ID: PMRREP35423| 189 Pages | 19 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

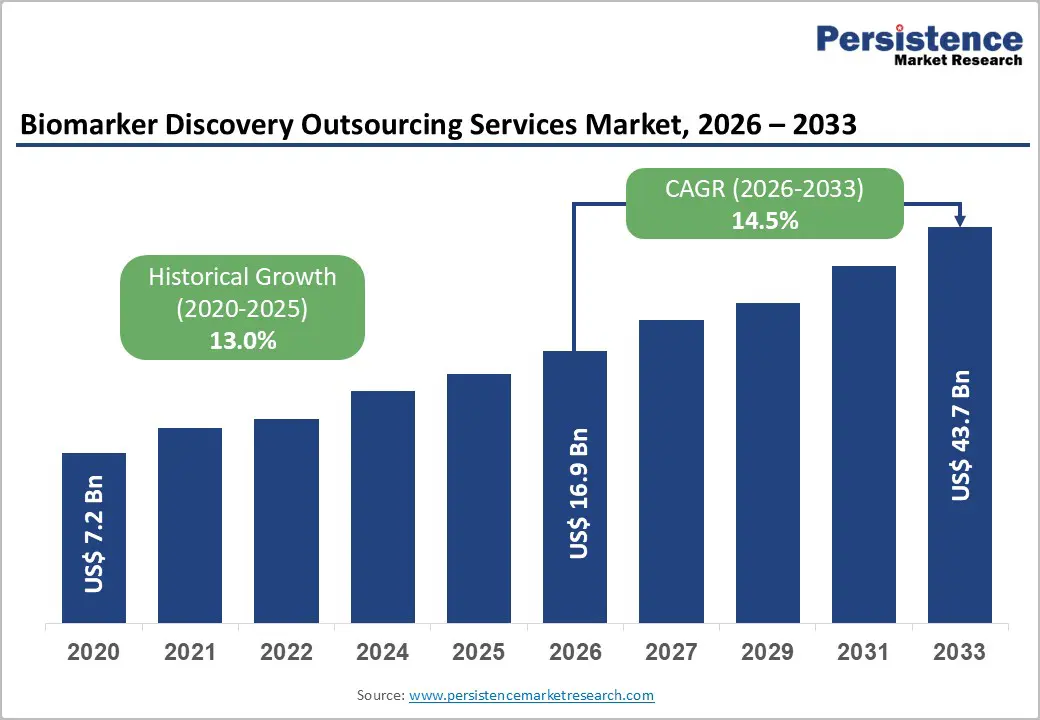

The global biomarker discovery outsourcing services market is estimated to grow from US$ 16.9 Bn in 2026 to US$ 43.7 Bn by 2033. The market is projected to record a CAGR of 14.5% during the forecast period from 2026 to 2033.

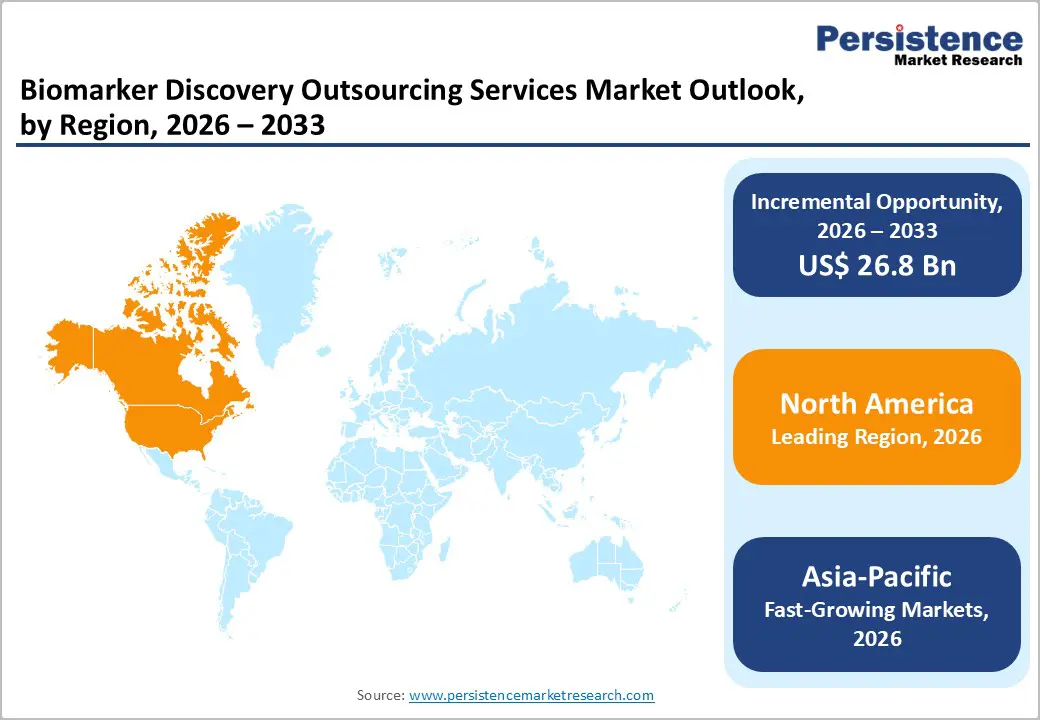

The global biomarker discovery outsourcing services market is growing steadily, driven by expanding use of healthcare analytics, digital platforms, and data-driven research models. North America leads due to strong research infrastructure and regulatory frameworks. Asia-Pacific is the fastest-growing region, supported by healthcare expansion, government initiatives, rising clinical trial activity, and increased investments in outsourced biomarker testing services.

| Key Insights | Details |

|---|---|

| Biomarker Discovery Outsourcing Services Market Size (2026E) | US$ 16.9 Bn |

| Market Value Forecast (2033F) | US$ 43.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 14.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 13.0% |

The global push toward personalized medicine is anticipated to propel the biomarker discovery outsourcing services market growth as it requires multi-layered, sophisticated data generation and analysis capabilities that most biotech and pharmaceutical companies lack in-house. Personalized therapies rely on the integration of metabolomic, proteomic, and genomic data to identify specific patient subgroups, requiring innovative platforms and specialized personnel. This demand is met by outsourcing firms equipped with AI-backed analytics, regulatory-grade validation protocols, and high-throughput sequencing technologies.

The surging demand is further augmented by the shift toward multi-analyte biomarker panels, which are increasingly required for companion diagnostics. Several companies are actively extending their biomarker innovation network through strategic collaborations with diagnostic and bioanalytical firms. For example, AstraZeneca collaborated with ANGLE for liquid biopsy assay development. It has collaborated with Roche to co-develop digital pathology algorithms for biomarker identification.

Strict regulatory compliance is predicted to create bottlenecks in next-generation biomarker discovery outsourcing. Regulatory agencies, including the European Medicines Agency and the U.S. Food and Drug Administration (FDA), now require biomarker assays to meet analytical validation standards equivalent to those for commercial diagnostics. This increases the operational burden on outsourcing firms, many of which lack ISO 15189-accredited or CLIA-certified laboratories capable of generating such compliant data across global trial sites. The Tufts Center for the Study of Drug Development has highlighted regulatory challenges as significant impediments in the development of personalized medicine and biomarker programs.

Global variation in regulatory expectations further complicates outsourcing workflows. The European Union’s In Vitro Diagnostic Regulation (IVDR), for instance, requires extensive clinical evidence and quality documentation for biomarker assays used in trials. Service providers and CROs have had to restructure their biomarker pipelines to accommodate these requirements, resulting in increased time-to-initiation and backlogs in assay development.

The surging complexity of personalized medicine biomarker research is creating significant opportunities for outsourcing partners by augmenting biopharma companies to seek specialized capabilities they cannot maintain internally. As the industry moves beyond single-analyte biomarkers to multi-omic, spatial biomarkers, the technical and computational demands have increased. For example, spatial transcriptomics requires high-end imaging platforms and AI-backed bioinformatics pipelines. CROs, including Veranome Biosystems and Genospace, are capitalizing on this trend by offering spatial multi-omics as a service.

Biomarker discovery involves real-world data, decentralized patient monitoring, and longitudinal bio-sample repositories. These require logistical and data integration expertise beyond conventional lab capabilities. It is pushing demand for outsourcing firms that manage cross-disciplinary workflows. For example, Thermo Fisher Scientific’s Olink Explore Platform was selected for the U.K. Biobank Pharma Proteomics Project to analyze over 5,400 proteins from 600,000 samples to enhance disease prediction and treatment.

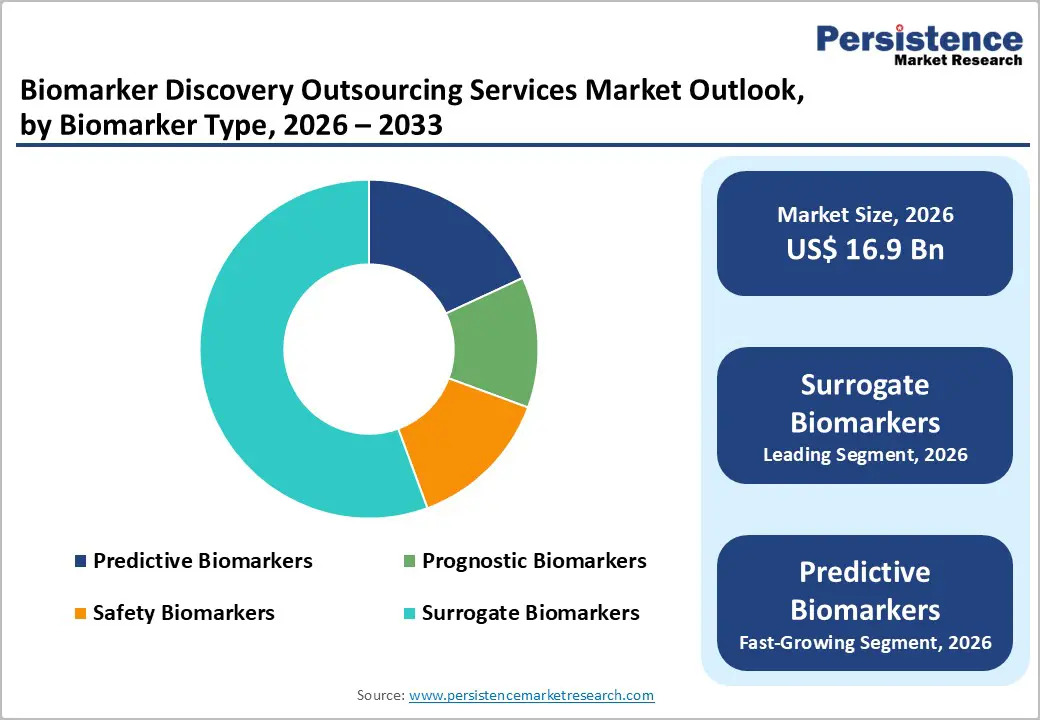

By biomarker type, the market is divided into predictive, prognostic, safety, and surrogate biomarkers. Out of these, the surrogate biomarkers segment will likely account for a 55.3% share in 2025 due to their ability to obtain quick regulatory approvals and clinical validation, primarily in therapeutic areas where direct clinical endpoints are difficult to measure. For example, in oncology drug development, surrogate biomarkers such as Tumor Mutational Burden (TMB) or circulating tumor DNA (ctDNA) are increasingly used as proxies for disease progression. This shift has gained impetus owing to regulatory agencies, including the FDA, recognizing surrogate endpoints under novel approval programs.

Predictive biomarkers, on the other hand, are expected to witness a significant CAGR from 2026 to 2033, owing to their ability to directly inform treatment decisions and stratify patient populations for targeted therapies. These factors determine the likelihood of a patient responding to a specific therapeutic intervention, which is crucial for pharmaceutical sponsors seeking to enhance drug efficacy and minimize trial attrition. In 2024 alone, more than 70% of all new oncology trials registered on ClinicalTrials.gov used predictive biomarkers for patient selection, showcasing their surging relevance in outsourced trial designs.

Based on therapeutic area, the market is segregated into oncology, cardiology, neurology, and autoimmune diseases. Among these, the oncology segment is predicted to account for approximately 34.6% of the biomarker discovery outsourcing services market share in 2025, backed by its high clinical heterogeneity and the increasing reliance on personalized therapies that require biomarker-based patient stratification. Cancer diagnostics mainly depend on molecular signatures, including immune profiles, protein expressions, or gene mutations. This makes biomarker discovery essential for drug development.

Autoimmune diseases are likely to exhibit average growth through 2032 amid their complex and overlapping symptom profiles, which make early diagnosis and treatment selection challenging. Autoimmune disorders such as multiple sclerosis and rheumatoid arthritis involve systemic immune dysregulation, requiring multi-dimensional biomarker panels for effective differentiation. As per a new study, the outsourcing of biomarker discovery in autoimmune conditions surged by 28% year-over-year in 2024, highlighting rising demand for transcriptomic analysis and multiplex cytokine profiling.

North America dominates the biomarker discovery outsourcing services market with 44.7% share in 2025, because it remains the global hub for clinical research and drug development, supported by substantial public and private investments in biomedical R&D. The United States conducts around 31 % of all registered clinical trials worldwide and hosts the highest number of studies, with over 145,000 listed on ClinicalTrials.gov as of late 2023, reflecting deep research activity and infrastructure. Government and institutional funding, such as billions annually from the National Institutes of Health (NIH) furthers advanced biomarker and precision medicine research, incentivizing pharmaceutical and biotechnology firms to outsource discovery services to specialized providers in the region. These factors collectively sustain North America’s leadership in both innovation and outsourcing demand.

Europe is an important region in the biomarker discovery outsourcing services market because it combines a significant share of global clinical research activity with strong public investment and collaborative scientific infrastructure. The European Union spent USD 412 billion on R&D in 2023, reflecting robust funding that supports precision medicine, oncology, and biomarker research across member states. This extensive R&D base fosters extensive collaboration among pharmaceutical companies, contract research organizations, universities, and public research initiatives. Europe also accounts for a substantial portion of global clinical trials, with regions like Germany, the United Kingdom, and France serving as research hubs, and benefits from harmonized regulatory frameworks such as those promoted by the European Medicines Agency, enhancing clinical research and outsourcing demand.

Asia-Pacific is the fastest-growing region in the biomarker discovery outsourcing services market because it has rapidly expanded its role in global clinical research and biomedical innovation, supported by strong government initiatives and increasing R&D expenditure. Between 2020 and mid-2025, six key APAC countries, including China, India, Japan, South Korea, Australia, and Singapore collectively hosted nearly 40,000 clinical trials, underscoring the region’s scale and attractiveness for drug development research. China alone accounted for more than 25,000 trials in that period. Governments are also streamlining regulatory approvals and incentivizing biotechnology R&D, while precision medicine investments surge, exemplified by the Asia-Pacific precision medicine market projected to grow substantially by 2034. These trends boost demand for outsourced biomarker discovery services across the region.

Leading biomarker discovery outsourcing services market companies emphasize advanced analytics, AI-driven platforms, and integrated service offerings. Focus areas include data interoperability, regulatory compliance, and workflow efficiency. Investments in genomics, proteomics, and multi-omics technologies enhance discovery accuracy, while collaborations with biopharmaceutical firms, CROs, and academic institutions accelerate clinical translation and global adoption.

The global biomarker discovery outsourcing services market is projected to be valued at US$ 16.9 Bn in 2026.

Rising biopharmaceutical R&D, precision medicine adoption, complex clinical trials, advanced analytics, and AI-driven biomarker discovery.

The global biomarker discovery outsourcing services market is poised to witness a CAGR of 14.5% between 2026 and 2033.

Predictive biomarkers, multi-omics integration, AI-driven analysis, oncology research, CRO partnerships, emerging markets, and digital health expansion.

Laboratory Corporation of America Holdings, Celerion, Charles River Laboratories, Eurofins Scientific, GHO Capital, ICON plc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Biomarker Type

By Therapeutic Area

By Discovery Phase

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author