ID: PMRREP35878| 188 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

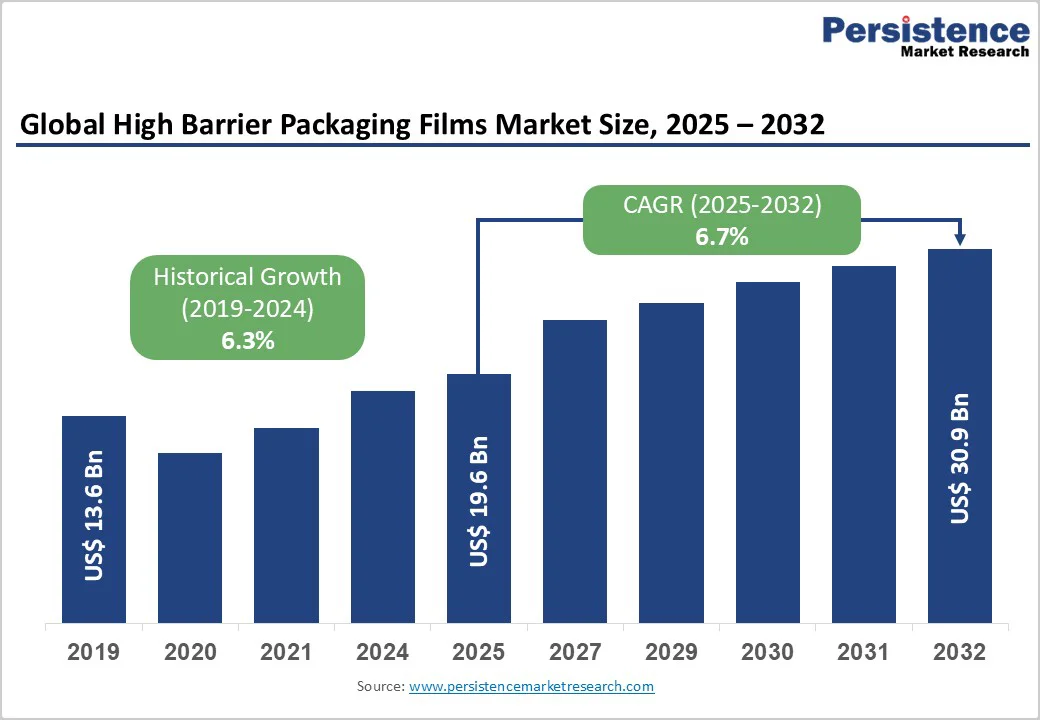

The global high barrier packaging films market size is likely to reach US$19.6 billion in 2025 and is projected to reach US$30.9 billion, growing at a CAGR of 6.9% between 2025 and 2032. This substantial expansion reflects sustained demand across food, pharmaceutical, and specialty packaging applications where product protection from environmental degradation is paramount.

| Key Insights | Details |

|---|---|

|

High Barrier Packaging Films Market Size (2025E) |

US$ 19.6 Bn |

|

Market Value Forecast (2032F) |

US$ 30.9Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.3% |

The high barrier packaging films market is fundamentally driven by the global shift toward convenience consumption and the need to preserve product freshness across extended distribution networks. According to the U.S. Department of Commerce, the U.S. food and beverage manufacturing sector accounted for 16.8% of total manufacturing sales in 2021, employing approximately 1.7 million workers. Within this context, high barrier films enable manufacturers to extend shelf life, reduce food waste, and meet retailer stocking requirements across increasingly complex supply chains.

The U.S. flexible packaging industry alone generated $41.5 billion in sales in 2022, with food packaging contributing nearly 50% of total shipments. Modified atmosphere packaging (MAP) technology, vacuum sealing, and multilayer barrier structures using materials such as ethylene vinyl alcohol (EVOH) and polyamide (PA) have become standard practice in meat processing, dairy products, and ready-to-eat meal categories.

India's food processing sector, valued at US$354.5 billion in 2024 and projected to reach US$535 billion by FY26, demonstrates comparable demand acceleration, with high barrier packaging essential for meeting domestic consumption growth driven by urbanization and changing consumer preferences.

Pharmaceutical and healthcare sectors represent the fastest-growing application segments for high-barrier packaging, driven by stringent regulatory requirements and expanding biopharmaceutical manufacturing.

The United States Pharmacopoeia (USP) Chapter <1671> establishes maximum demonstrated moisture permeability limits of ≤0.8 per day per tablet for oral dosage forms, necessitating barrier layers that achieve oxygen transmission rates below 0.1 cubic centimetres per square meter per day and water vapor transmission rates as low as 0.01 grams per square meter per day.

The International Council for Harmonisation (ICH) stability guidelines specify that moisture-sensitive formulations require packaging systems capable of providing permanent barriers to moisture and solvent passage requirements that drive pharmaceutical manufacturers toward aluminium foil laminates, metallised films, and multi-layer coated structures. Global pharmaceutical manufacturing output has expanded significantly, with the sector increasingly locating production facilities in the Asia Pacific to serve growing emerging market demand.

The FDA's guidance documents on container-closure systems require documented evidence of barrier performance through standardized testing protocols, creating technical and compliance drivers for high-barrier film adoption across the industry. Regulatory harmonization across major markets (FDA, EMA, ICH) has established consistent performance benchmarks that standardize high barrier film specifications, reducing customization requirements and enabling economies of scale within the high barrier packaging films market.

Asia Pacific e-commerce packaging market is witnessing strong growth driven by the exponential rise in online grocery shopping and food delivery platforms. This distribution channel transformation fundamentally alters packaging requirements, as products experience extended transit times, temperature fluctuations, and handling stresses during last-mile delivery conditions that demand superior barrier performance compared to traditional retail channels.

The U.S. packaged food market is experiencing robust expansion, with e-commerce platforms like Amazon, Instacart, and DoorDash driving structural shifts in packaging specifications. The protective packaging segment in Asia-Pacific food packaging markets dominates due to its ability to safeguard products from physical damage, contamination, and spoilage during storage and long-distance food delivery.

India’s packaging sector, valued at over USD 86 billion in 2024 and growing rapidly, reflects the convergence of e-commerce logistics requirements with manufacturing capacity expansion. High barrier films enable manufacturers to reduce product damage rates, minimize return claims, and maintain freshness standards across multi-day transit scenarios.

Consequently, the high barrier packaging films market benefits substantially from the structural acceleration in direct-to-consumer and online grocery channels, which require superior barrier properties compared to conventional retail distribution.

High barrier packaging films involve substantially higher manufacturing costs relative to conventional plastic films due to requirements for multi-layer coextrusion, specialty resin components (EVOH, polyamide, PVDC), and precision coating technologies (metallization, aluminium oxide deposition).

The European pulp and paper industry, while representing a mature sector, experienced average operating profit margins of 14% during recent measurement periods, with speciality segments achieving 18% margins indicative of the margin pressures inherent in converting operations. Petrochemical input costs for polyethylene, polypropylene, and specialty polymers exhibit cyclical volatility linked to crude oil pricing, creating planning uncertainty for manufacturers and customers.

The shift toward bio-based barrier materials such as polylactic acid (PLA) and polybutylene adipate terephthalate (PBAT) introduces additional cost considerations, as bio-based sourcing commands premium pricing relative to petroleum-derived alternatives. Small and medium-sized converters face particular vulnerability to raw material price fluctuations, potentially constraining market expansion in cost-sensitive end-use segments where price elasticity remains significant, thereby limiting addressable market penetration.

The global shift toward circular economic principles and regulatory mandates restricting single-use plastics creates substantial opportunities for innovation in sustainable high-barrier film formulations.

Research into compostable multilayer structures combining polybutylene adipate terephthalate (PBAT) with polyhydroxyalkanoate (PHA) and cellulose nanocrystal (CNC) barrier layers demonstrates the technical feasibility of achieving oxygen permeance reduction exceeding 90% while maintaining compostability within industrial composting timeframes of 60 days.

Bio-based polylactic acid (PLA) and polybutylene succinate (PBS) polymers, combined with natural fibre reinforcement and bio-based coatings, offer pathways toward mono-material high-barrier film solutions that maintain recyclability compatibility with existing waste streams.

The European Union's Extended Producer Responsibility (EPR) directives and packaging-specific recycled content mandates create regulatory drivers for market-pull innovation in sustainable high-barrier alternatives.

Food manufacturers increasingly face consumer pressure to adopt sustainable packaging, creating premium market segments where sustainable high-barrier films command price premiums, offsetting higher production costs. Companies successfully commercialising high-performance bio-based and recyclable barrier films position themselves to capture market share from manufacturers transitioning supply chains toward sustainability compliance.

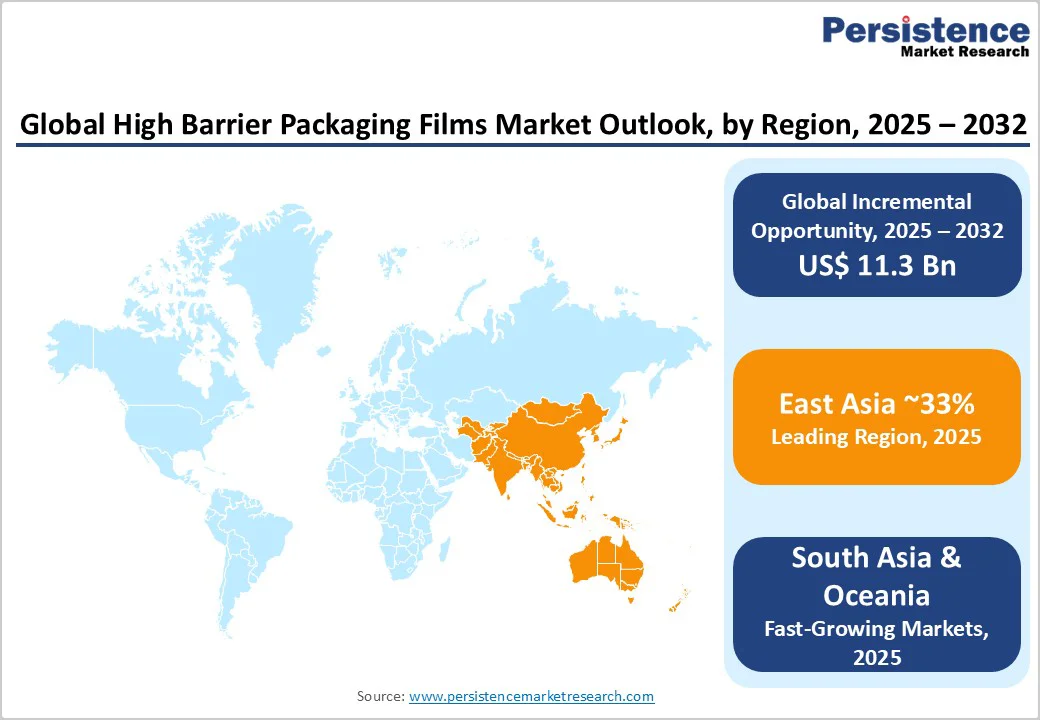

East Asia represents 33% of the global High Barrier Packaging Films Market valuation, driven by rapid urbanisation, rising disposable incomes, and the expansion of organized retail and e-commerce infrastructure in China and Southeast Asia. India's food processing sector, projected to reach US$1.1 trillion by FY35, reflects substantial downstream demand for high barrier packaging to support export-oriented manufacturing and domestic consumption expansion.

The pharmaceutical industry in India, attracting US$13.4 billion in FDI (April 2000–June 2025), creates parallel demand drivers as manufacturers invest in capacity for biopharmaceutical production requiring advanced barrier packaging systems. Brazilian healthcare markets, representing US$135 billion in market size, demonstrate similar expansion trajectories as developing middle-class populations increase consumption of packaged foods and pharmaceuticals requiring protective barrier packaging.

The High Barrier Packaging Films Market benefits from geographic expansion as healthcare infrastructure investment, food safety regulatory strengthening, and e-commerce penetration drive standardized packaging requirements across emerging market regions.

Manufacturing facility relocations by multinational food and pharmaceutical companies toward Asia-Pacific geographies create localized demand for high-barrier film supply, incentivizing regional production capacity expansion.

Government initiatives in India (National Mission on Sustainable Packaging, Production Linked Incentive Scheme for Food Processing Industry) provide structural support for domestic packaging industry development, potentially attracting foreign investment and technology partnerships that expand regional high barrier film production capacity.

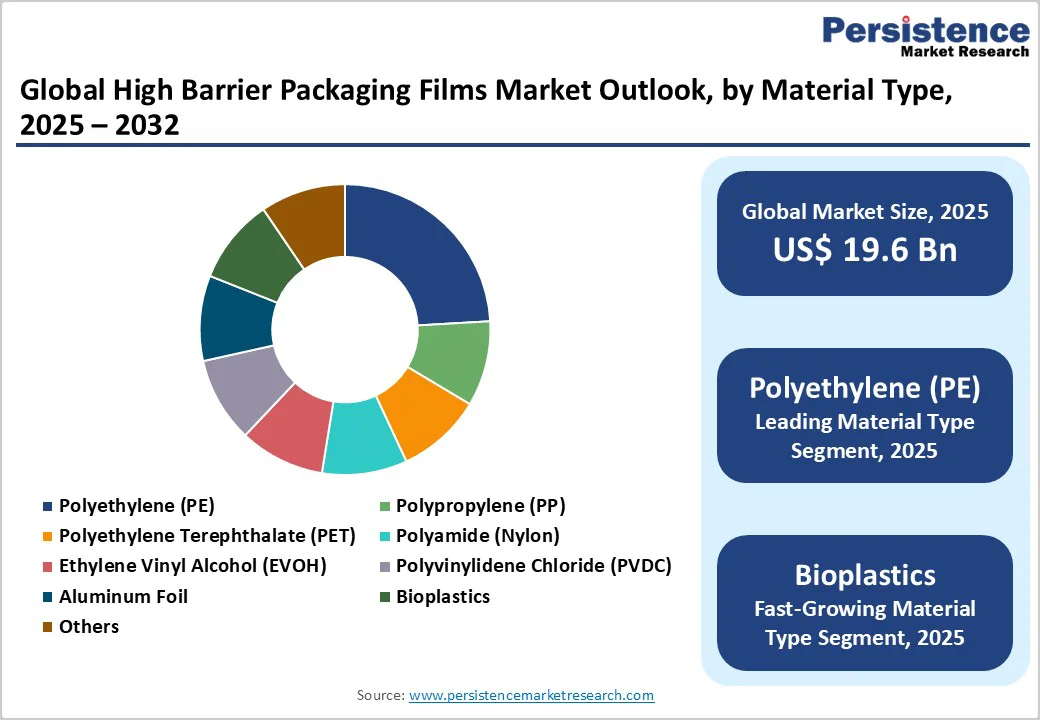

Polyethylene represents the dominant material substrate for high barrier packaging films, accounting for approximately 28% of the 2025 market valuation. This leadership position reflects PE's multifaceted advantages, including established manufacturing infrastructure, cost-competitive production processes, FDA approval across multiple resin grades for food contact applications, and proven compatibility with downstream conversion processes (blown film extrusion, lamination, coating).

High-density polyethylene (HDPE) and low-density polyethylene (LDPE) variants provide differentiated moisture barrier properties, with HDPE offering enhanced moisture vapour transmission resistance suitable for moisture-sensitive applications and LDPE delivering flexibility and puncture resistance for dynamic packaging environments.

PE-based structures coextruded with EVOH or PA barrier layers have become industry-standard configurations for extended shelf-life food packaging, with established supply chain relationships and validated performance data supporting rapid adoption across food and beverage manufacturers.

Bioplastics, encompassing polylactic acid (PLA), polyhydroxyalkanoates (PHAs), and polybutylene succinate (PBS), represent the fastest-growing material segment within the High Barrier Packaging Films Market.

Pouches represent the market-leading packaging format within the High Barrier Packaging Films Market, commanding 36% of the 2025 market valuation. This category encompasses stand-up pouches offering premium shelf presence and consumer convenience, zipper-closure variants enabling product resealing and portion control, and retort-capable structures capable of withstanding hot-fill and thermal processing requirements.

Stand-up pouches dominate food and beverage applications, including snacks, dehydrated foods, beverages, and pet food products, where the format provides space-efficient retail display, reduced material usage relative to rigid containers, and manufacturing flexibility enabling rapid product innovation cycles.

Lidding films represent the fastest-growing packaging format segment, driven by accelerating demand from food service industries, pharmaceutical blister pack applications, and modified atmosphere packaging (MAP) technologies require precise heat-seal compatibility and barrier performance characteristics.

Food and beverage applications command a dominant 60.5% market share within the High Barrier Packaging Films Market, reflecting fundamental economic importance and structural demand drivers inherent in packaged food supply chains.

The U.S. packaged food market, valued at USD 1.03 trillion in 2021 with a projected 4.8% CAGR through 2030, demonstrates the scale of commercial opportunity and the criticality of barrier packaging in preserving product freshness and extending shelf-life across extended distribution networks. India's food processing sector expansion (projected to reach US$535 billion by FY26) reflects parallel demand acceleration in emerging markets driven by urbanization, changing dietary patterns, and organised retail expansion.

Dairy products, baked goods, and confectionery categories demonstrate consistent demand for protective barrier films, maintaining texture, flavor, and nutritional integrity throughout retail and consumer storage periods.

Pharmaceutical and healthcare packaging represents the fastest-growing end-use segment, driven by global pharmaceutical manufacturing expansion, biopharmaceutical sector development, and heightened regulatory requirements for product protection and supply chain integrity.

North America comprises 21% of the global high barrier packaging films market valuation, anchored in the U.S. market, where the flexible packaging industry generated $41.5 billion in sales in 2022 representing the second-largest packaging segment.

The U.S. food and beverage manufacturing sector, accounting for 16.8% of total manufacturing sales in 2021 and employing 1.7 million workers, represents substantial end-user demand for protective barrier films supporting extended shelf-life products.

The U.S. packaged food market, valued at USD 1.03 trillion in 2021 with a projected 4.8% CAGR through 2030, drives consistent demand for high barrier film solutions across beverage, snacking, confectionery, and prepared meal categories.

Pharmaceutical manufacturing in North America, concentrated in the northeastern United States, requires validated high barrier packaging systems supporting FDA compliance and stability-tested shelf-life claims.

East Asia dominates with 33% market valuation, driven by China's position as the world's largest chemical industry producer with chemical sales reaching approximately US$2,431 billion in 2023, according to the European Chemical Industry Council (CEFIC).

China's pulp and paper industry, the world's largest, produces over 136 million metric tons of paper and cardboard annually, reflecting substantial downstream demand for integrated packaging solutions including high barrier films. The region's rapid urbanization, expanding middle-class consumer populations, and accelerating e-commerce infrastructure create structural demand drivers for advanced packaging solutions.

Pharmaceutical manufacturing in East Asia, particularly in India and China, representing major global active pharmaceutical ingredient production hubs, generates specialized demand for high barrier films protecting moisture-sensitive formulations and maintaining drug efficacy throughout extended storage periods.

Government initiatives supporting food safety standards and pharmaceutical manufacturing modernization create regulatory drivers for high barrier film adoption. Investment in manufacturing capacity by major multinational packaging companies (Amcor, Berry Global, Sealed Air) within the region supports local supply chain development and price competitiveness.

Europe represents 24% of the global market, characterized by mature manufacturing infrastructure, stringent regulatory frameworks, and advanced sustainability requirements shaping material selection and production processes. The European pulp and paper industry, employing 175,000 people directly and generating €100 billion in turnover with €20 billion contribution to EU GDP, reflects the region's packaging sector maturity and sophistication. European food manufacturing maintains established quality standards and traceability requirements, driving the adoption of barrier films capable of supporting extended shelf-life products meeting food safety regulatory compliance.

Pharmaceutical manufacturing in Europe, concentrated in Switzerland, Germany, and Nordic countries, maintains premium positioning within global markets, necessitating high-performance barrier packaging solutions supporting validated shelf-life claims and regulatory dossier requirements.

The global high barrier packaging films market is moderately consolidated, characterized by the presence of a few global leaders holding significant market shares alongside several regional manufacturers catering to niche applications.

Major players such as Amcor plc, Sealed Air Corporation, Mondi plc, Huhtamaki Oyj, Berry Global Group, Inc., and Constantia Flexibles Group GmbH dominate the competitive landscape through continuous innovations in sustainable, recyclable, and high-performance barrier materials.

These companies leverage strong R&D capabilities and global distribution networks to meet the growing demand for extended shelf-life and eco-friendly packaging solutions. Strategic expansions, material advancements, and partnerships aimed at circular economy goals further intensify competition within this evolving market.

The global High Barrier Packaging Films market is projected to be valued at US$ 19.6 Bn in 2025.

The Polyethylene (PE) segment is expected to hold around 28% market share by Material Type in 2025 in the Global High Barrier Packaging Films Market.

The market is expected to witness a CAGR of 6.7% from 2025 to 2032.

Rising demand for extended shelf-life food, e-commerce-driven logistics expansion, and sustainability-focused packaging innovations drive market growth.

Opportunities lie in recyclable mono-material films, high-barrier solutions for online grocery and ready-to-eat food packaging, and rapid adoption across Asia-Pacific’s expanding manufacturing base.

The leading global players in the High Barrier Packaging Films market are Amcor plc, Sealed Air Corporation, Mondi plc, Huhtamaki Oyj, Berry Global Group, Inc., and Constantia Flexibles Group GmbH.

| Report Attribute | Details |

|---|---|

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value |

|

Region Covered |

|

|

Key Companies Covered |

|

|

Report Coverage |

|

By Material Type

By Packaging Format

By Barrier Layer Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author