ID: PMRREP11377| 180 Pages | 22 Apr 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

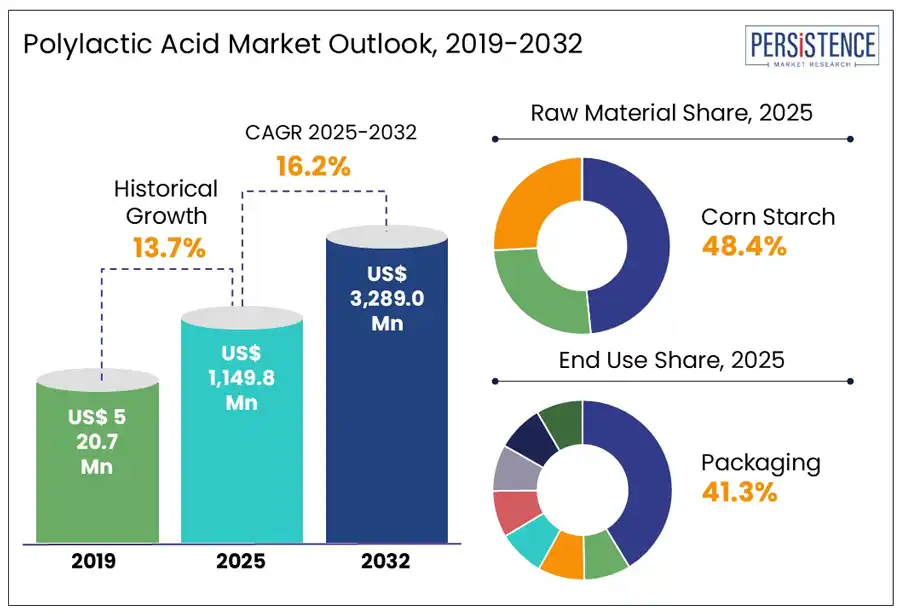

According to the Persistence Market Research report, the global polylactic acid market totaled US$ 1,149.8 Mn at the end of 2025. Worldwide demand for these solutions is predicted to accelerate at a CAGR of 16.2%, reaching a market valuation of US$ 3,289.0 Mn by 2032.

The growing demand for sustainable materials, coupled with regulatory pressure to reduce plastic pollution has positioned PLA as a strong alternative to conventional fossil-based plastics across packaging, textiles, and consumer goods sectors. Polylactic Acid, a bio-based and biodegradable thermoplastic polyester, supports global sustainability goals by offering compostability and recyclability. With only 9% of global plastic ever adequately recycled and 91 million tons mismanaged each year, PLA's recyclability into rPLA, approved for food contact, offers a circular approach. This helps reduce landfill volumes, carbon footprint, and dependence on virgin fossil-based feedstock.

PLA demand benefits from advancements in sorting technologies such as NIR and density separation, enabling 97% sorting purity. This supports efficient integration into existing recycling streams. The material’s potential to reduce greenhouse gas emissions, meet EU recycling targets, and align with circular economy strategies strengthens its market relevance and long-term growth outlook.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Polylactic Acid Market Size (2024A) |

US$ 989.5 Million |

|

Estimated Market Size (2025E) |

US$ 1,149.8 Million |

|

Projected Market Value (2032F) |

US$ 3,289.0 Million |

|

Value CAGR (2025 to 2032) |

16.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

13.7% |

The polylactic acid market continues to grow as companies introduce advanced technologies that strengthen value chain integration and improve production economics. In December, 2023, Sulzer launched SULAC™, a new lactide production technology that allows manufacturers to convert lactic acid into lactide with greater efficiency and reduced energy input. This innovation boosts production yield, lowers operational costs, and removes supply-side constraints.

By addressing key challenges in upstream processes, Sulzer enables PLA manufacturers to scale operations more reliably and meet growing demand for sustainable alternatives to conventional plastics. Sulzer unveiled CAPSULTM in November, 2023, a proprietary system for continuous polycaprolactone (PCL) production. Although CAPSULTM targets PCL, it complements Sulzers broader biodegradable polymer strategy and enhances end-to-end manufacturing capability.

These integrated technologies eliminate operational bottlenecks and ensure smoother transitions from raw materials to finished PLA products. Manufacturers benefit from consistent output, streamlined production flows, and stronger cost control. These advancements firmly positions PLA market for high growth by offering robust technological solutions that aligns with rising global demand for reliable and sustainable material alternatives.

While PLA is marketed as compostable, real-world composting often requires industrial-grade facilities. NatureWorks’ efforts to optimize compostable coffee pods reflect the ongoing need to improve biodegradation performance. The lack of consistent global standards for compostability and limited access to composting infrastructure hinders effective PLA disposal. This can result in PLA being treated like conventional plastic waste, reducing its environmental benefits.

Strategic collaborations continue to create strong opportunities to expand polylactic acid production capacity and extending its global footprint. In December, 2024, Emirates Biotech partnered with Sulzer to build the world’s largest manufacturing facility for this bio-based material in the UAE, with an annual capacity of 160,000 tonnes. This alliance reflects a growing shift toward scalable, circular infrastructure that supports long-term sustainability goals while addressing rising demand. By investing in large-scale, integrated operations, stakeholders can secure a stable supply chain and enable broader adoption across key end-use sectors.

In August 2024, Nagase & Co., Ltd. and TotalEnergies Corbion signed a distribution agreement to promote Luminy® in Japan. This cross-border partnership demonstrates how regional collaborations enhance accessibility and consumer reach. Such agreements allow companies to tap into established networks and cater to specific market needs, supporting eco-conscious product strategies across packaging, consumer goods, and industrial segments.

As global demand for sustainable alternatives accelerates, these partnerships play a pivotal role in reinforcing supply chain resilience, expanding commercial reach, and unlocking high-growth opportunities in the bio-based materials.

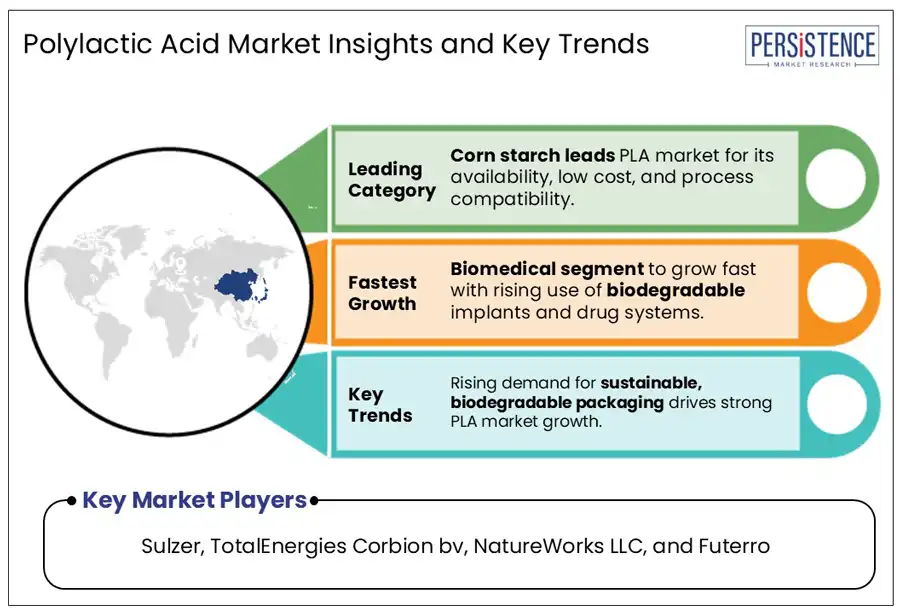

Corn starch stands out as the most widely used raw material for PLA production due to its abundance, renewability, and ease of conversion into lactic acid. Its dominance is especially strong in regions with large corn cultivation, such as North America and parts of Asia.

Recent collaborations, such as Sulzer’s partnerships for PLA plants in India and China, further cement corn starch’s relevance, as many of these facilities rely on agricultural feedstocks like corn. Its bio-based origin aligns with global sustainability goals, making it the go-to input for scalable bioplastic solutions.

Packaging leads PLA consumption due to its demand for sustainable, compostable, and food-safe alternatives to conventional plastics. From food containers to flexible wraps, PLA meets performance needs while reducing environmental impact.

The trend gained momentum as companies like NatureWorks and TotalEnergies Corbion developed PLA products targeting food and consumer packaging applications. In China and Japan, recent showcases and distribution deals reflect packaging as the primary gateway for PLA adoption, driven by eco-regulations and shifting consumer preferences.

The polylactic acid market in Asia Pacific is set to expand through significant capacity investments and localized production. In October 2023, NatureWorks began constructing a PLA manufacturing plant in Thailand, addressing the rising regional demand for biodegradable materials in sectors such as packaging and textiles. This investment in regional production strengthens supply chain aligns with the commitment to reducing plastic dependency and fosters the adoption of bio-based alternatives.

As more companies prioritize sustainability, the region is creating a robust foundation for the growth of PLA production, which supports environmental objectives while meeting the demands of eco-conscious consumers. These investments will help meet the growing demand for PLA in various applications, positioning Asia Pacific as a key player in the global PLA market.

Europe’s market is poised for growth driven by the increasing adoption of circular manufacturing practices. Futerro’s development of a fully integrated PLA biorefinery in France, announced on December 8, 2022, represents a significant step toward advancing the circular economy in the region.

With the growing regulatory pressures and consumer preference for sustainable alternatives, Europe is increasingly focusing on biodegradable materials such as PLA to replace conventional plastics. By incorporating molecular recycling processes, Europe is enhancing the lifecycle sustainability of PLA, aligning with EU environmental targets and fostering long-term market growth. The industry is also benefiting from the regions strong commitment to sustainability, making PLA a viable alternative for numerous applications, including packaging, textiles, and automotive components.

The global polylactic acid market is becoming increasingly consolidated as major players such as Sulzer, NatureWorks, and Futerro expand their production capabilities and invest in sustainable technologies. These companies are focusing on scaling up PLA manufacturing, enhancing circular economy solutions, and partnering for global growth, making the market more dominated by a few key players.

At the same time, regional companies such as TotalEnergies Corbion, and BASF are focusing on eco-friendly bioplastics for packaging and consumer goods. Their efforts to expand into new regions such as China and India indicate a growing presence in emerging markets, further consolidating the competitive landscape.

Despite the dominance of large corporations, smaller players and newer entrants continue to impact the market, especially in Europe and Asia. The ongoing competition and regional expansion contribute to the market's fragmented nature as smaller companies challenge the established giants.

The global market is projected to be valued at US$ 1,149.8 Million in 2025.

The packaging segment held 41.3% share in 2024, driven by rising demand for compostable and bio-based alternatives. Increased regulations on single-use plastics further support PLA adoption in packaging.

The market is poised to witness a CAGR of 16.2% from 2025 to 2032.

Key opportunities include strategic collaborations, expanding polylactic acid capacity, and technological advancements that improve production efficiency. Growing demand for sustainable packaging and bioplastics further drives market growth.

The leading players in the polylactic acid market include Sulzer, TotalEnergies Corbion bv, NatureWorks LLC, and Futerro.

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value, Tons for Volume |

|

Key Regions Covered |

|

|

Key Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Germany, Italy, France, Nordics, U.K., Spain, BENELUX, Russia, Central Asia, Baltics, Turkiye, South Africa, Gulf Cooperation Council Countries, Northern Africa, Japan, China, South Korea, India, ASEAN, Australia & New Zealand |

|

Key Companies Covered |

|

|

Report Coverage |

|

By Raw Material

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author