ID: PMRREP33141| 220 Pages | 20 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

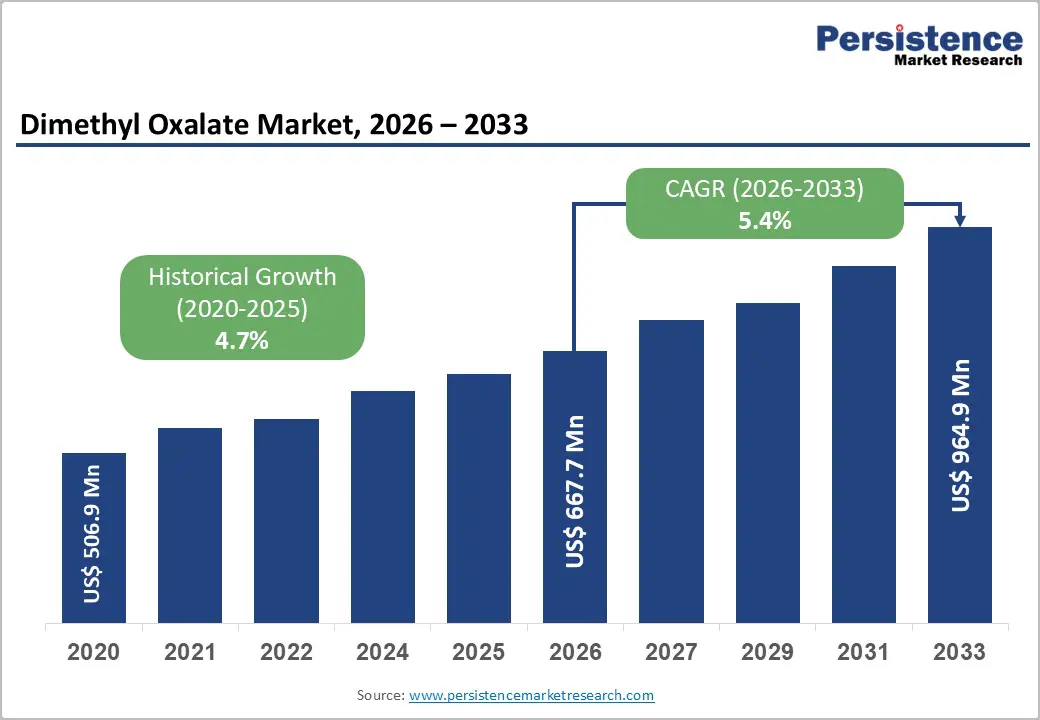

The global dimethyl oxalate market size is likely to be valued at US$ 667.7 million in 2026 and is expected to reach US$ 964.9 million by 2033, growing at a CAGR of 5.4% during the forecast period from 2026 to 2033. This expansion is primarily fueled by the increasing demand for pharmaceutical and agrochemical intermediates, as well as the rising need for specialized solvents and plasticizers in various industries.

| Key Insights | Details |

|---|---|

|

Dimethyl Oxalate Market Size (2026E) |

US$ 667.7 Million |

|

Dimethyl Oxalate Market Value Forecast (2033F) |

US$ 964.9 Million |

|

Projected Growth CAGR(2026-2033) |

5.4% |

|

Historical Market Growth (2020-2025) |

4.7% |

The global pharmaceutical and agrochemical industries have become the primary consumers of dimethyl oxalate, significantly driving market growth. Pharmaceutical manufacturers are increasing production of antiretroviral drugs, steroids, and barbiturates, which has boosted demand for dimethyl oxalate as a critical intermediate. In parallel, the agrochemical sector relies heavily on dimethyl oxalate for synthesizing pesticides, herbicides, and fungicides that enhance crop yields and protect agricultural output. This dual-sector dependence is creating steady and long-term demand growth.

In 2025, Merck’s announced the positive Phase 3 trial results for its investigational HIV treatment DOR/ISL. The U.S. FDA’s acceptance of the NDA, with a target action date of April 28, 2026, highlights the accelerating pace of advanced drug development. Islatravir’s complex synthesis requires specialized intermediates such as dimethyl oxalate, reinforcing its importance. Merck’s collaboration with Gilead on injectable formulations further strengthens demand for pharmaceutical-grade intermediates, directly supporting dimethyl oxalate market expansion.

Growing emphasis on green chemistry is strongly supporting the dimethyl oxalate market, as regulators and industries shift toward cleaner and more sustainable production methods. Dimethyl oxalate is increasingly researched for use in environmentally friendly industrial processes, including bio-based chemical production and direct oxidation fuel cells. Governments and multinational corporations are investing heavily in R&D to develop low-emission alternatives, positioning dimethyl oxalate as a preferred option due to its comparatively low toxicity and reduced environmental impact.

This transition is clearly reflected in UBE Corporation’s February 2025 groundbreaking ceremony for its DMC and EMC manufacturing plant in Louisiana. The facility will use UBE’s proprietary gas-phase nitrite process, which delivers lower energy consumption, fewer by-products, and superior quality. With planned production of 100,000 tons of DMC and 40,000 tons of EMC annually starting November 2026, the project demonstrates how dimethyl oxalate–derived products are enabling sustainable growth in battery, energy storage, and electric vehicle applications.

Dimethyl oxalate is classified as a corrosive chemical and requires strict handling and safety protocols, which creates regulatory challenges for manufacturers. Compliance with guidelines set by authorities such as the U.S. EPA and the European Chemicals Agency increases production complexity and costs. Regulatory approval processes can delay product launches and slow market entry, particularly for new or smaller producers. Manufacturers must invest in specialized storage, transportation, and disposal systems to meet safety standards, adding operational burdens.

These requirements can be especially challenging for small and medium enterprises with limited capital resources. Additionally, evolving environmental and occupational safety regulations require continuous monitoring and compliance upgrades. While these measures are essential for worker and environmental protection, they can restrict supply expansion and discourage new entrants. As a result, stringent regulatory frameworks remain a key restraint on the overall growth of the dimethyl oxalate market.

Despite its valuable chemical properties, dimethyl oxalate remains a niche product with relatively low awareness among end-users. Many industries continue to rely on traditional solvents and intermediates that are well-established, cost-effective, and integrated into existing manufacturing processes. This preference limits the adoption of dimethyl oxalate, particularly in price-sensitive markets. Additionally, the availability of substitute chemicals with similar functional performance further restricts market penetration.

End-users may be reluctant to shift to dimethyl oxalate due to perceived switching costs, limited technical familiarity, or insufficient supplier outreach. In emerging economies, lack of technical knowledge and training further constrains adoption. These factors collectively slow demand growth and prevent dimethyl oxalate from achieving wider commercial use. Overcoming this restraint will require targeted awareness initiatives, technical support, and cost-competitive offerings from manufacturers.

The pharmaceutical industry is increasingly exploring new applications for dimethyl oxalate in advanced drug development, including integrase inhibitors and next-generation therapies. Its flexibility as both a solvent and intermediate enables innovation in high-value API synthesis and specialty chemical manufacturing. Research into its use in direct oxidation fuel cells and other emerging technologies further expands its commercial potential.

In 2025, Thermo Fisher Scientific’s October 2025 partnership with OpenAI, which integrates AI capabilities into its Accelerator Drug Development platform. This collaboration enhances drug development efficiency across small molecules, biologics, and cell and gene therapies. With over 700 completed pharmaceutical programs across 14 therapeutic areas, Thermo Fisher supports rapid innovation for biotech firms requiring specialized intermediates. As AI-driven drug development accelerates clinical timelines, demand for high-purity chemical building blocks like dimethyl oxalate is expected to rise, opening new revenue opportunities for manufacturers.

Emerging economies such as India, China, and Brazil are experiencing rapid industrialization, creating strong demand for pharmaceutical and agrochemical intermediates. Government incentives, increased healthcare spending, and expanding agricultural output are supporting this growth. HefeiTNJ Chemical Industry Co. Ltd.’s 2025 expansion of pharmaceutical-grade production highlights this trend, particularly its focus on India’s fast-growing API market. The commissioning of advanced purification and crystallization facilities reflects rising quality standards among emerging-market manufacturers.

India’s pharmaceutical intermediate demand is projected to grow at a 6% CAGR through 2035, driven by backward integration strategies and expanding generic drug production. Asia-Pacific’s pharmaceutical chemicals market is expected to exceed USD 120 billion by 2027, further strengthening demand for locally sourced intermediates. HefeiTNJ’s expansion across Central Asia, the Middle East, and South America demonstrates how emerging economies are becoming key growth engines for the global dimethyl oxalate market.

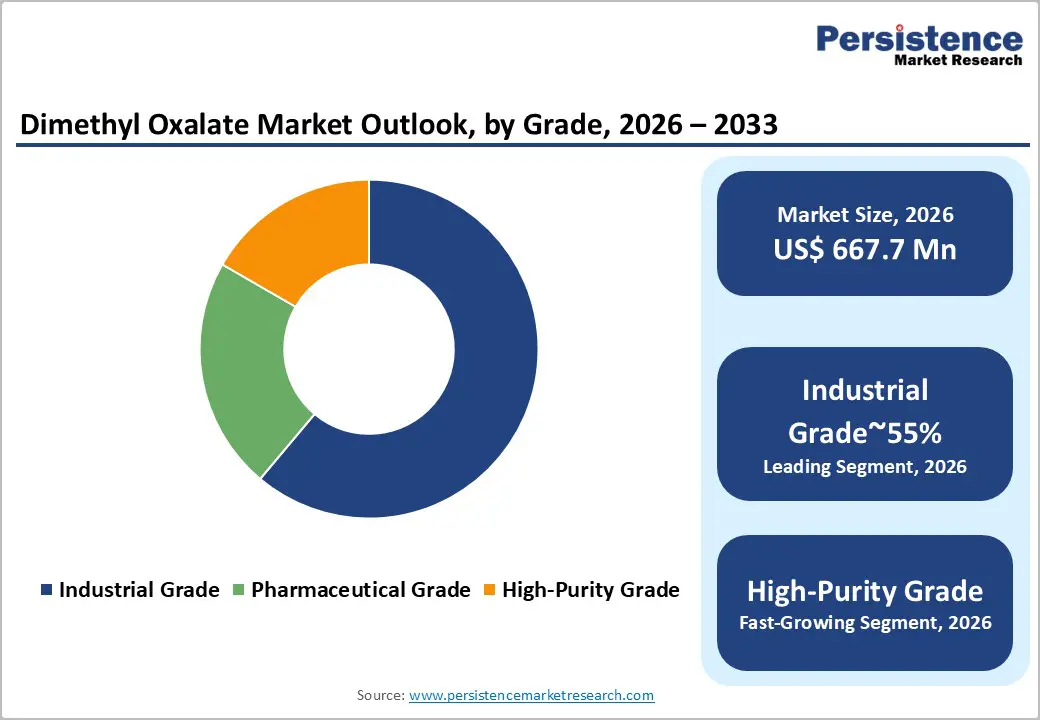

The Industrial Grade segment dominates the dimethyl oxalate market, accounting for approximately 55% of total demand. This leadership is driven by its extensive use in bulk chemical manufacturing, plastics, and agrochemical applications. Industrial-grade dimethyl oxalate offers a cost-effective solution for large-scale production, making it the preferred choice for manufacturers focused on volume and efficiency. Its suitability for multiple industrial processes further strengthens its market position.

At the same time, demand for pharmaceutical and high-purity grades is steadily increasing. Stricter quality standards in pharmaceutical manufacturing, laboratory research, and specialty chemical production are pushing manufacturers to invest in advanced purification technologies. As regulatory requirements continue to tighten, the premium segment is expected to grow faster, although industrial grade will remain the volume leader due to its widespread industrial use.

Pharmaceutical intermediates represent the largest application segment, accounting for approximately 45% of the dimethyl oxalate market. This dominance is driven by rising production of antiretroviral drugs, steroids, oncology treatments, and other advanced pharmaceuticals. Increasing R&D investments and global demand for HIV and cancer therapies continue to support growth. Dimethyl oxalate plays a critical role in synthesizing complex APIs, making it essential for pharmaceutical manufacturing.

The agrochemical intermediates segment is also expanding rapidly, supported by the growing need for pesticides and herbicides to improve agricultural productivity. As global food demand rises, agrochemical manufacturers are increasing output, further boosting dimethyl oxalate consumption. Together, these application segments form the backbone of market demand and are expected to sustain long-term growth.

The pharmaceutical industry is the largest end-user of dimethyl oxalate, accounting for approximately 40% of total consumption. Demand is driven by the need for high-quality APIs and specialty intermediates used in drug synthesis. Continuous expansion of pharmaceutical manufacturing capacity, especially in emerging markets, supports this trend. The agrochemical industry is another major consumer, particularly in regions with intensive agricultural activity.

Dimethyl oxalate is widely used in producing crop protection chemicals that enhance yields and reduce losses. Additional demand comes from textiles, metal fabrication, and other industrial sectors, where dimethyl oxalate is used as a solvent and processing aid. Although these segments represent a smaller share, they contribute to overall market stability and diversification.

Direct sales dominate the dimethyl oxalate market, accounting for approximately 60% of total distribution. Large manufacturers and industrial buyers prefer direct supplier relationships to ensure consistent quality, reliable supply, and customized solutions. Direct sales also enable long-term contracts and better price negotiation for bulk purchases. This channel is particularly important for pharmaceutical and agrochemical companies that require strict quality compliance.

Indirect sales channels, including distributors and agents, play a key role for small and medium enterprises and laboratory buyers. These customers value flexibility, smaller order volumes, and quicker access to products. While indirect sales account for a smaller share, they help expand market reach and improve accessibility, especially in regional and emerging markets.

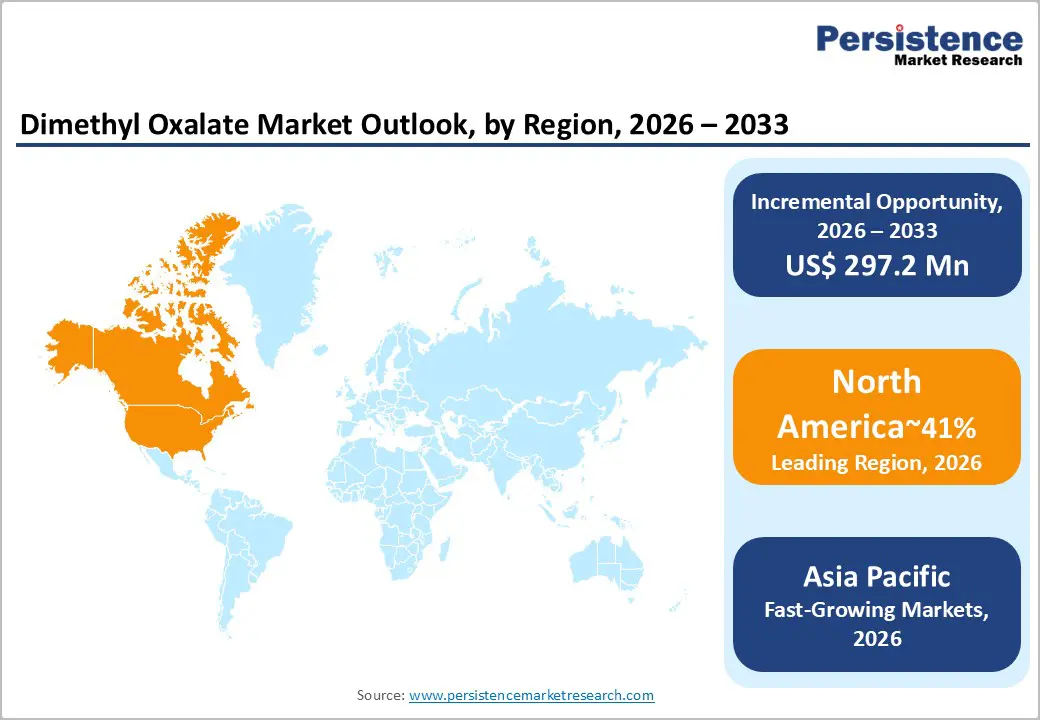

North America leads the dimethyl oxalate market, supported by strong pharmaceutical and chemical industries, advanced R&D infrastructure, and a robust regulatory environment. The United States remains the largest contributor, driven by investments in sustainable chemistry and specialty chemical manufacturing.

In November 2026, the plant will produce DMC and EMC using a low-emission, high-efficiency gas-phase nitrite process. This investment establishes a domestic supply chain for battery and semiconductor chemicals while reducing import dependence. The project also reflects North America’s focus on sustainability, innovation, and skilled job creation. Collaboration between chemical manufacturers and pharmaceutical companies continues to drive product innovation and market growth across the region.

Europe holds a significant share of the global dimethyl oxalate market, led by Germany, the U.K., and France. The region’s stringent environmental and quality regulations encourage adoption of sustainable and high-purity chemicals. Continuous R&D investments and the presence of global pharmaceutical leaders strengthen demand. Merck KGaA’s €300 million Advanced Research Center in Darmstadt highlights Europe’s commitment to pharmaceutical innovation.

Scheduled to begin operations in early 2027, the facility will focus on mRNA, antibodies, and biotechnological manufacturing solutions. These advanced research activities require specialized chemical intermediates, including dimethyl oxalate. Europe’s harmonized regulatory framework also facilitates cross-border trade, supporting market stability and long-term growth.

Asia Pacific is the fastest-growing region in the dimethyl oxalate market, driven by rapid industrialization, government support, and expanding pharmaceutical manufacturing. China leads as the largest producer and exporter, supported by large-scale capacity expansions and rising R&D investment. India is emerging as a key market due to growth in pharmaceuticals and agriculture. Sinopec’s US$40.9 billion purchasing agreements at CIIE 2025 reflect the region’s expanding chemical supply chain.

Rising production of ethylene, synthetic resins, and polymers further supports intermediate demand. HefeiTNJ Chemical’s expansion across Asia, the Middle East, and South America demonstrates strong regional integration. Competitive manufacturing costs, skilled labor, and supportive policies position Asia as a global hub for dimethyl oxalate production.

The global dimethyl oxalate market is moderately consolidated, with leading players controlling nearly one-third of global revenue. Companies such as UBE Corporation, Merck KGaA, Connect Chemical GmbH, Nanjing Chegyi Chemical, and HefeiTNJ Chemical Industry are strengthening their positions through strategic partnerships, R&D investments, and geographic expansion. Product quality, technological innovation, and regulatory compliance remain key competitive differentiators. Many players are also adopting sustainable manufacturing practices to meet evolving customer and regulatory expectations. Emerging business models focus on customized solutions for pharmaceutical and agrochemical clients, as well as environmentally friendly production methods. This competitive environment supports innovation while maintaining steady market growth.

The global Dimethyl Oxalate market is valued at US$ 667.7 Million in 2026 and is expected to reach US$ 964.9 Million by 2033.

Key drivers include rising demand from pharmaceutical and agrochemical industries, technological advancements, and global shifts toward sustainable chemical production.

The Industrial Grade segment holds the largest market share, accounting for approximately 55% of total demand.

Asia Pacific is the largest market, driven by rapid industrialization and strong manufacturing bases in China and India.

Expansion of novel applications in pharmaceuticals, specialty chemicals, and emerging economies offers significant growth potential.

Key players include UBE Corporation, Merck KGaA, Connect Chemical GmbH, Nanjing Chegyi Chemical Co. Ltd., HefeiTNJ Chemical Industry Co. Ltd., and others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Grade

By Application

By Industry

By Distribution Channel

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author