ID: PMRREP35140| 177 Pages | 4 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

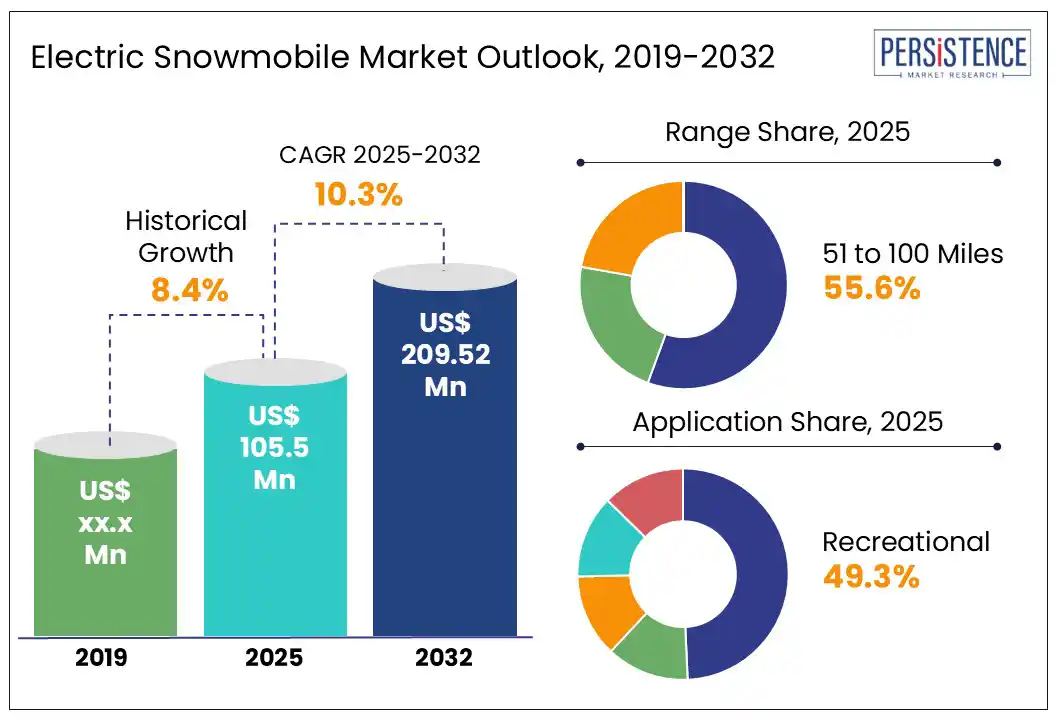

The global electric snowmobile market size is likely to be valued at US$ 105.5 Mn in 2025 and is estimated to reach US$ 209.5 Mn in 2032, growing at a CAGR of 10.3% during the forecast period 2025-2032. As winter landscapes become a field for sustainable innovation, electric snowmobiles are carving a new path forward. These are offering silent rides, zero tailpipe emissions, and increasingly competitive performance. This shift is not just about technology but also about changing how individuals experience snow. In recent years, early adopters ranging from eco-tourism operators to Arctic researchers have begun replacing their traditional sleds with electric counterparts. With novel battery systems, smart design integrations, and increasing interest from both public and private sectors, these vehicles are moving toward mainstream.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Electric Snowmobile Market Size (2025E) |

US$ 105.5 Mn |

|

Market Value Forecast (2032F) |

US$ 209.5 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

10.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.4% |

Rising eco-tourism and sustainable recreation trends are pushing the electric snowmobile market growth, specifically in protected environments where noise and emissions are tightly regulated. Operators in sensitive ecosystems such as Lapland, Yellowstone, and Banff are adopting electric models to comply with local conservation policies and attract environmentally conscious travelers. In Sweden and Finland, where Arctic tourism is a significant economic pillar, companies offering silent, electric snowmobile tours are commanding premium rates.

Aurora Powertrains' eSled fleet in Rovaniemi has enabled tour operators to extend night-time aurora safaris in silence, which would not be possible with conventional ICE sleds due to noise restrictions. Hence, businesses have reported up to 20% higher booking rates among tourists in Europe seeking quiet, climate-conscious adventures. The trend is also reshaping procurement decisions among national park authorities. In addition, carbon accounting and eco-certification are influencing buying patterns.

The lack of established charging infrastructure is a significant bottleneck to the widespread adoption of electric snowmobiles. It is evident in remote and backcountry areas where these vehicles are commonly used. Unlike urban EV networks, snowmobile trails rarely intersect with grid-connected facilities, making range anxiety a critical barrier. In Alaska and Northern Ontario, where snowmobile use spans hundreds of kilometers in off-grid terrain, operators have cited the absence of charging infrastructure as a reason for not integrating electric sleds into their fleets.

While pilot programs are a step forward, these efforts remain fragmented and insufficient for commercial scalability. Only a handful of trail networks in North America and Scandinavia currently support electric snowmobiles with designated charging points. It is creating logistical complications for tour operators and emergency responders who rely on uninterrupted access. Even where power grids are accessible, extremely cold weather affects charging performance and increases battery degradation. It requires specialized thermal management systems at charging points, which adds to installation complexity and cost.

Improved battery technology is directly expanding the operational scope of electric snowmobiles. It is opening new commercial and recreational use cases that were previously constrained by range and performance issues. Recent developments in cold-weather-optimized lithium-ion cells have significantly enhanced battery resilience in sub-zero conditions. These have made electric snowmobiles viable for longer tours, alpine rescue operations, and remote logistics.

Another opportunity comes from modular battery systems that allow quick swaps in the field. The incorporation of solid-state battery prototypes, which offer high energy density and quick charging with lower flammability risks, is under exploration. If successfully commercialized, these are expected to push electric snowmobiles beyond niche use into mainstream recreational markets.

In terms of range, the market is trifurcated into up to 50 miles, 51 to 100 miles, and above 100 miles. Among these, the 51 to 100 miles segment will likely hold about 55.6% of share in 2025 as it strikes a practical balance between battery size, vehicle weight, and real-world usability for most recreational and light commercial applications. This range covers the typical daily use scenarios of guided tours, patrolling, and personal trail riding without significantly compromising on performance. From a technical standpoint, snowmobiles with this range are more optimized for cold-weather efficiency.

Electric snowmobiles with a range above 100 miles are gaining impetus, backed by increasing demand from utility, expedition, and remote operations where uninterrupted rides are essential. Applications such as Arctic scientific missions, forestry patrols, and remote logistics in Canada often require snowmobiles to travel beyond typical recreational distances without access to charging infrastructure. In response, manufacturers are launching upgraded variants equipped with extended-range battery packs offering up to 135 miles per charge under moderate conditions.

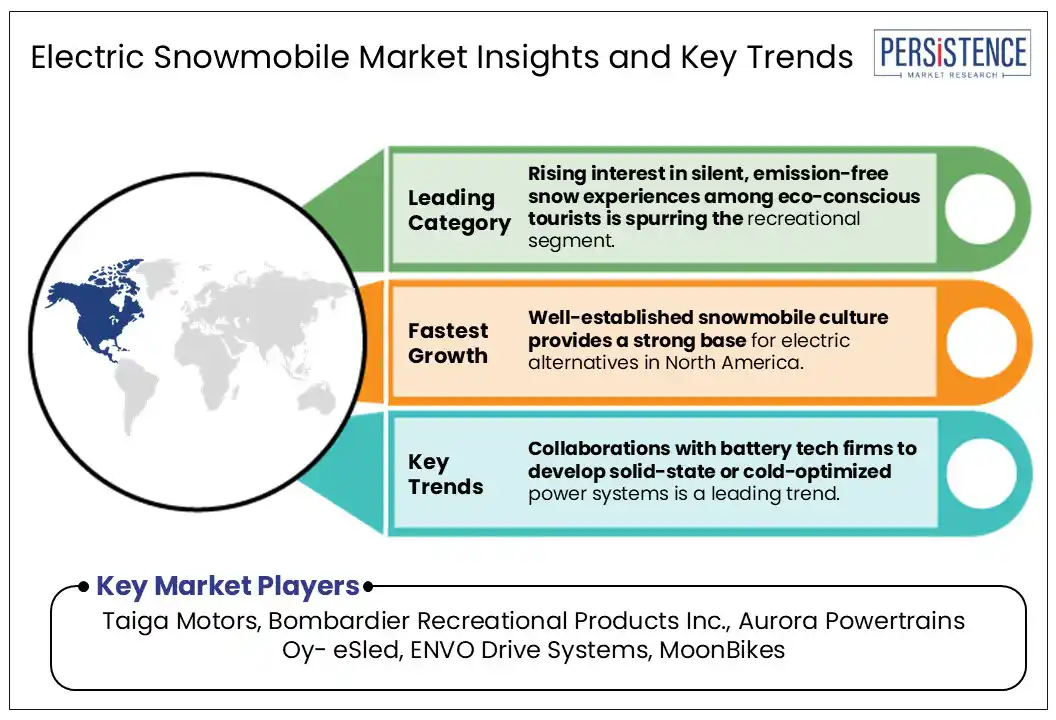

By application, the market is divided into recreational, performance and racing, utility and work, and eco-tourism and conservation. Out of these, the recreational segment is projected to hold nearly 49.3% of the electric snowmobile market share in 2025 as it caters to the changing preferences of a new generation of outdoor enthusiasts who prioritize eco-friendly experiences. Tourists are increasingly seeking low-impact alternatives that allow access to pristine natural areas without the noise, fumes, and vibration associated with internal combustion sleds. This demand is especially visible in Nordic countries and parts of North America, where snowmobile tourism is deeply integrated into regional economies.

Performance and racing applications are gaining momentum due to recent breakthroughs in torque delivery, weight optimization, and battery thermal management. These are allowing the vehicles to compete with their combustion-engine counterparts in short-distance acceleration and handling. The instantaneous torque delivered by electric drivetrains provides a significant edge in drag-style racing and hill climb events, where explosive starts and tight maneuvering are significant. This momentum is further driven by the entry of specialized racing events and leagues developed for electric snowmobiles.

In 2025, North America will likely account for approximately 66.8% of share due to increasing adoption in Canada’s Quebec and British Columbia as well as select U.S. states. Taiga Motors is a key player spearheading the transition, having launched the world’s first production electric snowmobiles in 2022. It reported significant uptake from fleet buyers in national parks and ski resorts, notably in Yellowstone National Park and Whistler, BC. The vehicles are preferred by tour operators and backcountry lodges aiming to meet decarbonization targets and reduce noise pollution.

Government incentives are also accelerating adoption. Canada’s Zero Emission Vehicle Infrastructure Program (ZEVIP) has funded charging installations in snowbelt provinces. The U.S. electric snowmobile market is estimated to see considerable growth. The Inflation Reduction Act (IRA) offers clean vehicle credits in the country. However, its impact on electric snowmobiles is limited due to classification issues as most are considered off-road vehicles. Additionally, the lack of charging infrastructure along snowmobile trail networks limits usage beyond short excursions or guided tours.

In Europe, the market is being propelled by strict emissions regulations, sustainable tourism initiatives, and widespread electrification policies. Sweden and Finland are at the forefront of adoption, supported by both government mandates and the private sector. Finland-based Aurora Powertrains has become a significant player by deploying its electric eSled for Arctic safari tours and scientific expeditions. As of 2024, its eSleds are in operation at over 30 Arctic tourism sites, especially in Lapland, where noise reduction and zero-emission features comply with local environmental goals.

Sweden's Vidde Snow Mobility, supported by Volvo Cars and the outdoor brand Peak Performance, is preparing to launch its first production model in late 2025. The company focuses on designing snowmobiles using recycled materials and carbon tracking technologies to meet the EU’s high demand for circular economy solutions. Its pilot tests in Åre, a popular ski resort, have received positive feedback, with test fleets showing 30% lower maintenance costs compared to ICE counterparts.

Asia Pacific is still at a nascent stage but starting to gain relevance, specifically in Japan and China, where snow tourism and winter sports infrastructure are undergoing modernization. In Japan, preparations for the 2025 Asian Winter Games in Hokkaido have sparked interest in sustainable mobility solutions, including electric snowmobiles for resort operations. Local ski resorts such as Niseko and Furano are piloting limited fleets of electric sleds, mostly imported from Europe and Canada. The government’s emphasis on green tourism under its Green Growth Strategy has enabled select resorts to access subsidies for eco-friendly equipment purchases, thereby pushing demand.

In China, development is more closely tied to the legacy of the 2022 Beijing Winter Olympics, which boosted winter sports infrastructure across northern provinces. While electric snowmobiles are not yet mainstream, domestic companies have shown interest in expanding into off-road electric mobility. Early-stage research and development partnerships between domestic EV manufacturers and regional sports authorities are exploring localized versions of electric snowmobiles catering to China’s terrain and battery supply chains.

The electric snowmobile market is still emerging but rapidly intensifying, propelled by technological innovation, environmental regulation, and high recreational demand. A few start-ups and established powersports manufacturers are shaping the market with differentiated approaches. A key differentiator in this competitive environment is battery performance in extreme cold. Companies with in-house battery management systems and thermal insulation technologies hold an edge. In addition, aftermarket serviceability and range capabilities are increasingly becoming make-or-break factors for buyers in remote or mountainous regions.

The electric snowmobile market is projected to reach US$ 105.5 Mn in 2025.

Rising demand for low-noise vehicles and innovations in battery efficiency are the key market drivers.

The electric snowmobile market is poised to witness a CAGR of 10.3% from 2025 to 2032.

Emergence of electric-only rental fleets in ski resorts and rising public awareness around climate change are the key market opportunities.

Taiga Motors, Bombardier Recreational Products Inc., and Aurora Powertrains Oy- eSled are a few key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Battery

By Range

By Seating Capacity

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author