ID: PMRREP20413| 196 Pages | 1 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

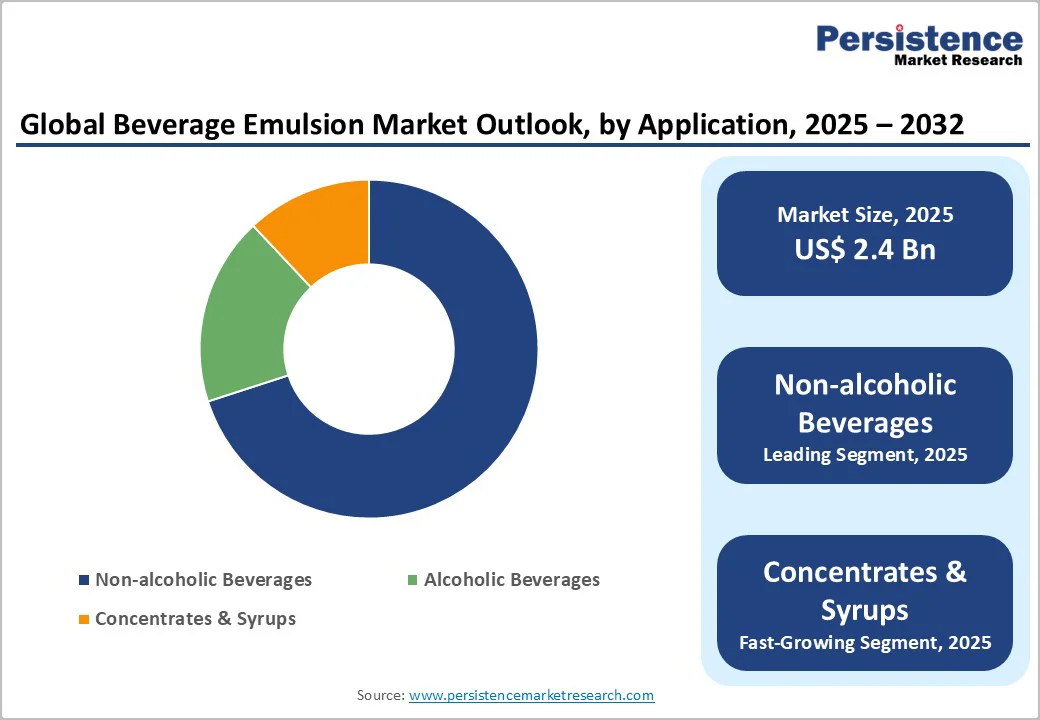

The global beverage emulsion market size is valued at US$ 2.4 billion in 2025 and projected to reach US$ 3.1 billion at a CAGR of 3.9% during the forecast period from 2025 to 2032. The beverage emulsion space is entering a transformation cycle driven by cleaner labels, high-clarity requirements, and rising demand from RTD, functional, and premium refreshment categories. Brands are accelerating reformulation and innovation cycles as emulsions become central to flavor delivery, stability, and sensory elevation across global beverage portfolios.

| Key Insights | Details |

|---|---|

|

Global Beverage Emulsion Market Size (2025E) |

US$ 2.4 Bn |

|

Market Value Forecast (2032F) |

US$ 3.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

3.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.2% |

A powerful consumption shift is reshaping demand for beverage emulsions as ready-to-drink and functional beverages surge across global markets. Consumers are gravitating toward convenience formats fortified with antioxidants, electrolytes, botanical extracts, vitamins, and natural flavors, creating a growing need for stable, high-performance emulsions that can carry complex active ingredients. Brands are racing to differentiate through cleaner labels, vibrant flavor systems, and visually appealing formulations, all of which rely on advanced emulsion technologies to maintain clarity, uniformity, and long shelf life. The expansion of hydration drinks, energy blends, probiotic beverages, and mood-enhancing formulations amplifies this pull, prompting beverage manufacturers to adopt emulsions that support consistent taste, improved nutrient dispersal, and premium sensory experiences across diverse product lines.

Growing scrutiny around ingredient transparency is tightening the spotlight on synthetic emulsifiers, creating a clear restraint for the global beverage emulsion market. As consumers demand cleaner formulations and recognizable ingredient lists, beverage brands face mounting pressure to replace artificial stabilizers with natural alternatives such as gum acacia, pectin, lecithin, and citrus fiber. This shift complicates formulation because natural emulsifiers often deliver weaker stability, shorter shelf life, or higher production costs. Manufacturers struggle to maintain flavor integrity, cloud stability, and visual appeal while staying within clean-label boundaries. The regulatory environment in major markets is reinforcing this transition, pushing producers to reformulate legacy beverages and rethink innovation pipelines, slowing the adoption of synthetic emulsifier–dependent emulsion systems.

A surge in premium RTD cocktails and alcohol-free mocktails is opening a powerful opportunity for beverage emulsion innovators that can deliver high-clarity, alcohol-stable systems. Brands are pushing for transparent, visually striking drinks that carry bold citrus, spice, and botanical oil profiles without haze, sedimentation, or flavor degradation. This demand creates room for advanced nano-emulsions, hybrid stabilizer systems, and alcohol-tolerant clouding agents tailored for spirits, seltzers, and functional mocktails. Startups can differentiate by engineering emulsions that withstand varying pH, carbonation, and ethanol levels while maintaining vibrant aroma release. Established players that scale precision-engineered, shelf-stable emulsions stand to secure long-term partnerships with RTD brands racing to launch next-generation flavor concepts.

Non-alcoholic beverages hold approx. 69% market share as of 2024, and this dominance reflects the category’s aggressive innovation curve and its sheer breadth across juices, carbonates, RTDs, sports drinks, and enhanced hydration formats. Brands constantly rely on emulsions to stabilize citrus oils, natural colors, clouding agents, and botanical extracts, making these formulations indispensable to product consistency and sensory appeal. The shift toward functional hydration, low-sugar beverages, and natural flavor systems further amplifies emulsion usage. Alcoholic beverages contribute steadily as premium RTD cocktails, hard seltzers, and flavored spirits require alcohol-stable emulsions that preserve clarity and aroma. Concentrates & syrups continue serving foodservice and industrial processors who depend on high-strength, cost-efficient emulsions to maintain uniform flavor delivery across large-volume production.

Flavor emulsion is projected to grow at a CAGR of 4.6% during the forecast period, a trajectory fueled by the beverage industry’s escalating shift toward dynamic, multilayered taste profiles. As consumers gravitate toward exotic fruits, botanical blends, and functional flavor systems, manufacturers increasingly rely on stable flavor emulsions to deliver consistent aroma, mouthfeel, and dispersion across diverse liquid matrices. These emulsions enable precise flavor release in acidic, carbonated, and heat-treated beverages, making them essential for next-gen RTDs, sports drinks, and hybrid wellness formulations. Rising experimentation with citrus oils, spice extracts, and natural flavor compounds is expanding demand. Their compatibility with clean-label expectations, paired with advancements in microencapsulation and droplet-size control, positions flavor emulsions as a core technology shaping future beverage innovation.

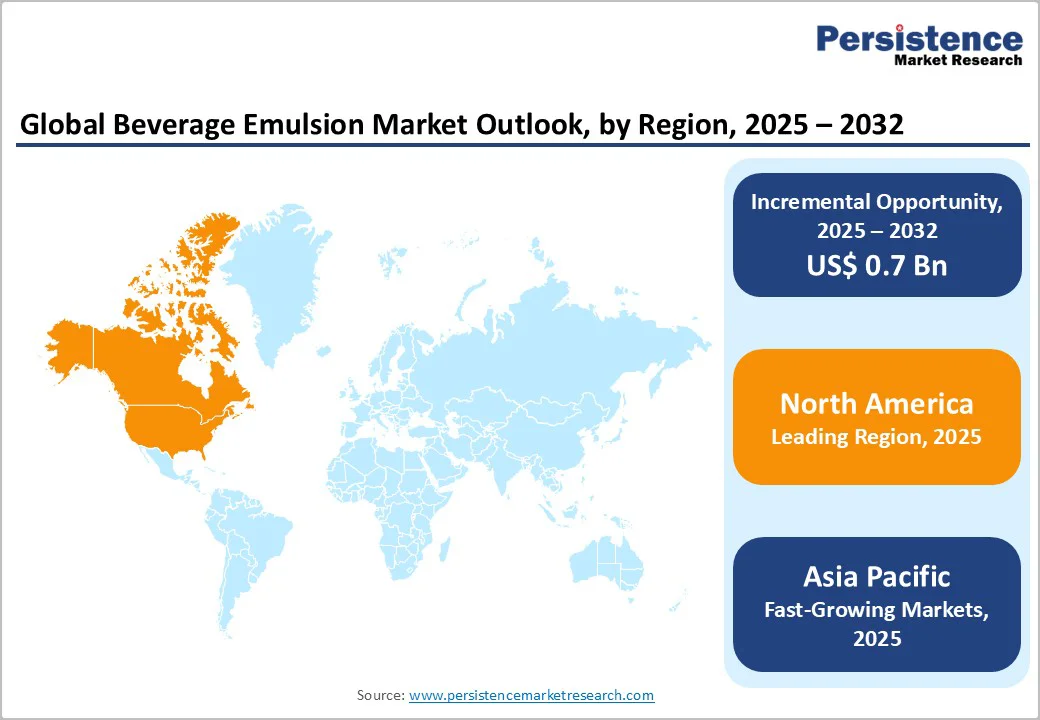

North America holds approximately 38% market share in the global beverage emulsion market, and the region’s trajectory is being shaped by rapid innovation across functional, clean-label, and sensory-driven beverages. In the US, brands such as Coca-Cola, PepsiCo, Ocean Spray, and AriZona are intensifying their use of high-stability emulsions to support bold citrus, tropical, and botanical flavors in RTD teas, energy drinks, and wellness beverages. Canada is witnessing rising adoption of natural and cloud-retaining emulsions as craft beverage producers expand into fruit-based sparkling waters, low-sugar refreshers, and premium mocktails. Across both countries, manufacturers are reformulating around natural flavor oils, gum-based stabilizers, and nano-emulsion systems to deliver clarity, flavor intensity, and stable mouthfeel. This push toward premium taste architecture and clean functionality is redefining the region’s competitive landscape.

Asia Pacific Beverage Emulsion Market is expected to grow at a CAGR of 5.3%, driven by a fast-evolving beverage culture shaped by urban lifestyles, rising disposable incomes, and bold flavor experimentation. China is accelerating demand for high-clarity citrus and botanical emulsions as RTD teas, sparkling fruit drinks, and vitamin beverages dominate convenience-store shelves. India is witnessing surging interest in spiced refreshers, mango-based beverages, and fortified juices, pushing manufacturers toward stable flavor-oil emulsions that withstand heat and distribution variability. Thailand is strengthening its position as a hub for tropical flavor innovation, with coconut, lychee, and pandan emulsions gaining traction among domestic and regional brands. Malaysia is expanding its functional beverage portfolio, prompting higher use of emulsions tailored for energy boosters, herbal drinks, and reduced-sugar formulations. Across the region, companies are prioritizing natural flavor oils, cloud-stable systems, and cost-efficient emulsifier blends to meet rapidly diversifying consumer tastes.

The market nature remains moderately fragmented, creating a competitive arena where global flavor houses and agile innovators battle for differentiation through technology, quality, and cleaner formulations. Leading companies are investing in high-shear mixing, nano-emulsion systems, and advanced cloudifying technologies to deliver stable, high-clarity emulsions suited for RTD beverages, functional drinks, and premium citrus applications. Many are expanding portfolios of natural flavor oils, organic-certified emulsifiers, and allergen-free stabilizers to align with accelerating clean-label pressure. Startups are entering with lean R&D models focused on botanical emulsions, low-sugar beverage bases, and customizable flavor systems for craft beverage brands. Certification upgrades from organic to Non-GMO are becoming a key promotional lever. Across the landscape, firms are refining shelf stability, sensory performance, and cost efficiency to secure long-term commercial traction.

The global beverage emulsion market is projected to be valued at US$ 2.4 Bn in 2025.

Rising Consumption of RTD & functional beverages is fueling the demand for Beverage emulsions in the global market.

The global beverage emulsion market is poised to witness a CAGR of 3.9% between 2025 and 2032.

A key market opportunity lies in developing high-clarity, alcohol-stable emulsions for citrus, spice, and flavor oils to be used in Ready-to-Drink (RTD) cocktails and mocktails.

Major players in the global Beverage Emulsion market include Cargill, Givaudan, IFF, Kerry Group, Tate & Lyle PLC, ADM, Ingredion, and others

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Emulsion Type

By Ingredients

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author