ID: PMRREP35303| 190 Pages | 5 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

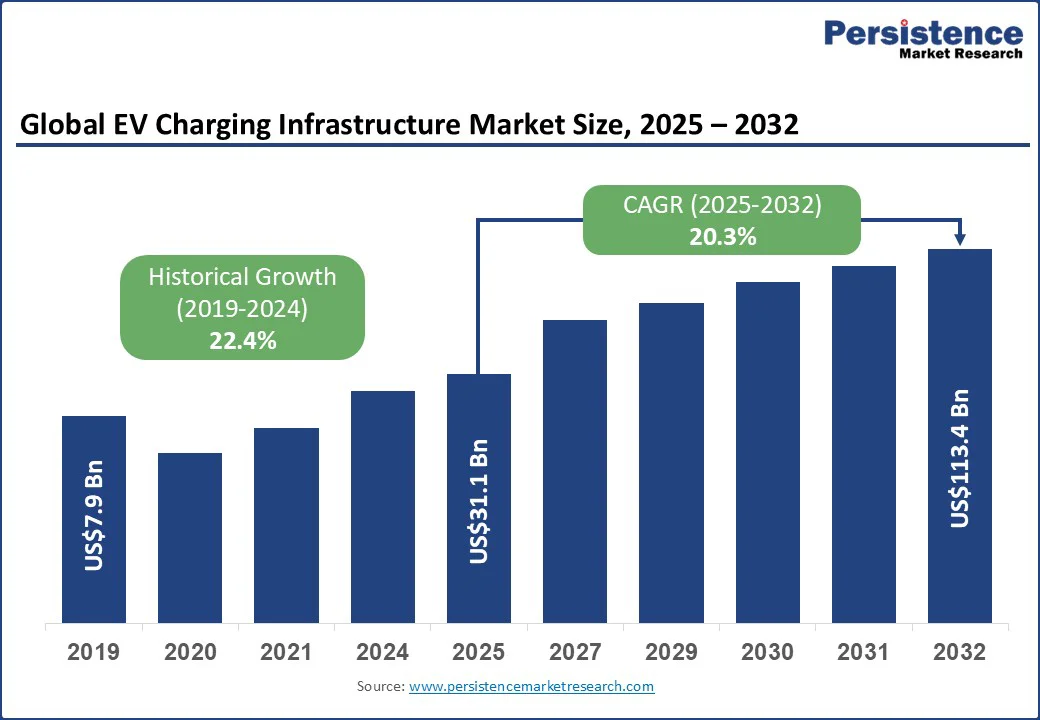

The global EV charging infrastructure market size is likely to be valued at US$31.1 Bn in 2025 and is expected to reach US$113.4 Bn by 2032, growing at a CAGR of 20.3% during the forecast period from 2025 to 2032. Surging EV sales, coupled with government-backed investments in sustainable mobility, are steering the growth of the EV charging infrastructure market.

Key Industry Highlights:

In parallel, advancements in battery technology, particularly in lithium-ion chemistry, standardization of charger types, rapid deployment of fast-charging networks, and growing public awareness are significantly accelerating the adoption of EV charging infrastructure worldwide.

Government policies and subsidies are among the prime drivers of the EV charging infrastructure market, fueling large-scale deployment of public and private charging stations. In the U.S., the Bipartisan Infrastructure Law, supported by the NEVI and CFI programs, aims to install 500,000 EV chargers nationwide by 2030, with more than 200,000 already operational. These initiatives are reinforced by the Department of Transportation and Federal Highway Administration, ensuring nationwide accessibility.

Europe’s Green Deal and “Fit for 55” package are accelerating investments in sustainable mobility, while the Alternative Fuels Infrastructure Regulation (AFIR) mandates high-powered charging stations every 60 kilometers along major highways by 2025. These policy frameworks help minimize investment risks, attract private sector participation, and accelerate the expansion of EV charging infrastructure. Combined with the growing consumer EV adoption, government-driven initiatives remain the foundation for sustainable growth in the EV charging infrastructure market.

One of the biggest restraints in the EV charging infrastructure market is the lack of global standardization, which creates challenges for interoperability, consumer convenience, and large-scale adoption. Different regions currently follow fragmented charging protocols. For instance, Japan uses CHAdeMO, Europe and South Korea rely on CCS2, the U.S. employs CCS1, and China depends on GB/T. This technological fragmentation forces infrastructure providers to install multi-standard charging stations, increasing costs and complexity.

EV drivers also face difficulties when traveling internationally due to incompatible connectors and voltage requirements, reducing the user-friendliness of EV ownership. While organizations such as CharIN and regulators in Europe are working toward greater alignment, full harmonization remains years away. Until standardization progresses, the EV charging market will continue to face higher operational costs, slower rollout speeds, and limited cross-border interoperability, restricting the pace of global EV adoption and infrastructure expansion.

The integration of Vehicle-to-Grid (V2G) technology represents one of the most promising opportunities for the EV charging infrastructure market, enabling electric vehicles to act as mobile energy storage systems. Through bi-directional charging, EVs can discharge electricity back into the power grid during peak demand, helping balance loads, reduce strain on aging infrastructure, and lower the overall energy costs for consumers. V2G-enabled charging stations play a key role in enhancing energy security, providing backup power during outages, and supporting renewable energy integration by stabilizing variable supply from wind and solar sources.

Leading innovators such as Nuvve are pioneering V2G platforms, while automakers such as Nissan have integrated the technology into LEAF models in collaboration with European and Japanese utilities. Global technology providers, including ABB and Siemens, are advancing V2G-compatible charging hardware, highlighting the commercial viability of this innovation. As the global V2G market is projected to reach US$47 Bn by 2032 with a staggering CAGR of 28%, it will transform EV charging infrastructure into the foundation of smarter, more resilient energy systems.

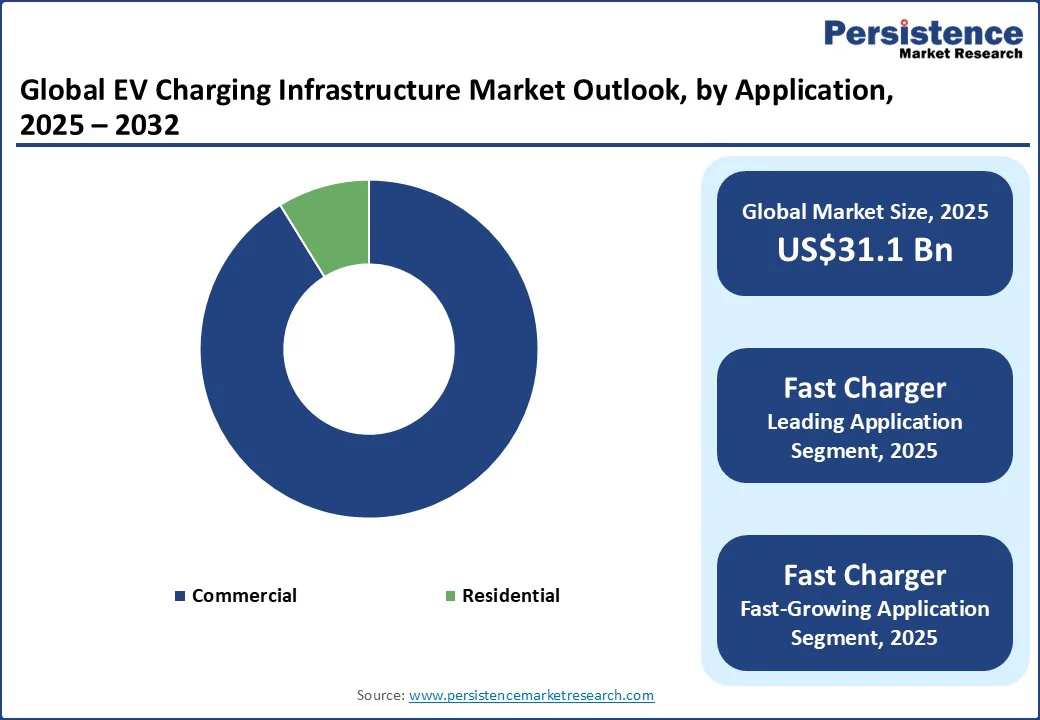

The commercial segment is expected to hold a dominant position, accounting for more than 90% of revenue from EV charging infrastructure in 2024. This growth is fueled by the expansion of public charging hubs, bus depots, fleet electrification, and highway charging networks, particularly driven by rapid developments in the electric buses market, supported by strong government funding and private partnerships.

Leading companies are actively investing in large-scale commercial EV charging networks to meet rising demand. For instance, BP Pulse’s collaboration with Hertz is focused on deploying nationwide Gigahubs across airports and high-traffic locations, strengthening access for both rental fleets and public users. Retailers and fleet operators are also playing a key role, hosting chargers to drive foot traffic and generate new revenue streams. This highlights how commercial EV charging is becoming pivotal to EV charging infrastructure, backed by policies promoting clean mobility and sustainable transport.

Level 2 charging is projected to dominate in 2025, offering an ideal blend of charging speed, affordability, and broad installation compatibility, making it a favorite in urban environments, residential complexes, workplaces, and public spaces. Across cities globally, Level 2 chargers are widely used due to their ease of deployment and high compatibility with a range of EV models.

Market momentum is strengthening further, as seen with ChargePoint's introduction of next-gen Level 2 chargers featuring bidirectional charging, dynamic load balancing, and compatibility with both CCS and NACS connectors; this innovation enables EVs to act as mobile energy assets during outages or energy transitions. Supported by smart home and utility integration, Level 2 remains a foundational technology in urban EV adoption, underlining its strategic importance in the overall charging infrastructure landscape.

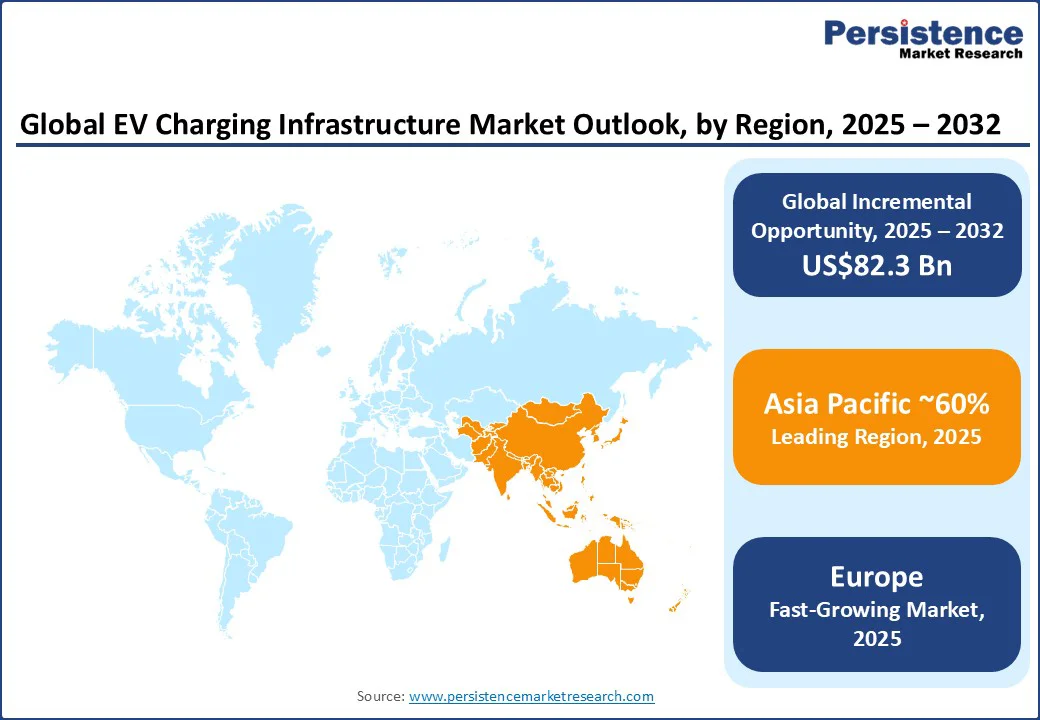

Asia Pacific is likely to dominate with approximately 60% of the revenue share in 2025. Countries such as China, Japan, and South Korea are known as hubs of electric vehicles and are heavily investing in the development of charging infrastructure. Currently, China accounts for the highest share of fast chargers out of the total public charging stock, at around 45%. In both the STEPS Stated Policies Scenario (based on existing policies already in place) and APS (Announced Pledges Scenario (based on pledged targets, even if not yet backed by firm policies), the stock of public fast chargers reaches around 7.5 million in 2035, almost six times the 2023 levels. The number of slow chargers reaches 8.2 million in 2035 in the APS.

Japan's Green Growth Strategy aims to deploy 150,000 charging points by 2030, including 30,000 fast chargers to reach a comparable level of comfort as for refueling conventional vehicles. In the APS, the number of LDV charging points reaches 160,000 by 2030, of which approximately 55,000 are fast chargers. By 2035, the number of public charging points will reach 190,000 in the APS. The number of electric LDVs per public charging point increases from around 18 in 2023 to over 80 in 2035 in the APS.

Europe is the world’s largest EV market, growing at the highest CAGR driven by strict regulations and supportive policies aimed at achieving net-zero emissions by 2050. The Europe electric vehicle market is expected to be valued at US$174 Bn in 2025 and expected to reach US$489 Bn by 2032, registering a double-digit CAGR of 18% during this period.

This evolving market also necessitates a strong and well-established EV charging infrastructure as a backbone. In view of this, several key players are developing various EV charging hubs across Europe. For instance, in March 2023, BP Pulse opened its most significant, most potent EV charging hub in the U.K., at Kettering, North Northamptonshire, built by The EV Network. The U.K. expects to install at least 300,000 public chargers by 2030.

In the APS, the roll-out of public chargers is slower but ensures sufficient charging capacity, with the stock reaching 220,000 chargers by 2030 and 300,000 by 2035, maintaining 1.2 kW of capacity per electric LDV. Considering the stock of electric LDVs approaches 20 million in 2035 in the APS, this corresponds to over 60 electric LDVs per public charging point, up from around 30 million in 2023.

North America is likely to expand rapidly, with a staggering CAGR of 15.9%, driven by surging EV adoption and supportive government initiatives. The U.S. leads with significant investments, including a US$1.5 Bn allocation under the National Electric Vehicle Infrastructure (NEVI) Formula Program to develop charging stations along 75,000 miles of highways.

In the U.S, the government has announced nearly US$50 Mn to subsidize projects that aim to expand access to convenient charging, in line with its objective of building a national network of 500,000 public EV charging ports by 2030. In the APS, the number of public chargers is projected to reach 900,000 by 2030 and 1.7 million by 2035, largely driven by private investments and extending beyond highway corridors. This translates to about 55 electric LDVs per charging point in 2035.

The global EV charging infrastructure market is highly competitive with established industry leaders and emerging startups competing to capture market share through innovation, technological advancements, and strategic integration with AI, IoT, and smart grid solutions. Major players are heavily investing in research and development to focus on improving charging speed, network reliability, energy management, and seamless user experience to offer greater value to both individual consumers and fleet operators.

Leading companies are forming strategic partnerships with automakers, energy providers, and technology firms to accelerate deployment, expand geographic reach, and deliver end-to-end charging solutions. Integration with renewable energy sources and development of smart, cloud-connected charging platforms are key trends shaping competitive strategies.

At the same time, new entrants, including clean-tech startups and software-driven EV infrastructure firms, are actively disrupting traditional utility models. These companies are securing venture capital funding, partnering with governments and private businesses, and launching pilot projects for fast-charging hubs, battery-swapping stations, and vehicle-to-grid (V2G) platforms.

The global EV charging infrastructure market is projected to grow from US$31.1 Bn in 2025 to US$113.4 Bn by 2032, registering a robust CAGR of 20.3%. Growth is driven by surging EV sales, government incentives, and large-scale investments in sustainable mobility solutions.

The fast charger segment led the market in 2025, accounting for about 70% of the global revenue share. Level 2 charging is also dominant due to its affordability, compatibility, and widespread adoption in residential, workplace, and public locations.

Asia Pacific holds the largest share, contributing nearly 60% of global revenue in 2025, driven by rapid EV adoption, government initiatives, and large investments in charging networks, especially in China, Japan, and South Korea.

Government subsidies and regulatory frameworks are among the strongest growth drivers. For example, the U.S. NEVI program targets 500,000 EV chargers by 2030, while Europe’s AFIR mandate requires high-powered charging stations every 60 kilometers along highways.

One of the biggest challenges is the lack of global standardization in charging protocols. Different regions rely on connectors like CHAdeMO, CCS1, CCS2, and GB/T, creating interoperability issues, higher costs for providers, and reduced user convenience.

The integration of Vehicle-to-Grid (V2G) technology presents significant opportunities, enabling EVs to act as mobile energy storage systems. This can support grid stability, renewable energy integration, and energy cost savings, with the global V2G market expected to reach US$47 Bn by 2032.

|

Report Attribute |

Details |

|

EV Charging Infrastructure Market Size (2025E) |

US$31.1 Bn |

|

Market Value Forecast (2032F) |

US$113.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

20.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

22.4% |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Charger Type

By Charging Type

By Installation Type

By Level of Charging

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author