ID: PMRREP21826| 239 Pages | 24 Dec 2025 | Format: PDF, Excel, PPT* | Energy & Utilities

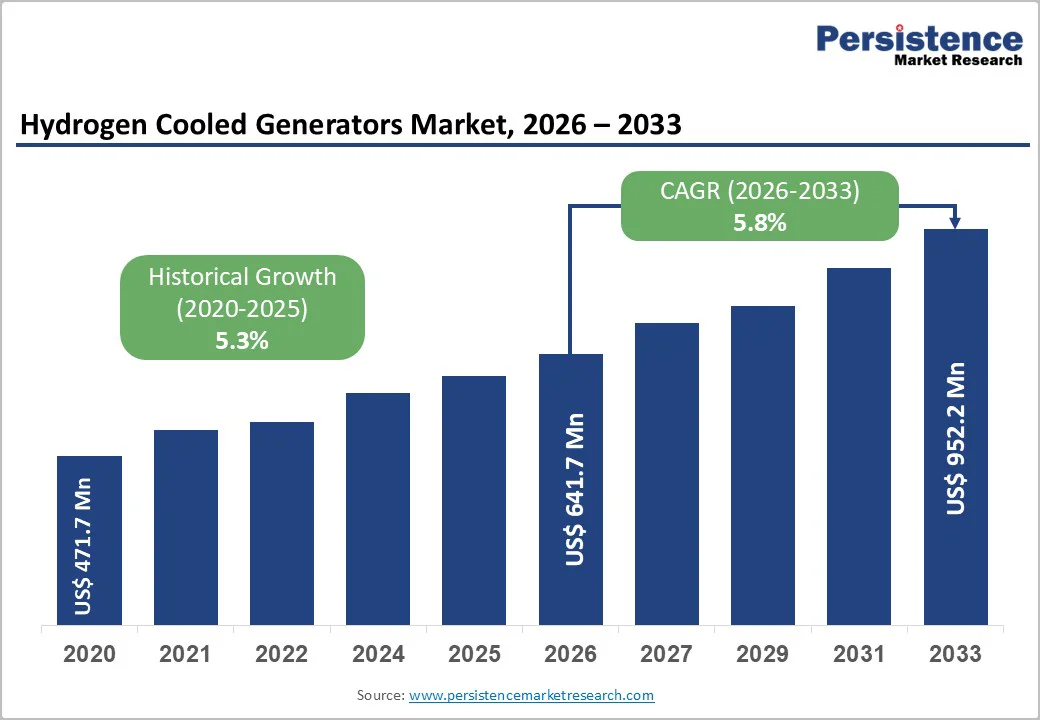

The global hydrogen cooled generators market size is likely to be valued at US$ 641.7 million in 2026, and is projected to reach US$ 952.2 million by 2033, growing at a CAGR of 5.8% during the forecast period for 2026 - 2033. The growth in the market is primarily driven by rising demand for high-efficiency power generation equipment, large-scale thermal and nuclear power expansion, and modernization of aging grid infrastructure. Utilities increasingly favor hydrogen cooling due to its superior thermal conductivity and lower windage losses compared to air-cooled systems. The regulatory emphasis on efficiency improvements and plant life extension further supports adoption across base-load power facilities.

| Key Insights | Details |

|---|---|

| Hydrogen Cooled Generators Market Size (2026E) | US$ 641.7 Mn |

| Market Value Forecast (2033F) | US$ 952.2 Mn |

| Projected Growth (CAGR 2026 to 2033) | 5.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 5.3% |

Operators have to upgrade aging power generation assets to boost efficiency, which heightens the demand for hydrogen-cooled generators. In Europe, for example, Électricité de France (EDF) advanced its nuclear fleet refurbishments through the START 2025 program, targeting thermal gains and lower outage risks. Generators exceeding 800 megavolt-amperes (MVA) rely on hydrogen cooling to achieve higher outputs, cut rotor drag, and prolong insulation durability. Utilities avoid new construction costs by extending asset life. Operators secure emissions cuts and regulatory adherence through these steps. Power providers should audit fleets for hydrogen readiness and partner with specialists for seamless retrofits that balance capital outlay with reliability gains.

Original equipment manufacturer (OEM) service agreements grew in 2025, as utilities maximized legacy plants. GE Vernova and Siemens Energy saw upticks in rewinding, sealing enhancements, and hydrogen monitoring at North American and European sites. These upgrades refine thermal control, slash interruptions, and prolong equipment service. Hydrogen systems deliver steady output under peak loads. Stricter efficiency rules propel this shift. Asset managers benefit by negotiating multi-year OEM pacts that embed predictive maintenance, forecast hydrogen purity needs, and align with decarbonization mandates for sustained baseload performance.

Hydrogen-cooled generators demand substantial initial capital for compressors, leak-proof piping, purity sensors, and safety systems, which exceeds costs of traditional options. Mid-sized utilities and independent producers under 500 MVA face particular barriers to entry. Hydrogen supply disruptions compound these issues. Europe’s cross-border pipeline network encountered two-to-three-year setbacks in 2025. Several initiatives faltered, such as Germany’s LEAG green energy center, ArcelorMittal’s € 2.5 billion hydrogen initiative, and Iberdrola’s reduced 2030 output goal from 350,000 to 120,000 tons annually after funding shortfalls. Operators mitigate risks by staging investments, securing off-take agreements early, and exploring hybrid cooling transitions that phase in hydrogen as infrastructure matures.

Infrastructure deficits raise logistics expenses, prolong project schedules, and amplify financial exposure, which curbs short-term expansion. Hydrogen’s combustible nature and handling demands necessitate sophisticated detection, enclosures, suppression tools, and skilled staff, elevating total ownership expenses. Inconsistent standards and extended approvals in key areas add friction. Purity control proves vital for performance and durability; lapses trigger outages and repairs. Developers should prioritize modular designs with built-in safeguards, pursue regulatory pre-approvals, and integrate digital twins for predictive purity management to navigate these constraints effectively.

Nuclear power expansion is opening a major, long-term opportunity for hydrogen-cooled generators. As of 2025, about 63 reactors are under construction globally, according to the International Energy Agency (IEA) and the International Atomic Energy Agency (IAEA), with China, India, and Eastern Europe driving most new capacity. For generators above 800 MVA, hydrogen cooling is the standard solution to achieve high thermal efficiency and stable performance. Strong baseload requirements and government-backed project financing make hydrogen-cooled systems a strategic fit for new nuclear plants. Developers and equipment suppliers should align their product roadmaps with national nuclear build-out plans to secure early involvement in these multi-decade projects.

Digitalization and predictive maintenance are creating valuable add-on revenue streams. IoT sensors for hydrogen purity, combined with artificial intelligence (AI) analytics, help operators reduce unplanned outages, extend generator life, and lower operational risk. At the same time, large-scale power infrastructure investments in South and Southeast Asia are generating Greenfield demand for high-capacity coal and gas-fired plants that benefit from hydrogen cooling. Vendors that bundle high-efficiency generators with advanced monitoring and service contracts can lock in long-term service revenue, improve plant reliability, and stand out in competitive markets, thereby reinforcing hydrogen cooling adoption in both emerging and mature economies.

Direct cooling systems are projected to remain the largest segment, holding over 60% of the market revenue share in 2026. Their superior heat removal efficiency supports higher power density, making them the preferred choice in nuclear and ultra-supercritical thermal plants. Direct cooling also improves operational stability and minimizes forced outages, aligning with the requirements of base-load generators. Utilities continue to favor this technology for large-capacity units due to its proven reliability and performance under continuous high thermal loads. Government-backed incentives for high-efficiency plants further reinforce adoption.

Indirect cooling systems are anticipated as the fastest-growing segment, projected to expand at a CAGR of 6.2% through 2033. The growth of this segment is driven by mid-capacity plants that prioritize enhanced safety, simplified maintenance, and compliance with evolving regulations, particularly in emerging markets. These systems provide adequate heat dissipation with lower operational risk and flexible installation options. Increased awareness of occupational safety and lifecycle maintenance optimization is boosting adoption. Emerging economies with new power infrastructure also favor indirect cooling for moderate-capacity generators. The segment’s steady CAGR reflects both market maturation and regulatory-driven modernization efforts.

The 500–800 MVA segment is expected to command approximately 38% of the hydrogen cooled generators market revenue share in 2026. Generators with this capacity are able to balance efficiency gains with manageable capital costs, making it the preferred choice for coal and gas-fired power plants. This range also allows utilities to achieve high operational output while controlling installation and maintenance expenses. Its prevalence across utility-scale projects is reinforced by its compatibility with retrofit programs and mid-to-large capacity generation requirements. Regional adoption is strong in Europe and North America, where existing infrastructure favors this rating.

The above 800 MVA segment is likely to register the highest CAGR during the 2026-2033 forecast period. The expansion of this segment is primarily driven by nuclear power projects and high-efficiency combined-cycle plants in Asia Pacific and Eastern Europe. Large-capacity generators in this range almost exclusively adopt hydrogen cooling to manage extreme thermal loads efficiently. Rising energy demand and long-term baseload reliability requirements further accelerate adoption. High-capacity projects benefit from enhanced fuel efficiency and reduced downtime, making this segment increasingly attractive. Its growth trajectory reflects both emerging nuclear capacity and the modernization of ultra-supercritical thermal facilities.

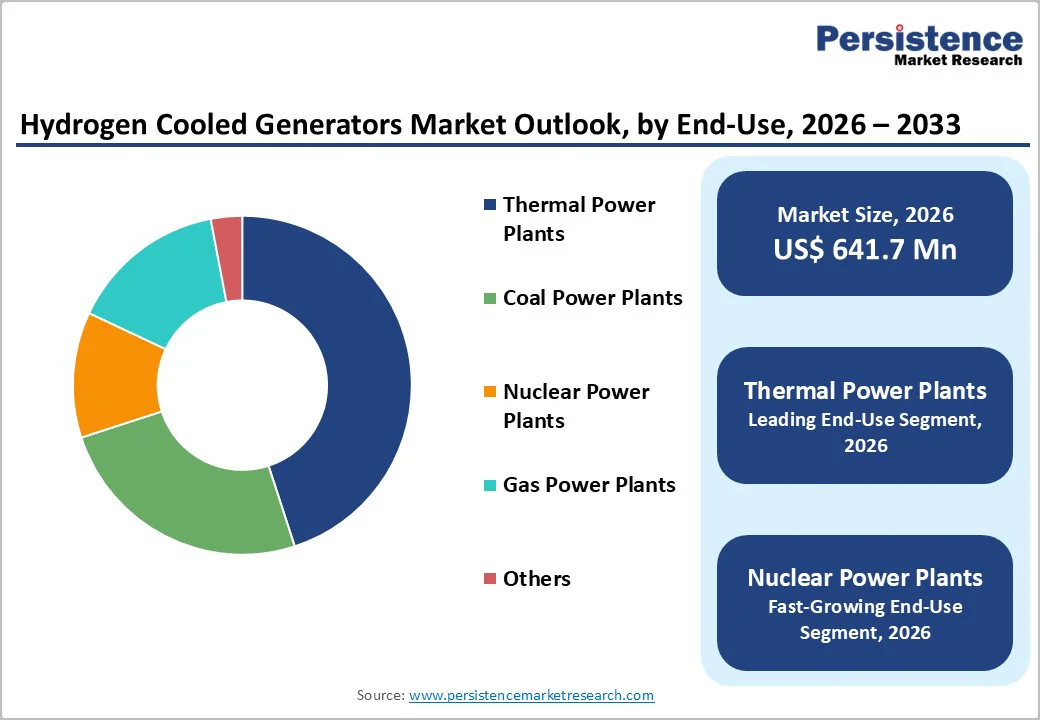

Thermal power plants are expected to be the largest end-users, poised to account for over 45% of the market demand in 2026. The coal and gas-fired facilities rely on hydrogen cooling to sustain continuous base-load operations under high thermal stress. The technology improves operational efficiency, reduces insulation degradation, and supports long-term plant reliability. Utilities favor hydrogen cooling in thermal plants to meet efficiency mandates and optimize fuel usage. Base-load stability and predictable maintenance schedules make thermal plants a consistent source of hydrogen-cooled generator demand. Government policies supporting efficient power generation further reinforce this dominance.

Nuclear power plants are projected to be the fastest-growing end-users from 2026 to 2033. Stringent efficiency, safety, and redundancy requirements make hydrogen cooling indispensable for nuclear generators above 800 MVA. New reactor constructions in Asia and Europe are driving incremental demand, while older nuclear fleets are being retrofitted to improve thermal performance. Hydrogen cooling ensures compliance with regulatory standards and supports long-term operational reliability. Growth is particularly strong in regions investing heavily in nuclear capacity expansion. The combination of efficiency mandates and high-capacity deployment underpins sustained adoption in this segment.

The market in North America, led by the United States, benefits from mature power infrastructure and strong federal oversight, which underpin investment in generator retrofits and nuclear life-extension programs. For instance, the U.S. Department of Energy (DOE) finalized a US$ 1.6 billion loan guarantee in 2025 to upgrade transmission infrastructure, reinforcing grid reliability needed for high-capacity generation. Nuclear plant modernization and base-load stability requirements continue to drive hydrogen-cooled system adoption. Utilities prioritize digital upgrades and integrated safety enhancements to improve reliability and reduce operational risk. Long-term service contracts dominate competitive dynamics, with OEMs securing multi-year agreements. Regulatory incentives for efficiency and emissions reductions further strengthen the case for hydrogen cooling.

Ongoing regional funding and policy support signal continued strategic focus on advanced generation technologies. In addition to direct energy infrastructure financing, hydrogen-related hubs and modular power initiatives receive targeted attention at federal and state levels, promoting cleaner energy transition pathways. The combination of retrofit demand, regulatory alignment, and infrastructure support creates a stable environment for hydrogen-cooled generator deployment. While growth is steady, the region is less aggressive than Asia Pacific, which is expanding at a faster rate due to large-scale capacity additions. The cost-effective modernization and lifecycle optimization remain key priorities for North American market players.

In Europe, the hydrogen cooled generators market expansion is driven by the decarbonization policies and targeted funding frameworks of the European Union (EU), which have strengthened investment in generator efficiency and grid modernization. Notably, the European Commission (EC) committed over € 250 million in 2025 to hydrogen infrastructure studies and deployment grants, enhancing cross-border hydrogen corridors and improving supply networks. These initiatives support future hydrogen availability, which is critical for hydrogen-cooled systems in high-capacity plants. EU energy efficiency directives actively encourage the integration of advanced generator cooling technologies to lower emissions and improve operational performance. Renewable and transitional energy projects receive priority funding, aligning decarbonization strategy with hydrogen infrastructure build-out. The competitive intensity is moderate, with utilities emphasizing compliance, lifecycle service partnerships, and retrofits over Greenfield orders.

Funding support and regulatory incentives in Europe create a stable environment for hydrogen-cooled generator adoption. Utilities prioritize retrofits and modernization projects to improve efficiency, reliability, and lifespan of existing assets. Advanced monitoring, predictive maintenance, and safety integration are increasingly incorporated to reduce downtime and operational risk. Investments are focused on nuclear and high-capacity thermal plants, which benefit most from hydrogen cooling. Permitting timelines and cross-jurisdiction coordination remain key considerations for project execution.

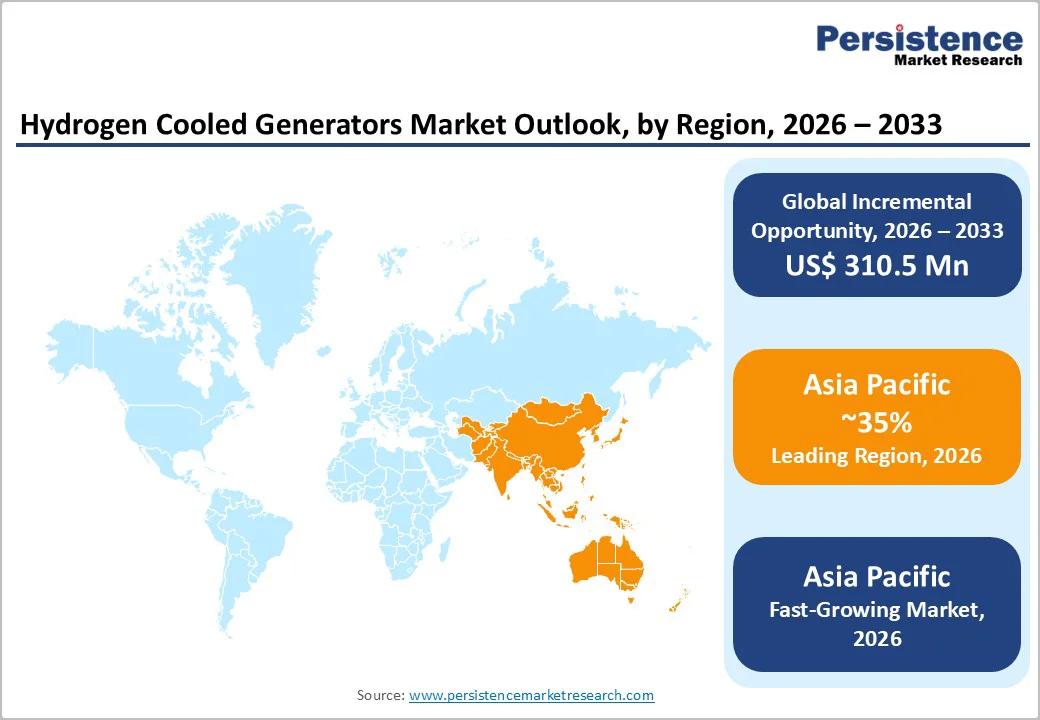

Asia Pacific is projected to be the dominant and fastest-growing region in the hydrogen-cooled generators market, expected to register a CAGR of 6.5% through 2033, with China and India leading demand. Large-scale thermal and nuclear power expansions drive growth, as governments prioritize energy security and rising electricity needs. In India’s 2025 Union Budget, the Nuclear Energy Mission received funding to build five indigenously developed small modular reactors (SMRs) by 2033 and expand nuclear capacity toward 100?GW by 2047, creating long-term demand for high-capacity hydrogen-cooled systems. China’s aggressive energy strategy, including new coal and nuclear projects and rapid grid electrification, further strengthens adoption. These strategic alignment of infrastructure financing, regulation, and technology partnerships accelerates deployment in both base-load and transitional energy portfolios.

The manufacturing advantages and local OEM collaborations reduce deployment barriers and shorten project cycles. Local firms are partnering with global providers to transfer expertise and adapt hydrogen cooling for tropical and high-demand conditions. Infrastructure development, government incentives, and strategic funding enhance the overall hydrogen ecosystem. Lower production costs and coordinated policy support reinforce the region’s competitiveness. These factors collectively make Asia Pacific the largest and most dynamic growth engine for hydrogen-cooled generator adoption worldwide, with robust adoption expected across multiple power generation applications.

The global hydrogen cooled generators market structure remains moderately consolidated, with major entities such as Siemens Energy, GE Vernova, Mitsubishi Hitachi Power Systems, Toshiba, and Alstom commanding substantial revenue shares. These leaders leverage extensive industrial gas networks and deep engineering expertise to deploy high-capacity hydrogen-cooled units. These giants are strengthening their competitive advantage by securing long-term OEM service contracts and forming strategic partnerships within the nuclear and thermal power sectors. Furthermore, these firms are prioritizing investments in digital monitoring, predictive maintenance platforms, and safety enhancements.

Regional competitors such as Harbin Electric, Doosan Heavy Industries, and Bharat Heavy Electricals Limited (BHEL) concentrate on mid-capacity facilities, retrofits, and specialized engineering solutions. High initial capital outlays, strict regulatory compliance, and complex integration requirements create formidable barriers for new entrants. Despite these challenges, smaller vendors carve out market space by utilizing IoT-enabled diagnostics and flexible service-based business models. The sector will likely experience continued consolidation through strategic acquisitions and technology licensing agreements. Buyers should assess these niche players for cost-effective retrofitting options while remaining vigilant regarding merger activities that might impact long-term support capabilities.

The global hydrogen-cooled generators market is projected to reach US$ 641.7 million in 2026.

The expansion of large-scale thermal and nuclear plants, grid modernization and generator retrofit programs, and efficiency and reliability mandates in high-capacity power generation are driving the market.

The market is poised to witness a CAGR of 5.8% from 2026 to 2033.

Nuclear power resurgence in Asia and Europe, integration of digital monitoring and predictive maintenance, and emerging market infrastructure investments in South and Southeast Asia are creating massive opportunities.

Siemens Energy, GE Vernova, Mitsubishi Electric, Toshiba Energy Systems, ABB Ltd., Hitachi Energy, and BHEL are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Cooling Method

By Power Rating

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author