ID: PMRREP33529| 199 Pages | 17 Jul 2025 | Format: PDF, Excel, PPT* | Food and Beverages

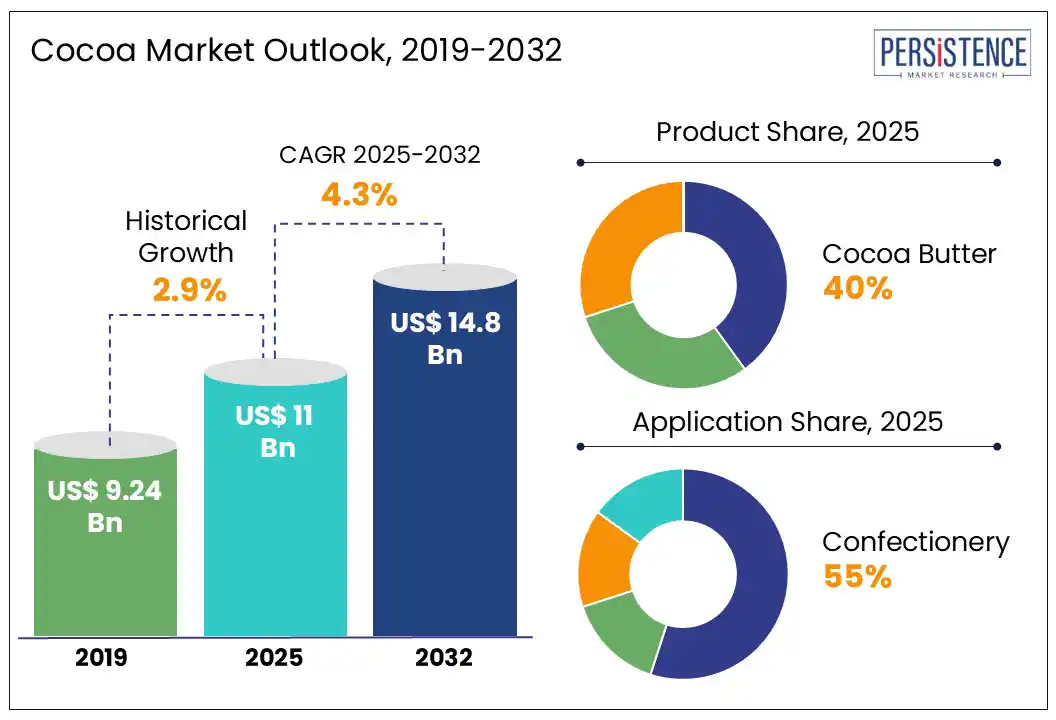

Global Cocoa Market size is likely to be valued at US$ 11 Bn in 2025 and is estimated to reach US$ 14.8 Bn in 2032, growing at a CAGR of 4.3% during the forecast period 2025 - 2032.

The cocoa market growth is driven by the rising global demand for chocolate products, increasing consumer awareness of cocoa's health and antioxidant benefits, and the expansion of cocoa's applications in cosmetics and pharmaceuticals.

Cocoa is a highly concentrated powder made from chocolate liquor, a paste derived from fermented cocoa beans, the fruit of the cacao (Theobroma cacao). Cocoa is the key ingredient of chocolates and chocolate confections, and it is used in beverages as a flavoring agent. Cocoa is sold as solid bars of eating chocolate or packaged as cocoa powder with flavanols for heart health. Raw beans can be crushed into cacao powder, but if the beans are roasted first, cocoa powder is produced. Unroasted cacao powder is more bitter than cocoa powder, and it also has more nutrients and caffeine.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Cocoa Market Size (2025E) |

US$ 11 Bn |

|

Market Value Forecast (2032F) |

US$ 14.8 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

2.9% |

Cocoa, especially dark varieties, is rich in polyphenols and flavanols, which are powerful antioxidants and support nitric oxide production, leading to improved blood flow, modest reductions in blood pressure (1–4?mmHg), and improved endothelial function. These vascular benefits lower the heart attack risks and strokes, along with improved brain function. Compounds, such as theobromine and magnesium, promote mild bronchodilation and may uplift mood through neurochemical effects, making dark chocolate for mood enhancement increasingly popular. Chocolate triggers the release of endorphins, the body’s natural feel-good chemicals. It also contains small amounts of serotonin, a neurotransmitter that plays a big role in regulating mood and emotions. According to data, 3.4% of the global population suffers from depression, highlighting a significant opportunity for chocolate positioned as a natural stress remedy.

Cocoa powder is nutrient-dense, providing approximately 6?mg of calcium, 1?mg of iron, 26?mg of magnesium, 39?mg of phosphorus, 135?mg of potassium, under 1?mg of zinc, 1?mg of selenium, and 2?µg of folate per tablespoon, making it a key ingredient in nutrient-rich cocoa-based superfoods. A 2021 study found that cocoa consumption significantly reduced triglyceride levels, making it popular as a cholesterol-lowering functional food. Consumer awareness of the health benefits associated with chocolate, particularly dark chocolate, is a significant growth factor. Dark chocolate is recognized for its ability to enhance blood circulation, reduce blood pressure, and improve brain function. Vegan, gluten-free, and sugar-free chocolates that align with dietary preferences and health-focused lifestyle are becoming popular.

Cocoa prices have surged to record levels, above US$ 10,000/ton in late 2024, driven by a global supply shortage, extreme weather, crop diseases such as Cocoa Swollen Shoot Virus (CSSV), and chronic underinvestment in West African farms, which produce about 80% of the world’s cocoa, intensifying concerns in the global cocoa supply chain crisis. Unpredictable climate patterns, such as El?Niño-driven droughts, erratic rains, and increasing temperatures, are reducing cocoa yields in West Africa.

Production remains below the five?year average, with critically low inventories and keeping prices to be around at US$ 6,000–10,000/ton through 2025. This persistent price pressure is prompting chocolate manufacturers to raise retail prices, pursue shrinkflation, and reformulate products, leading to 10–15% higher confectionery prices for consumers in 2025, and increasing demand for cost-effective chocolate product innovation. Aging trees and underinvestment in replanting also deter productivity. These environmental and structural challenges, regulatory compliance costs, and illicit smuggling are hampering market growth and posing serious risks for the future of sustainable cocoa production in West Africa.

Lab-based chocolate production to address sustainability and supply challenges by leveraging the plant cell culture for cocoa by extracting cells from cacao trees and growing them in bioreactors that imitate rainforest conditions is the latest innovation in cocoa production. These cells are then harvested, fermented, and roasted to produce non-GMO lab-grown cocoa solids and cocoa butter that contain the same flavor molecules as traditional chocolate. This will reduce deforestation, lower greenhouse gas emissions, promote ethical labor practices, and create a stable and climate-resilient cocoa supply chain. California Cultured, a food tech startup making cocoa via cellular agriculture, signed a 10?year agreement with Meiji to supply “flavanol cocoa powder,” through AI-enabled biomanufacturing facilities. The regulatory approvals such as FDA GRAS are expected by 2027.

High-tech cultivation is adopted in Brazil’s irrigated farms, promising scalable sustainable cocoa farming in tropical climates. There is an increasing consumer demand for ethically-sourced chocolate with functional health benefits. Precision agriculture and AI, including satellite NDVI and pod survival prediction tools enable targeted interventions that improve yields without increasing land use.

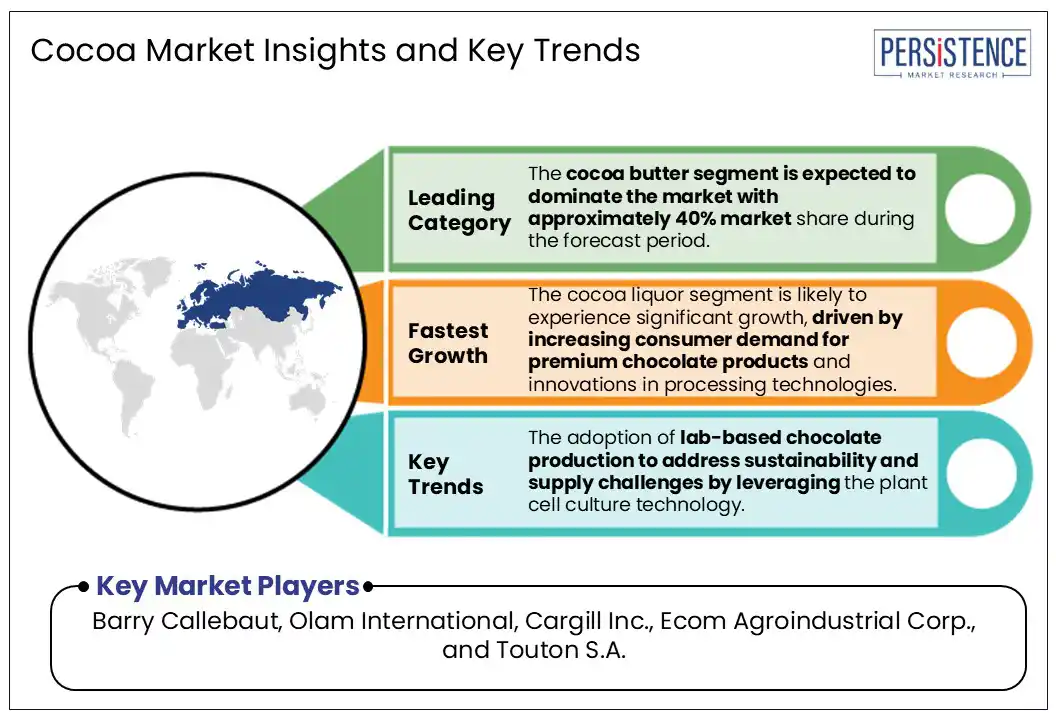

By product, the cocoa butter segment is expected to dominate the cocoa market with approximately 40% market share during the forecast period. Cocoa butter is an edible natural fat obtained from the Theobroma cocoa seeds found in dark chocolate. It is a rich source of monounsaturated and saturated fatty acids that mainly contains approximately 33% oleic acid, 25% palmitic acid, and 33% stearic acid. Cocoa butter is included in chocolate and other food products, and can also be found in over-the-counter skin products such as lotions, creams, and bars intended to maintain skin softness. Cocoa butter has been shown to reduce very-low-density lipoprotein (VLDL) cholesterol levels in animal studies, suggesting its potential use in lipid disorders. Major players such as Cargill and Bunge Loders Croklaan are investing in sustainable sourcing practices to meet regulatory requirements including the EU Deforestation Regulation.

The cocoa liquor segment is likely to experience significant growth, driven by increasing consumer demand for premium chocolate products and innovations in processing technologies. Cocoa liquor, a blend of cocoa solids and cocoa butter, is the foundational ingredient of all chocolate products, with its quality directly shaping flavor and texture. The demand for cocoa liquor is primarily driven by the chocolate and confectionery sector, which is projected to consume up to 52.8% of the total cocoa liquor share in 2025. This growth is fueled by consumer preferences for high-quality and artisanal chocolates and the increasing popularity of dark chocolate due to its perceived health benefits. Key players in the cocoa liquor market include Barry Callebaut, Cargill, Olam International, and Ecuakao Group Ltd., The trend toward clean-label and organic products is influencing market dynamics, with companies focusing on natural sweeteners and non-GMO ingredients.

By application, the confectionery segment is expected to dominate the market in 2025, accounting for around 55% of the market share, driven by usage in chocolate bars, candies, powders, confectionery ingredients, and related baked confections. Rising consumer demand for organic, clean-label, plant-based, premium, artisanal, and functional confectionery is driving manufacturers to innovate with low-sugar, high-protein, dark/vegan chocolates, and unique flavors, leveraging cocoa liquor for flavor complexity. Sustainability continues to gain prominence, with certifications such as Rainforest Alliance, Fairtrade, and bean-to-bar sourcing becoming essential to brand value and consumer loyalty. The rise of e-commerce, personalized and 3D-printed chocolates, and smart packaging also reflects digital acceleration, giving niche and small?batch brands expanded reach. Mars, Mondelez, Nestlé, Ferrero, Hershey, and Barry Callebaut are some of the companies using cocoa solid in their products.

The food & beverages segment is likely to be the fastest-growing over the forecast period, driven by cocoa’s versatility in food & beverages, culinary, wellness, and pharmaceutical sectors. It is the star ingredient in hot drinks such as chocolate and mocha lattes, and is increasingly featured in ready-to-drink beverages and protein shakes enhanced with antioxidants. In confectionery and baking, cocoa is essential in chocolate bars, cakes, cookies, and pastries, while dairy-based desserts such as ice cream and yogurt frequently rely on its rich flavor. Moreover, cocoa’s bioactive compounds, especially flavanols, have elevated its role in the functional foods and beverage market, supporting applications in health-focused snacks, supplements, and cosmetic formulations.

Europe is expected to dominate the market, accounting for over 48% of the market share in 2025. New EU regulations, such as the Deforestation-Free Products Regulation (EUDR), enable ethical sourcing and clean manufacturing. In Europe, there is a high demand for premium, single-origin, specialty, and artisan brand chocolates. Health-conscious consumers are increasingly opting for dark, low?sugar, plant?based, and functional chocolates infused with superfoods, probiotics, or natural sweeteners. E?commerce and direct?to?consumer sales are fueling market penetration, while geopolitical and climate pressures, especially rising cocoa prices and supply chain volatility caused by West African crop failures, are prompting product innovation, and packaging adjustments. The key players include Barry Callebaut, Cargill, Hershey, and Nestlé.

The Netherlands dominates within Europe and is the central hub in the global cocoa trade, importing the most cocoa beans in Europe and processing over 620,000 tonnes annually. There is a rising demand for artisanal, dark, and premium products. Cocoa prices in the Netherlands have also increased due to climate disruptions, crop diseases, and supply shortages in West Africa. The EU deforestation regulations are also making sourcing and traceability difficult. The key players include Cargill, Olam (ofi/De Zaan), Barry Callebaut, Dutch Cocoa B.V., and Tony’s Chocolonely.

The Asia Pacific cocoa and chocolate sector is booming, driven by rising urbanization, higher incomes, and evolving tastes, leading to a surging demand for premium, dark, single-origin, and ethically sourced chocolate products. Craft and artisanal varieties are gaining traction, and there is high demand from health-conscious customers for low-sugar, vegan, and superfood-infused chocolates. The e-commerce platforms, such as Alibaba, Amazon, Flipkart, and Lazada, are redesigning distribution, with online sales growing faster than traditional retail. India leads growth, and China dominates in consumption and processing, while Japan, Australia, and South Korea are showing steady expansion.

India is the fastest-growing cocoa and chocolate market in Asia Pacific, driven by a growing middle class, youthful demographics, and heightened interest in premium and artisanal chocolate products. The Indian government, through agencies such as the Directorate of Cashewnut and Cocoa Development (DCCD) and the Ministry of Agriculture, has been promoting cocoa cultivation as a viable cash crop. India is exporting cocoa products to Germany, the U.S., and the Netherlands, positioning itself as a source of ethically-produced cocoa beans.

In North America, growth is driven by rising consumer demand for premium and dark chocolates. There is an increasing preference for organic and sustainably sourced cocoa products, reflecting a broader trend toward ethical consumption. Cocoa is also becoming popular in non-traditional applications, including cosmetics, nutraceuticals, and beverages. The region is also bearing the brunt of soaring cocoa prices due to supply shortages and climate-related disruptions in key producing regions. These factors have led to higher retail chocolate prices and increased costs for manufacturers, impacting both large and small producers.

The U.S. cocoa market is experiencing significant growth owing to shifting consumer preferences and external supply challenges. There is a high demand for premium, dark, and artisanal chocolates, particularly those with higher cocoa content and health benefits. Online forums have boosted the sales of premium chocolates.

The global cocoa market is highly competitive with global giants such as Barry Callebaut, Olam International, Cargill, and Ecom, who control integrated sourcing, processing, and trading. Competitive differentiation now pivots on sustainability, traceability (blockchain), premiumization, and farmer programs, with smaller players capitalizing on niche trends even as large firms invest in tech, R&D, and ethical supply chains.

The global market is projected to be valued at US$ 11 Bn in 2025.

Market growth is driven by the rising global demand for chocolate products, increasing consumer awareness of cocoa's health and antioxidant benefits, and the expansion of cocoa's applications in cosmetics and pharmaceuticals.

The market is poised to witness a CAGR of 4.3% from 2025 to 2032.

The adoption of lab-based chocolate production to address sustainability and supply challenges by leveraging the plant cell culture technology.

Major players in the Global Cocoa Market include Barry Callebaut, Olam International, Cargill Inc., Ecom Agroindustrial Corp., and Touton S.A.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Nature

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author