ID: PMRREP35747| 186 Pages | 16 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

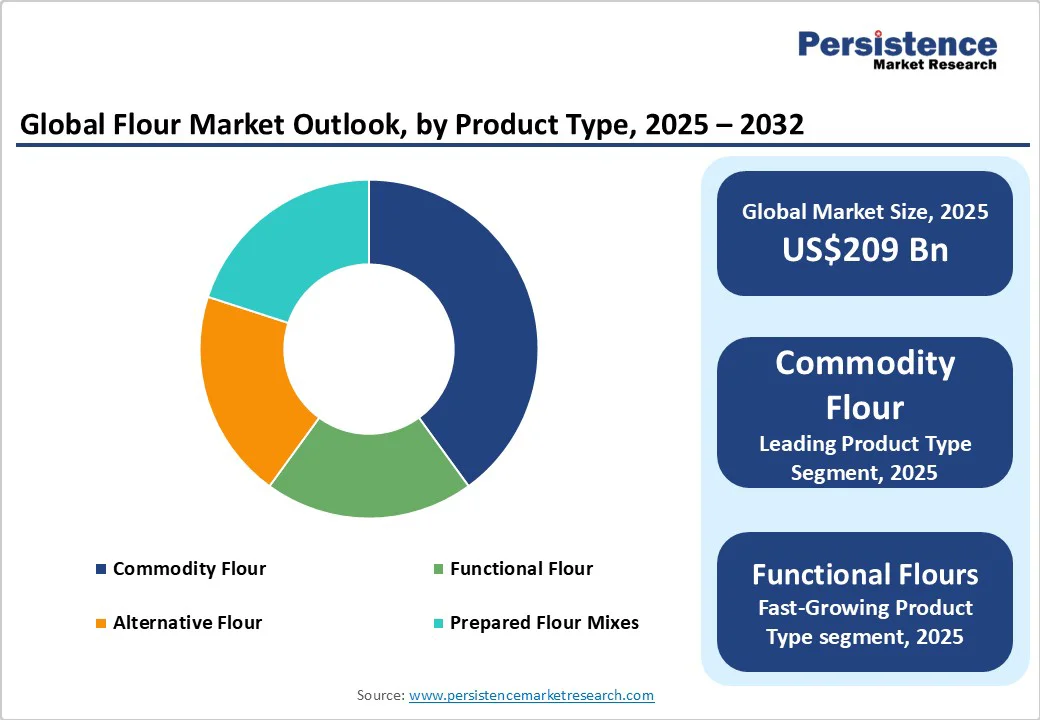

The global flour market is likely to be valued at around US$209 Billion in 2025, and is expected to reach approximately US$277.9 Billion by 2032, growing at a CAGR of 4.3% from 2025 to 2032, driven by rising consumption of bakery and processed foods, the growing popularity of ready-to-use flour mixes, and increasing demand for functional and alternative flours. Investments in milling automation, nutritional fortification, and supply chain integration are improving production efficiency.

| Key Insights | Details |

|---|---|

| Flour Market Size (2025E) | US$209 Bn |

| Market Value Forecast (2032F) | US$277.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.9% |

The global bakery industry accounts for the majority of flour consumption, representing approximately 39% of total commercial demand. Growing urban populations and the popularity of convenience foods have increased the production of bread, pastries, and snacks.

This steady consumption ensures predictable demand for both bulk and branded flour, reinforcing investments in industrial milling and logistics optimization. The proliferation of quick-service restaurants and packaged bakery products also strengthens the long-term stability of flour demand.

Prepared flour mixes for cakes, pancakes, batters, and instant baking applications are growing at a faster rate than traditional flour. Studies indicate an average growth rate of 8-9% annually in this segment, as consumers seek time-saving, high-quality products.

Foodservice chains, bakeries, and households increasingly rely on consistent premixed formulations. This shift offers flour manufacturers higher margins and encourages investment in packaging, formulation, and branded retail strategies.

Functional and health-oriented flours, including high-protein, fiber-rich, and alternative blends (from pulses, seeds, or legumes), are gaining momentum. These products cater to consumers with dietary restrictions and preferences for high-nutrition foods.

The premium flour category is projected to grow faster than the overall market, due to rising awareness of wellness and plant-based nutrition. Producers investing in R&D and partnerships with food innovators stand to capture a profitable segment with higher value per tonne compared to commodity flour.

Flour production heavily depends on cereal crops such as wheat, maize, and rice. Fluctuations in agricultural yields, weather conditions, and geopolitical trade restrictions directly impact raw material costs. Grain prices have historically varied by 15-30% annually, affecting profitability and pricing flexibility. Volatility in transportation and energy costs further compounds this issue, leading to compressed margins for millers, particularly in markets with regulated retail pricing.

Different countries impose varied labeling, fortification, and safety standards for flour. These fragmented requirements increase operational complexity for multinational producers. Small and mid-sized mills face difficulties meeting certification costs, resulting in uneven quality and compliance. Logistics challenges and trade tariffs can also disrupt cross-border flour distribution, raising operational expenses and delaying market entry in highly regulated economies.

The demand for ready-to-use and fortified flour blends presents a lucrative opportunity. The prepared flour mix segment is expected to double in value over the next decade as consumers seek convenience and health-focused ingredients.

Urban retail expansion, modern grocery stores, and online food retail platforms are driving accessibility. Manufacturers entering this space can leverage private-label partnerships and brand positioning to capture higher margins compared to bulk commodity flour.

Health-conscious consumers are increasingly adopting gluten-free and plant-based diets. Legume-based and high-protein flours are emerging as preferred alternatives. This trend aligns with the global shift toward sustainable food systems and provides opportunities for manufacturers to diversify product portfolios.

Market data suggests functional flours could account for a multi-billion-dollar subsegment by 2030, offering new revenue streams and product differentiation potential for forward-looking producers.

The bakery and confectionery sector accounts for the largest share of the market, representing approximately 40.2% of overall demand. Staples such as bread, biscuits, cakes, and pastries remain widely consumed across all demographics, ensuring a continuous demand for both industrial and retail flour producers.

Industrial-scale bakeries, such as Grupo Bimbo in Mexico and the U.S., contribute significantly by purchasing large volumes of flour for packaged breads, rolls, and snack products, supporting high-capacity milling operations.

Artisanal and specialty bakeries in Europe and North America increasingly demand high-quality, fortified, and specialty flours, creating opportunities for product differentiation. Retail bakery chains and packaged snack producers maintain consistent bulk purchasing volumes, providing stability for large-scale flour manufacturers.

The foodservice segment, encompassing quick-service restaurants, cafes, and catering operations, is witnessing rapid expansion, especially in urbanized and emerging markets. The recovery of the hospitality sector post-pandemic, combined with increased at-home baking activity, has driven demand for ready-to-use flour blends and premixes.

Companies such as Ardent Mills and King Arthur Baking offer premixed cake and pancake blends, emphasizing convenience, consistent quality, and shelf stability. Pre-portioned, fortified, and specialty mixes (such as gluten-free or high-protein options) are gaining traction in e-commerce channels and retail packaging.

Commodity flour continues to dominate the market with a market share of 55.4%, due to its essential role in staple food production worldwide. This category includes refined wheat flour, maize flour, rice flour, and other widely consumed basic flours. It serves both household and industrial users, including large-scale bakeries, noodle manufacturers, and packaged food producers.

Companies such as ADM, Cargill, and Bunge supply commodity flour globally, leveraging scale, efficient logistics, and competitive pricing. Despite being price-sensitive, commodity flour maintains market stability due to continuous demand for staple food products like bread, pasta, chapati, and noodles. Operational efficiency improvements in milling, storage, and transport help producers maintain margins despite raw material cost fluctuations.

Functional flours are witnessing the highest growth rates due to evolving consumer preferences for health-conscious and specialty diets. This category includes pulse-based flours (chickpea, lentil), seed-based flours (chia, flaxseed), high-protein wheat blends, gluten-free options (rice, almond, or coconut flour), and ancient grains (spelt, quinoa).

For instance, Bob’s Red Mill offers a wide range of gluten-free and high-protein flour options targeting health-oriented consumers. The increasing adoption of plant-based and low-carb diets in North America and Europe has driven this demand. Food manufacturers and bakery brands incorporate these flours into fortified snacks, protein bars, and ready-to-bake products, highlighting nutritional benefits and clean-label positioning.

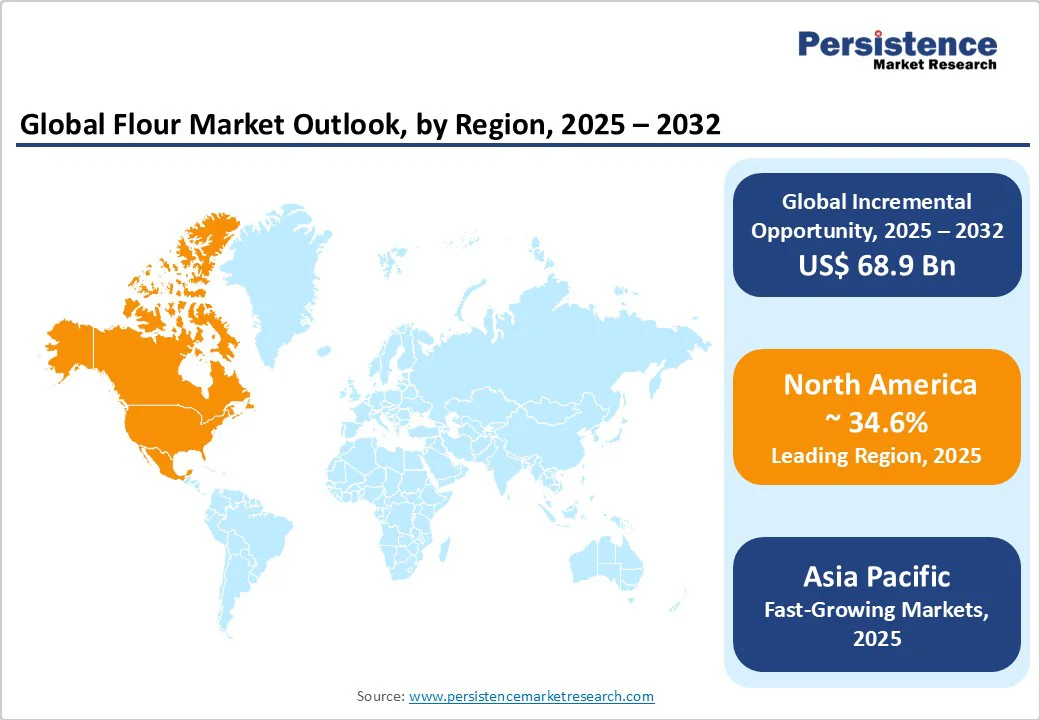

North America represents a mature yet dynamic flour market, holding a market share of 34.6%, driven by innovation in product formulation, diversification of flour-based foods, and evolving consumer preferences.

The U.S. remains the regional leader, accounting for the largest share of the market, supported by large-scale integrated milling facilities and a strong bakery and foodservice industry. Major players such as Ardent Mills, ADM, and Cargill continue to invest in automation, specialty flours, and fortified blends to meet growing consumer demand for functional and gluten-free products.

Nutritional labeling, fortification requirements, and sustainability standards encourage continuous R&D investments. For instance, in 2024, Ardent Mills launched a new line of high-protein and organic flours, catering to health-conscious consumers and specialty bakers.

Canada contributes significantly to regional grain sourcing and export, with companies such as Cargill Canada supplying flour to both domestic and international markets. Mexico is also expanding milling capacity to serve both local consumption and cross-border trade with the U.S.

The adoption of e-commerce channels and partnerships with retail chains is enhancing access to packaged and specialty flours, while investments in energy-efficient milling and renewable energy initiatives signal a shift toward sustainable production.

Asia Pacific is the fastest-growing region, led by China, India, Japan, and ASEAN countries. Rapid urbanization, rising disposable income, and increased processed food consumption are primary growth drivers. Large-scale bakery chains, food manufacturers, and packaged food producers are expanding rapidly, prompting major millers such as Interflour Group, COFCO Corporation, and Nisshin Flour Milling to scale production capacity.

Governments are actively supporting food fortification programs and promoting modernized milling infrastructure. For example, in India, several initiatives encourage the production of fortified flours to combat nutritional deficiencies, while China has implemented quality control standards that emphasize traceability and food safety.

The region’s cost-efficient manufacturing and growing foreign investment further enhance competitiveness. Recent developments include COFCO’s 2025 expansion of integrated milling facilities in Jiangsu Province, designed to serve both domestic consumption and export markets.

The rise of e-commerce platforms and urban supermarkets is also making premium, functional, and specialty flours more accessible to middle-class consumers. Asia Pacific’s combination of cost advantages, regulatory support, and the rising demand from both industrial and retail segments positions it for sustained high growth through 2032.

The flour market in Europe is characterized by established milling groups, high technological adoption, and strong consumer preference for premium, artisanal, and specialty flours. Countries such as Germany, the U.K., France, and Spain collectively represent the largest demand within the region.

Large players like GoodMills Group, Mühlenchemie, and Danisco (part of IFF) continue to invest in innovation, including organic and fortified flour lines, sustainable sourcing programs, and traceable production processes.

Regulatory harmonization under the EU standards ensures consistent product quality, fortification compliance, and accurate labeling. Recent developments include GoodMills’ €25 million investment in Poland in 2025, doubling its specialty flour production capacity and enhancing R&D for functional blends.

Sustainability initiatives, such as reduced water and energy usage in milling, are being prioritized, and cleaner-label formulations are increasingly favored by health-conscious consumers. Private-label and artisanal flours continue to strengthen retail competition, particularly in countries, such as France and Germany, where demand for organic and high-fiber flours is rising.

E-commerce and direct-to-consumer retail models are also expanding the reach, enabling European millers to cater to niche segments with higher margins.

The global flour market exhibits a combination of consolidation among global agribusiness giants and fragmentation at regional levels. Large corporations dominate grain sourcing, processing, and export networks, while regional millers cater to local bakeries and niche markets. National concentration ratios are high in developed markets, while smaller mills remain competitive in emerging economies through flexible production and local distribution.

Leading companies emphasize scale efficiency, vertical integration, and innovation in fortified and specialty flours. Key strategies include sustainability-driven sourcing, digital traceability, and retail diversification through private labels and direct-to-consumer offerings.

The market size is estimated to be US$209 Billion.

The flour market is projected to reach US$277.9 Billion by 2032.

Key trends are the rising demand for functional and fortified flours and the growth of ready-to-use mixes and convenience products.

By application, bakery & confectionery holds the largest share, accounting for approximately 40% of global demand.

The flour market is expected to grow at a CAGR of 4.3% between 2025 and 2032.

Major players include Archer Daniels Midland (ADM), Cargill, Incorporated, Bunge Global, Ardent Mills, and GoodMills Group.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Form

By Sales Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author