ID: PMRREP35724| 198 Pages | 14 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

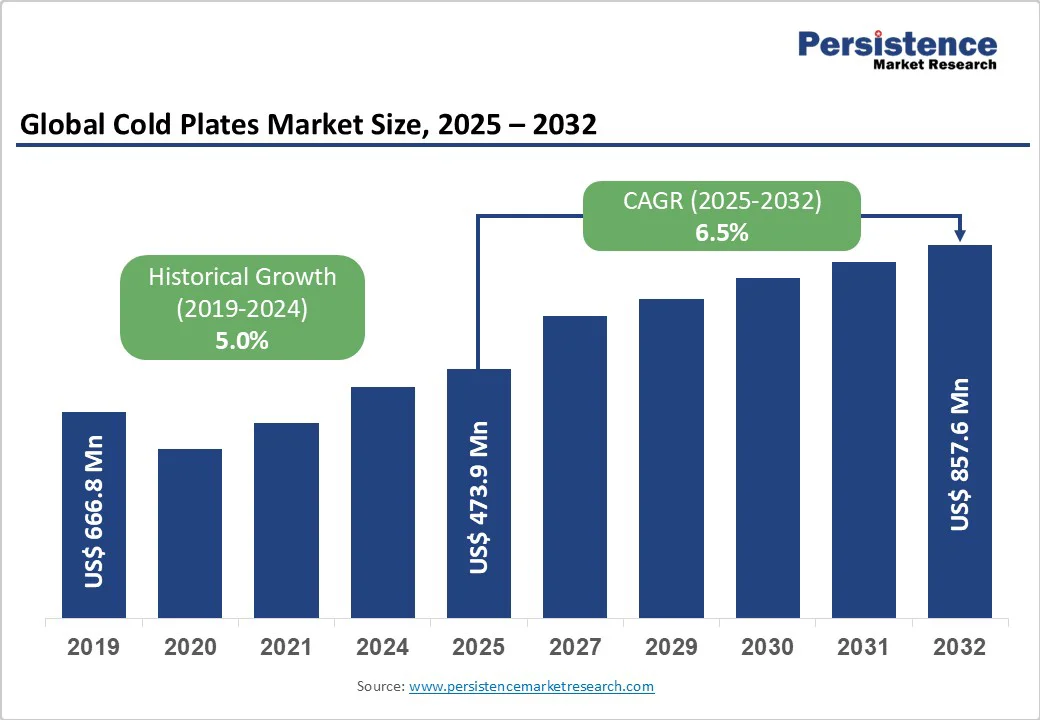

The global cold plates market size is likely to be valued at US$473.9 Mn in 2025 and is projected to reach US$857.6 Mn by 2032, growing at a CAGR of 6.5% between 2025 and 2032.

As electronic systems become increasingly compact and powerful, the need for efficient heat dissipation technologies has intensified, positioning cold plates as critical components in modern cooling infrastructure.

The market's robust growth trajectory reflects the growing integration of liquid cooling systems in data centers, electric vehicles, aerospace applications, and industrial equipment, where traditional air cooling methods prove inadequate.

| Key Insights | Details |

|---|---|

| Cold Plates Market Size (2025E) | US$473.9 Million |

| Market Value Forecast (2032F) | US$857.6 Million |

| Projected Growth CAGR(2025-2032) | 6.5% |

| Historical Market Growth (2019-2024) | 5.0% |

The electric vehicle (EV) industry is a major growth driver for the cold plates market, primarily due to the need for effective battery thermal management systems. These cooling plates are crucial for maintaining battery temperatures between 20 °C and 40°C and ensuring uniformity within 5°C, thereby preventing thermal runaway and extending battery life.

According to the International Energy Agency (IEA), global EV sales jumped 108% in 2021, highlighting the rising demand for thermal management solutions. Cold plates utilize liquid cooling technology, which has a much better heat transfer coefficient (100-20,000 W/m²·K) compared to air cooling (25-250 W/m²·K).

As fast-charging and extended driving ranges become increasingly important, advanced thermal management systems are essential for dissipating the heat generated during high-power charging, thereby ensuring battery performance and safety.

The exponential growth of data centers, particularly those supporting AI and high-performance computing, is driving a high demand for advanced cooling solutions, such as cold plates. In 2014, data centers used approximately 70 billion kWh of electricity, and this usage is projected to rise with increasing computational demands by 2030.

Cold plates can provide a 30-50% reduction in cooling energy consumption compared to traditional air conditioning by enabling direct heat removal and precise temperature control. This technology enables achieving Power Usage Effectiveness (PUE) ratios below 1.3, a key requirement for modern efficiency standards.

The implementation of cold plate cooling systems requires significant upfront capital investment compared to traditional air cooling solutions, creating a barrier to adoption, particularly among cost-sensitive applications and smaller organizations. Cold plate systems necessitate additional infrastructure, including pumps, heat exchangers, coolant distribution units, and monitoring systems, which substantially increases the initial system cost and complexity.

The specialized expertise required for design, installation, and maintenance of liquid cooling systems adds to the total cost of ownership, as organizations must invest in training personnel or hiring specialized technicians familiar with liquid cooling technologies.

Additionally, the risk of fluid leaks and potential damage to sensitive electronic components raises concerns that necessitate comprehensive leak detection systems and containment measures, thereby further increasing system complexity and costs. These factors can make the return on investment period longer compared to simpler air cooling solutions, despite the superior long-term performance and energy efficiency benefits.

The cold plates market faces significant challenges due to the lack of standardized interfaces and compatibility protocols across different manufacturers and applications, creating integration difficulties for end users. The diversity of coolant types, including water-based coolants, dielectric fluids, glycol mixtures, and specialized refrigerants, requires careful consideration of material compatibility and system design to prevent corrosion or performance degradation.

Different manufacturing processes, such as vacuum brazing, friction stir welding, and machined construction, yield varying performance characteristics and connection requirements, thereby complicating system integration efforts.

The absence of universal quick-disconnect standards, although companies such as Parker Hannifin are working to establish industry standards, including the Universal Quick Disconnect (UQD) Series, limits interoperability between components from different suppliers.

These compatibility challenges can lead to vendor lock-in situations and increased maintenance costs, as replacement parts and system upgrades may require specific manufacturer components rather than standardized alternatives.

The healthcare and medical device sector presents significant growth opportunities for the cold plate market, driven by the need for effective thermal management in advanced medical equipment. Devices like MRI machines, CT scanners, and surgical lasers generate substantial heat, requiring precise cooling solutions that comply with hygiene standards and ensure reliability in critical applications.

Cold plates excel in managing hotspots and preventing overheating while maintaining temperature uniformity within ±2°C. The demand for lightweight and efficient cooling solutions is increasing with the trend toward portable medical devices. Additionally, the rise of telemedicine is driving the need for compact devices that require sophisticated thermal management.

The integration of cold plates with emerging technologies such as 3D printing, additive manufacturing, and AI-driven thermal optimization presents a significant opportunity for performance enhancement. Additive manufacturing enables the creation of complex internal geometries, resulting in cold plates with enhanced thermal performance and reduced weight. Fujikura’s development of stacked cold plates showcases how innovative designs can cut thermal resistance by over 20%.

AI and machine learning enhance thermal optimization by accurately identifying heat signatures and directing coolant flow more effectively. Additionally, smart cold plate systems with IoT sensors enable predictive maintenance and performance monitoring, adding value for data centers and industrial applications. Hybrid cooling solutions that combine cold plates with other thermal management technologies offer new possibilities in space-constrained environments.

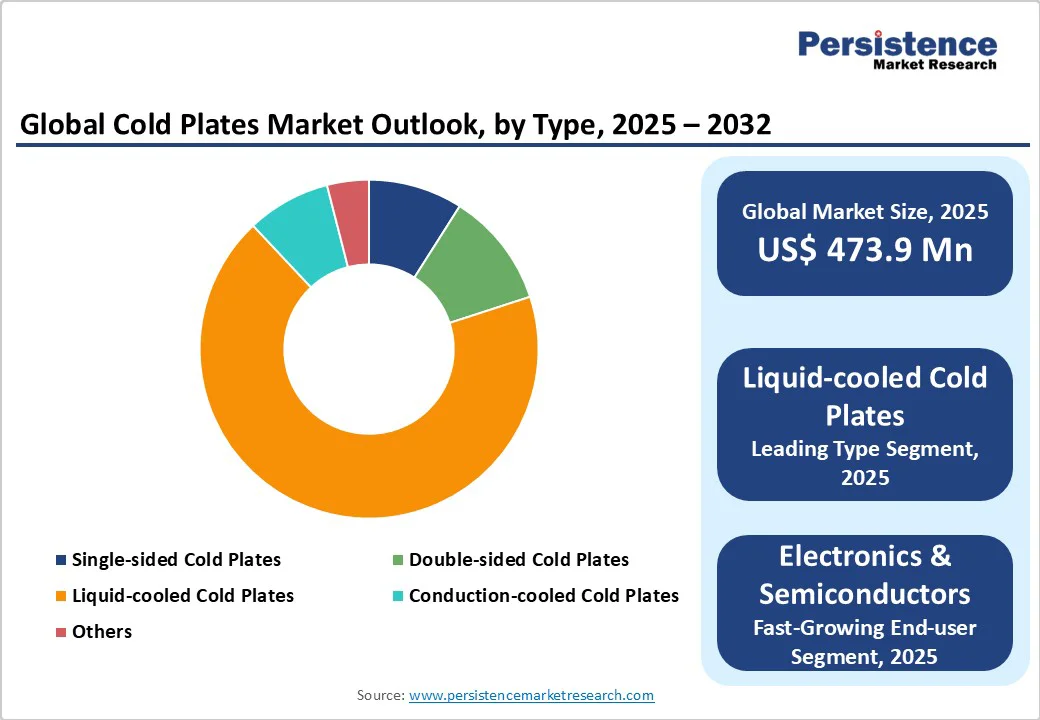

Liquid-cooled cold plates are likely to account for 68% share due to their superior thermal management capabilities, particularly in high-performance applications. They offer heat transfer coefficients ranging from 100-20,000 W/m²·K, significantly outperforming air cooling’s 25-250 W/m²·K.

This efficiency makes them ideal for compact, high-density environments such as data centers, enabling Power Usage Effectiveness (PUE) ratios below 1.3 through direct chip cooling. Their versatility accommodates various coolants, including water, dielectric fluids, and glycol mixtures, tailored for different applications.

Recent advancements, such as Microsoft's microfluidics, demonstrate three times better heat removal than traditional methods. Additionally, the adoption of liquid cooling is increasing in electric vehicles for battery thermal management, maintaining optimal temperatures between 20-40°C during fast charging.

Aluminum cold plates dominate, accounting for 45% share, owing to their ideal balance of thermal conductivity, weight, and cost. With a thermal conductivity of 237 W/m·K, aluminum offers excellent heat transfer and is significantly lighter than copper, making it perfect for aerospace, automotive, and portable electronics applications.

Its corrosion resistance and compatibility with various coolants further enhance its appeal, especially for vacuum-brazed and friction stir-welded designs. Aluminum cold plates are often used in electric vehicles, designed with thicknesses under 15mm to efficiently cool batteries. Recent advancements, including 3D printing, allow for more complex internal geometries while maintaining cost-effectiveness.

Vacuum-brazed cold plates dominate the market with around 40% share, representing the premium tier in high-performance applications that demand exceptional reliability and thermal performance. This technology creates strong metallurgical bonds in a vacuum, eliminating flux contamination and enabling thermal conductivity and pressure resistance up to 100 bars.

It allows for intricate internal geometries, maximizing surface contact with cooling fluids and reducing thermal resistance by over 20% compared to traditional designs. Manufacturers like Fujikura, Boyd Corporation, and Lytron use this technology for critical systems such as supercomputers, aerospace avionics, and high-power electronics. Its batch processing capabilities ensure high-volume production while maintaining stringent quality standards.

Water-based coolants hold a dominant 55% market share in the fluid segment, thanks to their exceptional thermal properties, including a high specific heat capacity of 4.18 J/g°C, making them significantly more effective than air for heat transport. Their leadership is attributed to superior thermal conductivity, widespread availability, and compatibility with cold plate materials when treated for corrosion and biological growth.

Deionized water is preferred in electronics cooling for its non-conductivity and thermal transfer, while glycol mixtures offer extended temperature ranges (-40°C to 107°C) for harsh environments. Continuous innovation in coolant formulations includes specialized fluids for extreme applications and dielectric fluids for electrical isolation.

Water-based coolants are crucial in data centers, enabling efficient direct liquid cooling systems, and the push for eco-friendly formulations is further supporting their market leadership.

Electronics & semiconductors hold the largest share at approximately 42%, fueled by the semiconductor industry's demand for advanced thermal management solutions to achieve higher power densities.

This sector includes high-performance computing, AI processors, and power electronics that produce heat fluxes over 250 W/cm², necessitating liquid cooling for reliable operation. The limitations of traditional air cooling have accelerated the adoption of cold plates, which allow for direct-to-chip cooling and maintain junction temperatures effectively.

Breakthroughs like Advanced Cooling Technologies' cold plates, capable of over 7.5 kW power dissipation, showcase this technology's potential for next-gen processors.

The segment is also supported by the growth of data centers for cloud computing and AI, with liquid cooling systems projected to grow at over 16% CAGR in the coming decade. Major tech companies such as Microsoft, Google, and IBM are leading the deployment of liquid cooling, driving cost reductions and standardization in the industry.

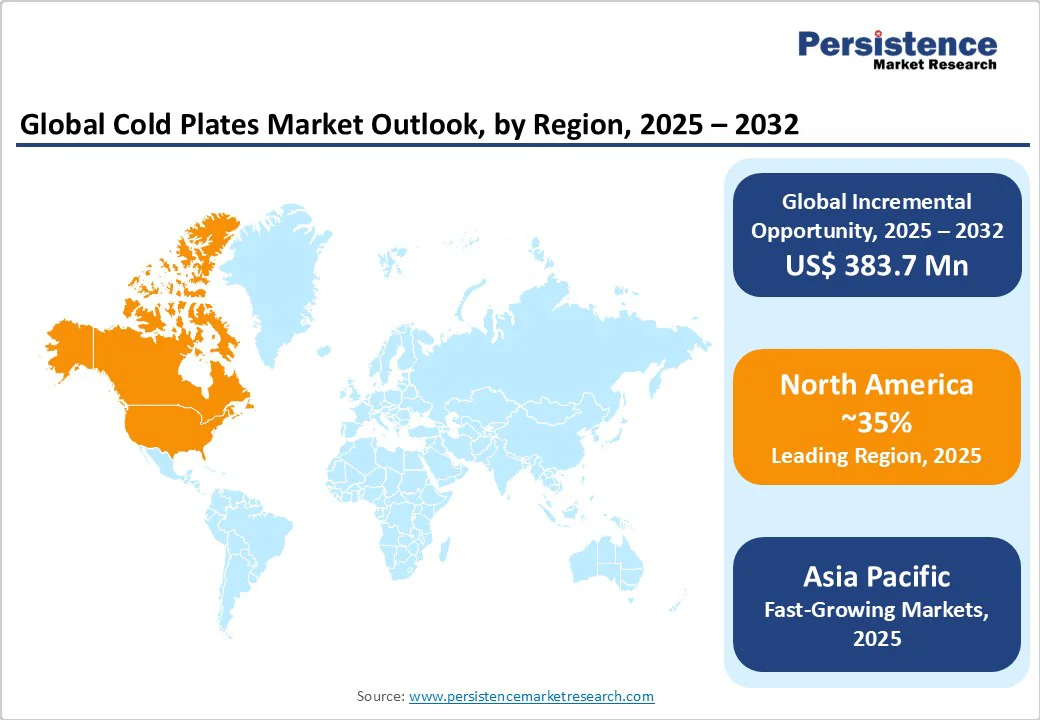

North America maintains market leadership with approximately 35% global market share, driven by the region's advanced technology infrastructure, significant investments in data center expansion, and robust adoption of electric vehicle technologies.

The United States leads regional growth through substantial government incentives for clean energy technologies and electric vehicle adoption, with the Inflation Reduction Act providing significant funding for domestic battery manufacturing and thermal management technology development.

The region's market dominance is reinforced by the presence of major technology companies, including Microsoft, Google, and Amazon, that are driving liquid cooling adoption in hyperscale data centers to manage increasing AI workloads and high-performance computing demands.

Asia Pacific demonstrates the highest growth potential with a leading share and is projected to exceed 50% by 2028, driven by massive electric vehicle production, expanding data center infrastructure, and significant government investments in clean technology.

China dominates regional market development through its position as the world's largest electric vehicle market and substantial domestic manufacturing base for cold plates and thermal management systems. The Chinese government's New Energy Vehicle mandate requires 40% of new car sales to be electric by 2030, creating unprecedented demand for battery cooling systems utilizing cold plate technology.

Europe represents a leading share, driven by aggressive environmental regulations, substantial electric vehicle market growth, and significant investments in renewable energy infrastructure. The European Union's Green Deal and Fit for 55 package mandate substantial reductions in greenhouse gas emissions, creating strong regulatory support for electric vehicle adoption and energy-efficient cooling technologies in data centers.

Germany leads regional market development through its automotive industry's transition to electric vehicles, with manufacturers such as BMW, Mercedes-Benz, and Volkswagen investing heavily in battery thermal management systems that rely on cold plate technologies.

The global cold plates market has a moderately fragmented competitive structure, featuring established players and emerging technology firms. Key industry leaders such as Boyd Corporation, Parker Hannifin, Sanhua Holding, and Fujikura collectively hold about 45-50% share, driven by comprehensive product portfolios and global manufacturing capabilities.

The landscape is shaped by continuous technological innovation, with significant investments in research and development for advanced manufacturing techniques such as vacuum brazing and additive manufacturing.

Strategic growth initiatives include facility expansions and acquisitions such as Schneider Electric's $850 million investment in Motivair Corp. Market leaders distinguish themselves through vertical integration, proprietary technologies, and comprehensive thermal management solutions beyond individual cold plate components.

The Cold Plates Market is valued at US$ 473.9 million in 2025 and is projected to reach US$ 857.6 million by 2032, growing at a CAGR of 6.5% during the forecast period.

Key demand drivers include the rapid expansion of electric vehicle battery cooling applications requiring thermal management systems, growing data center infrastructure supporting AI workloads, and increasing adoption of high-power electronics generating heat fluxes exceeding 250 W/cm².

Liquid-cooled cold plates represent the leading segment with approximately 68% market share, driven by superior thermal performance achieving heat transfer coefficients of 100-20,000 W/m²·K compared to traditional air cooling methods.

North America dominates the market with 35% share in 2025.

The healthcare and medical device sector presents significant growth opportunities through expanding applications in MRI machines, CT scanners, surgical lasers, and diagnostic equipment requiring precise thermal management with quiet operation capabilities.

Leading companies include Boyd Corporation, Parker Hannifin Corporation, Sanhua Holding Group, Fujikura Ltd., Lytron, Aavid Thermalloy, AMS Technologies, and emerging players such as Advanced Cooling Technologies and JetCool Technologies.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Material

By Design/Technology

By Fluid Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author