ID: PMRREP32981| 234 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

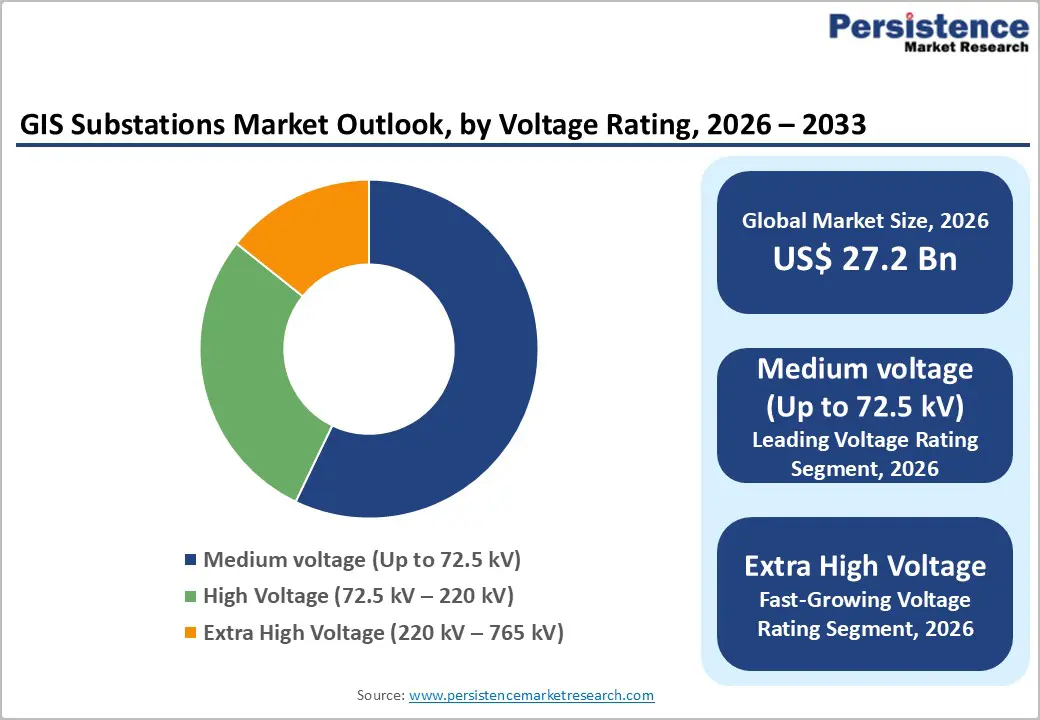

The global GIS Substations Market size was valued at US$ 27.2 Bn in 2026 and is projected to reach US$ 42.0 Bn by 2033, growing at a CAGR of 6.4% between 2026 and 2033. Market expansion is driven by accelerating global energy demand requiring modern, space-efficient substations, rapid urbanization in developed and emerging markets creating space constraints necessitating compact gas-insulated substations achieving 70% space reduction versus conventional air-insulated alternatives. Renewable energy integration driving infrastructure modernization with utilities and energy developers prioritizing compact, modular GIS solutions for wind and solar farm grid connections creates structural demand expansion.

| Key Insights | Details |

|---|---|

| Global GIS Substations Market Size (2026E) | US$ 27.2 Bn |

| Market Value Forecast (2033F) | US$ 42.0 Bn |

| Projected Growth CAGR(2026-2033) | 6.4% |

| Historical Market Growth (2020-2025) | 5.7% |

Rapid Urbanization and Space-Constrained Infrastructure Development Driving Compact GIS Adoption

Rapid urbanization particularly in Asia-Pacific, North America, and European regions creates unprecedented demand for compact, space-efficient power infrastructure solutions. Indoor GIS substation market growing from USD 9.5 billion in 2025 to USD 18.5 billion by 2035 demonstrates exceptional growth trajectory of space-constrained installations. Dense urban areas including Mumbai, Delhi, Bangalore, Tokyo, and Dubai requiring high-capacity electrical systems with minimal land footprint drives compact GIS adoption achieving 70% space reduction compared to conventional air-insulated alternatives.

High-rise buildings, underground metro systems, data centers, and commercial complexes in space-limited environments necessitate sealed metal enclosure gas-insulated designs eliminating environmental contamination risks while reducing maintenance requirements substantially. Urban electrification accelerating demand for reliable distribution infrastructure particularly in emerging markets experiencing rapid industrialization, establishing sustained growth opportunity throughout forecast period.

Renewable Energy Integration and Grid Modernization Supporting Demand Growth

Global renewable energy capacity expansion particularly solar and wind installations reaching multi-gigawatt scales across developed and developing markets creates substantial incremental demand for advanced GIS substation infrastructure. Renewable energy integration representing fastest-growing application segment at 9.7% CAGR reflects critical requirement for compact, modular GIS solutions capable of managing variable generation characteristics associated with wind and solar farms. Hybrid renewable microgrids and distributed energy resources requiring sophisticated switching and voltage regulation capabilities drive adoption of advanced GIS systems equipped with real-time monitoring and control features.

Grid modernization initiatives across USA, Europe, and Asia-Pacific supported by governmental stimulus programs including FERC, DOE, and EU initiatives generates multi-billion-dollar investment pipeline for substation technology upgrades. Utilities prioritizing grid resilience, reliability improvement, and transmission loss reduction drive accelerated capital expenditure on modern GIS infrastructure, establishing sustained market expansion through forecast period.

High Initial Capital Investment and Complex Integration Requirements Limiting Adoption

GIS substation technology requiring substantial capital investment significantly exceeding conventional air-insulated switchgear alternatives limits adoption particularly among cost-constrained utilities and industrial users. Complex installation, commissioning, and integration requirements necessitating specialized technical expertise and training increase total implementation costs beyond equipment acquisition, creating barriers to adoption in price-sensitive markets. SF6 gas handling and leak detection requirements combined with regulatory compliance obligations add operational complexity and ongoing maintenance costs impacting overall economic attractiveness.

Environmental Regulatory Compliance and SF6 Phase-Out Challenges

Transition from SF6 gas to environmentally-friendly alternatives required by EU regulations phasing out SF6 gas and stringent environmental mandates creates technological and operational challenges for manufacturers. Development and commercialization of SF6-free alternatives including fluoronitrile-based insulation materials requiring extensive testing and validation extends product development timelines and commercial deployment limiting market expansion velocity.

Smart Grid Integration and AI-Powered Predictive Maintenance Systems Creating Premium Market Segments

Integration of advanced digital technologies including artificial intelligence, machine learning, and Internet of Things into GIS substation infrastructure creates exceptional growth opportunity for next-generation power management systems. Digital substations equipped with real-time monitoring, remote diagnostics, and AI-driven predictive maintenance enable utilities to reduce unplanned downtime, optimize asset performance, and enhance grid reliability creating compelling value propositions justifying premium pricing.

Predictive maintenance sensors within GIS components providing real-time performance monitoring and health assessment establish new revenue streams for equipment manufacturers and service providers. Cloud-based analytics platforms enabling centralized monitoring across geographically dispersed substations support utilities' digital transformation objectives. Integration with smart grid frameworks supporting dynamic load management, distributed generation coordination, and demand response programs creates sustained expansion opportunity throughout forecast period.

Extra High Voltage and Ultra-High Voltage GIS Expansion Supporting Long-Distance Transmission

Rising demand for extra high voltage and ultra-high voltage transmission infrastructure particularly across China, India, and Asia-Pacific regions undertaking large-scale grid modernization projects creates exceptional growth opportunity. October 2025 Hitachi Energy contract for 1100 KV gas-insulated switchgear delivery to Nanchang ultra-high-voltage substation in Jiangxi Province, China demonstrates accelerating demand for advanced high-voltage systems supporting China's border ultra-high-voltage grid development initiative. High-voltage direct current technology expansion across Europe including North Sea offshore wind farm interconnections requires specialized high-capacity GIS solutions for long-distance power transmission with minimal losses.

National grid interconnection projects including cross-border electricity trading infrastructure create strategic demand for reliable, high-capacity transmission substations. Mobile GIS systems including 220kV mobile gas-insulated switchgear launched by POWERGRID and Toshiba in India October 2025 demonstrate innovation enabling rapid deployment and grid resilience, establishing sustained opportunity for emerging market expansion through forecast period.

Indoor GIS installations represent rapidly expanding market segment capturing majority market share growth driven by urbanization and space constraints. Indoor segment growing from USD 9.5 billion in 2025 to USD 18.5 billion by 2035 represents exceptional expansion momentum reflecting universal adoption of underground and enclosed substation designs. Indoor GIS preference justified by sealed metal enclosure design eliminating environmental contamination, reduced maintenance requirements, enhanced personnel safety through earthed enclosures, and improved aesthetic integration into urban infrastructure.

High-rise buildings, underground metro systems, data centers, and commercial facilities in densely populated urban areas particularly drive indoor GIS adoption with specific examples including Tokyo Metropolitan Substation deploying Mitsubishi Electric compact GIS and Dubai DEWA expansion utilizing high-voltage GIS systems in challenging hot, sandy environments. Indoor installation capturing approximately 55-60% market share with accelerating growth rate of 8.8% CAGR through 2033 establishes dominant positioning throughout forecast period.

Medium voltage gas-insulated substations representing approximately 52.4% market share command dominant market position driven by suitability for urban power distribution and commercial applications. Medium voltage systems operating up to 72.5 kV providing cost-effective, reliable solutions for metro networks, data centers, and industrial facilities establish universal applicability across diverse end-user segments. Medium voltage GIS advantages including compact footprint, low maintenance requirements, and operational reliability combined with ease of installation in congested city spaces justify widespread adoption across developed and emerging markets.

Government programs focused on aging distribution infrastructure modernization particularly in developing economies generate sustained demand for medium voltage solutions supporting smart urban grid development. Reliability advantages and sealed design characteristics providing superior protection from environmental contamination and reduced operational complexity establish medium voltage GIS as preferred choice for distribution utilities and commercial operators, ensuring continued market leadership through forecast period.

Power transmission utilities commanding approximately 49.5% market share represent largest and most strategically important end-user segment for gas-insulated substation technology. Transmission substations ensuring stable, long-distance power delivery with minimal energy losses and high reliability establish critical infrastructure role supporting national energy systems. Transmission segment leadership driven by global focus on expanding and modernizing transmission networks to support growing energy demand and renewable energy integration.

Interregional transmission projects connecting remote wind and solar farms to main grids create substantial high-voltage GIS demand for reliable, efficient power transfer. Adoption of ultra-high voltage and high-voltage direct current technologies across transmission networks increases GIS deployment for complex interconnections and multi-state power corridors. Governmental and utility investments prioritizing transmission expansion to reduce congestion, improve reliability, and enhance cross-border electricity trade establish sustained growth trajectory for power transmission segment throughout forecast period.

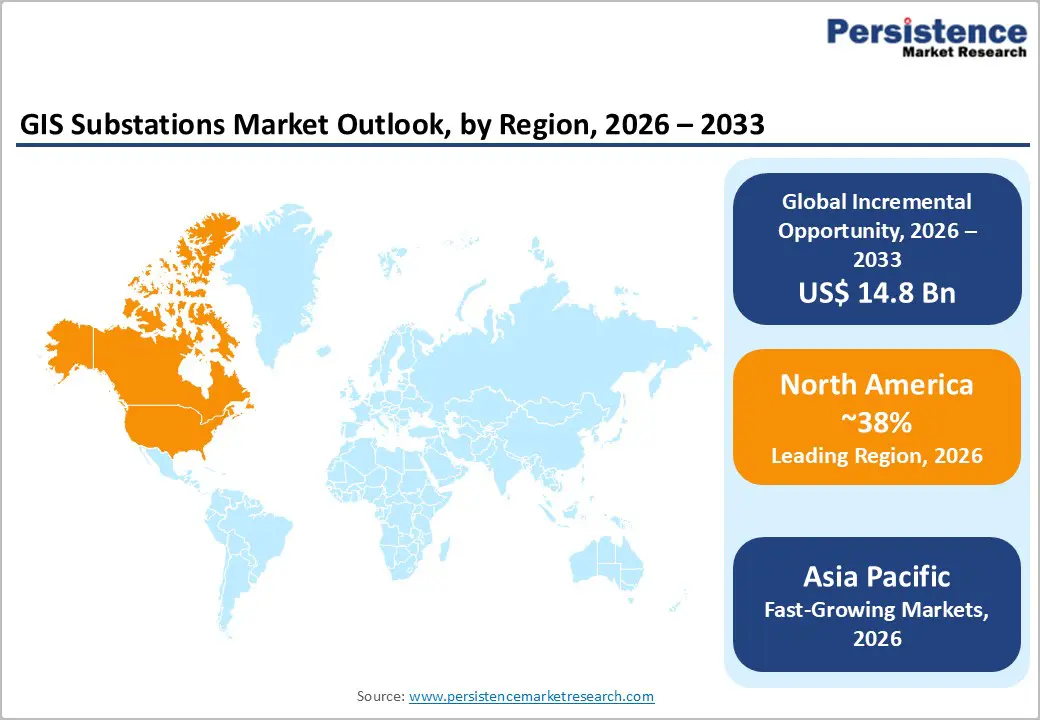

North America maintains developed market maturity with United States commanding regional leadership supported by aging power grid requiring modernization, strong renewable energy adoption, and regulatory framework promoting grid reliability. North American GIS substations market valued at USD 8.43 billion in 2025 demonstrates substantial established demand base. U.S. Department of Energy and Federal Energy Regulatory Commission initiatives promoting compact, low-maintenance substations drive GIS technology adoption for weather resilience and grid efficiency improvement.

North Sea offshore wind farm expansion creating unprecedented demand for high-capacity transmission infrastructure particularly in United Kingdom and Northern Europe necessitates compact GIS solutions for delivering renewable power to population centers with minimal transmission losses. Increasing utility awareness of SF6 gas environmental impact drives significant R&D investment in eco-friendly insulation alternatives including green gas and air-based insulation technologies positioning North America as innovation hub for sustainable GIS solutions.

Europe represents advanced developed market with Germany commanding regional leadership through stringent environmental regulations, ambitious climate targets, and advanced manufacturing expertise. European Union carbon neutrality targets for 2050 established institutional imperative for GIS substation investments replacing traditional air-insulated infrastructure. High-voltage direct current transmission expansion across Europe particularly supporting offshore wind interconnections generates specialized high-voltage GIS demand. Environmental regulations stricter than global standards drive European manufacturer innovation in SF6-free GIS technologies including clean air insulation and fluoronitrile-based alternatives.

European utilities embracing Industry 4.0 concepts implementing digital monitoring, remote diagnostics, and AI-powered optimization across substation networks create accelerated demand for advanced GIS solutions supporting grid modernization objectives. EU regulatory harmonization efforts establishing continent-wide standards for substation safety, environmental protection, and performance facilitate cross-border equipment standardization supporting market consolidation and economies of scale.

Asia-Pacific represents fastest-growing regional market driven by rapid urbanization, industrialization, and manufacturing hub consolidation. China establishing position as dominant GIS manufacturer through vertically integrated supply chains and cost-competitive production capturing substantial regional and global market share. China's ultra-high voltage grid development initiative exemplified by October 2025 Hitachi Energy 1100 KV GIS contract for Nanchang substation demonstrates extraordinary grid expansion ambitions requiring advanced GIS infrastructure. India emerging as fastest-growing market globally with 7.21% CAGR for gas-insulated switchgear driven by rapid urbanization in metropolitan centers including Mumbai, Delhi, and Bangalore combined with expanding power sector infrastructure.

Japan's emphasis on seismic-resistant power infrastructure including Mitsubishi Electric Tokyo Metropolitan Substation deploying compact earthquake-proof GIS establishes specialized market segment for high-reliability solutions. ASEAN region experiencing rapid economic growth with Indonesia, Malaysia, and Thailand undertaking substantial infrastructure investments creating emerging market opportunities for substation technology providers. October 2025 POWERGRID and Toshiba India 220kV mobile GIS launch represents innovation expanding GIS accessibility and deployment flexibility across emerging markets, establishing sustained growth opportunity through forecast period.

The GIS substations market exhibits strong competitive consolidation dominated by global industrial leaders including ABB, Siemens, General Electric, Mitsubishi Electric, and Hitachi commanding substantial combined market share through comprehensive product portfolios, technological expertise, and global distribution networks. Tier 1 manufacturers leveraging advanced R&D capabilities, manufacturing scale, and customer relationships maintain competitive advantages in premium high-voltage segments and strategic projects. Regional manufacturers including Toshiba, Nissin Electric, and L&T establish competitive positions through specialized expertise, local market knowledge, and responsive customer service. Strategic focus on technology differentiation emphasizing SF6-free alternatives, digital integration, and modular designs creates sustained competitive advantage. R&D investment prioritizing AI-driven monitoring, predictive maintenance, and grid resilience supports continuous market leadership.

Key Market Developments

The global GIS Substations Market is projected to reach US$ 42.0 billion by 2033, expanding from US$ 27.2 billion in 2025 at a CAGR of 6.4%, driven by urbanization, renewable energy integration, grid modernization, space efficiency demands, and environmental regulatory compliance.

Market demand growth is driven by multiple converging factors including rapid urbanization creating space constraints necessitating 70% compact GIS solutions, renewable energy integration acceleration with 9.7% CAGR fastest-growing application, grid modernization initiatives and smart grid adoption across North America, Europe, and Asia-Pacific, environmental regulatory emphasis promoting SF₆-free alternatives, EU 2050 carbon neutrality targets, and government support for transmission infrastructure modernization.

Medium voltage gas-insulated substations command market dominance with 52.4% market share, driven by suitability for urban power distribution and commercial applications, cost-effectiveness and operational reliability, ease of installation in congested urban spaces, and low maintenance requirements supporting smart urban grid development.

North America maintains market leadership anchored by United States aging infrastructure modernization requirements, renewable energy adoption emphasis, regulatory framework supporting grid reliability, advanced technology ecosystem, and substantial government and utility capital investment pipeline supporting sustained market expansion.

Major market opportunities include smart grid integration with AI-powered predictive maintenance and real-time monitoring, extra-high voltage infrastructure expansion driven by China's ultra-high-voltage grid development and Europe's HVDC expansion, renewable energy integration acceleration creating specialized high-voltage demand, emerging market electrification particularly India and ASEAN, and SF₆-free alternative technology development and commercialization.

Leading market players include ABB maintaining global leadership through comprehensive GIS portfolio and October 2025 Nanchang 1100 KV contract; Siemens Energy commanding European presence with Blue GIS clean air technology; General Electric with GrGAS environmental-friendly solutions; Mitsubishi Electric establishing Asia-Pacific leadership through seismic-resistant designs and strategic projects; and Toshiba Corporation demonstrating innovation through October 2025 India 220kV mobile GIS launch.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Installation Type

By Voltage Rating

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author