- Executive Summary

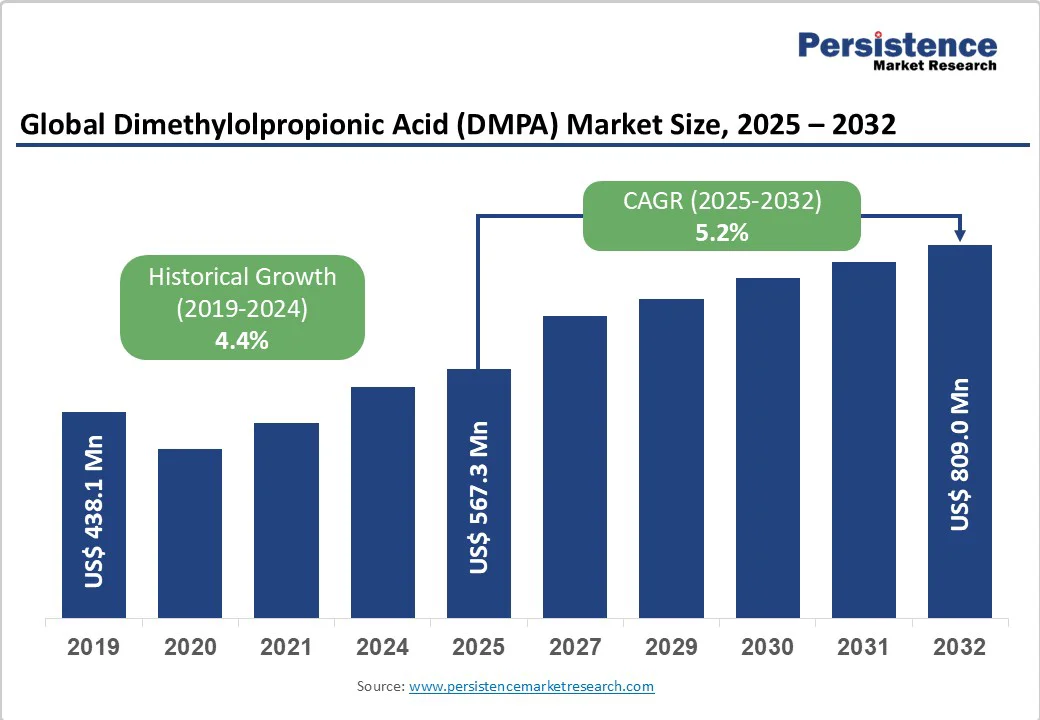

- Global Dimethylolpropionic Acid (DMPA) Market Snapshot 2025 and 2032

- Market Opportunity Assessment, 2025-2032, US$ Mn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Construction Industry Overview

- Global Automotive Industry Overview

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 – 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: Product Type

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Product Type, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- Market Attractiveness Analysis: Product Type

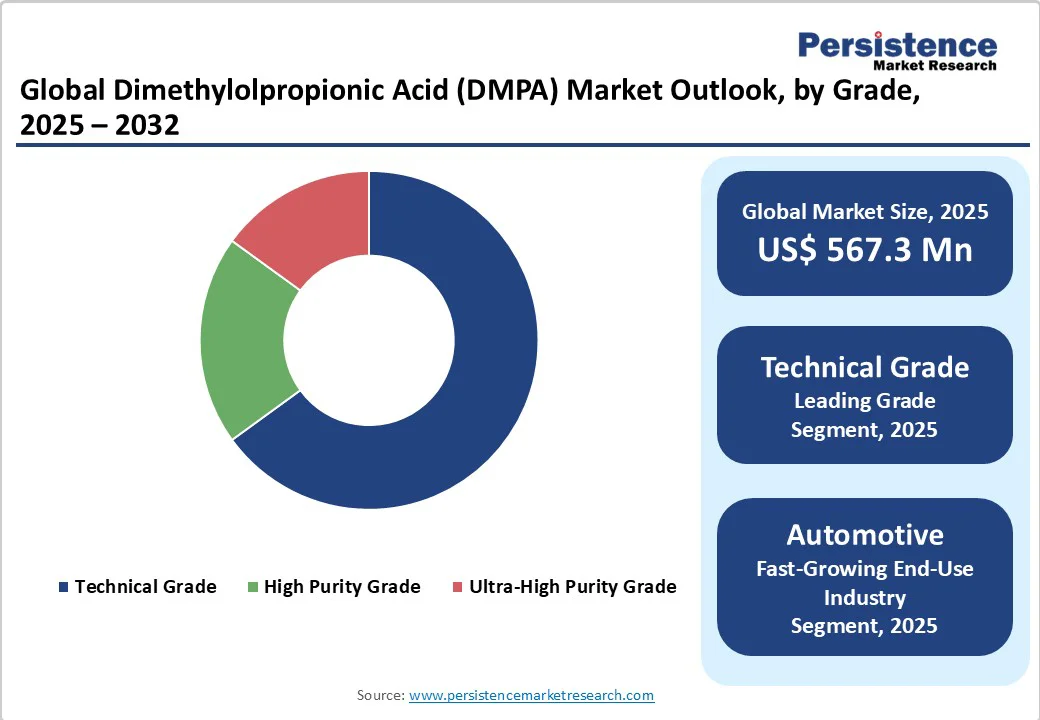

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: Grade

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Grade, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- Market Attractiveness Analysis: Grade

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Application, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- Market Attractiveness Analysis: Application

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: End-Use Industry

- Introduction/Key Findings

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by End-Use Industry, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- Market Attractiveness Analysis: End-Use Industry

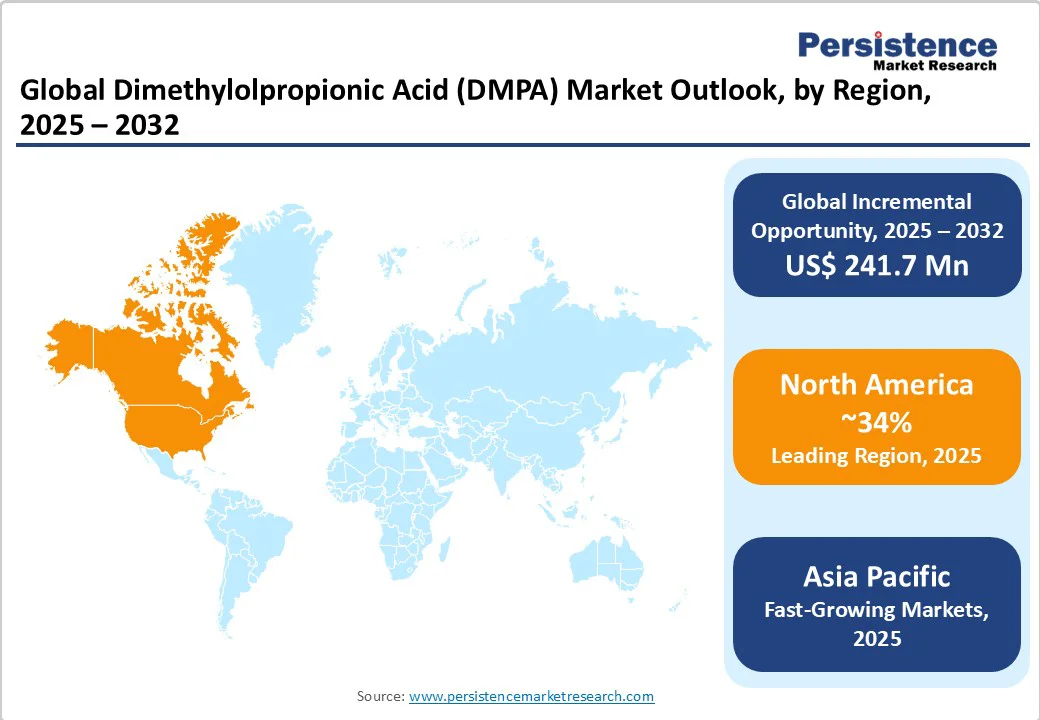

- Global Dimethylolpropionic Acid (DMPA) Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Units) Analysis by Region, 2019-2024

- Current Market Size (US$ Mn) and Volume (Units) Forecast, by Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- U.S.

- Canada

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- North America Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- Europe Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- Europe Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- East Asia Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- East Asia Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- South Asia & Oceania Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- South Asia & Oceania Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- Latin America Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- Latin America Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- Middle East & Africa Dimethylolpropionic Acid (DMPA) Market Outlook: Historical (2019 – 2024) and Forecast (2025 – 2032)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2025-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Product Type, 2025-2032

- Polyurethane Dispersions

- Resins

- Powder Coatings

- Electrodeposition Coatings

- Others

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Grade, 2025-2032

- Technical Grade

- High Purity Grade

- Ultra-High Purity Grade

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by Application, 2025-2032

- Coatings

- Adhesives & Sealants

- Textiles & Synthetic Fibers

- Glass Fiber Sizing

- Wood Finishes & Laminates

- Others

- Middle East & Africa Market Size (US$ Mn) and Volume (Units) Forecast, by End-Use Industry, 2025-2032

- Automotive

- Construction & Wood Products

- Industrial & Protective Coatings

- Textile & Apparel

- Electronics & Electrical

- Consumer Goods & Furniture

- Others

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Geo Specialty Chemicals, Inc.

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Perstorp Specialty Chemicals AB

- Henan Fianfu Chemical Ltd.

- Jiangxi Nancheng Hongdu Chemical Technology Development Co., Ltd.

- Shenzhen Vtolo Chemicals Co. Ltd.

- Lemman Laboratories International Co.,Ltd

- Biosynth Carbosynth

- Yigyooly Enterprise Limited

- Jiangxi Selon Industrial Co.,Ltd.

- Wacker Chemie AG

- BASF

- Lanxess

- Dow Chemical Company

- Celanese Corporation

- Arkema SA

- Geo Specialty Chemicals, Inc.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment