ID: PMRREP33612| 200 Pages | 30 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

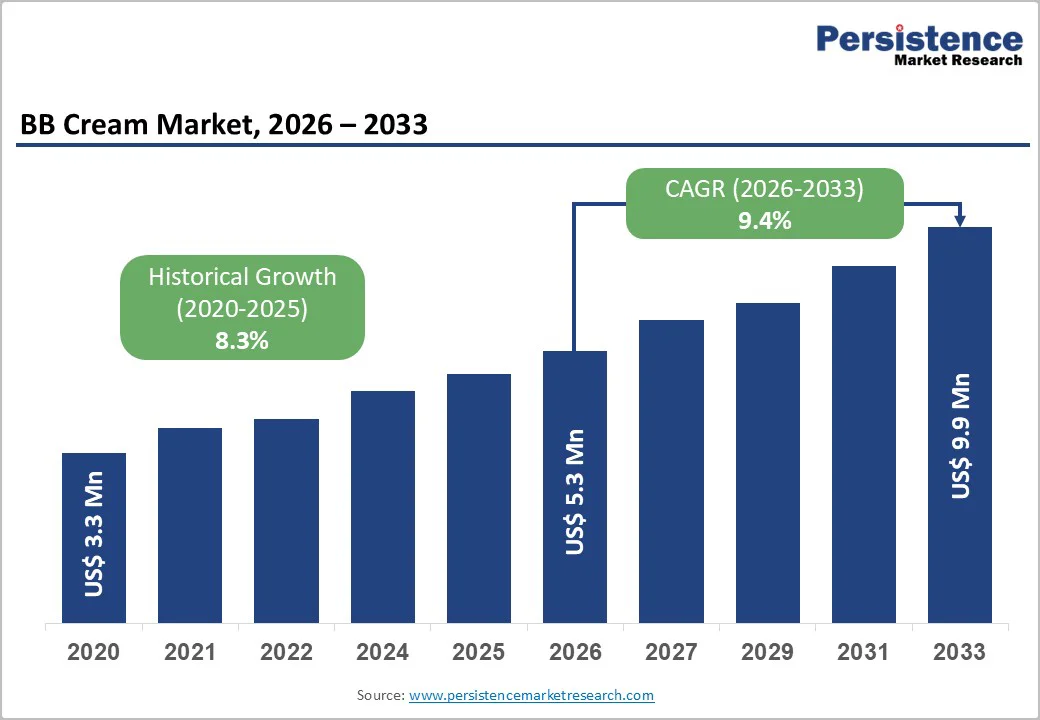

The global BB cream market size is likely to be valued at US$ 5.3 billion in 2026 and is expected to reach US$ 9.9 billion by 2033, growing at a CAGR of 9.4% during the forecast period from 2026 to 2033.

The BB cream market is experiencing strong momentum, fueled by three key factors: a growing consumer shift toward multifunctional beauty products that merge skincare and cosmetic benefits, increasing awareness of sun protection and overall skin health, and a rising preference for lightweight, time-saving solutions among busy professionals and younger users. These dynamics highlight BB Creams as an increasingly important segment within the broader cosmetics industry, supported by evolving beauty routines and demand for efficient, hybrid formulations.

| Key Insights | Details |

|---|---|

| BB Cream Market Size (2026E) | US$ 5.3 Billion |

| Market Value Forecast (2033F) | US$ 9.9 Billion |

| Projected Growth CAGR (2026 - 2033) | 9.4% |

| Historical Market Growth (2020 - 2025) | 8.3% |

The BB Cream market is strongly influenced by the global shift toward multifunctional beauty products that simplify daily skincare and makeup routines. Modern consumers, particularly busy professionals, students, and millennials, are increasingly seeking time-efficient solutions that combine hydration, sun protection, coverage, and skincare benefits in a single application. BB Creams address this need by replacing multiple products, offering a streamlined routine without sacrificing performance or skin health benefits. This trend reflects a broader movement toward hybrid beauty, where versatility and convenience drive purchasing decisions.

Consumer insights further reinforce this behavior, with a substantial proportion preferring BB Creams containing SPF over traditional foundations. The category’s appeal is strengthened by its ability to deliver 8-10 benefits simultaneously, from moisturization to anti-aging effects. As hybrid beauty continues to dominate global cosmetics trends, BB Creams remain central to this evolution, supported by strong demand for products that merge skincare efficacy with cosmetic functionality.

A major driver shaping the BB Cream market is the heightened global awareness of UV protection, skin health, and preventive skincare. Public health campaigns such as the Skin Cancer Foundation’s “Don’t Fry Day” and Australia’s “Slip-Slop-Slap” initiative have significantly influenced consumer behavior, encouraging daily use of SPF-based products. As a result, more consumers now prioritize sun protection as a non-negotiable step in their morning routines, creating strong demand for beauty products that incorporate SPF seamlessly into makeup.

This shift has contributed to the growing popularity of BB Creams, which offer both cosmetic coverage and essential protection from UV damage. The appeal is further enhanced by the integration of skincare ingredients such as hyaluronic acid, niacinamide, antioxidants, and glycerin components that support hydration, barrier repair, and overall skin wellness. With rising adoption across multiple demographics and regions, BB Creams continue to benefit from this convergence of skincare and makeup, positioning them as preferred daily-use products.

The BB cream market is constrained by strong competition from established beauty giants such as L’Oréal, Maybelline, and Estée Lauder, whose global presence and brand loyalty make it difficult for newer entrants to gain visibility. At the same time, closely related alternatives, including CC creams, tinted moisturizers, and hybrid foundations, offer similar benefits, reducing clear differentiation in consumer perception. This overlap forces brands to continually modify formulations or packaging to remain relevant.

Price competition intensifies these challenges, particularly in cost-sensitive markets where consumers often revert to traditional foundations or lower-priced substitutes. As a result, companies must invest heavily in R&D, marketing, and distribution to compete effectively. These rising operational demands limit profitability for emerging brands and restrict their ability to scale within the highly saturated BB Cream segment.

Another major restraint is the limited shade diversity available in many BB Cream ranges, which often focus on light and medium tones. This narrow offering excludes consumers with deeper or undertoned complexions, reducing market penetration and weakening brand appeal in regions with diverse populations. In contrast, foundations typically offer wider shade ranges, making BB Creams less competitive for certain demographic groups.

Regulatory compliance adds further complexity, especially when products claim SPF protection or skincare benefits. Agencies such as the U.S. FDA and EU regulators require extensive testing and documentation to validate claims, increasing costs and extending launch timelines. Additionally, variations in SPF labeling standards, particularly around higher SPF values, create uncertainty for manufacturers expanding internationally. These combined challenges can hinder product rollout, inflate operational expenses, and contribute to consumer skepticism regarding claim accuracy.

The BB Cream market is witnessing a strong opportunity within the rapidly expanding male grooming segment, which continues to outperform the traditional female category in adoption speed and market engagement. Growing awareness around skincare, increased social media influence, and rising comfort among men using subtle cosmetic enhancers are shifting grooming behaviors globally. Male consumers increasingly prefer lightweight, non-greasy BB Creams that provide shine control, skin-tone balancing, and natural finishes suitable for daily and professional use, especially in video-focused workplaces and urban environments.

Brand strategies that emphasize gender neutrality or offer male-specific formulations can unlock high-growth potential. Companies introducing tailored textures, matte finishes, and minimalist packaging are likely to succeed in this emerging demographic. As the male grooming category continues accelerating, the BB Cream segment stands to benefit significantly by filling the gap for discreet, practical complexion-perfecting products designed for men’s unique skincare needs.

Significant opportunity lies in expanding BB Cream portfolios across emerging markets such as India, Southeast Asia, Brazil, and the Middle East, where beauty awareness, digital influence, and e-commerce accessibility are rising rapidly. These regions are experiencing growing interest in multifunctional products driven by K-beauty trends, social media tutorials, and increasing disposable incomes among younger consumers. BB Creams are becoming preferred entry-level complexion products due to affordability, convenience, and their blend of skincare and makeup benefits.

Simultaneously, the global clean beauty movement presents substantial product innovation potential. Consumers increasingly seek BB Creams formulated with natural ingredients, vegan and cruelty-free claims, and sustainable or refillable packaging. Brands prioritizing transparency, clean-label formulations, and eco-conscious design can differentiate themselves in competitive markets. These clean beauty preferences are growing faster than the broader cosmetics sector, positioning responsibly formulated BB Creams to capture strong demand from environmentally aware consumers across emerging regions.

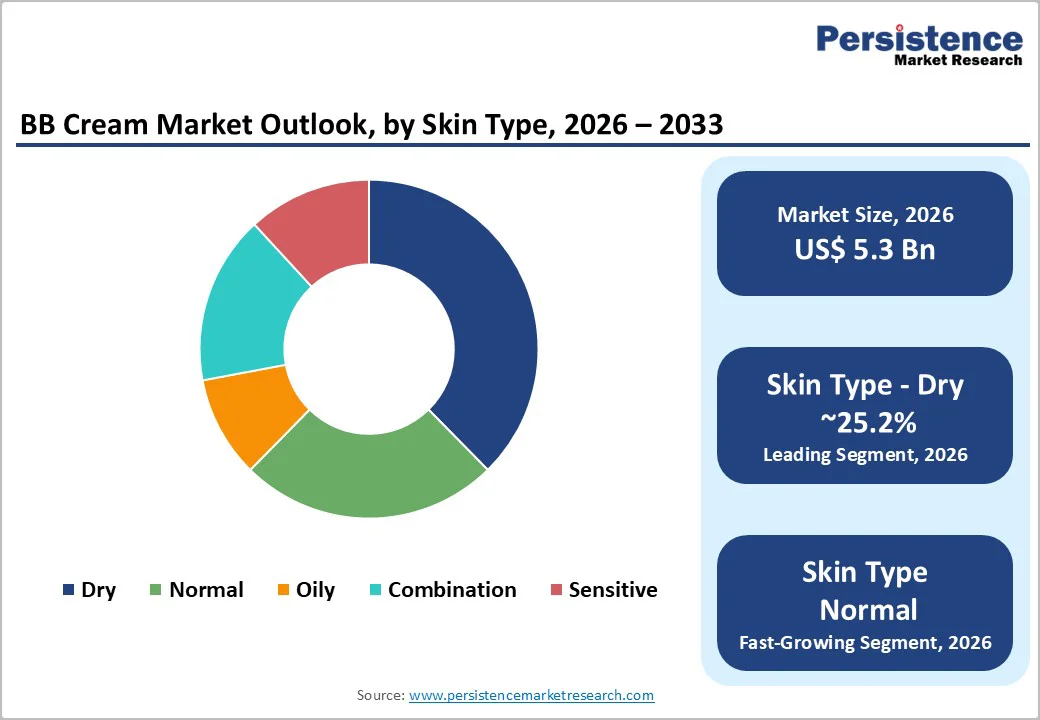

The Dry Skin segment leads the BB Cream market with a 25.2% share in 2025, driven by strong demand for hydrating and nourishing formulations that provide both skincare benefits and cosmetic coverage. Products enriched with hyaluronic acid, glycerin, and emollients deliver superior moisture retention, anti-aging effects, and consistent performance across climates. Mature consumers particularly value these multifunctional formulations that combine coverage with skin health.

Emerging segments, including Normal, Oily, Combination, and Sensitive Skin, are rapidly gaining traction. Normal Skin users prefer balanced, everyday coverage; Oily and Combination Skin consumers demand oil-control and mattifying benefits; while Sensitive Skin requires hypoallergenic, soothing solutions. These niches represent high-growth opportunities for brands to develop specialized BB Creams that address diverse consumer needs, skin concerns, and regional preferences.

Between 15-30 SPF dominates the SPF-based BB Cream category with a 50.0% share in 2025, reflecting consumer preference for a balance between effective UV protection and cosmetic elegance. Its lightweight, blendable formulations allow daily use without white cast or heavy textures, making it ideal for professional and urban consumers.

The Above 30 SPF segment caters to users needing enhanced UV defense in outdoor or tropical conditions, while the Below 15 SPF segment focuses on indoor or lightweight applications. These variations ensure BB Creams meet specific lifestyle requirements, while the mid-range SPF segment continues to drive mass adoption due to its optimal performance and daily-use convenience.

Women dominate the BB Cream market, holding approximately 78.0% share, supported by extensive product portfolios that cater to hydration, anti-aging, coverage, and tone correction needs. These formulations appeal across age groups, skin types, and regional preferences, solidifying women as the core consumer base.

The male segment, however, is the fastest-growing demographic. Increasing male grooming awareness, social media influence, and demand for subtle, natural-looking coverage are driving adoption. Brands targeting this segment with lightweight, shine-controlling formulations and gender-inclusive marketing strategies are successfully tapping into an underserved but high-potential market, expanding BB Cream reach and reinforcing the category’s growth trajectory.

Supermarkets and Hypermarkets dominate BB Cream distribution with a 45.5% share, driven by their extensive store networks, high consumer footfall, and competitive pricing strategies. These outlets offer mass-market accessibility, allowing shoppers to compare multiple brands and products easily, making them the primary purchase route for mid-range and popular BB Creams. Their visibility and convenience reinforce consumer trust and loyalty, particularly in urban and semi-urban regions.

Specialty Stores and Online Stores are emerging as the fastest-growing channels. Specialty Stores appeal to consumers seeking curated product selections, premium brands, and expert recommendations, while Online Stores thrive due to e-commerce penetration, home delivery, and digital marketing influence. Pharmacies and Convenience Stores provide essential localized access in developing regions, supporting incremental sales and broadening market reach. Together, these channels create a diversified distribution network that maximizes both accessibility and consumer engagement.

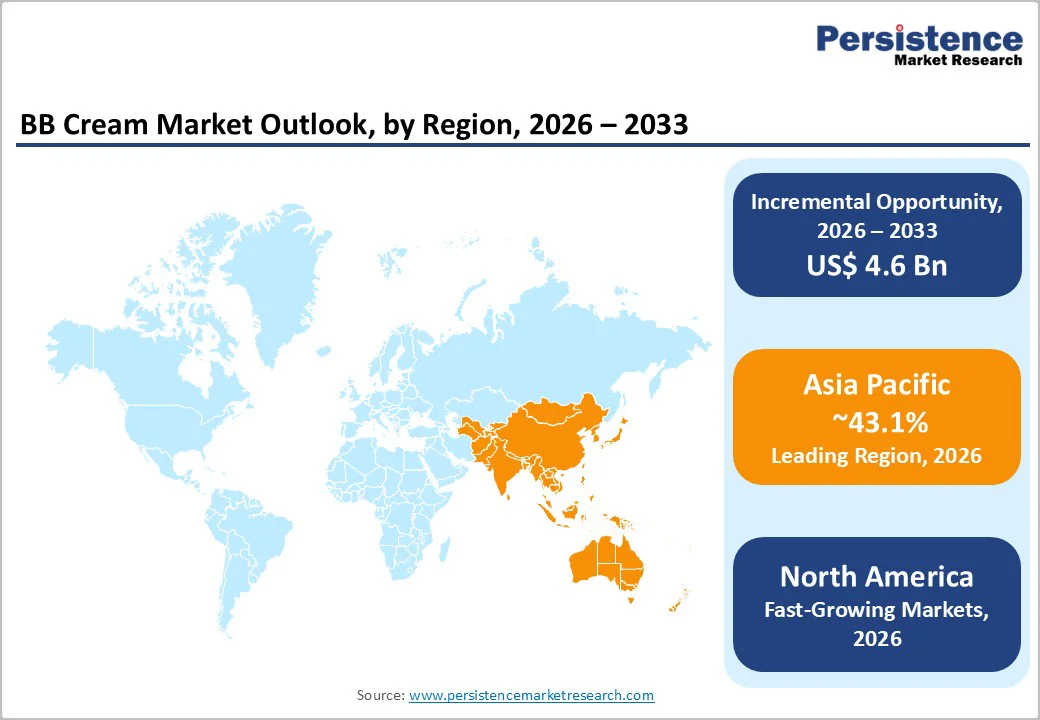

North America, particularly the United States, represents a key market with a 35.6% share. Consumers demonstrate high awareness of skincare benefits, SPF protection, anti-aging ingredients, and sustainability. The region benefits from mature retail infrastructure, omnichannel networks, and e-commerce platforms, which ensure widespread accessibility. Leading brands like Maybelline and Estée Lauder emphasize dermatologically tested formulations, expanded shade ranges, and clean ingredient profiles to capture urban and professional consumers.

The U.S. market is projected to grow at a CAGR of 9.8% from 2025 to 2033, supported by convenience-focused routines, minimalist makeup trends, and professional usage. Regulatory frameworks on SPF efficacy and ingredient transparency create advantages for established brands. Combined with online retail penetration and daily sun protection awareness campaigns, North America remains a major contributor to global BB Cream revenue and innovation trends.

Europe demonstrates strong growth potential for BB Creams, with a CAGR of 9.6% from 2025 to 2033. Consumers increasingly demand cruelty-free, organic, and vegan formulations, alongside dermatologically tested products for sensitive and aging skin. The United Kingdom, Germany, Italy, and France are key markets, with UK brands like The Body Shop and Garnier leveraging sustainability positioning, while German consumers prioritize ingredient transparency and efficacy.

Harmonized EU regulations streamline product approvals across member states, enabling brand expansion. European consumers favor hybrid beauty products that combine light coverage with skincare benefits, aligning with minimalist and wellness-oriented trends. Specialty retail, direct-to-consumer channels, and growing e-commerce penetration support premium BB Cream positioning. Europe’s focus on ethical sourcing, environmental responsibility, and sustainable formulations makes the region a critical innovation hub for advanced BB Cream offerings.

The Asia Pacific region dominates the global BB Cream market, holding a 43.1% share, driven by the origin of the BB Cream phenomenon and the global influence of South Korean K-beauty trends. China, South Korea, Japan, and Australia/New Zealand are key contributors, with China expanding at 10.3% CAGR, South Korea at 9.9%, and Australia/New Zealand at 10.5% from 2025 to 2033. Consumers prioritize multifunctional formulations offering hydration, sun protection, skin-brightening, and anti-aging benefits, while brands leverage influencer marketing and digital platforms to engage tech-savvy audiences.

Emerging markets like India and Southeast Asia are experiencing rapid adoption due to rising disposable incomes, increasing beauty awareness, and growing e-commerce penetration. K-beauty brands such as Missha, Dr. Jart+, Skin79, and The Face Shop set global trends, while local innovation and ingredient sourcing advantages strengthen market competitiveness. Combined with consumer-centric product development, the Asia Pacific is the largest and fastest-growing BB Cream market worldwide.

The BB Cream market features a moderately consolidated competitive structure, with leading global players controlling significant market share while numerous regional and emerging brands compete in niche segments. Market leaders leverage extensive distribution networks, strong R&D capabilities, and brand recognition to drive growth through product innovation, geographic expansion, and direct-to-consumer digital strategies.

Emerging brands capitalize on K-beauty trends, specialized formulations, and sustainable positioning to differentiate themselves. Key competitive factors include ingredient innovation, shade inclusivity, clean formulations, personalized solutions, and targeted marketing toward specific demographics. Regulatory expertise, supply chain efficiency, and consumer trust further enhance market positioning, while opportunities exist in niche, eco-conscious, and digitally driven segments.

The global BB cream market is projected to reach US$ 9.9 Billion by 2033, growing from US$ 5.3 Billion in 2026 at a CAGR of 9.4%, driven by multifunctional products combining skincare, sun protection, and cosmetic coverage.

Market growth is fueled by consumer demand for multifunctional cosmetics, rising UV protection awareness, and the incorporation of advanced skincare ingredients like hyaluronic acid and niacinamide.

The Dry Skin segment leads with a 25.2% share, driven by intensive hydrating formulations that address moisture retention, anti-aging, and skin nourishment across diverse regions.

Asia-Pacific dominates the market with 43.1% share, led by K-beauty influence, large consumer base, rising incomes, and manufacturing advantages.

Key opportunities include expanding into emerging markets (India, Southeast Asia, Latin America), developing clean, sustainable formulations, and innovating for the fastest-growing male grooming segment.

Leading market players include L'Oréal S.A., Estée Lauder, Shiseido, Amorepacific, Maybelline, and Garnier.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn/Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Skin Type

By SPF Type

By End-users

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author