ID: PMRREP29158| 192 Pages | 4 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

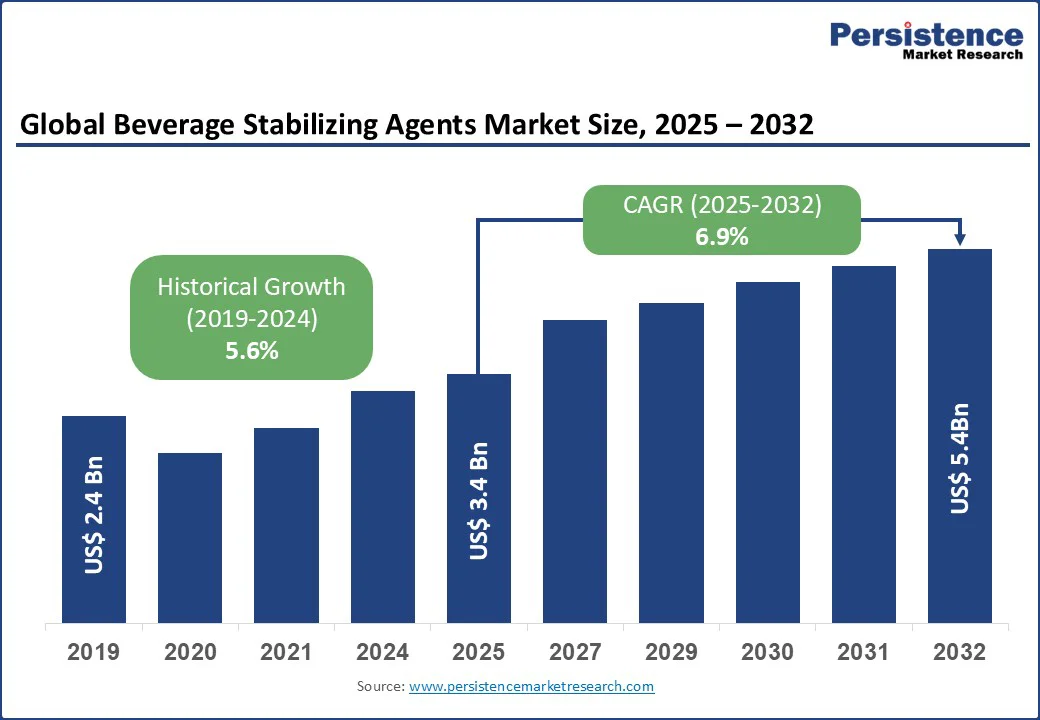

The global beverage stabilizing agents market size is likely to be valued at US$ 3.4 Bn in 2025 and expected to reach at US$ 5.4 Bn by 2032, growing at CAGR of 6.9% during 2025 - 2032.

It is experiencing strong growth, driven by rising demand for consistent texture, improved mouthfeel, and extended shelf life in beverages. Increasing consumption of functional drinks, plant-based alternatives, and low-calorie beverages is fueling the need for stabilizers that maintain product quality and visual appeal. Clean-label and natural ingredient trends are shaping innovation, boosting the use of plant-based and naturally derived stabilizers such as carrageenan and pectin.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Beverage Stabilizing Agents Market Size (2025E) |

US$ 3.4 Bn |

|

Market Value Forecast (2032F) |

US$ 5.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.6% |

The beverages stabilizing agents market is propelled by the growing demand for functional beverages, clean-label trends, and the surge in non-alcoholic beverages. The global rise in health-conscious consumers has increased the popularity of functional beverages, such as smoothies and protein drinks, which require stabilizing agents, such as xanthan gum and carrageenan, to maintain texture and prevent ingredient separation.

The clean-label movement, driven by consumer preference for natural stabilizers, has boosted demand for plant-based stabilizers such as gum arabic and pectin, with manufacturers reformulating products to meet transparency demands.

The decline in alcohol consumption, with a notable shift toward non-alcoholic beverages such as soft drinks and tea, has increased the need for beverage stabilizer applications to enhance shelf life and mouthfeel. The expansion of beverage stabilizer e-commerce, with increased online sales of packaged beverages, supports beverage stabilizer distribution, particularly for dairy alternatives and fruit drinks.

Advancements in beverage stabilizer innovations, such as improved emulsification and texturization techniques, enhance product quality, driving beverage stabilizer demand in specialty stores and hypermarkets/supermarkets. The growing popularity of beverage stabilizer health benefits, such as low-calorie and gluten-free options, further fuels beverage stabilizer growth across beverage stabilizer consumer preferences.

The beverage stabilizing agents market faces challenges due to high production costs, stringent regulatory frameworks, and raw material price volatility. The production of natural stabilizers, such as carrageenan and gum Arabic involves costly sourcing and processing, impacting affordability in price-sensitive markets. Regulatory compliance, particularly in regions such as the EU with strict food safety standards, increases costs for beverage stabilizer brands, affecting beverage stabilizer applications in functional beverages.

Fluctuating prices of raw materials, such as seaweed for carrageenan, create supply chain uncertainties, impacting beverage stabilizer distribution in non-alcoholic beverages and dairy alternatives. Limited consumer awareness in developing regions about beverage stabilizer health benefits hinders beverage stabilizer growth, affecting beverage stabilizer consumer preferences and beverage stabilizer e-commerce.

The beverage stabilizing agents market offers significant opportunities through beverage stabilizer innovations, sustainable beverage stabilizer packaging, and expansion in emerging markets. Innovations in plant-based stabilizers, such as bio-based xanthan gum and pectin, cater to the clean-label trend, enhancing beverage stabilizer health benefits and driving demand for functional beverages. Sustainable packaging solutions, such as eco-friendly containers for beverage stabilizer distribution, that align with consumer demand for environmentally responsible products, and support packaging in online retail and specialty stores.

Emerging markets with rising urbanization and disposable incomes present growth opportunities for beverage stabilizer brands, with non-alcoholic beverages and dairy alternatives gaining traction in beverage stabilizer e-commerce. Strategic partnerships with beverage manufacturers and investments in R&D for beverage stabilizer innovations further enhance beverage stabilizer demand, positioning the market for growth in beverage stabilizer trends and beverage stabilizer applications.

Xanthan Gum holds a 30% market share in 2025, driven by its versatility in beverage stabilizer applications, particularly in functional beverages and non-alcoholic beverages. Its ability to act as a thickener and emulsifier enhances beverage stabilizer demand. In beverages containing proteins, minerals, and flavorings, it prevents separation and ensures a smooth, uniform texture throughout the product’s shelf life.

Carrageenan is the fastest-growing, fueled by demand for plant-based stabilizers in dairy alternatives and soft drinks, aligning with beverage stabilizer trends for clean-label products. The surge in demand for vegan, lactose-free, and health-conscious products has significantly contributed to carrageenan’s popularity. Its natural and sustainable sourcing appeals to eco-conscious consumers and supports manufacturers in meeting clean-label claims.

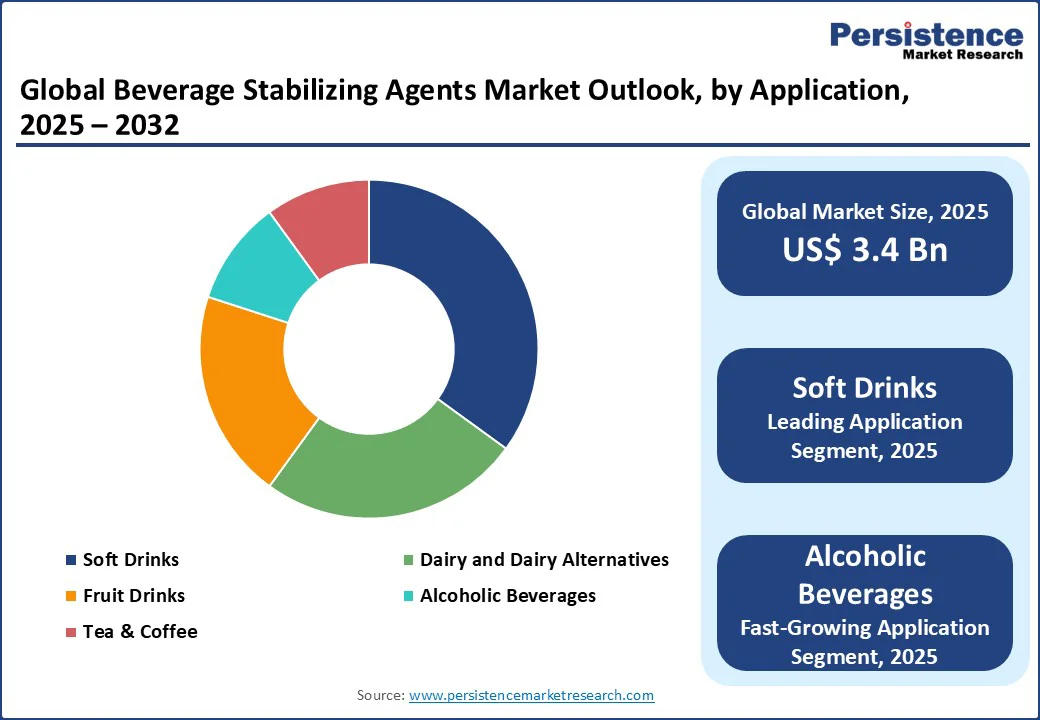

Soft drinks account for a 35% share in 2025, driven by high consumption of non-alcoholic beverages, which require stabilizing agents for texture and shelf life. Soft drinks often contain colorants, flavors, sweeteners, and carbonation all of which require stabilization to maintain visual appeal and prevent ingredient separation. Beverage stabilizers such as xanthan gum, guar gum, and pectin play an essential role in preserving the clarity, viscosity, and mouthfeel of these beverages.

Alcoholic beverages grow fastest, fueled by beverage stabilizer health benefits and demand for nutrient-enriched drinks, aligning with beverage stabilizer growth. The clean-label movement further influences this segment, pushing manufacturers to use natural and plant-based stabilizers to align with health-conscious consumer preferences.

Stabilization account for a 40% share in 2025, driven by its critical role in preventing ingredient separation in functional beverages and non-alcoholic beverages. These products often contain proteins, fibers, and other insoluble components that can settle or float without proper stabilization. By maintaining uniform dispersion and viscosity, stabilizers extend shelf life and enhance the visual appeal of beverages.

Texturization grows fastest, fueled by consumer demand for enhanced mouthfeel in dairy alternatives and soft drinks, aligning with beverage stabilizer consumer preferences. Texturizers such as xanthan gum, cellulose derivatives, and locust bean gum are increasingly used to replicate the creamy and rich texture traditionally associated with dairy products.

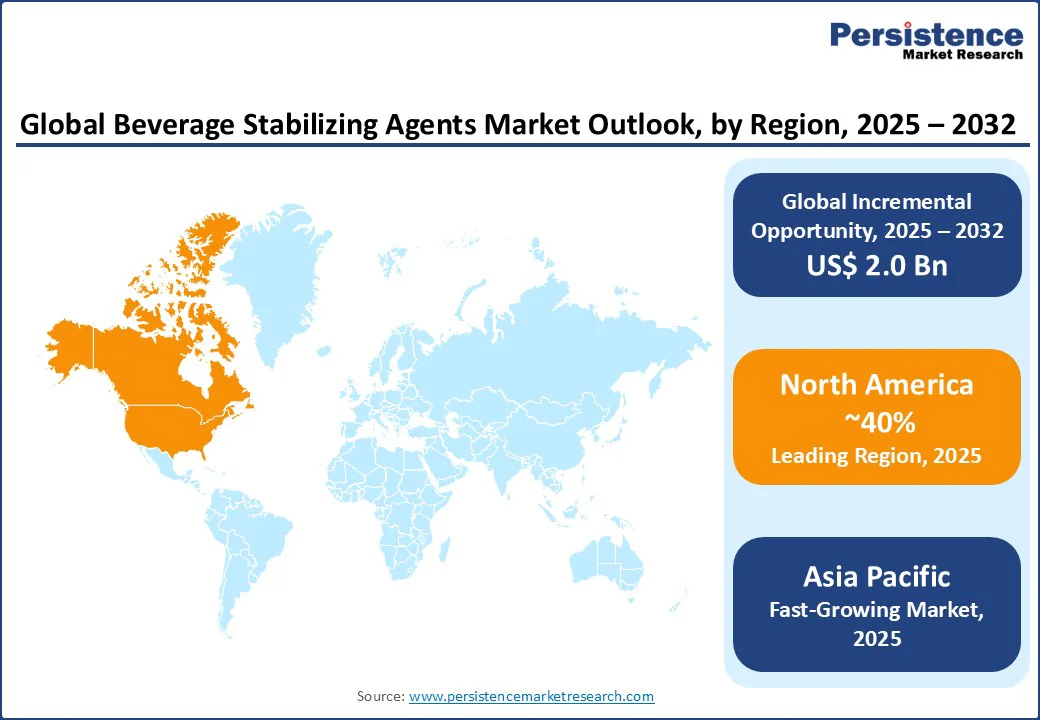

North America accounts for a 40% share in 2025, with the U.S. leading due to advanced beverage manufacturing and strong demand for functional beverages. The U.S. market thrives on beverage stabilizer trends, with non-alcoholic beverages and dairy alternatives driving demand for plant-based stabilizers such as carrageenan.

Health-conscious consumers prioritize low-sugar and clean-label products, boosting beverage stabilizer health benefits in soft drinks and functional beverages. Hypermarkets/supermarkets dominate beverage stabilizer distribution, while beverage stabilizer e-commerce grows rapidly, supporting beverage stabilizer packaging for fruit drinks.

Cargill leads with innovations in natural stabilizers. Regulatory support for food safety, such as USDA guidelines, enhances beverage stabilizer innovations, driving beverage stabilizer brands in specialty stores and online retail, aligning with beverage stabilizer consumer preferences.

Europe accounts for a 30% global market share in 2025, led by Germany, the UK, and France, driven by strong demand for natural stabilizers and functional beverages. Germany’s market grows due to consumer preference for clean-label non-alcoholic beverages, with xanthan gum gaining traction in specialty stores.

The UK market benefits from beverage stabilizer health benefits, with texturization enhancing dairy alternatives in hypermarkets/supermarkets. France’s market is driven by innovation in beverage stabilizer applications, with carrageenan expanding in tea & coffee via online retail. Tate & Lyle leads with beverage stabilizer innovations. The region’s focus on sustainability supports beverage stabilizer packaging, driving beverage stabilizer growth and beverage stabilizer e-commerce.

Asia Pacific is the fastest-growing region, led by China, Japan, and India, driven by urbanization and rising demand for functional beverages. China’s market is fueled by beverage stabilizer growth in soft drinks and dairy alternatives, with plant-based stabilizers gaining popularity in hypermarkets/supermarkets. India’s market grows due to increasing disposable incomes and urban consumption, with non-alcoholic beverages expanding in specialty stores.

Japan’s market benefits from a strong beverage culture, with beverage stabilizer innovations in tea & coffee driving beverage stabilizer e-commerce. Kerry Group leads with natural stabilizers. Digitalization and growing health consciousness support beverage stabilizer distribution, enhancing beverage stabilizer brands in the beverage stabilizers market.

The global beverages stabilizing agents market is highly competitive, with Cargill, Tate & Lyle, Ashland, Kerry Group, CP Kelco, Ingredion, DSM, Palsgaard, Glanbia Nutritionals, BASF, Nexira, Advanced Food Systems, Nouryon, and CARAGUM International focusing on beverage stabilizer innovations and plant-based stabilizers.

Companies leverage beverage stabilizer trends and natural stabilizers to gain beverage stabilizer market share. Strategic R&D investments and partnerships with beverage manufacturers drive beverage stabilizer applications, addressing beverage stabilizer consumer preferences and beverage stabilizer health benefits.

The beverage stabilizing agents market is projected to reach US$ 3.4 Bn in 2025, driven by beverage stabilizers market and functional beverages.

Rising demand for functional beverages and clean-label natural stabilizers fuels beverage stabilizer demand.

The beverage stabilizing agents market grows at a CAGR of 6.9% from 2025 to 2032, reaching US$ 5.4 Bn by 2032.

Innovations in plant-based stabilizers and sustainable beverage stabilizer packaging drive beverage stabilizer growth.

Key players include Cargill, Tate & Lyle, Kerry Group, CP Kelco, and Ingredion.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Function

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author