ID: PMRREP35598| 179 Pages | 10 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

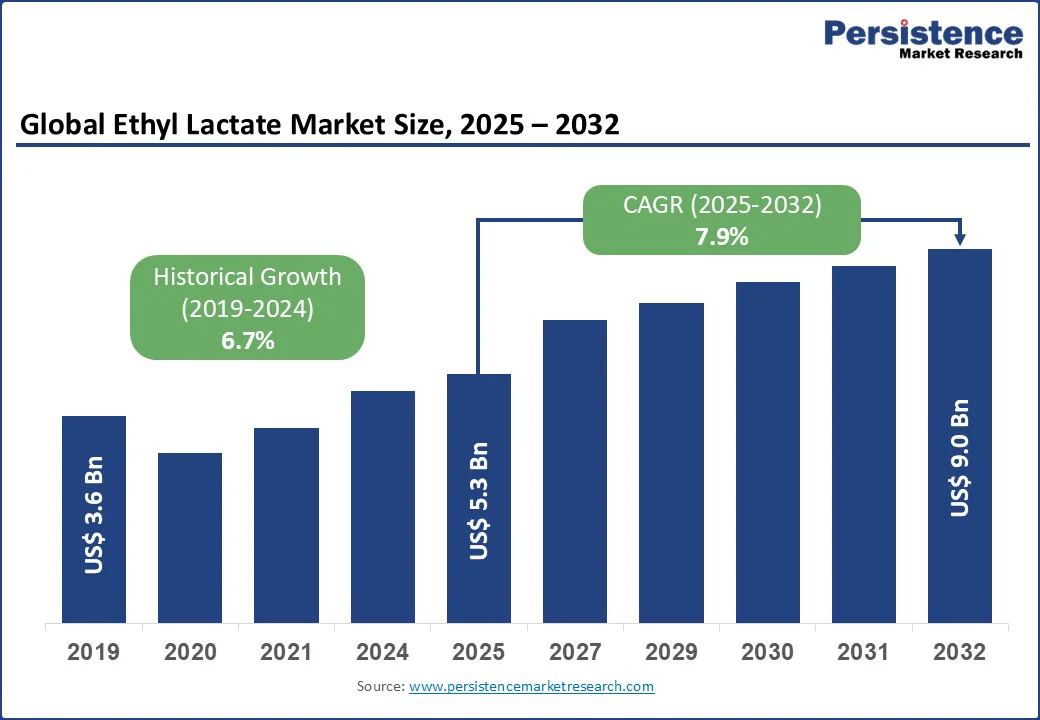

The ethyl lactate market size is likely to be valued at US$ 5.3 Bn in 2025 and is estimated to reach US$ 9.0 Bn in 2032, growing at a CAGR of 7.9% during the forecast period 2025 - 2032.

Key Industry Highlights

| Global Market Attribute | Key Insights |

|---|---|

| Ethyl Lactate Market Size (2025E) | US$5.3 Bn |

| Market Value Forecast (2032F) | US$9.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 7.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 6.7% |

The ethyl lactate market growth is being pushed by sustainability and regulatory compliance. Rising demand in cosmetics, pharmaceuticals, food processing, and industrial coatings segments is fueling its adoption. This is because manufacturers are looking for eco-friendly alternatives to traditional petrochemical solvents.

Companies such as Corbion N.V. and BASF SE are intensifying research and development activities to improve production efficiency and develop high-purity grades. The competitive landscape is both dynamic and fragmented, with global leaders utilizing expansion and development.

The cosmetic and personal care industry is pushing demand for ethyl lactate as brands are under pressure to replace petrochemical-based solvents with safe and bio-based alternatives. Ethyl lactate fits neatly into this shift since it is gentle on the skin, biodegradable, and non-irritating.

This makes it ideal for formulations such as cleansers, toners, and exfoliating solutions. Various K-beauty companies are launching water-light serums using ethyl lactate as a solvent for botanical extracts, showing its ability to deliver actives without causing sensitivity.

Its use in natural fragrance-based cosmetics also strengthens demand. As ethyl lactate improves the stability of essential oils without altering their scent profile, personal care brands are incorporating it in body mists, deodorants, and aromatherapy products. U.S.-based wellness brands, for instance, are adding ethyl lactate in their roll-on essential oil blends to achieve long-lasting aroma while avoiding synthetic carriers.

The rising cost of lactic acid, driven by climate-induced irregularities in crop yields, high energy costs, and increased logistics expenses, is negatively impacting the production cost of ethyl lactate. As lactic acid is the primary feedstock, any hike in its price translates into high manufacturing costs for ethyl lactate.

In 2024, for example, several ethyl lactate manufacturers across India and China reported production slowdowns or selective supply prioritization to manage cost pressures, specifically for industrial-grade products used in coatings and cleaning applications.

The cost pressure is also influencing purchasing behavior across various industries. Industries such as cosmetics and personal care, which are highly price-sensitive, are evaluating alternative solvents or reducing solvent-intensive formulations to manage budgets.

In addition, high raw material prices create uncertainty for long-term contracts and supply agreements. Companies reliant on medical- or food-grade ethyl lactate are mainly affected. It is because they cannot easily switch feedstock without compromising quality.

The industrial coatings industry is creating new avenues for ethyl lactate manufacturers as it is under increasing pressure to reduce VOC emissions and comply with strict environmental regulations. Ethyl lactate’s low toxicity and biodegradability make it an ideal replacement for traditional petroleum-based solvents in paints, varnishes, and protective coatings. The rising demand for high-performance and eco-friendly coatings in the automotive, aerospace, and electronics sectors is further broadening opportunities.

In the U.S., various leading aerospace suppliers have started using ethyl lactate in primer and cleaning applications for aluminum components. They have recognized its effectiveness in dissolving residues without compromising safety or equipment integrity. This demonstrates how ethyl lactate is penetrating highly technical and regulated coating applications where performance and environmental compliance are equally important.

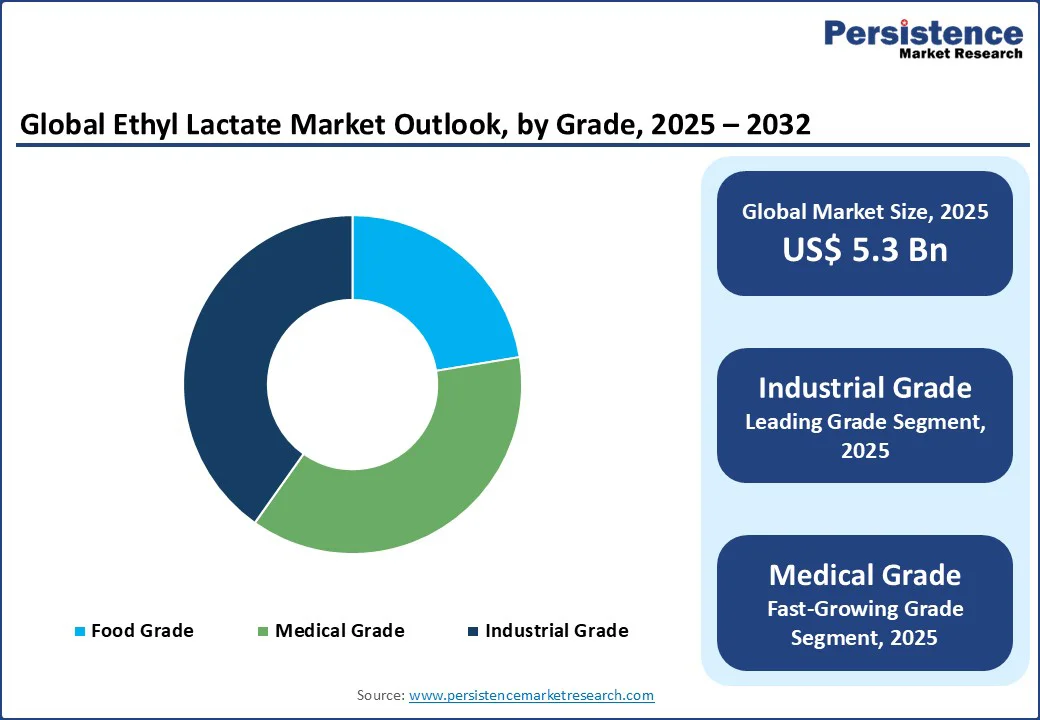

Based on grade, the market is trifurcated into food grade, medical grade, and industrial grade. Out of these, the industrial grade segment is speculated to account for nearly 40.2% of the share in 2025 due to its versatility in large-scale applications where ultra-high purity is not essential.

It works as a powerful yet biodegradable solvent for coatings, inks, and cleaning formulations. This makes it attractive to manufacturers that seek cost-effective yet eco-friendly alternatives to petroleum-based solvents. Several China-based electronics manufacturers, for example, have shifted to industrial-grade ethyl lactate for cleaning semiconductor wafers and LCD panels as it provides superior solvency while meeting green chemistry requirements.

Medical-grade ethyl lactate is predicted to witness steady growth owing to increased demand for solvents that combine high purity with safety and environmental compliance across healthcare and pharmaceutical industries.

Medical-grade variants are stringently processed to remove impurities, making them suitable as excipients in drug formulations and as carriers for active pharmaceutical ingredients. Medical-grade ethyl lactate also delivers a biodegradable solution, which is why some U.S. hospitals have already integrated it into surface disinfectants.

In terms of application, the market is segregated into solvents, additives, fragrances, APIs, and drug carriers. Among these, the solvent segment will likely hold around 29.7% of the share in 2025 as ethyl lactate provides a rare combination of solvency power and environmental safety, which few alternatives deliver. Its ability to dissolve both polar and non-polar substances makes it highly effective in industries such as coatings, inks, and cleaning. Another reason is its biodegradability and low toxicity, which cater to global regulatory trends.

Fragrances are a key application of ethyl lactate because the compound acts as a natural and non-toxic solvent that improves the stability and release of aromatic ingredients. Several synthetic solvents traditionally used in perfumery are under scrutiny for their allergenic potential or environmental impact, making ethyl lactate an ideal substitute. Its biodegradability also makes it relevant for clean beauty and sustainable fragrance launches. Ethyl lactate allows perfumers to dissolve essential oils and natural extracts while complying with regulatory and consumer expectations.

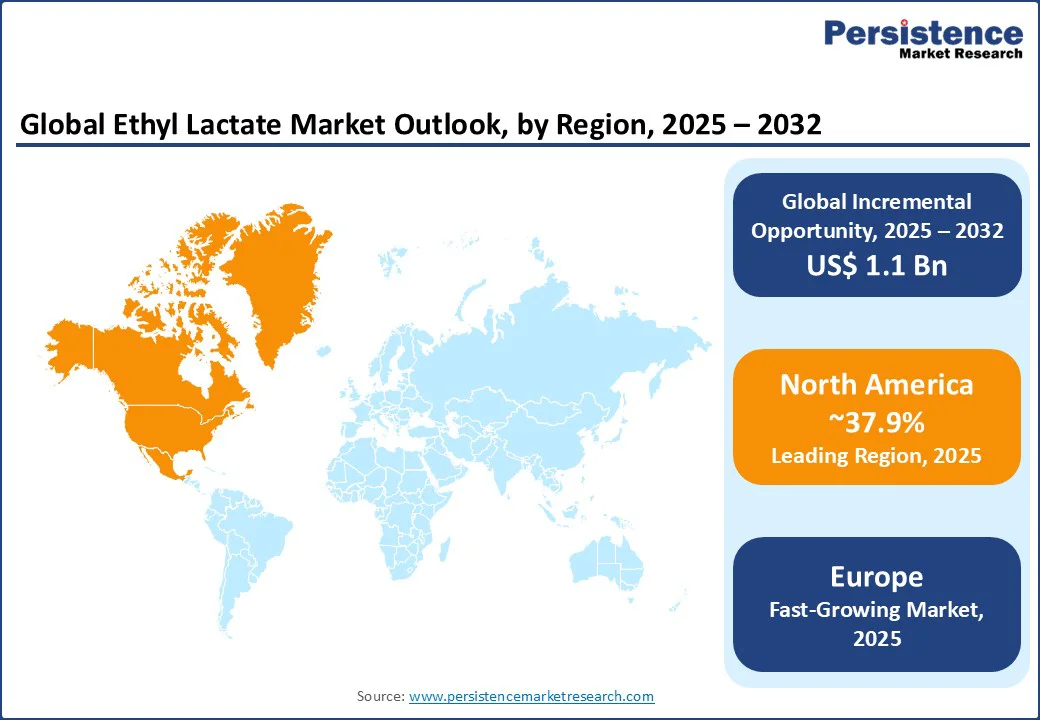

North America is predicted to account for approximately 37.9% of share in 2025 owing to the increasing emphasis on sustainability and eco-friendly solvents across various industries. The U.S. ethyl lactate market is expected to be fueled by increasing adoption of the compound as a safer alternative to traditional solvents. It caters to the country’s commitment to reducing Volatile Organic Compound (VOC) emissions and adheres to stringent environmental regulations.

The demand for ethyl lactate in North America spans several sectors, including food and beverages, pharmaceuticals, and cosmetics. In the food industry, it serves as a flavoring agent and solvent, while in pharmaceuticals, it is utilized as an excipient.

The cosmetics industry benefits from ethyl lactate's mild and non-irritating properties, making it suitable for various personal care products. Facility expansion is an emerging trend in the regional market. Manufacturing companies now focus on broadening their operations to meet the rising demand.

Europe is currently experiencing steady growth, augmented by an increasing emphasis on sustainability and regulatory compliance across several industries. In the U.K., growth is being spurred by the rising demand for bio-based solvents in food and beverages, pharmaceuticals, and cosmetics segments. Key players in the country are investing in the development of new and energy-efficient production processes for ethyl lactate.

They are focused on processes that utilize novel catalysts and improved heat integration techniques. With these, they aim to reduce energy consumption while maintaining the high purity standards required for ethyl lactate. Such developments highlight the market’s focus on improving production efficiency and sustainability. The increasing adoption of bio-based ethyl lactate also supports the market's growth. It is driven by rising demand for sustainable chemicals and strict environmental regulations.

In the Asia Pacific, the market is influenced by ongoing industrial expansion and rising environmental awareness. China and India are at the forefront of production, with China-based firms extending their bio-based production from corn and sugarcane. Players in India are extensively using ethyl lactate in pharmaceuticals and agrochemicals. This local manufacturing strength helps the Asia Pacific meet the surging demand from the food, coatings, and electronics industries.

The region is also considered one of the most prominent consumers of ethyl lactate globally, with cosmetics, personal care, and industrial cleaning segments adopting it as a green solvent. Medical-grade ethyl lactate is gaining impetus as healthcare requirements rise.

It is evident in India, South Korea, and Japan, where pharmaceutical standards are pushing for high-purity solvents. Governments and industries are further encouraging eco-friendly solvents, and ethyl lactate’s biodegradability and low toxicity fit perfectly into these initiatives.

The ethyl lactate market is characterized by various established multinational corporations, regional players, and specialized manufacturers across multiple geographies. Key players continue to lead by embracing their extensive research and development capabilities as well as sustainable production methods to meet the rising demand for eco-friendly solvents.

Regional players are also focusing on niche applications and local market requirements. The market is further diversified by a multitude of small manufacturers and distributors, specifically in China. They provide competitive pricing and cater to a wide range of applications.

The ethyl lactate market is projected to reach US$ 5.3 Bn in 2025.

Rising demand for eco-friendly solvents and strict VOC limits are the key market drivers.

The ethyl lactate market is poised to witness a CAGR of 7.9% from 2025 to 2032.

Development of circular production processes and localized manufacturing in Asia Pacific are the key market opportunities.

Corbion N.V., Henan Kangyuan Flavor Factory Co., Ltd., and Musashino Chemical Laboratory are a few key market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Grade

By Application

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author