ID: PMRREP11464| 188 Pages | 3 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

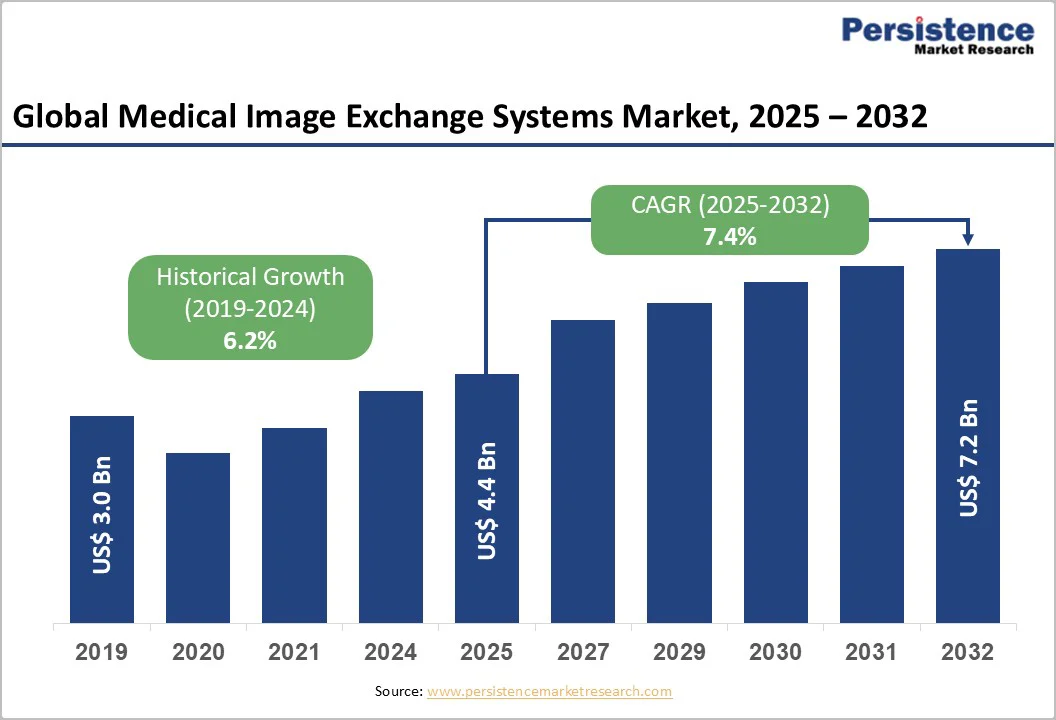

The global medical image exchange systems market size is valued at US$ 4.4 billion in 2025 and is projected to reach US$ 7.2 billion growing at a CAGR of 7.4% between 2025 and 2032. Medical image exchange enables healthcare providers to access and share medical images across all connected Health Information Exchanges (HIEs) within a community.

These systems facilitate the secure transfer of imaging data beyond individual institutions using web-based and cloud-based solutions. There is an increasing demand for high-quality, reliable, and efficient medical image exchange workflows, including PACS (Picture Archiving and Communication System) transfers, HIE portals, clinical workflows, and automated imaging processes.

Such workflows support diverse healthcare end-users, streamline data access, enhance collaboration among providers, and ensure timely, accurate, and secure sharing of patient imaging information.

| Key Insights | Details |

|---|---|

| Global Medical Image Exchange Systems Market Size (2025E) | US$ 4.4 Billion |

| Market Value Forecast (2032F) | US$ 7.2 Billion |

| Projected Growth (CAGR 2025 to 2032) | 7.4% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.2% |

The global medical image exchange systems market is being driven by the exponential growth of medical imaging data and the need for efficient, interoperable solutions to manage, store, and share this information. Accurate diagnosis, effective treatment, and AI-driven insights rely on seamless access to imaging studies from Computed Tomography (CT), Magnetic Resonance Imaging (MRI), X-ray, Positron Emission Tomography (PET), and ultrasound.

Standards such as DICOM (Digital Imaging and Communications in Medicine) and technologies such as PACS have transformed image management, resolving interoperability issues and enabling secure, electronic storage and transfer across healthcare providers. The shift from analog films to digital systems has reduced retake rates and improved workflow efficiency.

Additionally, adoption of cloud-based platforms allows providers to digitize imaging data, enhance accessibility, and support remote consultations. Implementation of 5G technology further accelerates data transfer, enabling faster and more reliable sharing of large imaging files. The increasing volume of high-resolution scans, coupled with advanced analytics and automation, continues to drive global demand for medical image exchange systems and solutions.

The global medical image exchange systems market faces several restraining factors despite its rapid growth. System incompatibility and legacy PACS infrastructure continue to hinder seamless interoperability, as traditional DICOM protocols often struggle to integrate with modern web applications and cloud-based platforms.

Data security and privacy concerns, including compliance with regulations such as HIPAA (Health Insurance Portability and Accountability Act) make sharing large imaging files complex, requiring strict access controls and secure transmission methods.

High technology costs, staff training requirements, and the need to maintain image quality further challenge adoption, particularly in resource-constrained settings. Operational inefficiencies, siloed systems, and outdated workflows contribute to delays in diagnostics, while the growing shortage of radiologists exacerbates patient waiting times.

Although solutions such as vendor-neutral archives (VNAs), hybrid encrypted APIs (Application Programming Interface), and AI-driven validation offer mitigation strategies, healthcare organizations must strategically invest in scalable, standards-based platforms to overcome cost, complexity, and security barriers, enabling efficient, secure, and interoperable medical image exchange across providers.

The global medical image exchange systems market presents significant opportunities driven by advancements in cloud-based solutions, and AI-powered technologies. Cloud-native platforms enable secure, scalable, and vendor-agnostic sharing of medical images, reducing dependency on legacy workflows and improving clinician collaboration across institutions.

Adoption of standards such as FHIR (Fast Healthcare Interoperability Resources) and TEFCA (Trusted Exchange Framework and Common Agreement) allows healthcare organizations to create consistent, shareable patient records and access broader cross-organizational data.

AI, machine learning, and API-driven integration streamline data normalization, flag discrepancies, and provide real-time, accurate patient information, while single sign-on (SSO) simplifies clinician access across multiple platforms.

Strategic partnerships with experienced technology providers accelerate the adoption of enterprise-wide imaging strategies, ensuring faster, more precise patient care. Initiatives such as Abu Dhabi’s Malaffi platform demonstrate real-world impact, connecting 83 EMRs (electronic medical records) across 2,600 facilities and enabling seamless radiology image and report sharing to enhance clinical decision-making and patient outcomes.

Medical image exchange software is projected to capture a dominant 61.4% share of the global medical image exchange systems market in 2025, driven by the growing adoption of cloud-based and web-based solutions. These platforms enable seamless sharing of medical images across healthcare networks, allowing clinicians to automatically identify and retrieve external images from connected facilities.

Images are delivered directly to local PACS or imaging systems ahead of time, eliminating manual retrieval steps and saving both time and labor. By bridging gaps between providers, release of information vendors, and health information exchanges, this software organizes patient imaging histories and delivers them efficiently to EHRs (electronic health records), supporting faster and more informed clinical decision-making.

Hospitals are projected to remain the dominant segment in 2025, representing approximately 28.8% of the global medical image exchange systems market. The high demand for medical imaging technology in hospitals stems from its critical role in enabling doctors to analyze, monitor, and track patient conditions effectively.

Medical image exchange systems are primarily utilized to facilitate remote diagnoses and consultations, allowing healthcare providers to access and share imaging data across locations, streamline workflows, and deliver timely, accurate patient care.

By 2025, North America is projected to account for around 32.3% of the global medical image exchange systems market. The United States leads this region, driven by a mature digital healthcare infrastructure and widespread adoption of advanced imaging workflows. A key catalyst is the increasing investment in healthcare IT, with favorable reimbursement frameworks supporting digital archiving and image exchange.

Simultaneously, providers are rapidly moving away from CDs (compact discs) and adopting cloud-based PACS and vendor-neutral archives (VNAs), which enable remote consultations and efficient cross-site sharing. The region’s growing diagnostic imaging volume-fueled by cancer screening programs and rising chronic disease prevalence-further amplifies the need to share and store large numbers of scans.

Beginning in 2009 the Radiological Society of North America (RSNA) and partner project introduced the Image Share Network and its 2016 Validation Testing Program, reinforcing vendor compliance for image sharing standards. A pivotal initiative occurred in November 2024, when the Advanced Research Projects Agency for Health (ARPA-H) launched its INDEX program to build a medical imaging data exchange platform, bridging data-providers and AI developers.

In November 2025, Medicom Technologies, Inc. announced contracts across 17 of 18 VISNs within the Veterans Health Administration, exemplifying large-scale system deployment in the nation’s largest integrated health system.

By 2025, Europe is projected to capture approximately 28.6% of the global medical image exchange systems market, making it a key growth region. A major driver is the emphasis on workforce optimization within public healthcare systems, which is enhancing the demand for efficient image-sharing solutions.

Countries such as France, the U.K., and Spain are leading this adoption, with France’s market growth propelled by advancements in diagnostic imaging modalities, medical image management software, increased investments in medical imaging, and government initiatives promoting EMR adoption. Interoperability requirements are also rising due to national and regional Health Information Exchanges and cross-hospital networks, while cost-containment strategies and shared specialist hubs encourage image sharing over duplicative scans.

The U.K. exemplifies large-scale deployment through its Sectra Image Exchange Portal (IEP), first launched over a decade ago to enable NHS hospitals to share X-rays, ultrasounds, CTs, MRIs, PET scans, and other diagnostic images without relying on CDs. By 2025, IEP has expanded to 500 institutions, facilitating the secure exchange of approximately 47 million images weekly.

The system has been vital during the COVID-19 pandemic, supporting alternative hospital visits, teleradiology, computer-aided diagnosis, and cross-geographical patient care, highlighting the value of integrated image exchange in Europe’s healthcare landscape.

The Asia Pacific market is experiencing rapid growth, with a projected CAGR of 9.1% over the forecast period. The region is witnessing significant growth due to accelerated digitalization across general and healthcare sectors. Widespread access to devices such as computers, smartphones, high-speed internet, and cloud-based services is driving modernization of healthcare delivery, thereby increasing demand for medical image exchange systems.

Significant investments in digital health and cloud infrastructure are further enabling healthcare providers to bypass legacy CD-based workflows, facilitating faster, secure sharing of imaging data across institutions. Government initiatives and private partnerships aimed at digitizing care are further accelerating the adoption of these platforms, ensuring efficient, interoperable systems for hospitals and clinics.

Additionally, the integration of artificial intelligence is transforming medical image analysis; for example, researchers at CSIRO’s Australian e-Health Research Centre (AEHRC) are leveraging visual language models to generate diagnostic reports directly from X-ray images.

These technological advancements, combined with growing digital health infrastructure and supportive government policies, are key drivers propelling the Asia Pacific medical image exchange systems market forward.

Major players including GE Healthcare, Siemens Healthineers, and Koninklijke Philips N.V. dominate with integrated platforms that combine imaging modalities, cloud-based exchange and AI-driven analytics. Emerging vendors and startups push innovation with agile, vendor-agnostic solutions and niche functionality. Strategic alliances, acquisitions and focus on interoperability, security, and scalable infrastructure underscore the race for leadership in this sector

The global market is projected to be valued at US$ 4.4 Billion in 2025.

Growing medical imaging data, cloud adoption, AI integration, and the need for interoperable, secure image sharing drive market growth.

The global market is poised to witness a CAGR of 7.4% between 2025 and 2032.

AI-powered analytics, cloud-based platforms, FHIR/TEFCA integration, and scalable, vendor-agnostic image exchange solutions present major growth opportunities.

Major players in the global are GE HealthCare, Koninklijke Philips N.V., FUJIFILM, Seimens Healthineers, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author