ID: PMRREP32306| 231 Pages | 29 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

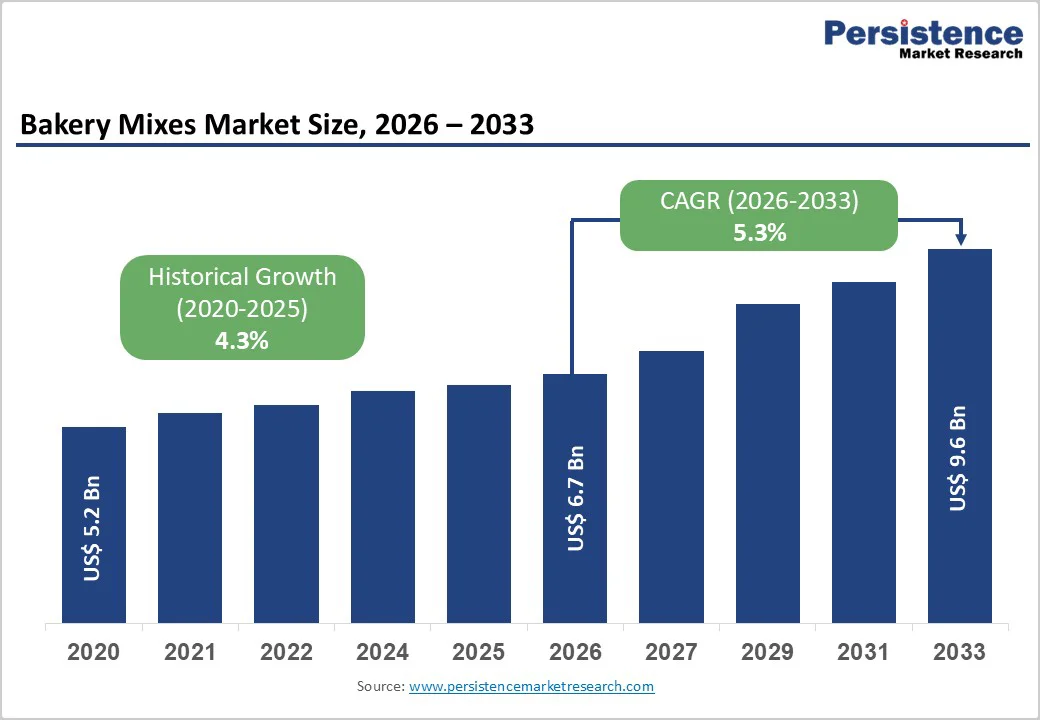

The global bakery mixes market size is expected to be valued at US$ 6.7 billion in 2026 and projected to reach US$ 9.6 billion by 2033, growing at a CAGR of 5.3% between 2026 and 2033.

Growth is primarily driven by rising demand for convenient baking solutions among both professional and home bakers, who increasingly rely on ready-formulated mixes for consistent quality and time savings. The surge in artisanal baking and home baking during and after the pandemic highlighted the appeal of reliable mixes, while foodservice operators and industrial bakeries use them to standardize recipes across multiple outlets and improve operational efficiency.

| Global Market Attributes | Key Insights |

|---|---|

| Global Bakery Mixes Market Size (2026E) | US$ 6.7 Bn |

| Market Value Forecast (2033F) | US$ 9.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 5.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.3% |

A pivotal growth driver for the bakery mixes market is the structural shift toward convenient, fail-safe baking formats for both households and professional users. During the COVID-19 period, brands such as King Arthur Flour Company, Inc. reported online flour sales rising by over 2,000% in March 2020, illustrating how at-home baking rapidly scaled as a leisure and comfort activity. This momentum has evolved into durable demand for cake, bread, cookie, and pizza dough mixes that compress preparation time by providing pre-measured flours, leavening agents, and flavorings in a single pack. Foodservice chains and in-store bakeries rely equally on mixes to ensure batch-to-batch consistency and reduce dependence on skilled labor, reinforcing long-term adoption across bread, cookies & biscuits, and cakes & pies applications.

One key restraint for the bakery mixes market is the volatility in prices of core commodities such as wheat flour, cocoa, vegetable oils, and sugar, which directly affects production economics. Climatic events in major grain-producing regions, logistics disruptions, and geopolitical tensions have translated into higher input and energy costs for millers and ingredient manufacturers. Since many mixes are sold into price-sensitive retail and quick-service channels, producers cannot always pass through cost increases fully, compressing margins and limiting investment capacity in innovation and marketing.

A compelling growth avenue in the bakery mixes market lies in premium offerings inspired by artisanal and gourmet baking. Suppliers are increasingly developing specialized mixes for sourdough, brioche, and craft-style breads that integrate distinctive grains, seeds, and plant-derived ingredients to create differentiated taste, texture, and visual appeal. These advanced mixes simplify complex formulations, allowing artisan bakeries, premium cafés, and hospitality kitchens to deliver consistent, high-quality products with reduced labor and process variability. As consumers gravitate toward indulgent baked goods with authentic character and clear provenance, mix manufacturers that pair functional reliability with narratives around craftsmanship, fermentation, and natural ingredients can drive higher margins and build strong loyalty in premium bakery segments.

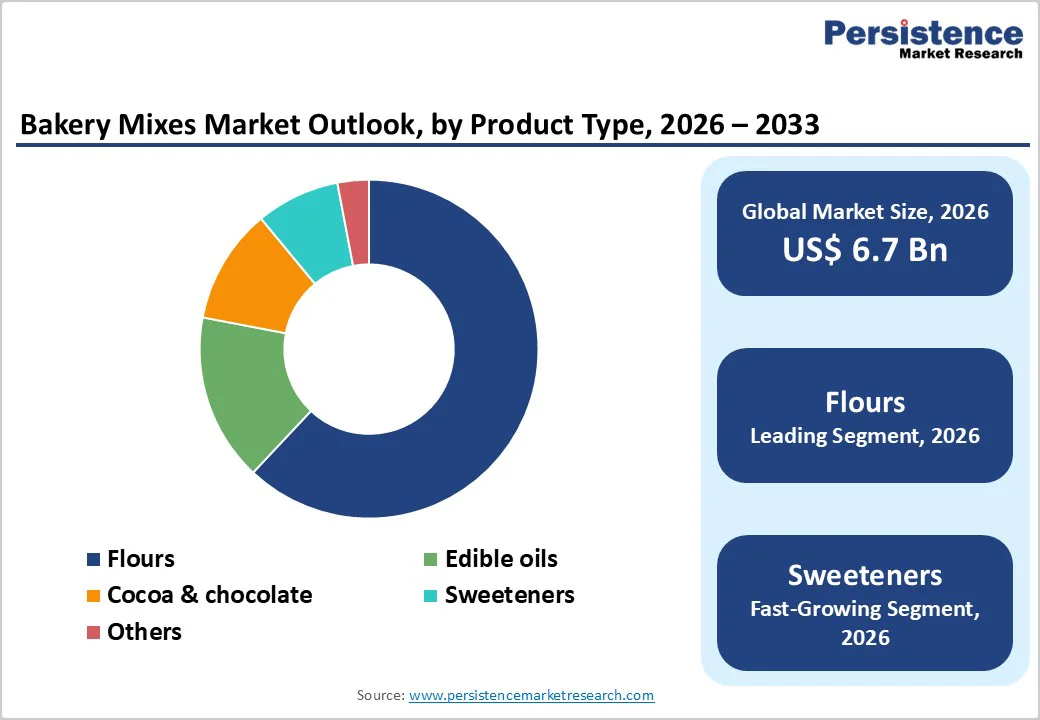

Within product type, flours dominate the bakery mixes market, accounting for about 64% of the total value in 2025. Flours form the functional backbone of virtually every mix, from standard bread and pizza dough bases to cakes, pancakes, and cookie mixes. Large ingredient companies such as Cargill Inc. and ADM offer a wide portfolio of wheat, rye, and specialty flours tailored to specific applications, often combined with improvers and enzymes to optimize dough handling and volume. The surge in home baking during 2020, when overall flour sales grew nearly 162% year-on-year over a four-week period in the U.S., underscores the centrality of flour-based mixes in meeting demand for easy baking solutions. As mixes evolve into more functional and health-oriented formats, enriched and whole-grain flours are likely to gain additional share within this leading segment.

By nature, the conventional segment is expected to remain the leading category, representing an estimated around 80% share in 2025, due to its extensive presence in mass-market retail, quick-service restaurants, and industrial bakeries. Conventional mixes benefit from well-established supply chains for refined flours, stan-dard vegetable oils, cocoa, and sugar, enabling competitive pricing and simplified sourcing for high-volume users. However, the organic sub-segment is expanding more rapidly as more retailers and brands launch certified organic baking lines that avoid synthetic additives and prioritize traceability in crops. This growth is particularly visible in North America and Europe, where organic bakery sales have been rising with double-digit gains in certain channels, encouraging mix suppliers to introduce organic cake, bread, and pancake bases positioned around health and sustainability.

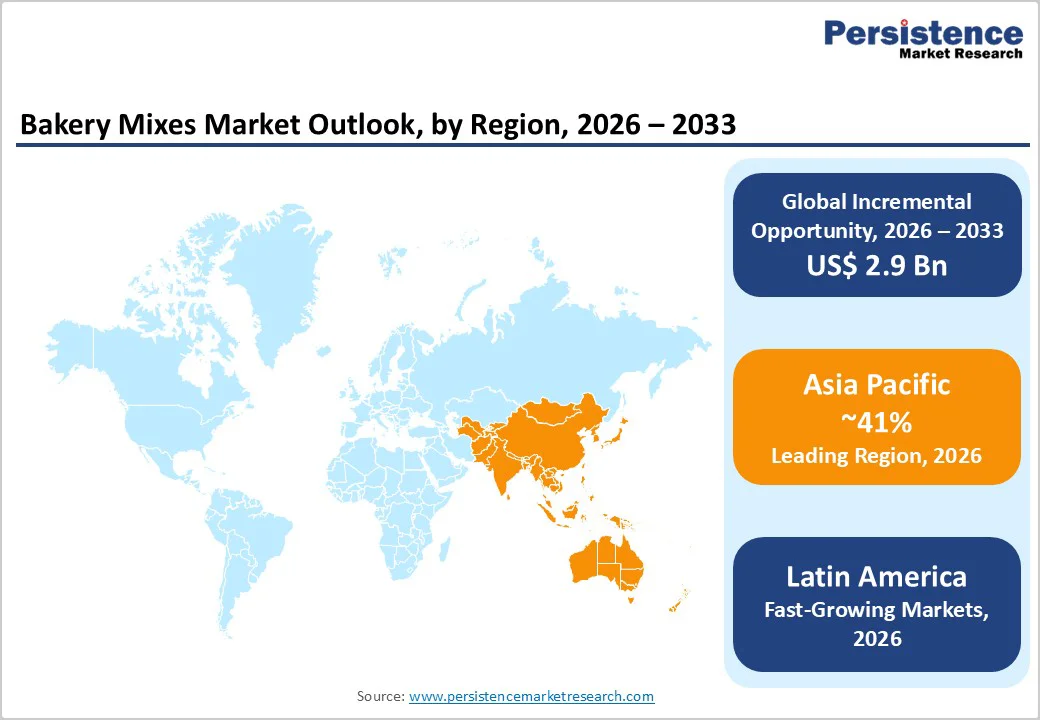

Asia Pacific is the leading regional market for bakery mixes, accounting for roughly 41% of the market in 2025, driven by rapid urbanization, rising middle?class incomes, and Westernization of diets. Countries such as China, Japan, India, and major ASEAN economies have seen strong growth in modern retail, café chains, and full-service restaurants that rely on standardized bread, cake, and pastry mixes to efficiently scale operations. Local and international ingredient companies supply mixes tailored to regional taste profiles, such as soft sweet breads, filled buns, taro or matcha-flavored cakes, and crispy biscuits, leveraging regional mills and oilseed processing capacity to maintain competitive pricing.

Manufacturing advantages in the region include access to cost-effective flour milling, sugar refining, and vegetable oil production, which underpin large-scale mix manufacturing hubs that serve domestic and export markets. At the same time, growing interest in organic ingredients and clean-label baking is particularly evident in markets like Japan and in premium urban districts in China and India, encouraging suppliers to launch organic and additive-reduced mixes through specialty retail and e-commerce channels. As bakery culture deepens beyond traditional staples into pastries, cookies, and Western-style desserts, the Asia Pacific is expected to remain the anchor of global demand growth for bakery mixes.

In Europe, bakery mixes are widely used across industrial and artisan bakeries, with Germany, the U.K., France, and Spain representing key demand centers. Bread and pastry remain dietary staples, and the region’s long tradition of artisanal baking is increasingly supported by specialized premixes that help small and mid-sized bakers manage labor shortages while maintaining authenticity. Companies like Lesaffre and Puratos provide complete and concentrated mixes for sourdough, baguettes, brioches, panettone, and sweet goods, integrating enzymes, improvers, and plant extracts to achieve specific volume, crumb, and color targets.

The European Union’s harmonized regulations on additives, labeling, and health claims have driven a strong focus on transparency, increasing demand for mixes that meet “no artificial colors or flavors” expectations and support salt and sugar-reduction targets. Is growth also supported by expanding retail private-label ranges and discounter chains that introduce value-priced bread, cake, and pizza mixes, while premium supermarket formats and café chains increasingly adopt high-end gourmet bakery mixes featuring ancient grains, seeds, and inclusions to differentiate their offerings.

The bakery mixes market is moderately consolidated at the global level, with large multinational ingredient companies and specialized bakery solution providers operating alongside regional millers and blenders. Key players such as Cargill Inc., ADM, Lesaffre SA, Puratos Ltd., and Bakels Worldwide offer complete mixes, concentrates, and tailor-made formulations for bread, cakes, cookies, and pizza dough. Competitive differentiation increasingly centers on clean-label formulation expertise, technical support for process optimization, and the ability to co-develop bespoke solutions with industrial and gourmet bakery customers. Emerging business models include subscription-based supply for chains, digital recipe support platforms, and small-batch premium mixes targeting e-commerce and specialty retail channels.

Key Developments:

The global bakery mixes market is expected to reach around US$ 6.7 billion in 2026, reflecting sustained demand for convenient and standardized baking solutions across households, foodservice, and industrial bakeries.

A major demand driver is the growing need for convenience and consistent quality, as mixes allow both home bakers and professional operators to reduce preparation time and skill requirements while delivering reliable, high‑quality baked goods.

Asia Pacific leads the global bakery mixes market with an estimated 41% share in 2025, supported by rapid urbanization, expanding modern retail, and rising consumption of bread, cakes, and biscuits.

A key opportunity lies in premium, clean‑label, and organic bakery mixes that cater to gourmet bakery and artisanal baking trends, combining convenience with authentic formulations and transparent ingredient lists.

Key players include Cargill Inc., ADM, Lesaffre SA, Puratos Ltd., Bakels Worldwide, Allied Mills Pty Ltd., King Arthur Flour Company, Inc., Pillsbury Company, LLC, and several regional specialists and niche gluten‑free or organic mix brands.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author