ID: PMRREP3834| 197 Pages | 16 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

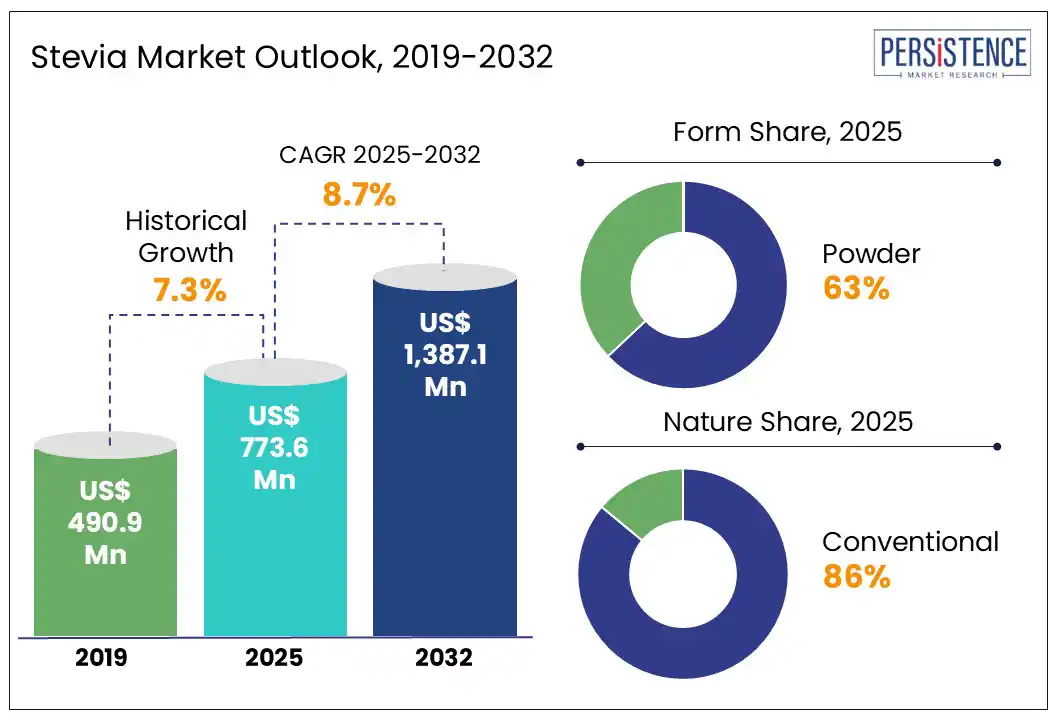

The global stevia market size is likely to be valued at US$ 773.6 million in 2025 and is expected to reach US$ 1,387.1 million by 2032, growing at a CAGR of 8.7% during the forecast period from 2025 to 2032.

Stevia, a natural, zero-calorie sweetener derived from the Stevia rebaudiana plant, has gained significant traction in the global market due to its applications in food, beverages, pharmaceuticals, and cosmetics. Stevia is increasingly used in sugar-free products, diabetic-friendly foods, and functional beverages and valued for its intense sweetness and health benefits. As consumers’ demand for clean-label and low-calorie alternatives surges, stevia's market relevance continues to grow. Recent innovations include its use in plant-based products and personalized nutrition solutions. Therefore, the stevia market is experiencing robust growth, driven by a huge demand for plant-based, low-calorie sweeteners, changing dietary habits, in the Reb M and Reb D formulations for improved taste and functionality.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Global Stevia Market Size (2025E) |

US$ 773.6 Mn |

|

Market Value Forecast (2032F) |

US$ 1,387.1 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

8.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

7.3% |

Shifting nutrition habits are significantly accelerating interest in plant-based sweeteners such as stevia. According to a 2024 study by the International Food Information Council (IFIC), 74% of U.S. consumers are actively limiting or avoiding sugar, reflecting the increasing awareness of the negative health impacts linked to excessive sugar intake. This behavior is fueling demand for natural, zero-calorie alternatives that support dietary goals without compromising taste. Stevia, being a plant-based sweetener with no glycemic impact, aligns perfectly with the growing adoption of low-carb and ketogenic diets. The USDA Dietary Guidelines for Americans emphasize reducing added sugars to less than 10% of daily caloric intake, reinforcing the consumer shift toward healthier options. As stevia is derived from a plant, it also resonates with vegetarians, vegans, and clean-label seekers. These evolving preferences are positioning stevia as a leading solution in the functional and natural sweeteners category.

Strong aftertaste remains a significant restraint affecting product appeal in the stevia market. Although steviol glycosides, natural compounds responsible for stevia’s sweetness, are up to 350 times sweeter than sugar, their high intensity can activate bitter taste receptors, leading to a lingering licorice-like or metallic aftertaste. This sensory drawback complicates product formulation, particularly in beverages, dairy, and confectionery where taste balance is critical. A 2024 consumer survey revealed that 35% of participants were dissatisfied with the aftertaste in stevia-sweetened products. Complementing this, the Food and Beverage Innovation Study found that 40% of consumers cited aftertaste as the leading reason for avoiding stevia in favor of other sweeteners. As brands continue to innovate with cleaner ingredients, overcoming taste-related barriers remains crucial. Effective taste-masking techniques and blended sweetener systems are explored to improve palatability without compromising the health benefits that drive consumer interest in stevia.

Collaboration with leading food and beverage companies presents a strong opportunity for stevia market players to drive product diversification and expand application breadth. Strategic partnerships enable ingredient manufacturers to integrate stevia into innovative product lines across beverages, dairy, bakery, and nutrition categories. For instance, Ingredion acquired PureCircle to provide clean-label stevia-based solutions to major global brands, helping them reduce added sugar while maintaining taste and functionality. A notable example is Coca-Cola, which has launched several low- and zero-sugar beverages sweetened with stevia, such as Coca-Cola Life and Sprite Green for select markets, reflecting growing mainstream adoption. Such collaborations streamline formulation, improve sensory profiles, and enable scalable commercial rollout. As consumer demand shifts toward healthier, plant-based, and low-calorie products, co-development ensures brands stay ahead of wellness trends. These alliances also aid regulatory navigation and sustainable sourcing, positioning stevia at the forefront of next-generation clean-label innovation.

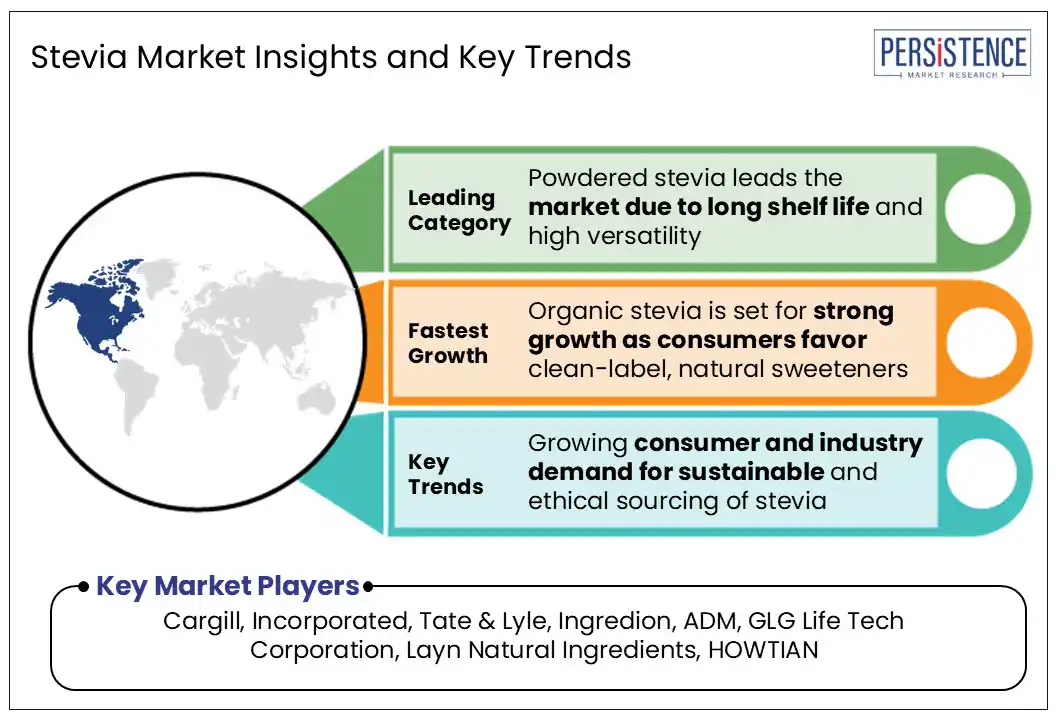

Powdered stevia accounts for a substantial share of 63% in 2025 in the stevia market, driven by its long shelf life, high sweetness concentration, and exceptional versatility across food and beverage applications. It is widely used in tabletop sweeteners, baked goods, dairy products, and nutritional supplements due to its ease of storage, accurate dosing, and compatibility with dry formulations. Powdered stevia is also favored in industrial-scale production for its consistency, cost-efficiency, and stability under varying temperatures. Its format allows seamless blending with bulking agents or other natural sweeteners to mask aftertaste and enhance flavor. In contrast, liquid stevia is gaining popularity in flavored drinks and syrups due to its quick solubility and convenience, while dried stevia leaves are more common in traditional or home-use settings, especially in teas and herbal infusions.

Organic stevia is expected to grow at a projected CAGR of 9.9% during the forecast period from 2025 to 2032, driven by the accelerating shift toward clean-label and chemical-free food choices. Health-conscious consumers are increasingly seeking natural sweeteners that align with sustainable sourcing and minimal processing values. Organic stevia meets these expectations by offering a plant-derived, zero-calorie solution free from synthetic pesticides, artificial additives, or GMOs. Its appeal is particularly strong in premium product categories such as functional beverages, protein supplements, and wellness snacks, where formulation transparency influences purchasing decisions. As demand rises for organic-certified ingredients that support better metabolic health and environmental responsibility, organic stevia is carving out a niche among flexitarians, diabetics, and consumers following plant-based diets. Manufacturers are responding with new product launches and expanded retail presence, further reinforcing stevia’s position in the global organic sweetener segment.

North America dominates the stevia market with a 36% market share as of 2024, driven by rising health consciousness and a growing preference for clean-label products. U.S. consumers are increasingly seeking natural, zero-calorie sweeteners, supported by the FDA's GRAS (Generally Recognized as Safe) status for stevia, which assures regulatory confidence. Innovation in stevia extraction, particularly purer and better-tasting variants such as Reb M and Reb D, is helping to overcome aftertaste issues and expanding usage across dairy, bakery, confectionery, and tabletop sweeteners. Canada is also witnessing increased adoption of stevia in reduced-sugar applications, especially in the functional food space. Imports of stevia from Asian producers, including China, continue to rise in response to growing demand. Strategic partnerships between stevia suppliers and U.S. beverage leaders, such as PepsiCo, are accelerating product diversification and market penetration, reinforcing North America’s leadership in the evolving natural sweetener segment.

Europe is expected to achieve at a CAGR of 9.2% from 2025 to 2032 in the stevia market, supported by strong health-driven policies and evolving consumer preferences. Government-led sugar reduction initiatives are fueling demand for natural, calorie-free sweeteners across the region. With the European food and drink industry generating nearly EUR 1.1 trillion in turnover, stevia is gaining momentum in a variety of reformulated products. High obesity and diabetes rates have prompted both regulators and brands to adopt healthier alternatives. The region’s growing vegan and plant-based movement aligns well with plant-derived sweeteners such as stevia. Organically certified stevia is increasingly favored, particularly in markets like Germany the largest organic food market in Europe. Local production efforts in France and Spain, combined with rising import demand in key countries like the UK, Italy, and the Netherlands, are positioning Europe as a dynamic growth hub for premium stevia applications.

Asia Pacific stevia market is expected to achieve a CAGR of 9.9% from 2025 to 2032, fueled by a strong production base and expanding consumption across health-driven food sectors. China remains a global leader in stevia cultivation and export, supported by large-scale farming, efficient extraction processes, and cost-competitiveness. Japan and South Korea are key consumers, where stevia enjoys longstanding acceptance in beverages and reduced-sugar products. India is rapidly emerging as a stevia-producing country, backed by government support and rising domestic health awareness. Continuous R&D across the region is focused on refining stevia’s taste profile and improving its functional stability in heat-processed and acidic formulations. This has encouraged its broader application in beverages, dairy, confectionery, and functional foods. The region’s growing middle-class population, along with increasing demand for natural and diabetic-friendly sweeteners, is driving long-term growth for stevia-based solutions.

The stevia market's competitive landscape is rapidly evolving as players pursue innovation, sustainability, and strategic global positioning. A strong emphasis on next-generation stevia compounds such as Reb M and Reb D is driving differentiation, supported by advancements in fermentation and bioconversion technologies enhance taste and scalability. Companies are increasingly integrating vertically to gain control over cultivation, processing, and distribution, ensuring consistency and quality. Tabletop sweeteners remain a focal point for innovation, particularly through convenient formats and sustainable packaging solutions. Ethical sourcing, certified ingredients, and transparent labeling are becoming essential to meet consumer and regulatory expectations. Firms are also expanding their global networks to cater to diverse regional markets and align with public health goals targeting sugar reduction. However, competition from other plant-based sweeteners and adverse climate conditions affecting stevia crops present ongoing challenges that require agile, science-backed strategies to maintain leadership.

The global Stevia market is projected to be valued at US$ 773.6 Mn in 2025.

Shifting nutrition habits towards plant-based sweeteners is driving interest in Stevia.

The Global Stevia market is poised to witness a CAGR of 8.7% between 2025 and 2032.

Collaboration with leading food and beverage companies to promote product diversification is the key market opportunity.

Major players in the Global Stevia market include Cargill, Incorporated, Tate & Lyle, Ingredion, ADM, GLG Life Tech Corporation, Layn Natural Ingredients, HOWTIAN, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn and Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Form

By Nature

By End-use

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author