ID: PMRREP33272| 200 Pages | 5 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

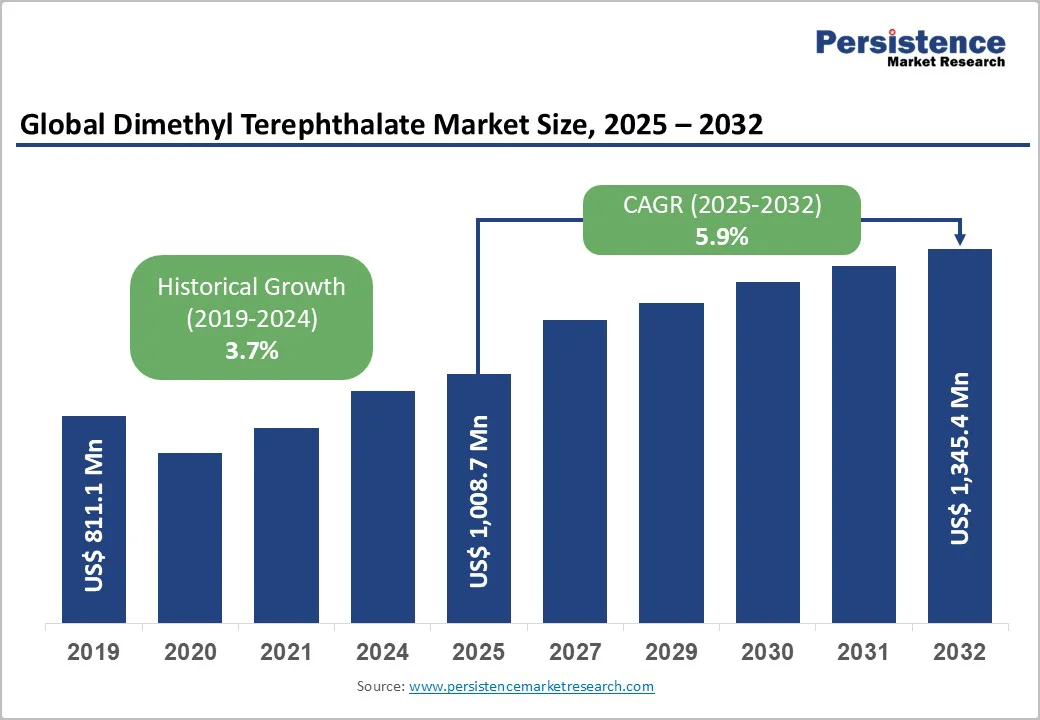

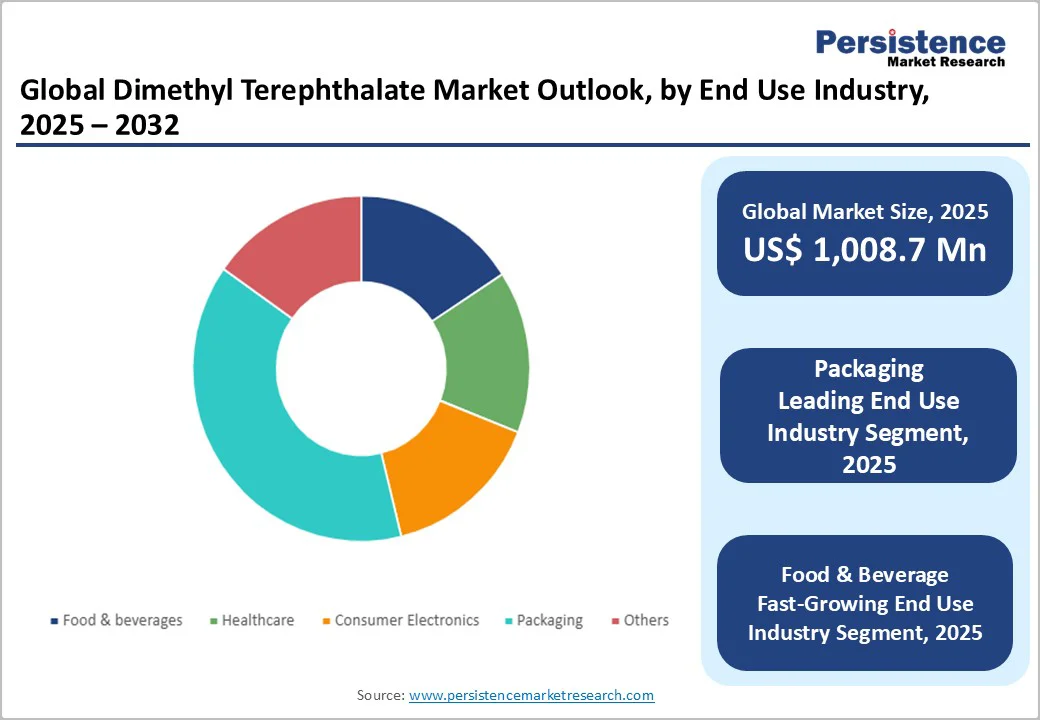

The global dimethyl terephthalate market size was valued at US$ 1,008.7 Mn in 2025 and is projected to reach US$ 1,506.7 Mn by 2032, growing at a CAGR of 5.9% between 2025 and 2032. Accelerating demand for polyethylene terephthalate and polybutylene terephthalate polymers across packaging, consumer electronics, and automotive applications, coupled with the rising global demand for polyester fibers supporting textile and industrial applications are some of the primary factors driving the dimethyl terephthalate demand across the globe.

| Key Insights | Details |

|---|---|

|

Dimethyl Terephthalate Market Size (2025E) |

US$ 1,008.7 Mn |

|

Market Value Forecast (2032F) |

US$ 1,506.7 Mn |

|

Projected Growth CAGR(2025-2032) |

5.9% |

|

Historical Market Growth (2019-2024) |

3.7% |

Rising PET Resin Production and Expanding Polyester Demand

The global Dimethyl Terephthalate (DMT) market is significantly driven by the rising production of Polyethylene Terephthalate (PET) and polyester fibers, as DMT remains a key intermediate in the value chain. Global PET resin demand has crossed 82 million tons, fueled by the beverage, food packaging, and consumer goods sectors. Polyester fiber consumption continues to grow at 4% annually, particularly in Asia Pacific, which accounts for over 65% of global textile production. This surge directly elevates the need for DMT as manufacturers expand capacities to meet downstream requirements.

The shift toward lightweight, durable, and recyclable packaging materials is strengthening PET adoption, reinforcing DMT demand. Rapid urbanization, lifestyle changes, and rising apparel consumption, especially in emerging markets like India and Southeast Asia, continue to accelerate polyester output. Collectively, these structural industry shifts position DMT as a critical raw material with sustained demand growth across packaging, textile manufacturing, and industrial applications.

Growing Adoption of Recycled and Sustainable Feedstocks

Sustainability initiatives are reshaping chemical supply chains, driving increased interest in DMT for recycling and circular economy pathways. With global plastic recycling rates averaging only 9%, governments and industries are accelerating efforts to integrate chemical recycling technologies. DMT plays a central role in PET depolymerization, enabling recovery of high-purity monomers for reuse in bottles, films, and fibers. Countries in Europe and North America are investing heavily in advanced recycling systems, with the EU targeting 30% mandatory recycled content in PET bottles by 2030.

This transition has prompted manufacturers to expand DMT-based recycling capacities, as the process yields consistent quality suitable for food-grade applications. The growth of eco-friendly polyester, expected to rise at over 7% CAGR, further supports demand for recycled DMT. As brands implement sustainability commitments and regulatory compliance becomes stricter, demand for DMT as a conversion and recycling intermediate continues to strengthen globally.

Raw Material Volatility and Feedstock Cost Pressures

Paraxylene and other raw material price volatility impacting DMT production costs and profitability. Feedstock availability constraints affecting production capacity utilization particularly in Asia-Pacific region. Energy cost inflation increasing overall production expenses through heat-intensive manufacturing processes. Supply chain disruptions affecting feedstock accessibility particularly during adverse weather conditions. Import dependency in certain regions creating vulnerability to global market fluctuations.

Oversupply and Competitive Pricing Pressures

Capacity expansions creating oversupply particularly in Chinese market constraining pricing power. DMT prices under pressure in early 2025 due to ongoing oversupply and weak demand fundamentals. Weak downstream demand from key end-use sectors affecting demand growth. Ample supply from Asian producers increasing competitive pressure in global markets.

Expansion of PET Packaging Demand Across Food, Beverage & Consumer Goods

The rapid global shift toward PET-based packaging presents a major growth opportunity for the DMT market. PET packaging demand is projected to surpass USD 110 billion by 2030, driven by rising consumption of bottled beverages, ready-to-eat foods, personal care items, and household products. The beverage industry alone uses over 500 billion PET bottles annually, and this volume continues to increase due to urban lifestyle changes and growing acceptance of single-serve formats. PET is favored for its lightweight nature, cost-efficiency, chemical resistance, recyclability, and barrier properties, factors that strengthen its demand in both developed and emerging markets.

As packaging manufacturers invest in capacity expansions, especially in regions like Asia-Pacific (which accounts for over 45% of global PET packaging output), the requirement for high-quality DMT-based intermediates will escalate. This structural, long-term growth in the global packaging industry provides sustained expansion opportunities for DMT suppliers, particularly those capable of delivering consistent purity and integrated supply models.

Rising Investments in Chemical Recycling and Circular Economy Initiatives

Increasing emphasis on circular economy practices and plastic waste reduction is creating significant opportunities for DMT as a key component in PET chemical recycling technologies. Global investment in advanced recycling exceeded USD 3 billion in the last five years, with several companies deploying large-scale depolymerization units. DMT plays a crucial role in methanolysis, a process capable of converting post-consumer PET waste into high-purity DMT and MEG, suitable for producing virgin-quality PET. As nations implement stricter regulations, such as Europe’s mandate for 30% recycled content in PET bottles by 2030 and rising EPR (Extended Producer Responsibility) frameworks, demand for recycled PET (rPET) is expected to grow at over 8% CAGR.

This directly enhances the need for DMT in chemical recycling pathways. Brand owners across FMCG, textiles, and beverage industries are committing to 100% recyclable or reusable packaging by 2025–2030, creating a robust commercial environment for DMT-enabled recycling technologies. Manufacturers who innovate in high-efficiency recycling will gain a competitive advantage and capture long-term market opportunities.

Flake DMT dominates the dimethyl terephthalate market, accounting for nearly 72% of total demand due to its superior handling, storage, and processing efficiencies. Flake-form DMT offers enhanced thermal stability, uniform particle size, and easier flow characteristics, making it highly suitable for large-scale industrial applications such as PET production, polyester fibers, and specialty resins.

Manufacturers prefer flake DMT because it minimizes material loss during transportation, reduces contamination risks, and ensures consistent melting behavior in continuous production lines. Its improved bulk density and packaging convenience further support cost-effective logistics compared to molten or liquid forms. These operational advantages, combined with its compatibility with automated feeding systems, drive widespread adoption across chemical, textile, and packaging sectors, securing its dominant market share.

Polyethylene Terephthalate (PET) dominates the dimethyl terephthalate market, accounting for approximately 59% of total application demand due to its extensive use in the global packaging industry and highly favorable material properties. PET’s strength-to-weight ratio, transparency, chemical resistance, and recyclability make it the preferred material for beverage bottles, food containers, pharmaceutical packaging, and personal care product solutions. The growing consumption of packaged beverages, estimated to exceed 1.4 trillion units globally, continues to elevate PET resin production, directly boosting DMT demand.

Increasing adoption of lightweight and sustainable packaging across FMCG, e-commerce, and grocery retail sectors reinforces PET’s dominant position. Rising demand for PET films and sheets in electronics, automotive interiors, and industrial applications further contributes to its large market share. The combination of performance advantages, regulatory friendliness, and high recyclability rates ensures PET remains the primary growth engine within the global DMT application landscape.

The packaging industry dominates end-user consumption in the global dimethyl terephthalate (DMT) market, accounting for approximately 42% of total demand, primarily driven by the extensive use of PET resins in food and beverage containers. DMT serves as a crucial raw material in producing PET bottles, trays, films, and rigid containers that require high clarity, strength, and resistance to moisture and chemicals. The global beverage industry alone consumes billions of PET bottles annually, with rising demand for bottled water, carbonated drinks, and ready-to-drink products further amplifying material requirements.

Increasing emphasis on lightweight, recyclable, and cost-efficient packaging solutions continues to push manufacturers toward PET, directly boosting DMT consumption. The growth of convenience foods, e-commerce packaging, and pharmaceutical containers reinforces the segment’s dominance. Regulatory support for sustainable and recyclable packaging formats further strengthens PET adoption, keeping the packaging industry the largest and most influential end-user segment in the DMT value chain.

North America maintains a strong market position driven by its well-established polymer production infrastructure, robust chemical processing capabilities, and high-volume demand from the packaging and automotive industries. The United States leads regional consumption, supported by extensive PET and PBT manufacturing capacities that cater to beverage packaging, food containers, textiles, engineering plastics, and automotive components. Growing demand for lightweight and recyclable packaging materials continues to boost PET resin production, indirectly strengthening DMT requirements.

The region’s focus on energy-efficient and high-performance engineering plastics, especially for automotive electrification, electronics, and 3D printing, drives steady uptake of PBT resins. Investments in recycling technologies, bottle-to-bottle PET initiatives, and circular economy programs further influence DMT demand patterns as manufacturers adopt more sustainable resin production strategies. Overall, North America remains a key market characterized by technological maturity, strong downstream industries, and continuous innovation across polymer value chains.

Europe demonstrates a stable market position supported by its mature polymer manufacturing base, well-developed chemical industry, and strict regulatory environment that shapes production and consumption dynamics. The region hosts several long-established PET and polyester value-chain manufacturers, ensuring consistent demand for DMT in packaging, fibers, and engineering plastics. Europe’s stringent regulations on sustainability, recyclability, and carbon footprint reduction are accelerating the transition toward circular packaging solutions, indirectly influencing the types and quality of PET resins produced.

As industries prioritize lightweight, energy-efficient, and recyclable materials, demand for high-purity DMT remains steady, particularly in food-grade packaging and specialty polyester applications. The region’s strong focus on innovation, such as advancements in recycling technologies, chemical depolymerization, and bio-based polymer development, continues to shape market trends. Additionally, demand from automotive, textiles, and electrical components supports stable downstream consumption, reinforcing Europe’s position as a mature yet resilient DMT market.

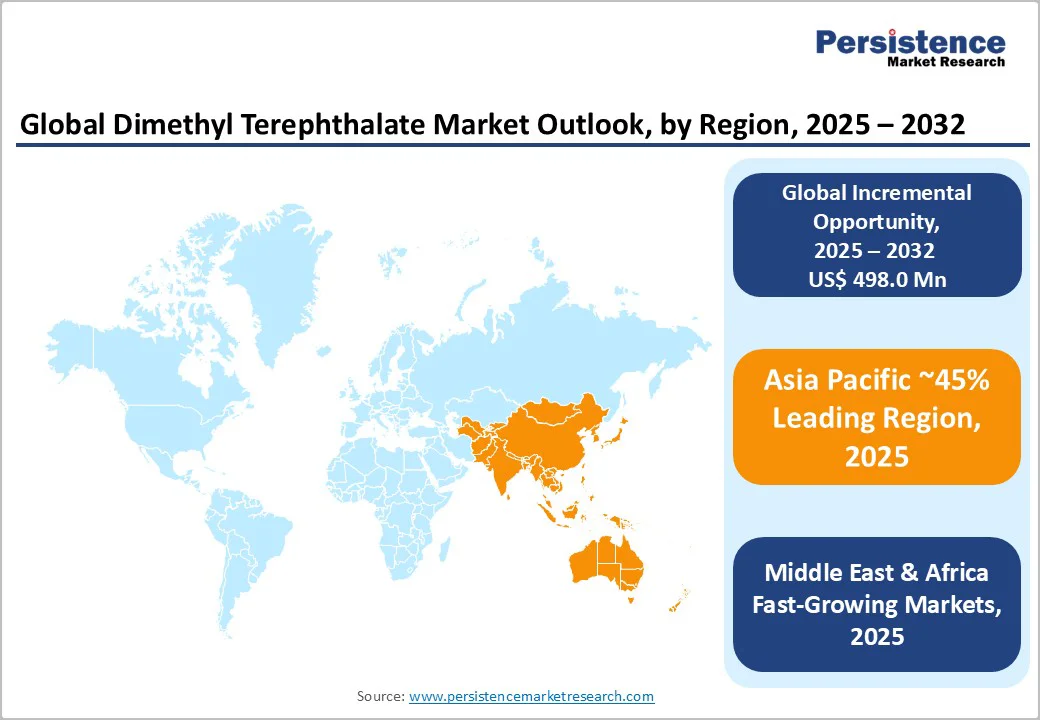

Asia Pacific dominates the global dimethyl terephthalate market, accounting for 45% of market share, driven by its extensive production capacities, integrated petrochemical infrastructure, and high-volume polymer manufacturing ecosystem. The region accounts for the largest share of global DMT output, supported by rapid industrialization, expanding packaging demand, and strong polyester fiber production. China leads the regional market, holding the highest production capacity and consumption levels due to its massive PET resin, polyester filament, and engineering plastics industries. The country’s robust beverage packaging sector, one of the world’s largest consumers of PET bottles, continues to stimulate DMT demand.

Southeast Asian economies such as India, Thailand, and Indonesia are witnessing rising consumption driven by growing FMCG markets, textile manufacturing expansions, and increasing adoption of lightweight packaging. Investments in capacity expansions, cost-efficient production technologies, and integrated value-chain operations further reinforce Asia Pacific’s dominance. The region remains the central hub for global DMT demand growth, cost competitiveness, and long-term supply chain strength.

The global dimethyl terephthalate (DMT) market exhibits moderate consolidation, with leading manufacturers such as OxxyNova, Invista, Eastman, and several major regional producers collectively accounting for approximately 50–60% of total market share. OxxyNova maintains a strong competitive position with an estimated 15% revenue share, driven by advanced production technologies, high product purity, and large-scale manufacturing capabilities.

Tier-two participants, including established chemical companies across Europe, North America, and Asia, capture substantial regional demand through specialized formulations, flexible production models, and long-standing customer relationships. Emerging Asian manufacturers, particularly in China and India, are rapidly expanding their presence by leveraging cost-efficient production, proximity to downstream PET and polyester industries, and strong domestic consumption.

The global dimethyl terephthalate market was valued at US$ 1,008.7 million in 2025 and is projected to reach US$ 1,506.7 million by 2032, representing a CAGR of 5.9% during the forecast period.

Rising global production of PET resins and polyester fibers used extensively in packaging, textiles, and consumer goods. Growing demand for lightweight, recyclable, and high-performance materials across food & beverage, automotive, and electronics industries further accelerates DMT consumption.

Flake DMT commands approximately 72% market share, driven by handling convenience, storage stability, automated production integration, straightforward material management, and proven effectiveness in diverse polymerization processes supporting mainstream adoption.

Asia Pacific maintains market dominance with 45% global market share, driven by China production concentration, polyester fiber dominance, emerging manufacturing hubs in Vietnam, and highest consumption volumes supporting regional leadership position.

Sustainable packaging solutions and circular economy integration represent highest-value opportunity through bio-based and recycled DMT development, chemical recycling infrastructure expansion, and corporate sustainability initiatives supporting emerging revenue streams with premium positioning.

Market leaders include Oxxy Nova (Global) commanding 15% revenue share with technology leadership, Invista (United States) leveraging polyester value chain integration, and Eastman Chemical Company (United States) with chemical manufacturing expertise, collectively representing approximately 50-60% market concentration.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Form

By Application

By End User Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author