ID: PMRREP32450| 198 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

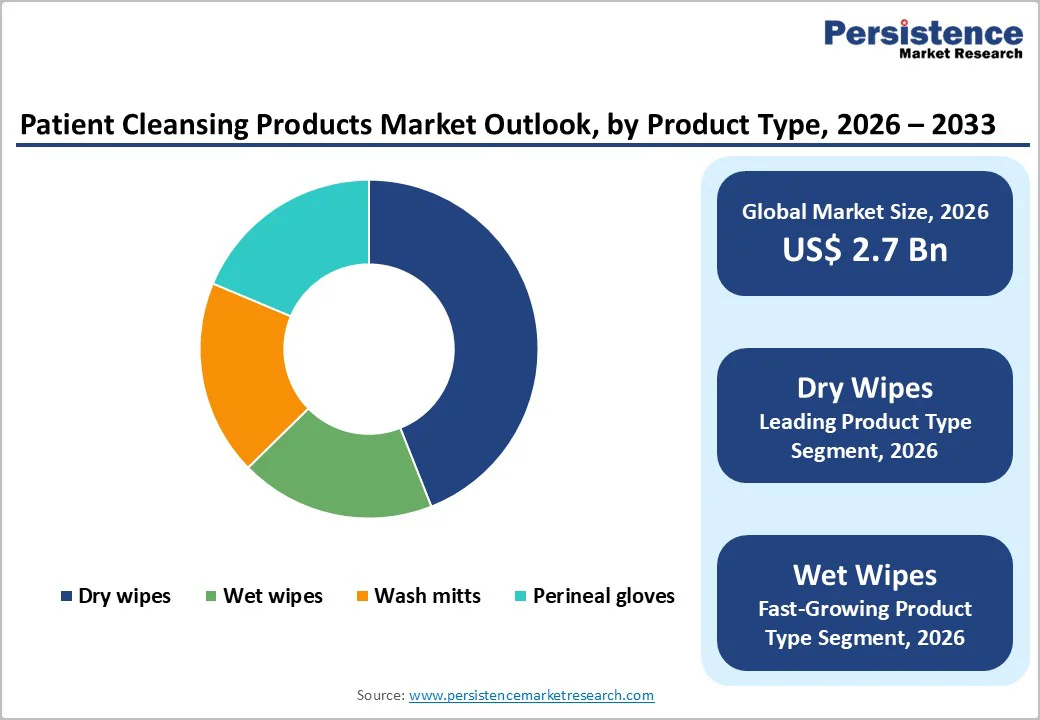

The global Patient Cleansing Products market size is expected to be valued at US$ 2.7 billion in 2026 and projected to reach US$ 5.1 billion by 2033, growing at a CAGR of 9.4% between 2026 and 2033.

Patient Cleansing Products comprise a range of items designed to maintain hygiene and grooming for patients, aiming to prevent infections and cross-contamination from traditional cleaning methods like wash basins, cloths, and tap water. Reusable linens and basins can harbor harmful bacteria, acting as major sources of nosocomial infections, which are linked to high patient mortality. Growing awareness of these risks, especially among high-risk patients, has led to increased demand for specialized cleansing products that ensure sanitation and personal hygiene while reducing cross-contamination. Products like healthcare wipes, for instance, Betz & Betz LLC’s Cleanbuds, launched in 2018, demonstrate innovative applications in daily patient care and surface hygiene.

The rising prevalence of hospital-acquired infections is a key driver for market growth, as healthcare facilities prioritize infection control. While adoption is expanding across hospitals and care centers, regulatory concerns remain about chemicals in some products that may not suit all skin types, influencing compliance and formulation standards globally.

| Global Market Attributes | Key Insights |

|---|---|

| Patient Cleansing Products Market Size (2026E) | US$ 2.7 Bn |

| Market Value Forecast (2033F) | US$ 5.1 Bn |

| Projected Growth (CAGR 2026 to 2033) | 9.4% |

| Historical Market Growth (CAGR 2020 to 2024) | 8.6% |

The global rise in elderly populations is a key driver for the patient cleansing products market, as older adults increasingly require assistance with personal hygiene. WHO projects that by 2030, 1.4 billion people will be aged 60 and above, with Asia Pacific’s elderly share rising from 12.2% to 22.9% by 2050. This demographic shift is fueling demand for convenient, no-rinse cleansing solutions that support independent hygiene, reduce caregiver burden, and enhance quality of life. Home healthcare adoption further boosts market growth, as Medicare-supported services integrate dry wipes, wash mitts, and other disposable hygiene products into daily routines, helping prevent hospital readmissions. For instance, NHS England utilizes over 630 million dry wipes annually in care homes, demonstrating a 30% efficiency improvement over traditional basins and cloths while minimizing cross-contamination. Growing emphasis on patient-centered care models and infection prevention protocols in both clinical and home settings continues to reinforce the demand for safe, effective, and easy-to-use patient cleansing products worldwide.

Environmental regulations on disposable plastics are a significant restraint on the patient-cleansing products market. Governments in the UK, EU, and other eco-regulated regions are implementing strict measures to phase out non-biodegradable wet wipes, with the UK set to ban plastic wet wipes by 2026. Compliance pressures have already led to factory closures and job losses, as seen with Kimberly-Clark shutting facilities affecting 220 employees due to rising production costs. The EU Single-Use Plastics Directive restricts non-compostable materials, increasing raw material expenses by 25–30% and complicating supply chains in regulated markets. These regulations challenge manufacturers to reformulate products with biodegradable, plant-based, or compostable components while maintaining performance and shelf life. Additionally, supply chain complexities and higher production costs can impact pricing, profit margins, and adoption rates in both hospitals and home care settings. Consequently, stringent sustainability mandates are slowing growth for conventional disposable wipes, particularly in markets with rigorous environmental compliance, forcing companies to innovate while balancing efficacy, cost, and regulatory adherence.

Biodegradable wet wipes present a significant opportunity in the patient-cleansing products market, particularly for sensitive-skin care and home healthcare applications. The wet wipes segment is the fastest-growing category, driven by demand for plant-based, hypoallergenic, and eco-friendly alternatives. Innovations such as pH-balanced, moisturizing formulations address the rising prevalence of chronic skin conditions among elderly populations, which the WHO estimates has increased by 25% in recent years. Products certified by organizations like the National Eczema Association demonstrate up to 40% reduced irritation, enhancing consumer confidence and supporting premium pricing strategies. Biodegradable wipes also align with EU circular economy policies, enabling compostable options that meet sustainability mandates while appealing to environmentally conscious consumers. In the Asia Pacific, the rapid expansion of e-commerce and home care services allows broader distribution of these premium offerings, creating scalable growth opportunities. By combining functional benefits, eco-friendly credentials, and suitability for sensitive skin, biodegradable wet wipes offer manufacturers a pathway to differentiate products, capture high-value market segments, and expand adoption across both clinical and home-based care settings globally.

Dry wipes are the leading product type in the patient cleansing products market, commanding an 34% share in 2025 due to their versatility, convenience, and cost-effectiveness. Widely used across hospitals, long-term care facilities, and home healthcare settings, dry wipes support bed baths, incontinence care, and general patient hygiene. NHS England procures over 630 million units annually, highlighting their role in reducing hospital-acquired infections through no-residue cleaning. Their indefinite shelf life makes them ideal for emergency preparedness kits and institutional stockpiles.

Additionally, CDC guidelines recommend dry wipes for non-critical disinfection, which demonstrate 25% higher efficacy in sterile environments than wet wipes. The lower cost, approximately 30% cheaper than moist wipes, reinforces their market leadership. Manufacturers continue to innovate with pH-neutral, hypoallergenic, and antimicrobial variants, ensuring safety, patient comfort, and regulatory compliance while maintaining high adoption in both clinical and home care environments.

Hospitals and specialty clinics dominate the distribution of patient cleansing products, driven by bulk procurement through institutional tenders and adherence to CDC-mandated hygiene protocols. This channel holds the largest market share, ensuring steady volumes for high-demand products such as dry and wet wipes, wash mitts, and perineal gloves. Pharmacies have a significant portion, approximately 29.8%, providing accessibility for home care users and supporting small-scale purchases.

The online channel, however, is the fastest-growing distribution segment, expanding at an annual rate of 18% as e-commerce platforms enable convenient home delivery, subscription-based supplies, and personalized hygiene solutions. Growth in online sales is fueled by rising adoption of home healthcare, busy caregiver schedules, and demand for eco-friendly, biodegradable, and sensitive-skin-compatible products. The combined presence of institutional, retail, and digital channels ensures comprehensive market coverage, meeting the needs of hospitals, long-term care facilities, and individual consumers while supporting both volume-driven and premium product strategies.

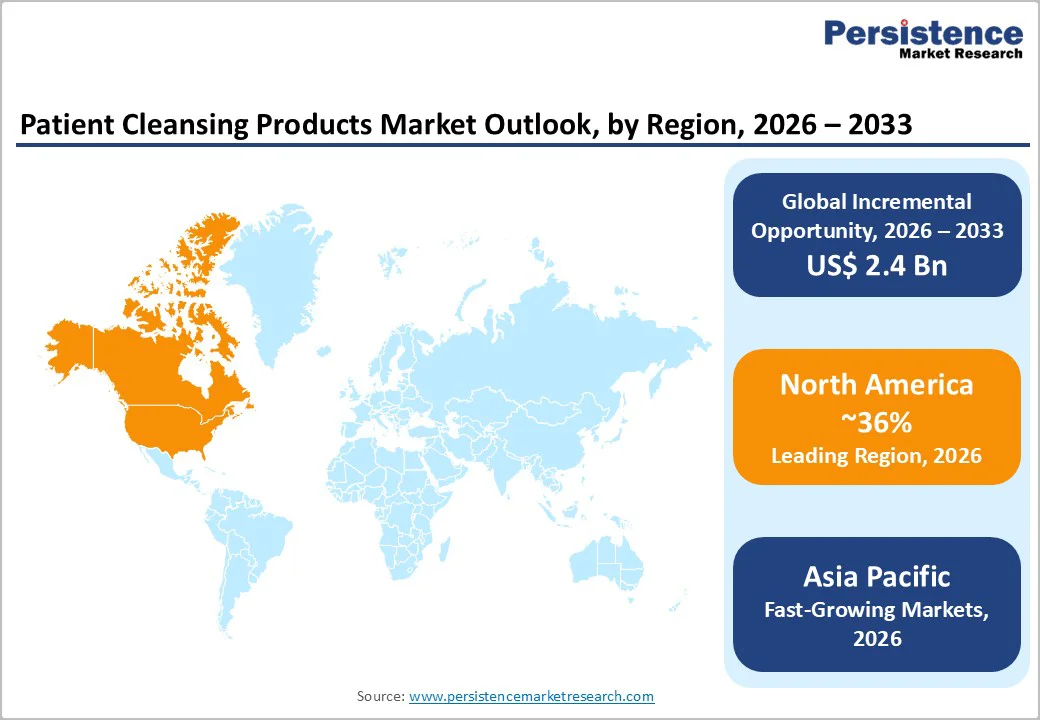

North America holds a leading position in the global patient cleansing products market, commanding approximately 36% of the market in 2025. The United States drives this dominance, with CDC reports indicating that 1 in 31 hospital patients experiences a hospital-acquired infection (HAI) daily, resulting in annual costs of US$28–45 billion. Regulatory frameworks, including FDA 510(k) clearances, have encouraged innovation, exemplified by Kimberly-Clark’s WypAll X70 cloths, offering 10% enhanced absorbency for clinical hygiene. Growth in home healthcare through Medicare Advantage programs further boosts demand for no-rinse wipes, catering to the projected 25% increase in the elderly population by 2030. Institutional bulk procurement via group purchasing organizations (GPOs) ensures consistent volumes, while e-commerce channels such as Amazon and Walgreens experience 18% annual growth, supporting home delivery. Health Canada emphasizes antimicrobial efficacy against pathogens like C. difficile, promoting adoption in hospitals and care facilities. Sustainability considerations are driving the development of biodegradable wipes, aligning with EPA scrutiny. Strong R&D hubs in California and New Jersey support ongoing product innovation, biocompatibility testing, and market expansion across the region.

Asia Pacific is the fastest-growing region in the patient cleansing products market, driven by demographic shifts, policy initiatives, and rising demand for home care. China anticipates 25% of its population will be over 60 by 2035, while India’s Ayushman Bharat scheme provides healthcare coverage to 500 million people. WHO forecasts the regional elderly population will reach 22.9% by 2050, intensifying demand for convenient hygiene solutions in both home and institutional settings. Japan’s Long-Term Care Insurance mandates wipe usage in 15,000 facilities, ensuring high adoption, while ASEAN countries leverage manufacturing cost advantages, approximately 30% below global averages, to expand production. Nice-Pak has scaled operations in Vietnam to meet both domestic demand and exports. E-commerce platforms such as Alibaba and Flipkart are growing 25% annually, supporting subscription-based models for chronic care and home hygiene. Regulatory approvals, like China’s NMPA clearance for pH-neutral formulas, reduce skin irritation by 40%. Urbanization, integrated care policies such as ICOPE, and increased awareness of hygiene protocols are driving institutional adoption across major population hubs in the region.

The patient cleansing products market is moderately consolidated, with leading companies such as Kimberly-Clark and Nice-Pak together accounting for approximately 45% of the global market. These players leverage large-scale production, advanced R&D capabilities, and established distribution networks to maintain their dominance. Strategic initiatives focus on product innovation, particularly in biodegradable and environmentally friendly wipes, and on compliance with regulatory standards, including EPA certifications and ISO quality norms. Market leaders employ a mix of B2B tenders targeting hospitals, care homes, and long-term care facilities, alongside D2C e-commerce channels that cater to home healthcare needs. Differentiation is achieved through pH-neutral, hypoallergenic, and functional formulations designed for sensitive skin, infection control, and patient comfort. Emerging direct-to-consumer subscription models are gaining traction, offering convenience, consistent supply, and personalized solutions for home care. Overall, the market structure encourages innovation, premium product positioning, and multi-channel distribution strategies to meet both institutional and consumer demands.

The global market is projected to be valued at US$ 2.7 Bn in 2026.

Rising elderly population, home healthcare expansion, infection prevention protocols, hospital-acquired infection concerns, and preference for convenient, no-rinse hygiene solutions.

The global market is expected to witness a CAGR of 9.4% between 2026 and 2033.

Biodegradable, plant-based wet wipes, sensitive skin formulations, direct-to-consumer subscriptions, e-commerce distribution, and premium hygiene products for home and clinical care.

Kimberly-Clark, Nice-Pak, Paul Hartmann AG, Unicharm, Medline Industries, Johnson & Johnson, SCA Hygiene, Halyard Health, Ontex, Cardinal Health.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn and Volume (if Available) |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author