alipay, PayPal, and Brazil's PIX. The Reserve Bank of India will implement two-factor authentication for all digital payments starting April 1, 2026, enhancing security and consumer confidence.

In Europe, the new Payment Services Regulation (PSD3) was approved in November 2025, updating the rules for enhanced payee verification and strong customer authentication for credit transfers. The rise of mobile payment platforms is facilitating cross-border remittances and peer-to-peer transfers, expanding access to digital financial services, while secure technologies like biometrics and tokenization foster trust and adoption in the retail and hospitality sectors.

Despite advancements in technology, mobile payment systems still struggle with security issues that hinder consumer trust and adoption. High-value cyber fraud incidents surged in fiscal 2023–24, leading to losses of INR 1.77 billion and over 29,000 cases. Key security risks include fraud, identity theft, mobile malware, and insecure WiFi. A recent study found flaws in more than 25 financial apps, making fraud detection increasingly vital.

Providers are investing in AI to monitor transactions in real-time. While encryption and authentication have improved, mobile payments remain vulnerable to attacks like eavesdropping and data tampering. User concerns about data security persist, although over 60% of users view NFC payments as safer than magnetic stripe cards. Compliance with PCI DSS 4.0 poses additional challenges, especially for smaller merchants, with new requirements due by March 31st, 2025.

The mobile payment industry faces a complex regulatory landscape with varying requirements across regions. PCI DSS compliance fines can range from £4,000 to £80,000, while GDPR violations lead to significant penalties for data breaches involving cardholder information.

In Europe, the Payment Services Directive 2 (PSD2) promotes innovation through over 300 authorized fintech firms by 2023, and adds operational challenges for payment processors managing multiple regulations. The shift to the ISO 20022 messaging standard and real-time gross settlement infrastructure requires substantial investments, creating hurdles for smaller players. Additionally, regulatory differences in countries like Switzerland and Norway result in interoperability issues that hinder cross-border payment flows and complicate unified platform strategies.

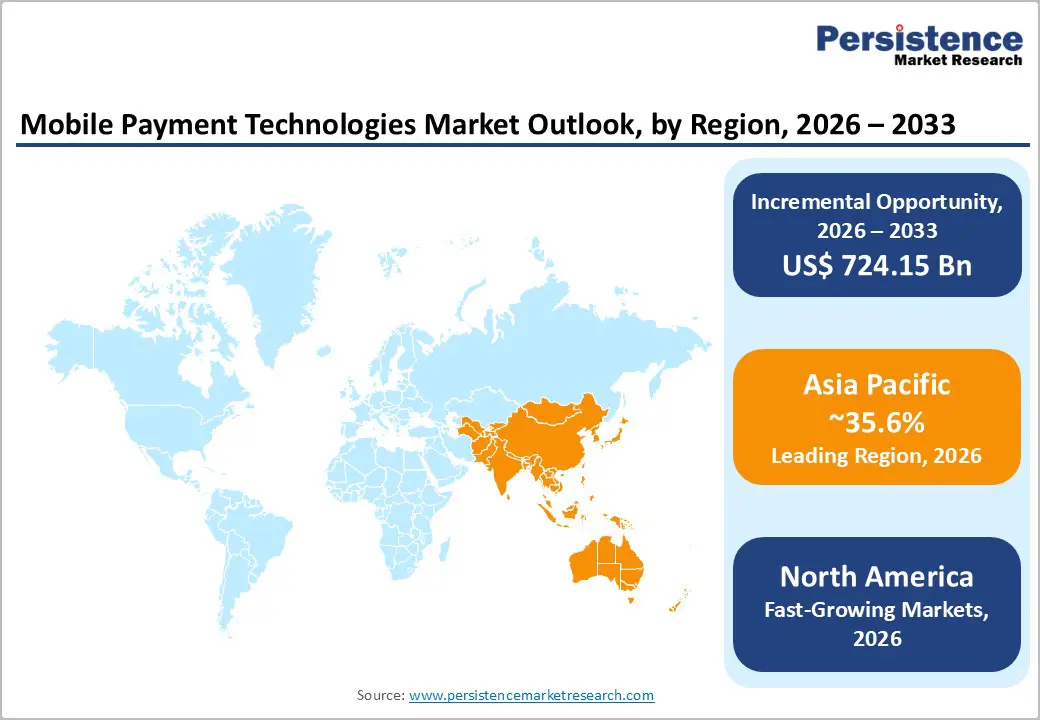

The Asia-Pacific region is rapidly emerging as the fastest-growing market for mobile payments, with a CAGR of more than 34.76% through 2030. In 2023, China's digital wallet usage reached 82% for e-commerce and 66% for in-store purchases, with projections showing that 86% of e-commerce transactions will use digital wallets by 2027. India's mobile payment adoption also exceeded 50% for online and in-store purchases, supported by the UPI system, which aims for 500 million active users by 2025. Government initiatives, like Taiwan’s goal of 90% mobile payment penetration by 2025, along with increasing smartphone adoption in rural areas, are further expanding market opportunities in Southeast Asia.

The rise of super-apps integrating multiple financial services has created embedded payment opportunities that generate recurring transaction volumes in sectors such as transportation, hospitality, and healthcare. This aligns with Mobile Payment Transaction Market growth, promising 25%+ CAGR in low-penetration regions.

The integration of mobile payment technologies with automated retail and public transportation systems offers significant growth potential. Mastercard's chief product officer highlighted at a recent investor meeting that the rise of tap-to-pay services in transit creates a "halo effect," where commuters use the same device for everyday purchases. In the retail vending machine market, contactless payment options are increasingly popular. Furthermore, NFC wearables are projected to grow at a CAGR of 39.6%, enabling payments via smartwatches and cars. Mastercard is focusing on AI and tokenization for seamless embedded finance in retail vending, with partnerships in IoT potentially capturing 20% of new transaction volume by 2030.

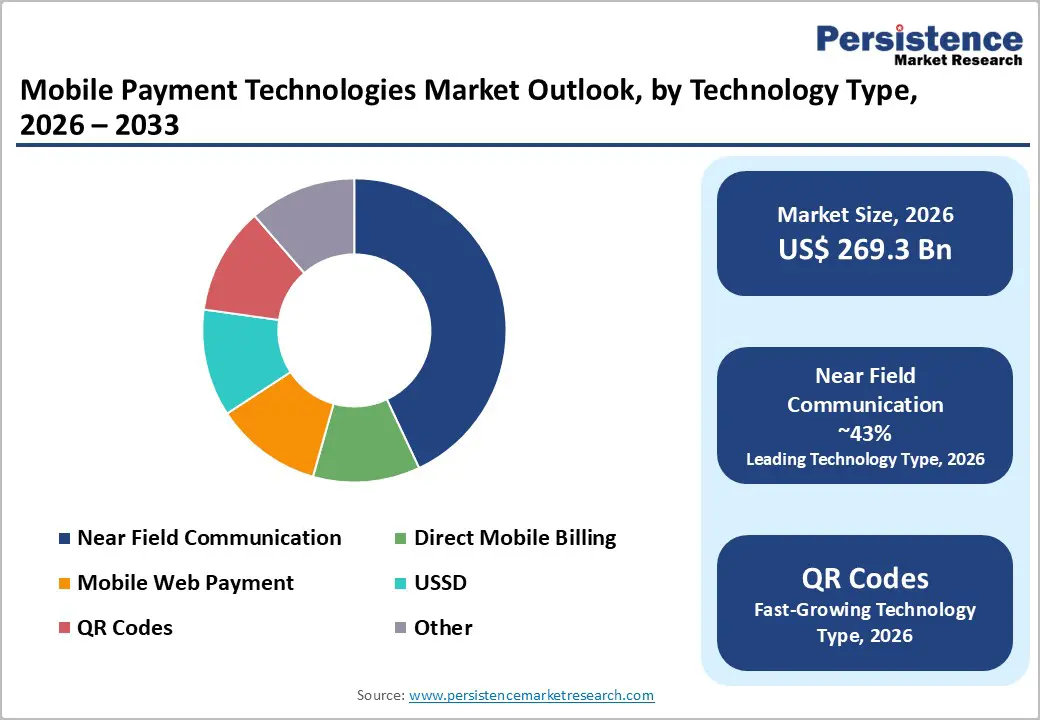

Near Field Communication (NFC) has a 43% market share, primarily due to its integration in 92% of smartphones and 89% of point-of-sale (POS) terminals. This dominance stems from the widespread use of NFC-enabled devices and the extensive contactless payment infrastructure established by major retailers. As of 2025, Apple Pay is accepted by 92% of major U.S. retail chains, including Walmart and Target.

NFC’s security features, like tokenization and encryption, make it ideal for high-value transactions, with Apple Pay users averaging $57 per transaction, compared to $48 for Google Pay. Meanwhile, QR code technology is rapidly growing in the Asia Pacific region, appealing to small merchants and street vendors due to its affordability and ease of implementation, particularly in markets like China and India.

The BFSI (Banking, Financial Services, and Insurance) sector leads the Industry segmentation with approximately 33% market share, driven by the sector's early adoption of mobile payment infrastructure and continuous innovation in digital banking services. Major financial institutions have integrated mobile payment capabilities into their core service offerings, with Visa acquiring Pismo for $1 billion in July 2025 to expand real-time payment support across Latin America, Asia-Pacific, and Europe.

Mastercard launched AI-powered fraud detection in 2025, cutting fraud rates by up to 20% and blocking suspicious transactions in under 50 milliseconds, demonstrating the sector's commitment to enhancing security while maintaining a seamless user experience. The retail sector follows closely, benefiting from the shift toward e-commerce and omnichannel shopping experiences, where mobile payment technologies facilitate frictionless checkout processes and enable personalized loyalty programs. PayPal expanded its stablecoin (PYUSD) for use in mobile checkout in August 2025, allowing users to pay with cryptocurrency at millions of online merchants, bridging the gap between digital assets and everyday commerce.

North America represents a mature mobile payment market characterized by advanced digital infrastructure and high consumer adoption rates for contactless payment technologies. U.S. leads with advanced infrastructure and 85% revenue share, fueled by Apple Pay doubling to 10% global cards by 2025. The region benefits from strong regulatory frameworks that balance innovation with consumer protection, exemplified by enhanced data security requirements and fraud prevention mandates implemented by financial regulators. The innovation ecosystem is supported by the presence of technology giants, including Alphabet Inc., Microsoft Corporation, Apple Inc., and PayPal, Inc., which continuously invest in research and development to introduce advanced features such as biometric authentication, artificial intelligence-driven fraud detection, and seamless integration with wearable devices.

Regulatory compliance requirements, including PCI DSS 4.0 implementation, with a March 31st, 2025 deadline for critical security requirements, have created substantial compliance cost investments throughout the North American payment processing ecosystem, while simultaneously enhancing consumer confidence in mobile payment security infrastructure.

Europe is undergoing significant regulatory transformation with the implementation of PSD3 and the new Payment Services Regulation (PSR), which will introduce more stringent authentication requirements and expand liability frameworks for online platforms that fail to address fraudulent content. The regulatory changes mandate that payment service providers enable customers to set their own spending limits and block credit cards and other payment instruments where fraud is suspected, enhancing consumer control and protection.

Key markets, including Germany, the U.K., France, and Spain, are experiencing robust growth driven by increasing adoption of contactless payments and the expansion of open banking services that facilitate seamless data sharing between financial institutions.

Asia Pacific dominates the global mobile payment technologies market, accounting for over 35.6% market share in 2024, driven by exceptional smartphone penetration, rapid urbanization, and aggressive government-led initiatives promoting cashless transactions. India's UPI system has achieved unprecedented scale, with 300 million active users facilitating 117.7 billion transactions in 2023, accounting for approximately INR 183 trillion.

Japan has witnessed remarkable growth in mobile payment adoption, with PayPay announcing in December 2025 that it reached 65 million registered users, fundamentally shifting the country away from its historically cash-dependent culture. The dominance of the QR code app has cemented PayPay as the "super app" for Japanese payments, illustrating how technology can reshape deeply ingrained consumer behaviors when combined with strategic partnerships and widespread merchant acceptance.

The mobile payment technologies market exhibits a moderately consolidated structure with several dominant players commanding significant market share, while numerous regional and niche providers address specific market segments. Key differentiators employed by market leaders include superior security features, extensive merchant acceptance networks, seamless integration with existing financial infrastructure, and innovative value-added services such as loyalty programs and personalized offers. Emerging business model trends include the integration of cryptocurrency payment options, embedded finance solutions, and super app ecosystems that combine payment functionality with complementary services, including e-commerce, social networking, and financial management tools, creating higher switching costs and enhancing customer lifetime value.

Apple Inc. (Cupertino, U.S.) maintains a commanding position in the premium smartphone segment, with Apple Pay achieving 88% activation rate among iPhone users within 30 days of device setup in 2025 and accounting for 32% of all US contactless POS payments. The company's vertically integrated ecosystem, combining hardware, software, and services, creates a seamless user experience that drives high engagement, with 67% of Apple Watch users using Apple Pay daily, making it the most-used wearable wallet.

Alphabet Inc. (Mountain View, U.S.), through Google Pay, has established a strong presence in Android-based markets, commanding 26% of Android-based in-store payments globally and demonstrating 72% preference among gig economy users who value fast fund transfers and low barriers to entry. The company's strategic advantage lies in its massive Android user base and integration with Google's broader ecosystem of services, including search, maps, and e-commerce platforms

Visa, Inc. (San Francisco, U.S.) holds the majority of shares in the credit card market in2025, leveraging its extensive merchant acceptance network and continuous technology innovation, including the recent Pismo acquisition to strengthen real-time payment capabilities. The company's focus on enabling secure, reliable payment processing across multiple channels and geographies positions it as critical infrastructure for the global payments ecosystem, serving both traditional card-based transactions and emerging mobile payment modalities.

The mobile payment technologies market is likely to be valued at US$ 269.3 billion in 2026, reaching US$ 993.45 billion by 2033 at 20.5% CAGR.

Key demand drivers include exponential growth in smartphone penetration, government initiatives promoting cashless economies, such as India's UPI, which processed 16.58 billion transactions in October 2024, integration of advanced security features such as biometric authentication, and the expanding e-commerce sector requiring frictionless checkout experiences.

Near Field Communication (NFC) technology leads the market with approximately 43% share, supported by widespread adoption of NFC-enabled smartphones, extensive contactless payment infrastructure deployment, and superior security features.

Asia Pacific dominates the global market with over 35.6% share in 2024, driven by exceptional smartphone penetration, rapid urbanization, aggressive government-led digital transformation initiatives, and the success of platforms like India's UPI

Significant opportunities exist in healthcare digital payments where mobile wallets enable seamless medical bill settlement, integration with retail vending machines and transit systems, creating "halo effects" for routine purchases, expansion in emerging markets with increasing internet connectivity, and the convergence of cryptocurrency payment options with traditional mobile payment infrastructure.

Apple Inc., Alphabet Inc., PayPal Inc., and Visa Inc. lead the mobile payment technologies market via ecosystems and partnerships.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Technology Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author