ID: PMRREP35472| 148 Pages | 9 Jul 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

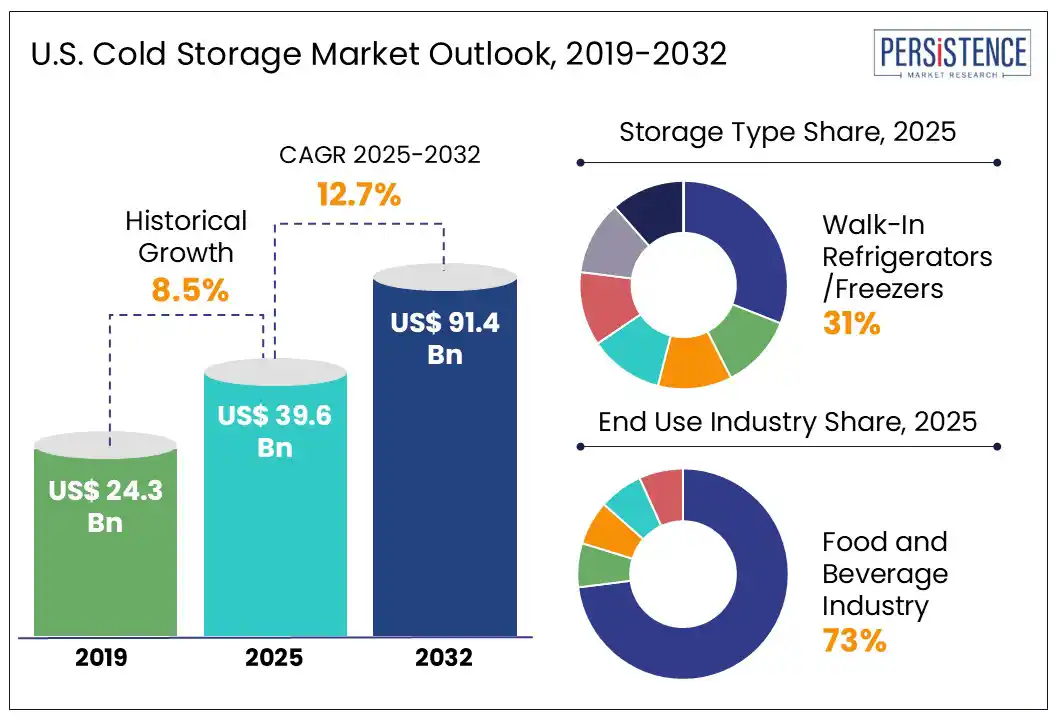

The U.S. cold storage market size is likely to be valued at US$ 39.6 Bn in 2025 and is expected to reach US$ 91.4 Bn by 2032, growing at a CAGR of 12.7% during the forecast period from 2025 to 2032.

According to the Persistence Market Research report, cold storage market in the U.S. is evolving rapidly due to shifting consumer preferences for fresh, healthy, and locally sourced foods. Demand for meal kits, organic produce, and dairy is pushing operators to expand and enhance temperature-controlled storage. This shift is accompanied by rising expectations for food safety, transparency, and sustainability.

To meet these needs, facilities are adopting automation and energy-efficient solutions, including advanced temperature controls, automated picking systems, and carbon reduction technologies like LED lighting and solar panels. With urban land scarcity, companies are also investing in micro-fulfillment centers in cities and suburbs to reduce transit time and enhance delivery speed.

For instance, companies like Sunshine Solar Cold Storage in Florida, and Aldelano Solar Solutions in Tennessee, are leading innovation and path to sustainability in cold storage market with their fully solar powered cold warehousing solutions.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

U.S. Cold Storage Market Size (2025E) |

US$ 39.6 Bn |

|

Market Value Forecast (2032F) |

US$ 91.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

12.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

14.1% |

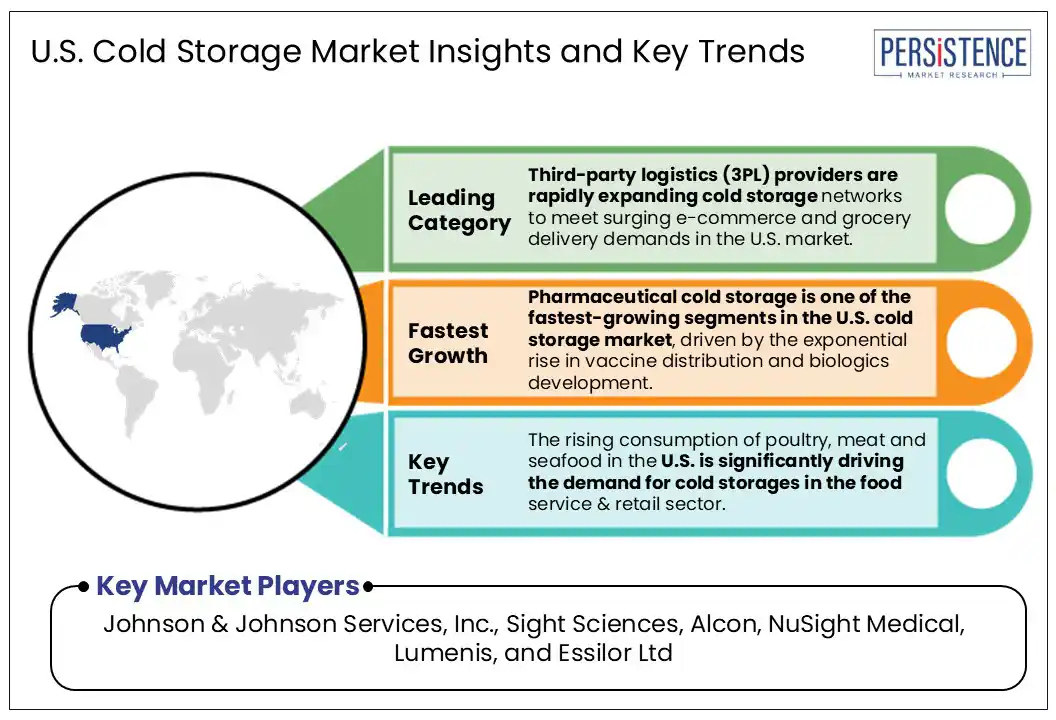

The rising consumption of poultry, meat and seafood in the U.S. is significantly driving the demand for cold storages in the food service & retail sector. In particular, the walk-in freezers which are highly preferred for this applications have seen increased demand in the country.

According to the USDA, an average U.S. resident consumes 224.6 pounds of meat including beef, pork, broilers, and turkey annually. Similarly, the U.S. per capita seafood consumption reached 20 pounds per year for the first time in 2021, showing significant growth in the U.S. Seafood Market during the past years. The recent data from USDA reveals that the poultry sector in the U.S. worth more than US$ 75 Bn.

The surging demand for these products in the U.S. has turned the food service and retail operators to explore cold storage facilities and logistic options for safer and un-contaminated movement of goods. In the coming years, as the protein demand continue rising, the expansion of cold storage infrastructure will thrive in the U.S.

The development and expansion of the cold storage facilities in the U.S. are hindered by the high construction and operating costs. Building a new cold storage warehouse in the U.S. costs between US$ 250 to US$ 350 per square foot, which is atleast 2 times more expensive than conventional dry warehouses.

Cold storage requires specialized insulation panels, under-roof heating, high ceilings, rooftop refrigeration system and backup power infrastructure. At present, the average refrigerated warehouse in the U.S. uses 24.9 kWh per square foot of energy every year, making it 4 times higher than the conventional warehouse.

As a consequence, the high upfront Capex and persistent Opex make speculative builds risky, requiring long-term leases and deterring new entrants, ultimately restricting rapid expansion in the U.S. cold storage market.

The U.S. cold-storage market is witnessing a noticeable shift towards increased use of automation and robotics for efficient and scalable operations. Adopting automation and robotics offers compelling productivity and cost-saving benefits. For example, integrating autonomous forklifts and mobile robots can increase operational efficiency by up to 40-50% and achieve labor cost reductions of 30-40% within five years, often with payback periods around six months.

The warehouse automation not only significantly reduces errors in the operation but also achieves 99.9% order accuracy rate compared to manual operation, thereby reducing product spoilage and waste. An automated cold-storage system also enhances space utilization, and could cut the energy usage by 66%, minimizing environmental impact. With visible inflation and rising labor cost in the U.S., the automated and robot-operated cold storage market will emerge as scalable, resilient and profitable option for the cold storage market players.

Pharmaceutical cold storage is one of the fastest-growing segments in the U.S. cold storage market, driven by the exponential rise in vaccine distribution and biologics development. The U.S. pharmaceutical logistics market is projected to reach US$43 Bn by 2032 with a significant growth rate of 8.4%, where cold-chain logistics is estimated to acquire a dominant market share. The rising demand for vaccines, drugs, small molecule biologics and other medical products that require cold conditions and specialized storage compartments is fueling the demand for pharmaceutical-grade cold storage from healthcare industry.

In 2022, medicines requiring cold storage accounted for 35% of the pharmaceutical market, up from 26% in 2017. This upward trajectory is expected to continue, with nearly half of all new drugs launched over the next five years anticipated to require cold storage and distribution, driven by the growing prominence of biologics and other temperature-sensitive therapies.

Ultra-cold logistics surged during the COVID-19 vaccine rollout, demonstrating the necessity for robust cold-chain infrastructure. As demand for mRNA vaccines, monoclonal antibodies, and cell therapies rises, pharmaceutical-grade cold storage capacity is rapidly expanding across the U.S., making it a pivotal growth driver in the industry.

Third-party logistics (3PL) providers are rapidly expanding cold storage networks to meet surging e?commerce and grocery delivery demands in the U.S. market. the U.S. E-commerce grocery sales have surged to around US$ 9.8?billion monthly as of April 2025, representing a 15% year-over-year increase, while May’s numbers showed 27% annual growth, reaching US$ 8.7?billion. This growth has spurred demand for localized refrigerated facilities, enabling same? and next?day delivery of fresh goods.

Consequently, supermarket chains and meal?kit services increasingly outsource operations to 3PLs with temperature?controlled warehouses, reducing their capital exposure. Leading providers like Lineage and Americold have built extensive networks, adding over 18?million square feet of space since 2019. As consumer expectations intensify, 3PLs are central to scalable, flexible cold chain logistics.

Texas

Texas is the leading cold storage market in the U.S., with around 231 million cubic feet of storage capacity. The market is driven by significant growth in population and the online grocery sector. Key players such as Americold are investing in the Texas cold storage market to reinforce leadership in retail and 3PL networks.

Georgia

Georgia is a Southeast cold storage hotspot, expanding over 500,000?sq?ft near Savannah’s Port, which grew 11% in refrigerated capacity to 2.2?million?sq ft in 2023. Vertical Cold Storage added a 350,000?sq.?ft. facility with blast-freezing near the port, strengthening import-export cold chain capability.

Florida

Florida’s booming tourism and e-grocery markets are the key demand drivers for decentralized cold storage in the state. The rising penetration of online grocery (about 13% in 2021 to more than 20% by 2025) supported by continuous investments for cold storage by market participants, is fostering market growth from a demand-supply perspective. For example, Construction continues near Miami and Orlando, supported by (Commercial Real Estate Services) CBRE’s projection of 100 millionsq.ft. of new cold space nationwide in five years.

California

As America’s largest food producer, California leads cold storage development. CBRE estimates ~396?million sq.ft. industrial cold space, with strong growth from egrocery and fresh?produce logistics concentrated in Los Angeles and the Central Valley.

Louisiana

Louisiana’s New Orleans Cold Storage operates four USDA certified port-based facilities totaling over 15 million cubic feet, with blast-freezing capacity exceeding 1.2 million lbs/day, crucial for meat and seafood exports via the Mississippi River.

The peer competition in the U.S. cold storage market is moving towards consolidation with significant capacity expansion from leading market participants. The industry giants are not only focusing on building new facilities but also strategically acquiring small firms to gain larger share of the market. For instance, in April 2025, Lineage Logistics, the leading cold storage company in the U.S. and global market, announced an agreement to acquire and take over operations of 4 existing cold storage warehouses (approx. 49 million cubic feet cumulative capacity) and related assets of Tyson Foods for US$247 Mn.

The companies are targeting and designing cold storage warehouses according to their business and end-customers. Some companies focus on retail & e-commerce, while others focus on logistics and industrial sectors. Partnerships between cold storage construction companies and logistic support providers is becoming a common trend in the U.S. market. For instance, in April 2025, Americold began constructing a cold storage facility at Port Saint John, partnering with CPKC and DP World to strengthen North American cold chain logistics and intermodal connectivity.

The U.S. cold storage market is estimated to be valued at US$ 39.6 Bn in 2025.

Growing consumption of poultry, meat, and seafood in the U.S. is the key demand driver for cold storage market.

In 2025, Southwest U.S. dominates the market with ~34% share in the U.S. cold storage market.

Among End-use Industry, demand from Pharmaceuticals & Healthcare segment is expected to grow rapidly at 14.3% CAGR from 2025-2032.

Lineage Logistics, Americold, US Cold Storage, Inc., Interstate Warehousing, Inc., and FreezPak Logistics are the leading players in U.S. cold storage market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Units |

Value: US$ Mn, Volume: cubic ft. |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Storage Type

By Application

By Ownership

By End-use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author