ID: PMRREP11260| 201 Pages | 24 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

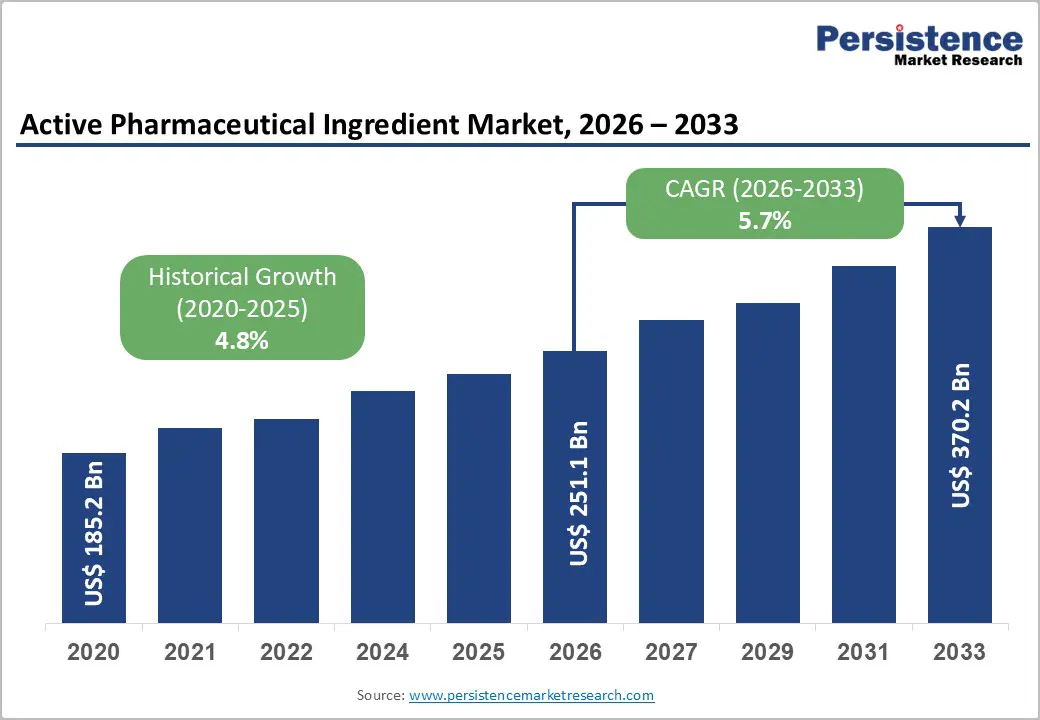

The global active pharmaceutical ingredient market is estimated to grow from US$ 251.1 Bn in 2026 to US$ 370.2 Bn by 2033. The market is projected to record a CAGR of 5.7% during the forecast period from 2026 to 2033.

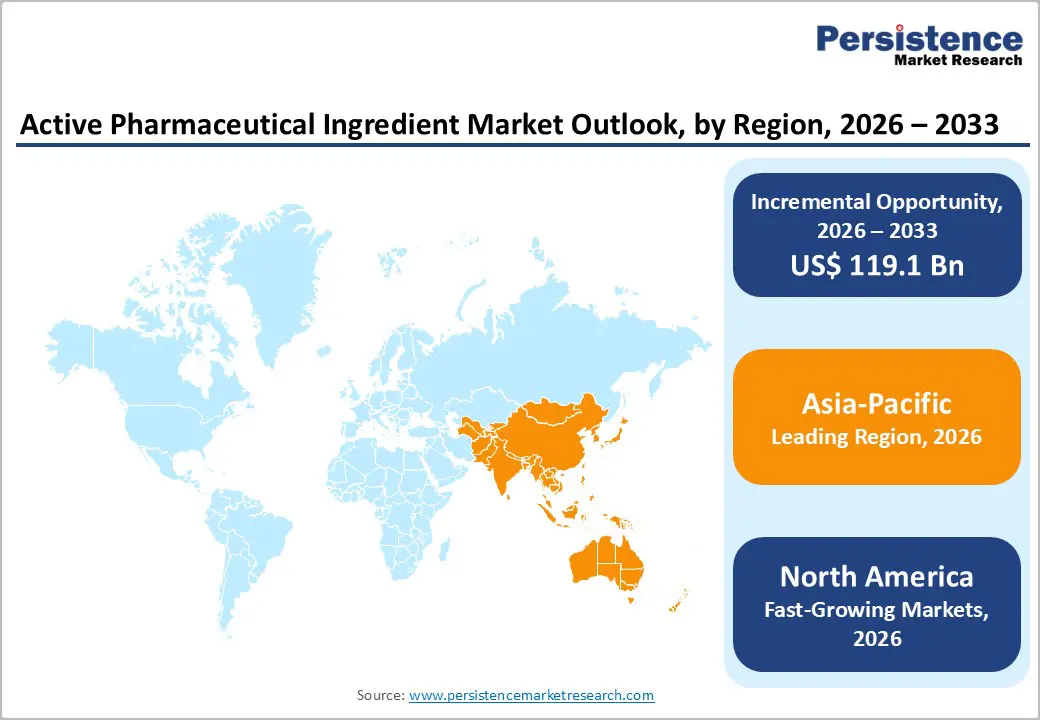

The global active pharmaceutical ingredient market is growing steadily, driven by rising pharmaceutical production, increasing generic drug demand, and expanded outsourcing. North America leads due to strong manufacturing capabilities, strict regulatory compliance, and high R&D investments. Asia-Pacific is the fastest-growing region, supported by cost advantages, expanding manufacturing capacity, government support, and growing healthcare demand.

| Global Market Attributes | Key Insights |

|---|---|

| Global Active Pharmaceutical Ingredient Market Size (2026E) | US$ 251.1 Bn |

| Market Value Forecast (2033F) | US$ 370.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.8% |

The increasing global burden of chronic diseases is a major driver for the Active Pharmaceutical Ingredient (API) market. Noncommunicable diseases (NCDs) such as cardiovascular disease, cancer, diabetes, and chronic respiratory conditions are responsible for about 74 percent of deaths worldwide, with at least 43 million people dying from these conditions in 2021 alone. This high disease burden sustains demand for therapeutic drugs and the APIs that constitute them.

Chronic conditions like diabetes illustrate this trend: the number of adults living with diabetes has surged to approximately 828 million worldwide, up from 200 million in 1990, and accounts for significant morbidity and healthcare expenditure. Such prevalence directly translates to higher demand for APIs used in chronic disease medications, supporting sustained expansion of global API production and supply chains.

API manufacturing involves complex, highly regulated chemical synthesis processes requiring specialized facilities, cleanrooms, and strict regulatory compliance. Establishing an API production plant demands significant capital outlay; pharmaceutical companies often outsource API production to mitigate these costs rather than build in-house capacity.

Operational costs also remain high due to stringent Good Manufacturing Practice (GMP) standards, quality control, and ongoing regulatory compliance. Cost of goods sold (COGS) for pharmaceutical producers can exceed 30 percent of revenue, and pressures to reduce manufacturing cost have led many firms to outsource to lower-cost regions or invest in automation to lower labour intensiveness and improve cost efficiency.

High-potency active pharmaceutical ingredients (HPAPIs) present a strong opportunity for the API market due to rising demand for targeted precision therapies. According to the U.S. FDA, oncology drugs consistently account for the largest share of new drug approvals each year, with cancer therapies representing over 30% of novel drugs approved in recent years. Many of these treatments rely on highly potent molecules that require specialized API manufacturing, directly increasing demand for HPAPIs.

This opportunity is further reinforced by advances in biologics, antibody–drug conjugates (ADCs), and hormone-based therapies. The U.S. National Cancer Institute reports more than 1.9 million new cancer cases annually in the United States alone, driving sustained demand for potent, low-dose therapeutics. HPAPIs enable precise targeting with reduced systemic toxicity, making them critical for modern drug pipelines. As a result, pharmaceutical companies increasingly rely on specialized API manufacturers and CDMOs with containment and regulatory expertise.

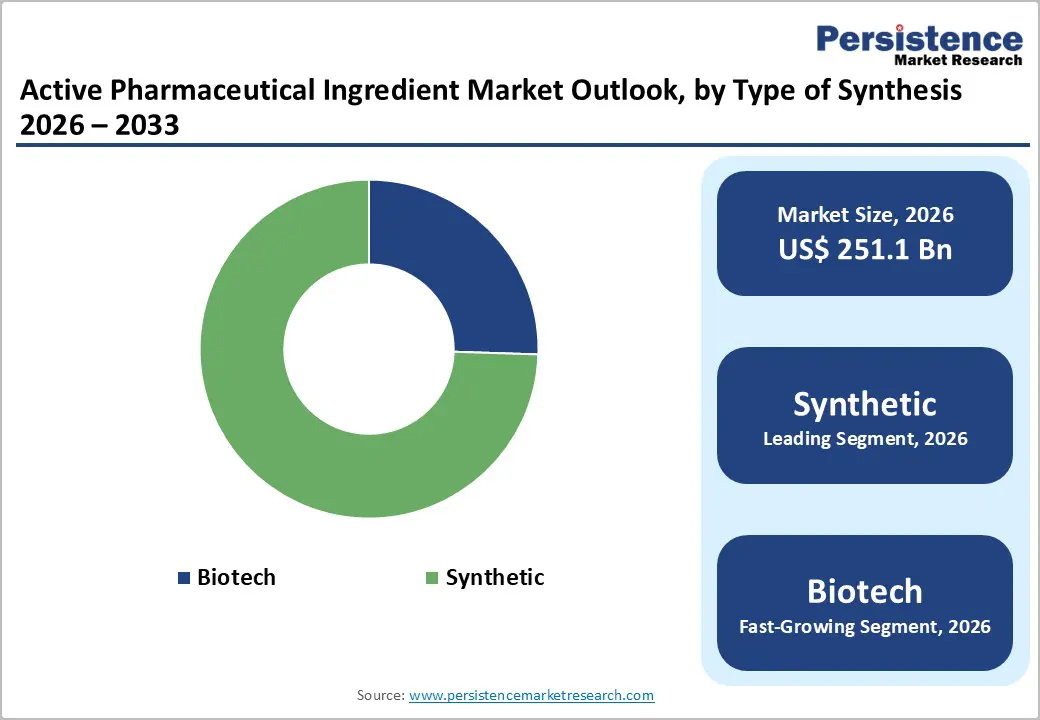

Synthetic APIs occupies 74.5% share of the global market in 2025, because the vast majority of medicines worldwide are chemically synthesized small-molecule drugs rather than biologics. Synthetic APIs account for roughly 70–80 percent of global API usage, driven by their application in high-volume therapeutic areas such as cardiovascular, diabetes, anti-infective, and central nervous system drugs that are essential in public health systems. Many core essential medicines used globally are based on synthetic small molecules, supported by well-developed, scalable chemical synthesis infrastructure that delivers consistent quality at lower cost and with streamlined regulatory pathways. This broad applicability and cost efficiency underpin the dominance of synthetic APIs in global pharmaceutical supply.

The merchant API manufacturing model dominates because pharmaceutical companies increasingly outsource active ingredient production. Merchant manufacturers, third-party API producers including contract development and manufacturing organizations (CDMOs) provide cost-efficient, scalable production without the need for pharmaceutical firms to invest in expensive in-house facilities or complex regulatory compliance systems. Outsourcing allows companies to focus internal resources on core strengths such as research, development, and marketing while accessing specialized expertise and quality systems from external manufacturers. This model is especially prevalent among small and mid-sized drug firms and generics producers, reinforcing the merchant segment’s share of the API landscape.

Asia-Pacific dominates the active pharmaceutical ingredient market with 42.4% share in 2025, because countries such as China and India produce a substantial share of world APIs, especially generics and bulk drugs. Reliable industry analysis indicates Asia Pacific accounts for more than 60 percent of global API production, with China alone historically controlling roughly 40 percent of global API volume and India contributing significantly to global generic drug and API supply. This scale derives from large manufacturing capacity, low production costs, and widespread regulatory compliance improvements, enabling competitive export pricing and high-volume supply to markets in North America and Europe. Domestic government support, including manufacturing incentives and regulatory modernization, further strengthens the region’s manufacturing ecosystem.

Europe remains strategically important in the API market due to its advanced regulatory environment, high technical expertise, and emphasis on pharmaceutical quality and innovation. European regulators, such as the European Medicines Agency (EMA), enforce stringent Good Manufacturing Practice (GMP) standards and harmonized quality requirements that are internationally respected, supporting safe and effective API production. Although much API manufacturing has shifted to Asia, Europe still maintains significant manufacturing capacity for complex and high-value APIs and is a hub for downstream pharmaceutical R&D and biotech innovation. The pharmaceutical sector in the EU contributes substantial value added and invests heavily in R&D relative to other industries, reflecting deep scientific and industrial capabilities.

North America is emerging as the fastest-growing region in the API market due to expanding domestic investment in pharmaceutical manufacturing, strategic regulatory initiatives, and rising demand for innovative and complex therapies. In response to supply chain vulnerabilities highlighted during the COVID-19 pandemic, U.S. policies, including efforts to accelerate domestic generic drug reviews and build a Strategic Active Pharmaceutical Ingredients Reserve, aim to strengthen local API production. Government focus on supply-chain resilience encourages new manufacturing capacity and faster regulatory pathways for domestically produced APIs. Growing biotech development, chronic disease prevalence, and a shift toward reshoring key pharmaceutical production underpin above-average growth in North America’s API sector.

Leading active pharmaceutical ingredient market companies focus on scalable manufacturing, process optimization, and strict regulatory compliance. Investments in advanced synthesis technologies, continuous manufacturing, and quality analytics improve yield, consistency, and safety. Strategic partnerships, integrated supply chains, and capacity expansion support reliable API supply for generic, branded, and specialty pharmaceutical production globally.

The global active pharmaceutical ingredient market is projected to be valued at US$ 251.1 Bn in 2026.

Rising chronic diseases, growing generic drug demand, outsourcing, patent expirations, and stringent regulatory compliance drive growth.

The global active pharmaceutical ingredient market is poised to witness a CAGR of 5.7% between 2026 and 2033.

Expansion of high-potency APIs, biologics, contract manufacturing, continuous production, and growth in emerging pharmaceutical markets.

AbbVie Inc., Albemarle Corporation, Aurobindo Pharma, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Cipla Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type of Synthesis

By Type of Manufacturer

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author