ID: PMRREP12523| 190 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

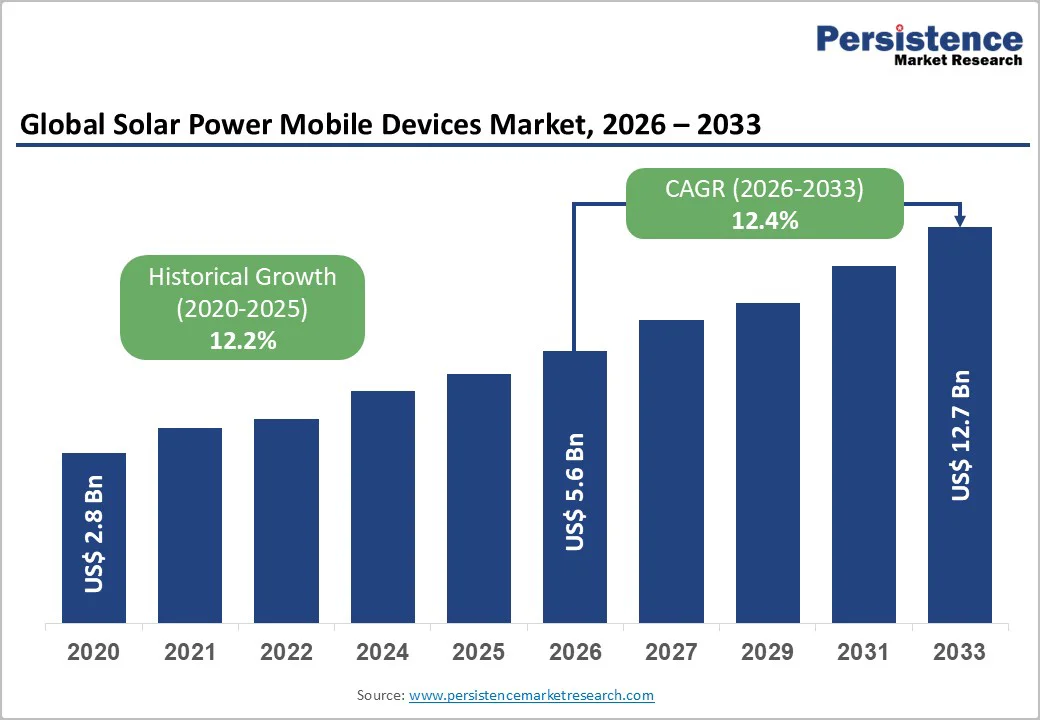

The global solar power mobile devices market size is likely to be valued at US$ 5.6 billion in 2026 and is estimated to reach US$ 12.7 billion by 2033, growing at a CAGR of 12.4% during the forecast period 2026−2033. Growth is driven by the rising demand for off-grid charging solutions, increased adoption of renewable-powered consumer electronics, and expanding outdoor recreation activities requiring portable power. Advancements in high-efficiency monocrystalline and thin-film technologies are enhancing device performance and reducing cost-per-watt outputs. Policy support for clean energy adoption and growing resilience needs during grid outages further support market expansion.

| Key Insights | Details |

|---|---|

| Solar Power Mobile Devices Market Size (2026E) | US$ 5.6 Bn |

| Market Value Forecast (2033F) | US$ 12.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 12.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 12.2% |

Rising demand for renewable energy solutions is a primary force strengthening adoption as users shift toward cleaner and more resilient power sources for mobile charging. Corporate sustainability goals, policy support for decarbonization and growing environmental consciousness are reshaping expectations for energy-efficient personal technology. This shift is backed by a strong expansion in clean-energy infrastructure, reflected in International Renewable Energy Agency (IRENA)’s report confirming a 15.1% global increase in renewable-power capacity in 2024, reinforcing confidence in solar-enabled consumer technologies and accelerating acceptance in mainstream applications.

The transition is further supported by the need for reliable, off-grid energy access across travel, outdoor recreation, emergency response and remote professional use. Rising device power requirements are creating a clear performance gap that traditional charging formats struggle to meet in low-infrastructure environments. Solar-powered systems address this gap with continuous energy availability, lower operational burden and compatibility with multi-device ecosystems. Brands responding to this demand are introducing higher-efficiency panels, compact form factors and faster conversion capabilities, strengthening user trust in solar-driven charging solutions. This alignment of sustainability priorities with functional reliability is creating a strong market pull toward renewable-based mobile power formats.

Specialized photovoltaic components, rugged materials, and integrated battery systems required to ensure reliable off-grid charging performance raise the initial financial burden. Manufacturers must use compact yet durable solar modules, advanced semiconductors, and premium energy-storage solutions to maintain efficiency within limited surface areas, driving up production expenses. These inputs elevate retail prices, reducing mass-market adoption, especially in price-sensitive regions. The need for continuous R&D investment to improve conversion rates and miniaturize hardware further adds to upfront expenditure, creating a financial barrier for both producers and consumers.

Efficiency limits stem from the inherent constraints of portable device dimensions and fluctuating real-world solar exposure. Small panel sizes restrict total energy capture, while shading, environmental variability, and suboptimal angles lower conversion output during daily use. Users expect rapid charging speeds, yet compact solar cells can only generate modest wattage, narrowing their appeal for high-capacity electronics. Thermal stress and energy-loss during power regulation reduce overall performance, underscoring a gap between consumer expectations and technological capability. These limitations curb large-scale adoption, shaping the market’s pace of advancement and commercial penetration.

Outdoor and emergency scenarios have created a distinct demand for mobile devices that operate independently of conventional power sources. Users in remote locations, disaster zones, or during extended travel require reliable energy solutions to maintain connectivity, navigation, and communication. Solar-powered devices address this need by offering portability and continuous energy generation, ensuring critical functionality without reliance on grid electricity. This capability positions devices as essential tools for professionals in fieldwork, adventurers, and emergency responders who face unpredictable conditions.

The value proposition extends to enhancing operational efficiency and safety in critical situations. Devices that can harness sunlight reduce downtime and operational disruptions, allowing for uninterrupted data access and communication. This independence from electrical infrastructure translates into cost savings, logistical flexibility, and enhanced resilience. The ability to provide power in areas with limited infrastructure drives adoption among both individual consumers and organizations that prioritize preparedness and mobility. Such practical benefits make these devices a strategic choice in markets that prioritize reliability, safety, and continuous performance.

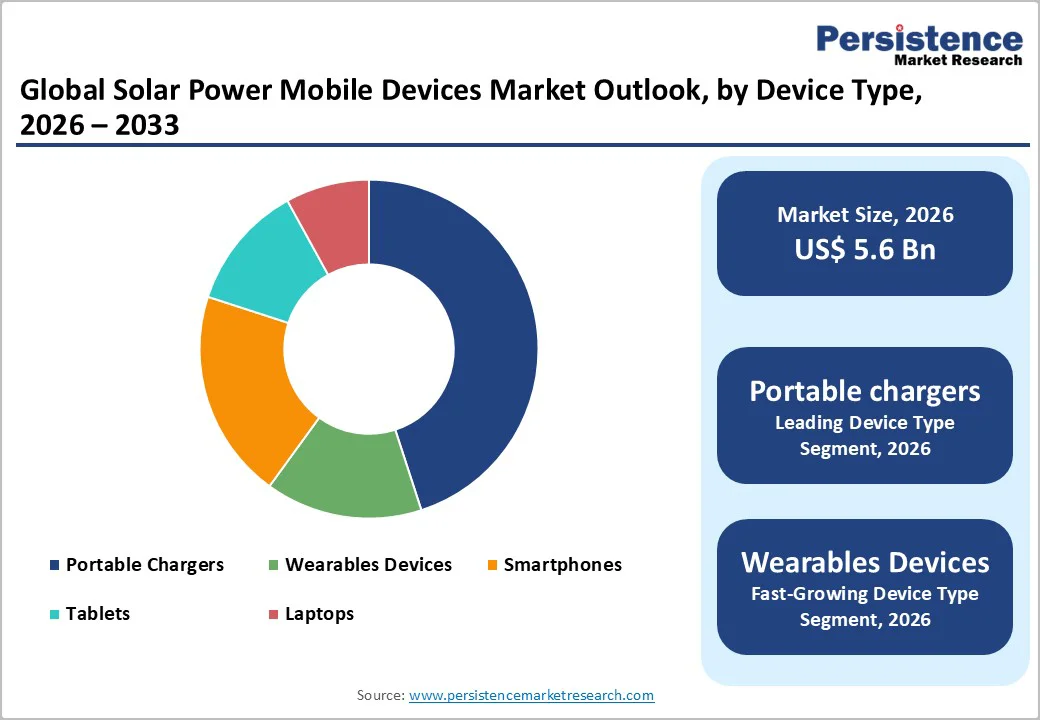

Portable chargers are projected to dominate the market with an anticipated 45% of the solar power mobile devices market revenue share in 2026. Their universal compatibility across smartphones, tablets, and other mobile devices positions them as essential tools for everyday use and outdoor activities. The reliance on mobile devices for communication, work, and entertainment drives high demand, as consumers increasingly seek reliable power backups. Their convenience, compact design, and ability to deliver energy on the go make portable chargers a cornerstone in energy mobility solutions.

Wearable devices are expected to experience rapid growth through 2033, driven by fitness trackers and smartwatches integrating solar panels for continuous operation. The expansion of the Internet of Things (IoT) ecosystem adds extra fuel to this adoption momentum. Consumers are prioritizing uninterrupted functionality for health monitoring, notifications, and lifestyle management, making solar-enabled wearables highly attractive. Their integration of energy independence and smart features creates a strong value proposition, positioning wearables as the fastest-growing segment and a strategic area for innovation and investment.

Monocrystalline solar cells are projected to hold the largest market share of about 48% in 2026, attributed to their superior efficiency and durability. They are highly suitable for compact mobile devices where surface area is limited. Their long lifecycle and consistent performance make them the preferred choice for smartphones, tablets, and high-end portable chargers. Although production costs are higher, the premium energy output and reliability ensure broad adoption among consumers seeking efficient, long-lasting, and high-performance solar solutions.

Thin-film solar cells are anticipated to be the fastest-growing segment from 2026 to 2033, owing to their lightweight, flexible design that accommodates curved and unconventional device surfaces. They offer effective performance in low-light conditions, making them ideal for wearables, outdoor gadgets, and mobile applications used in variable environments. Cost-effective manufacturing at scale enhances their appeal to both producers and consumers. The combination of adaptability, affordability, and functional efficiency positions thin-film solar cells as a key growth area within the market, supporting innovation and expanded adoption.

Consumer electronics are forecasted to dominate in 2026, with an anticipated 40% revenue share. The segment is driven by the widespread need for daily charging of smartphones, tablets, and other portable devices. High urban penetration and ecosystem integration enhance convenience and drive volume, as users seek seamless energy solutions for multiple devices. The reliability, accessibility, and compatibility of solar-powered solutions position consumer electronics as the dominant segment, ensuring sustained adoption and reinforcing their leadership in supporting everyday mobile energy demands.

Emergency power supply is likely to be the fastest-growing segment during 2026-2033, driven by the critical need for electronic devices in disaster-prone regions and policies encouraging reliable backup solutions. Consumers and organizations increasingly prioritize uninterrupted power access for safety, communication, and operational continuity. Portable solar-enabled emergency units provide mobility and energy independence during outages or crises, enhancing resilience. Their strategic relevance in preparedness planning, coupled with expanding awareness and adoption, positions emergency power supply as a high-growth segment. Continuous innovation in compact, efficient designs further supports its rapid market expansion and long-term potential.

In 2026, North America is expected to hold a significant position in the market. The regional market benefits from high smartphone and wearable penetration, strong consumer awareness of sustainable technology, and advanced renewable energy infrastructure. The presence of leading technology companies and innovative startups investing in solar-integrated devices drives product diversification and continuous innovation. Supportive policies, incentives for clean energy adoption, and a culture of early technology adoption further encourage consumers to embrace solar-powered mobile solutions for everyday use, outdoor activities, and professional mobility.

The region is also experiencing steady growth as consumers increasingly prioritize energy-independent devices for emergency preparedness and outdoor applications. Well-established e-commerce and retail networks enable wide distribution, while partnerships between tech firms and renewable energy providers accelerate the development of efficient, compact, and user-friendly solar solutions. Demand for premium, connected devices, combined with advancements in solar panel and battery efficiency, positions North America as a strategically important market. This ensures sustained adoption and a growing pipeline of innovative solar-powered mobile products tailored to regional lifestyles and consumer expectations.

Europe occupies a central place in the market for solar-powered mobile devices, driven by high environmental awareness and strong adoption of sustainable technologies. Consumers and businesses increasingly prioritize energy-efficient and renewable solutions, creating demand for solar-integrated smartphones, tablets, and portable chargers. Supportive government regulations, incentives for clean energy, and ambitious renewable energy targets further encourage adoption. The region’s mature technology ecosystem, combined with a preference for premium and eco-friendly products, positions it as a strategic area for innovation and long-term growth in solar-powered mobile solutions.

The regional market is also witnessing steady growth due to increasing use of mobile devices in outdoor, travel, and emergency scenarios. Technological advancements, such as flexible solar panels for wearables and portable devices, enhance usability in urban and remote areas. Partnerships between device manufacturers and renewable energy providers facilitate the introduction of efficient, reliable, and compact solutions tailored to local consumers. This focus on sustainability, combined with strong purchasing power and early adoption tendencies, ensures the region remains a crucial and expanding area for solar-powered mobile devices.

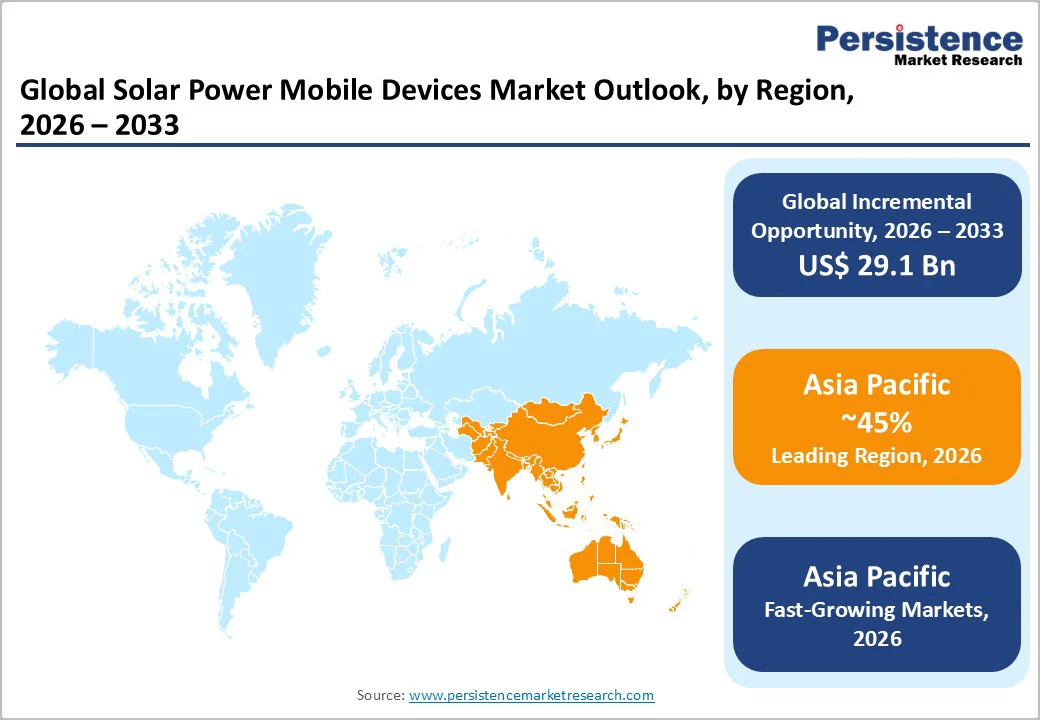

Asia Pacific is poised to dominate with an estimated 45% solar power devices market share in 2026. The region’s dominance is underpinned by a combination of high smartphone penetration, rapid urbanization, and well-established manufacturing infrastructure for electronics. China and India serve as both major production hubs and key consumer markets, enabling streamlined supply chains and cost efficiencies. Rising awareness of renewable energy solutions and government incentives for clean technology adoption further reinforce demand. The growing integration of solar capabilities into premium mobile devices, wearables, and portable chargers positions Asia Pacific as the most strategically important market, attracting both global and regional players to focus investments and innovation efforts within the region.

The market here is also slated to experience fastest growth from 2026 to 2033 due to increasing reliance on mobile technology in off-grid and rural areas, coupled with frequent exposure to climate-related power disruptions. Expanding middle-class populations and high disposable income levels accelerate the adoption of energy-independent devices. Furthermore, partnerships between local governments and tech manufacturers for solar-powered public and consumer electronics initiatives create a favorable ecosystem for growth. The combination of strong infrastructure, technological innovation, and policy support allows Asia Pacific to simultaneously maintain market leadership and rapid growth, solidifying its pivotal role in the global solar-powered mobile devices landscape.

The global solar power mobile devices market structure is moderately fragmented, featuring a mix of consumer electronics giants, solar technology manufacturers, and specialized portable charger companies. The top players collectively control an estimated 35% of the total market share. Competition revolves around product efficiency, durability, pricing, and seamless integration with mobile devices. Large manufacturers leverage economies of scale to maintain cost advantages and expand distribution networks, while maintaining strong brand presence.

Emerging players are attempting to differentiate themselves through innovation, particularly in thin-film solar technology and rugged outdoor devices. As consumer demand for renewable-powered electronics grows, companies increasingly focus on integrating solar solutions into mainstream products. This drives technological advancement, intensifies competition, and encourages continuous development of efficient, reliable, and versatile mobile energy solutions.

The global solar power mobile devices market is projected to reach US$ 5.6 billion in 2026.

Rising mobile device usage, high demand for energy independence, growing renewable energy adoption, and consumer preference for sustainable technology are driving the market.

The market is poised to witness a CAGR of 12.4% from 2026 to 2033.

Key market opportunities include outdoor and emergency applications, wearable devices, portable chargers, and integration of solar technology into consumer electronics.

Some of the key market players include Anker Innovations, Goal Zero, RavPower, Xiaomi Corporation, Samsung Electronics, and Panasonic Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Device Type

By Solar Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author