ID: PMRREP33206| 342 Pages | 22 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

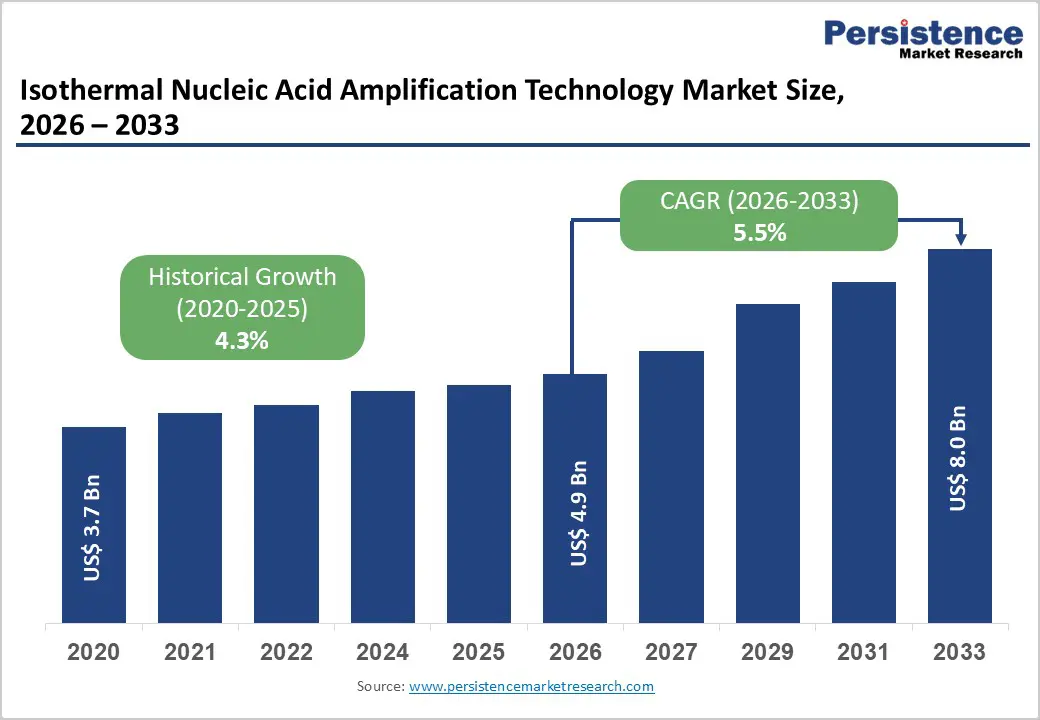

The global isothermal nucleic acid amplification technology market size is estimated to grow from US$ 4.9 Bn in 2026 to US$ 8.0 Bn by 2033. The market is projected to record a CAGR of 5.5% during the forecast period from 2026 to 2033.

Global demand for isothermal nucleic acid amplification technology is rising steadily, driven by the growing need for rapid, sensitive, and cost-effective molecular diagnostics across clinical, public health, and decentralized testing settings. Increasing incidence of infectious diseases, recurring outbreak scenarios, and heightened emphasis on early detection have significantly expanded adoption of isothermal amplification methods. These technologies enable nucleic acid detection without thermal cycling, supporting faster turnaround times and simplified workflows compared with conventional PCR. Advancements in assay chemistry, enzyme performance, and signal detection have improved sensitivity and specificity, broadening use in blood screening, pathogen identification, and point-of-care diagnostics. The growing shift toward decentralized testing models, including near-patient and field-based applications, is further accelerating demand. Integration of isothermal platforms with portable instruments, automation, and digital reporting tools is enhancing operational efficiency and scalability. Expanding public health funding, increased diagnostic preparedness initiatives, and rising healthcare investments in emerging markets continue to reinforce long-term demand. Additionally, continuous innovation in reagents, multiplex assay development, and workflow integration is supporting sustained market growth across hospitals, diagnostic laboratories, and research institutions.

| Global Market Attributes | Key Insights |

|---|---|

| Isothermal Nucleic Acid Amplification Technology Market Size (2026E) | US$ 4.9 Bn |

| Market Value Forecast (2033F) | US$ 8.0 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

Driver – Rising Demand for Rapid, Decentralized Molecular Diagnostics and Point-of-Care Testing

Growth is being propelled by the increasing need for fast, accurate, and infrastructure-light molecular diagnostic solutions across healthcare and public health settings. Isothermal nucleic acid amplification technologies enable nucleic acid detection without complex thermal cycling, making them highly suitable for point-of-care, near-patient, and field-based testing. Escalating incidence of infectious diseases, recurring outbreak scenarios, and the need for timely clinical decision-making have intensified adoption of rapid amplification platforms in hospitals, diagnostic laboratories, and emergency care environments.

Public health surveillance programs increasingly rely on isothermal methods for large-scale screening and outbreak monitoring due to their short turnaround times and operational simplicity. In parallel, expanding use of molecular diagnostics in blood screening, transplant safety, and antimicrobial resistance testing is supporting sustained demand. Technological advancements have improved assay sensitivity, specificity, and multiplexing capability, enabling broader clinical utility beyond infectious disease detection. Integration of isothermal platforms with portable detection systems and digital reporting tools further enhances usability in decentralized settings. Additionally, growing investments by governments and healthcare providers in strengthening diagnostic preparedness are expanding installed bases. Collectively, these factors are driving consistent adoption across both developed and emerging healthcare systems.

Restraints – Performance Variability, Standardization Gaps, and Integration Challenges

Several limitations continue to restrict wider penetration. Performance variability across different isothermal amplification methods can affect sensitivity and specificity, particularly in low-viral-load samples or complex biological matrices. Unlike conventional PCR, some isothermal assays face challenges related to nonspecific amplification and assay optimization, which can impact clinical confidence. Lack of universal standardization across platforms and protocols further complicates result comparability between laboratories. Operational constraints also persist, as integration of isothermal systems into existing laboratory workflows and information systems can require additional validation and training. While instruments are generally simpler than thermal cyclers, ensuring consistent assay execution and quality control remains critical. Reagent stability, storage requirements, and supply chain reliability can pose challenges in resource-limited settings.

Regulatory approval pathways for newer assays may be lengthy, delaying commercialization and market entry. In addition, limited awareness among smaller healthcare facilities and uneven reimbursement policies across regions can slow adoption. These technical, regulatory, and operational barriers collectively moderate the pace of expansion, particularly outside well-established diagnostic markets.

Opportunity – Expansion into Emerging Markets, Home Testing, and Multiplex Assay Development

Significant opportunities are emerging from the expansion of molecular diagnostics beyond centralized laboratories into community, home-care, and low-resource settings. Isothermal amplification technologies are well positioned to support self-testing, mobile diagnostics, and decentralized screening programs due to their simplicity and minimal equipment requirements. Rising healthcare access initiatives and infectious disease screening programs in emerging economies are creating strong demand for cost-effective and scalable amplification solutions. Development of multiplex assays capable of detecting multiple pathogens simultaneously presents additional growth potential, particularly for respiratory infections, sexually transmitted diseases, and blood-borne pathogens. Integration with digital health platforms, smartphone-based readers, and cloud-connected reporting systems is further enhancing clinical value and adoption.

Growing interest from biotechnology startups and contract manufacturers is accelerating assay innovation and localized production, improving affordability and supply resilience. Partnerships between diagnostic companies, public health agencies, and non-governmental organizations are expanding deployment in surveillance and outbreak response programs. As global focus shifts toward early detection, prevention, and rapid response, these advancements are expected to unlock new revenue streams and support long-term market expansion.

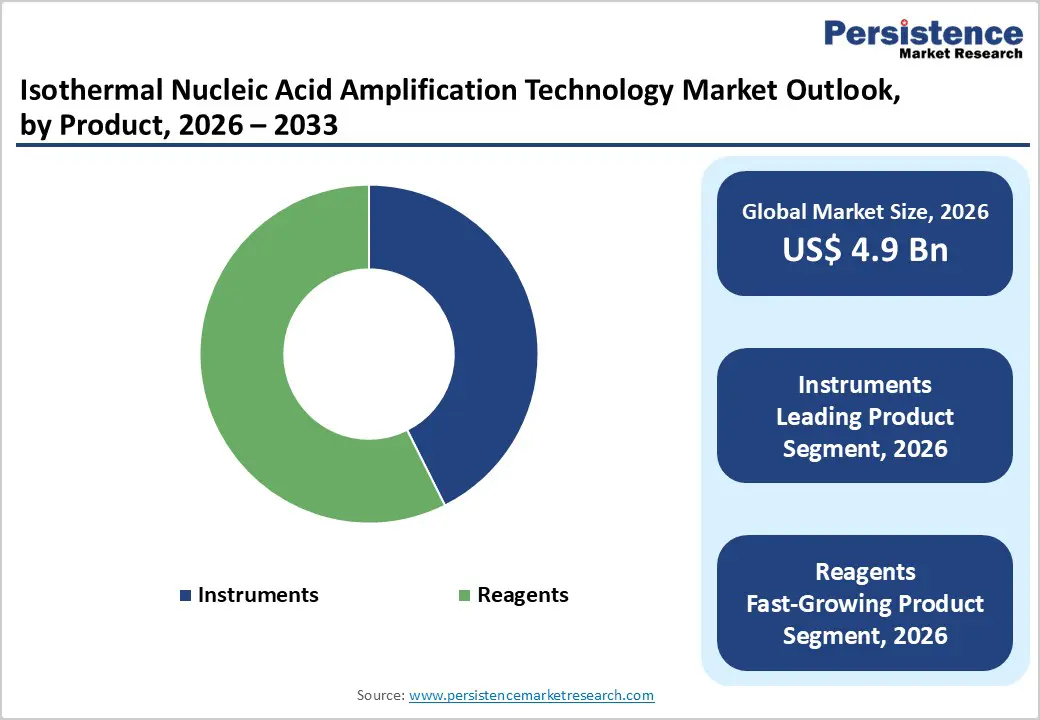

By Product, Instruments Dominate Owing to Widespread Deployment in Rapid Molecular Testing

The instruments segment is projected to dominate the global isothermal nucleic acid amplification technology market in 2026, accounting for a revenue share of 58.0%. This dominance is driven by the increasing adoption of automated and semi-automated isothermal amplification platforms across clinical diagnostics, point-of-care testing, and public health laboratories. Growing demand for rapid, sensitive, and decentralized molecular diagnostics particularly for infectious diseases has accelerated investments in compact amplification systems and integrated detection platforms. Hospitals and diagnostic laboratories increasingly rely on advanced instruments capable of delivering fast turnaround times with minimal infrastructure requirements. Technological improvements in assay sensitivity, multiplexing capability, portability, and workflow integration are also encouraging replacement of conventional PCR systems with isothermal platforms. In addition, rising deployment of these instruments in emergency care, remote settings, and resource-limited environments supports sustained capital spending. As molecular testing volumes continue to rise globally, instruments are expected to retain their leading revenue contribution throughout the forecast period.

By Application, Blood Screening Leads Due to High-Volume Testing and Regulatory Mandates

The blood screening segment is expected to lead the market in 2026, capturing a revenue share of 21.6%. This leadership reflects the critical role of isothermal nucleic acid amplification technologies in ensuring transfusion safety through rapid and highly sensitive pathogen detection. Blood banks and screening centers increasingly adopt isothermal methods for early identification of viral and bacterial contaminants, including HIV, hepatitis, and emerging infectious agents. The ability of these technologies to deliver fast results without complex thermal cycling makes them particularly suitable for high-throughput blood screening workflows. Regulatory emphasis on minimizing transfusion-transmitted infections further reinforces adoption across public and private blood collection facilities. Additionally, expanding voluntary blood donation programs and rising demand for safe blood products in surgical procedures and trauma care continue to drive testing volumes. As global healthcare systems strengthen transfusion safety protocols, blood screening is expected to maintain its leading position among application segments.

By End User, Diagnostic Laboratories Lead Driven by Large-Scale Testing Demand

Diagnostic laboratories are projected to dominate the global isothermal nucleic acid amplification technology market in 2026, accounting for a revenue share of 34.5%. This dominance is primarily driven by the high volume of molecular diagnostic testing conducted in centralized and reference laboratories. Diagnostic labs increasingly rely on isothermal amplification technologies to support infectious disease testing, outbreak surveillance, and routine molecular screening due to their speed, scalability, and operational efficiency. The growing shift toward decentralized sample collection, coupled with centralized testing models, further strengthens laboratory demand for reliable amplification platforms. High investments in laboratory automation, quality control systems, and regulatory compliance enable rapid adoption of advanced diagnostic technologies. In addition, collaborations with hospitals, public health agencies, and research institutions expand testing volumes. As demand for rapid and cost-effective molecular diagnostics continues to grow, diagnostic laboratories are expected to remain the leading end-user segment throughout the forecast period.

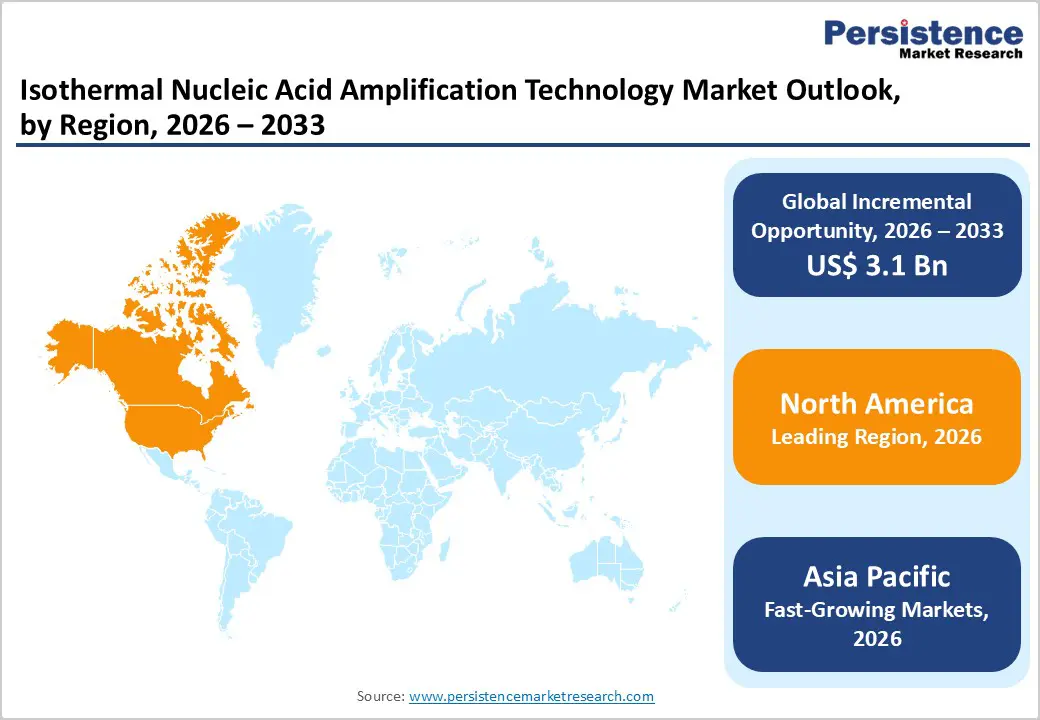

North America Isothermal Nucleic Acid Amplification Technology Market Trends

North America is expected to dominate the global isothermal nucleic acid amplification technology market with a value share of 47.7% in 2026, led primarily by the United States. The region benefits from a mature diagnostics ecosystem, strong molecular testing infrastructure, and early adoption of advanced diagnostic technologies. High prevalence of infectious diseases, coupled with strong preparedness for outbreak response, continues to drive demand for rapid amplification methods. Substantial funding from government agencies, including public health departments and federal research bodies, supports large-scale deployment of molecular diagnostics across hospitals and laboratories.

The presence of leading diagnostic manufacturers and biotechnology companies accelerates innovation and commercialization of isothermal platforms. Favorable reimbursement policies, well-established regulatory frameworks, and strong intellectual property protection further support market growth. Additionally, widespread awareness of point-of-care diagnostics, availability of skilled laboratory professionals, and integration of automation and digital health solutions are expected to sustain North America’s leadership throughout the forecast period.

Europe Isothermal Nucleic Acid Amplification Technology Market Trends

The European isothermal nucleic acid amplification technology market is projected to grow steadily, supported by robust public healthcare systems, strong academic research networks, and increasing emphasis on rapid diagnostics. Countries such as Germany, the U.K., France, Italy, and Spain are leading adoption due to well-established laboratory infrastructure and proactive infectious disease surveillance programs. European Union–backed research initiatives and cross-border collaborations play a critical role in advancing molecular diagnostics and standardizing testing protocols. Public healthcare reimbursement ensures broad access to diagnostic testing, encouraging routine use of nucleic acid amplification technologies. Stringent regulatory standards promote high-quality assay validation and reliable diagnostic outcomes.

The region is also witnessing growing adoption of isothermal amplification methods in hospital laboratories, blood banks, and emergency care settings. Continuous investments in laboratory modernization, workforce training, and digital diagnostics integration are expected to support consistent market expansion while maintaining Europe’s strong position in the global landscape.

Asia Pacific Isothermal Nucleic Acid Amplification Technology Market Trends

The Asia Pacific isothermal nucleic acid amplification technology market is expected to register a higher CAGR of around 7.6% between 2026 and 2033, driven by expanding healthcare infrastructure, rising diagnostic awareness, and increasing government investments in molecular testing. Countries including China, India, Japan, South Korea, and Australia are rapidly strengthening their diagnostic capabilities through public health initiatives and laboratory expansion. Growing population size, rising burden of infectious diseases, and frequent outbreak scenarios are accelerating demand for rapid and scalable testing solutions.

Increasing presence of local diagnostic manufacturers and cost-effective production capabilities further support market penetration. Adoption of point-of-care diagnostics in rural and semi-urban settings is also expanding, particularly in resource-limited regions. Additionally, growing participation in global disease surveillance programs, expansion of CROs, and integration of digital health platforms enhance regional capabilities. Collectively, these factors position Asia Pacific as the fastest-growing regional market for isothermal nucleic acid amplification technology over the forecast period.

The global isothermal nucleic acid amplification technology market is highly competitive, with strong participation from companies such as QIAGEN, Quidel Corporation, Thermo Fisher Scientific, Inc., BD, and Alere, Inc. These players leverage extensive global distribution networks, established brand equity, and diversified life science and diagnostics portfolios to address the growing demand for rapid, sensitive, and cost-effective molecular testing solutions.

Their product portfolios primarily include isothermal amplification–based instruments, reagents, and assay kits for infectious disease detection, blood screening, and decentralized diagnostic applications. Continuous innovation in assay design, point-of-care compatibility, workflow automation, multiplexing capabilities, and compliance with international regulatory and quality standards remains critical for sustaining competitive advantage in the global isothermal nucleic acid amplification technology market.

Key Industry Developments:

The global Isothermal Nucleic Acid Amplification Technology Market is projected to be valued at US$ 9.1 Bn in 2026.

The isothermal nucleic acid amplification technology market is driven by growing adoption of precision medicine, rising genomic research, and rapid advances in sequencing and qPCR technologies.

The global isothermal nucleic acid amplification technology market is poised to witness a CAGR of 5.6% between 2026 and 2033.

Major opportunities lie in RNA-based therapeutics, liquid biopsy applications, and expanding use of transcriptomics in drug discovery and clinical diagnostics.

QIAGEN, Quidel Corporation, Thermo Fisher Scientific, Inc., BD, and Alere, Inc. are some of the key players in the isothermal nucleic acid amplification technology market.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn Volume (in units) If Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Technology

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author