ID: PMRREP30175| 187 Pages | 10 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

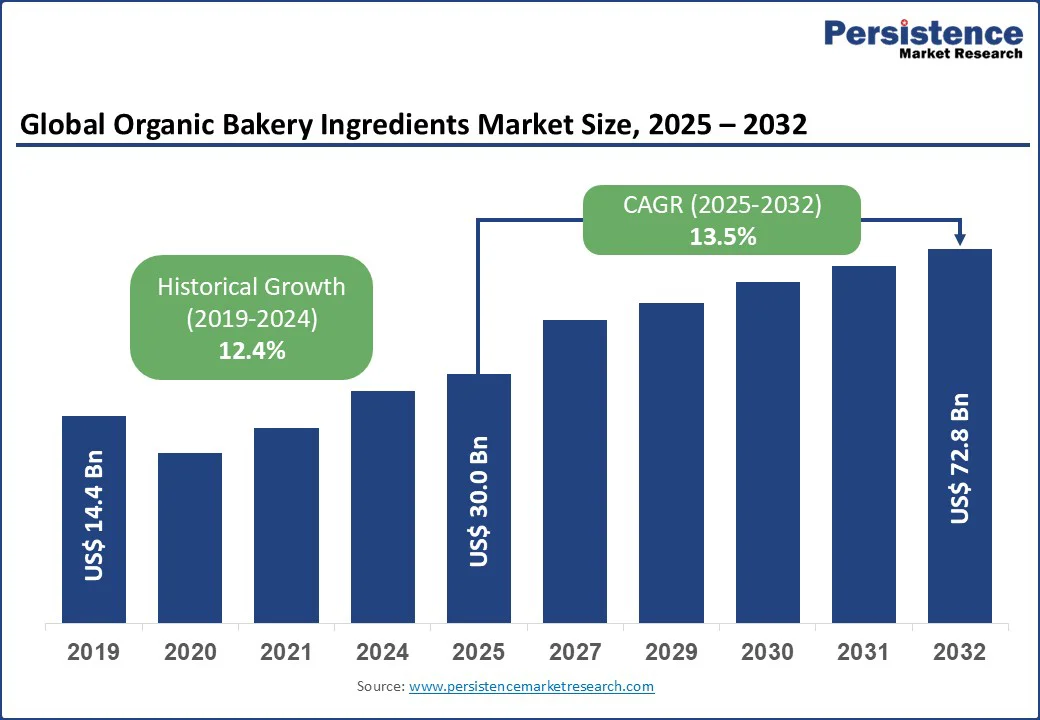

The global organic bakery ingredients market size is likely to be valued at US$30.0 Bn in 2025 to US$72.8 Bn by 2032, registering a CAGR of 13.5% during the forecast period from 2025 to 2032.

Key Industry Highlights:

| Global Market Attribute | Key Insights |

|---|---|

| Organic Bakery Ingredients Market Size (2025E) | US$30.0 Bn |

| Market Value Forecast (2032F) | US$72.8 Bn |

| Projected Growth (CAGR 2025 to 2032) | 13.5% |

| Historical Market Growth (CAGR 2019 to 2024) | 12.4% |

The organic bakery ingredients market is experiencing robust growth, fueled by increasing consumer demand for healthy and natural products, advancements in organic farming technologies, and a rising preference for clean-label bakery items. Industry expansion is further supported by global initiatives promoting sustainable agriculture and enhanced food safety standards in developing regions.

The global surge in health-conscious consumers is a primary driver of the organic bakery ingredients market. According to the Organic Trade Association, organic food sales in the U.S. surpassed $60 Bn in 2023, with bakery products holding a significant share due to consumer dislike of synthetic additives and pesticides.

This trend, particularly strong among millennials and the urban population, underscores the need for organic ingredients such as flour and sugar that support metabolic health and minimize chemical exposure. It is observed that a large share of consumers prioritize clean-label products, emphasizing the demand for organic bakery ingredients in staples such as bread and pastries, where health benefits significantly enhance consumer loyalty.

Technological advancements in organic ingredient production are significantly boosting market growth. Modern platforms, such as precision agriculture and biotech-enhanced organic farming from companies such as Cargill, deliver high purity and yield, reducing contaminants and enabling faster supply chains through real-time quality profiling.

Industry studies indicate that organic processing technologies can cut production time by nearly two-fifths compared to conventional methods, achieving purity rates above ninety-five percent for ingredients such as organic fats and oils. Innovations such as sustainable extraction methods and AI-integrated supply chain analysis further drive adoption, particularly in resource-constrained settings where synthetic alternatives are being phased out.

The high cost of organic bakery ingredients remains a significant barrier to widespread adoption, particularly in low- and middle-income countries. Advanced production methods, equipped with certified organic sourcing and contamination-free processing, require substantial upfront investment. Additionally, ongoing costs for certification, testing, and quality control increase the total cost of ownership.

In regions such as Sub-Saharan Africa and rural South Asia, where food budgets are limited, these financial constraints restrict access to organic bakery ingredients, despite rising health trends. The Food and Agriculture Organization notes that “the premium pricing of organic products may be a disincentive,” highlighting high production costs as a barrier to widespread adoption in many countries.

The need for skilled personnel to handle and process organic bakery ingredients also hinders market growth. Sourcing and blending organic components such as eggs and dairy require specialized training for supply chain professionals. A shortage of certified experts in organic agriculture in developing regions exacerbates this challenge. This skills gap, combined with high training costs, limits the adoption of premium systems in emerging markets, slowing market expansion.

The development of innovative and sustainable organic bakery ingredients presents significant growth opportunities, enabling use in diverse baking scenarios, from home kitchens to commercial production. These advanced ingredients overcome the limitations of conventional synthetic options, making them ideal for decentralized food systems.

For example, King Arthur Flour’s organic blends offer rapid mixing and consistent results, making them suitable for use in small-scale and artisanal settings. As food systems prioritize natural products, demand for such solutions is rising, particularly in regions with limited industrial infrastructure.

The growing popularity of clean-label and functional organic ingredients, such as fortified flours for enhanced nutrition, provides another avenue for market expansion. These ingredients require minimal additives and deliver improved health benefits, making them suitable for health-focused environments.

Industry studies indicate that functional organic ingredients can extend product shelf life by nearly one-third compared to traditional methods, driving demand in trend-driven areas such as gluten-free and low-sugar baking.

The integration of digital platforms for supply chain monitoring and data sharing further enhances market potential. Companies such as ADM are adopting blockchain-enabled tracking systems, enabling real-time transparency and proactive quality control. This trend improves accessibility and operational efficiency, supporting market growth in both developed and emerging regions.

The organic bakery ingredients market is segmented into organic flour, organic sugar, organic fats and oils, organic eggs, and organic dairy ingredients. Organic flour dominates, holding approximately 35.5% share in 2025, due to its critical role as a base component in bakery products. Advanced organic flour products, such as those from Bob’s Red Mill, are widely adopted for their ease of use and consistent quality, making them essential in production settings.

Organic dairy ingredients are poised to grow rapidly, driven by increasing demand for high-nutrition additions in research and commercial baking. Innovations in organic dairy processing technologies, such as those from Kerry Group, offer superior quality and versatility, boosting adoption in high-volume bakery centers.

The organic bakery ingredients market is divided into retail, foodservice, online, and wholesale. Retail leads with a 40% share in 2025, driven by its widespread accessibility in consumer markets. These channels facilitate direct purchases, critical for everyday use, with over one million tons distributed annually worldwide for home and small-scale baking.

Online is the fastest-growing segment, fueled by advancements in e-commerce platforms and the rising prevalence of digital procurement. Its ability to offer convenient access with a wide variety drives its adoption in advanced supply networks, particularly following the global e-commerce boom.

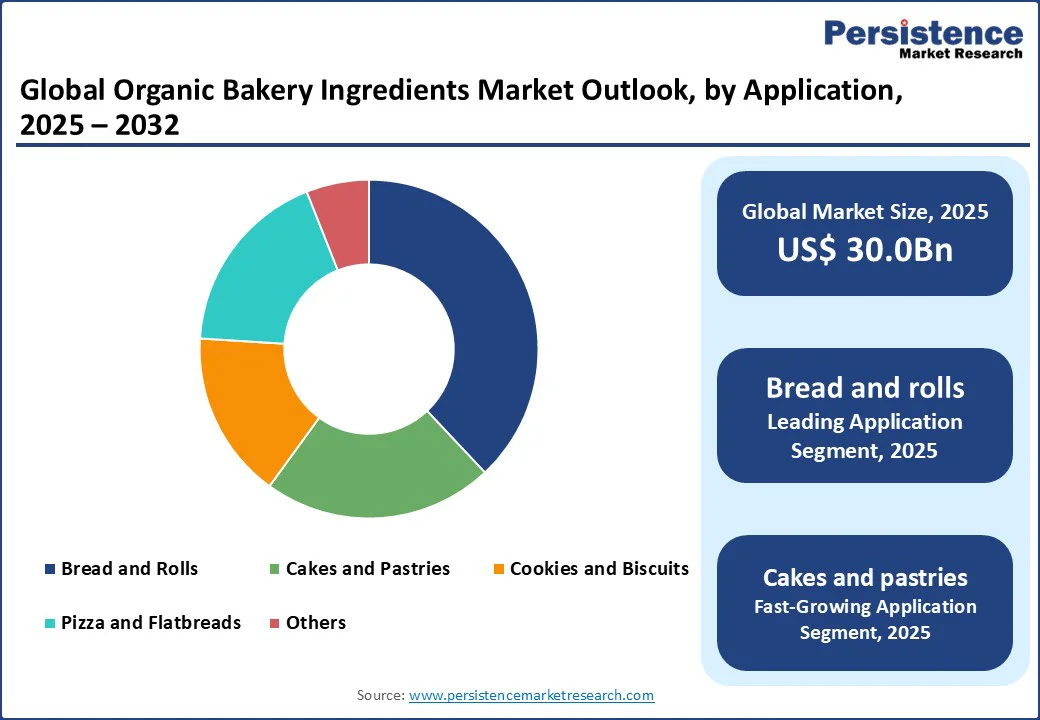

The global organic bakery ingredients market is segmented into bread and rolls, cakes and pastries, cookies and biscuits, pizza and flatbreads, and other bakery products. Bread and rolls dominate with a 38% share in 2025, driven by their high consumption volumes and staple nature. This application relies on simple integration methods to enhance nutrition, making it essential for routine production in factories and artisan shops.

Cakes and pastries is the fastest-growing segment, propelled by increasing demand for premium and indulgent bakery items for special occasions. These applications, which allow for creative flavor profiles, cater to the growing demand for high-end baking and specialty markets.

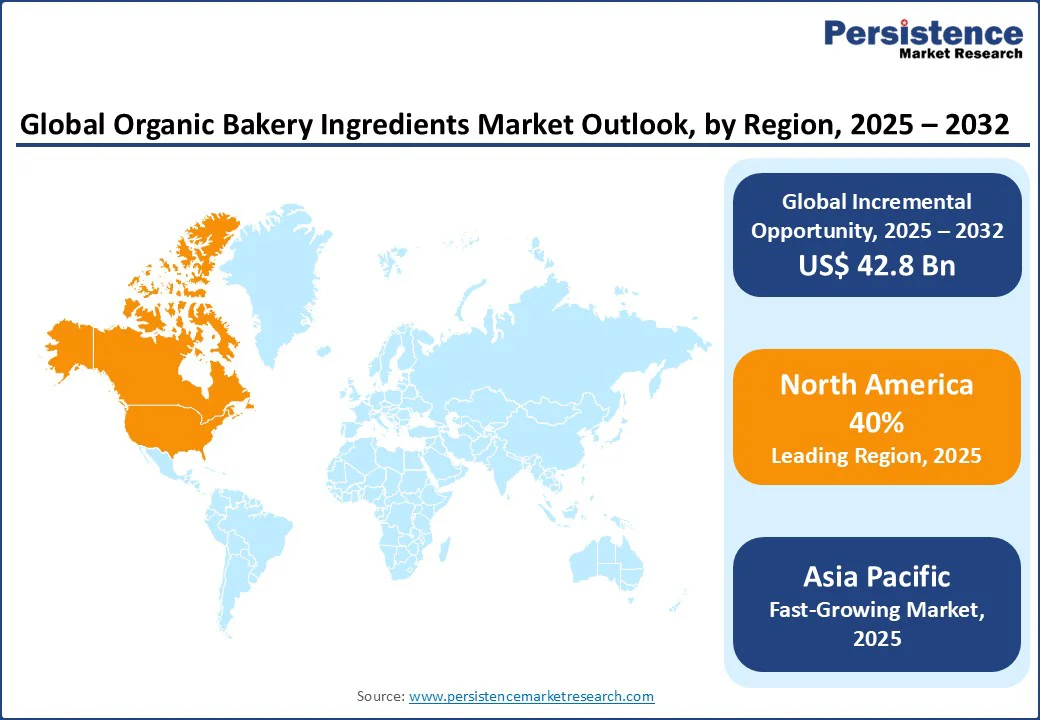

North America dominates the organic bakery ingredients market, expected to account for 40% share in 2025. This dominance is driven by high demand for health-focused foods, advanced retail infrastructure, and increasing preferences for clean-label products.

The USDA reports substantial growth in organic certifications annually, underscoring the need for robust natural ingredient solutions. Leading brands such as Cargill and ADM are developing innovative platforms to support bakers with purity, efficiency, and consumer-friendly options.

Consumer preferences are shifting toward versatile, fortified organic ingredients with AI-integrated sourcing, such as Whole Foods Market’s blends, which enhance product quality and appeal. Stringent USDA regulations prioritize food safety, encouraging the adoption of reliable, high-purity components. Favorable policies for organic subsidies further incentivize manufacturers and retailers to invest in advanced supplies, supporting market growth.

Europe is led by Germany, the U.K., and France, driven by regulatory support and high consumption volumes. Germany holds the largest share, supported by strong sales from companies such as Doves Farm and AAK AB. The EU’s Organic Action Plan fosters innovation and compliance, promoting the adoption of advanced flour and sugar systems in major food facilities.

In the U.K., market growth is driven by rising demand for artisanal organics, with products such as King Arthur Flour’s ingredients gaining popularity for their quality and sustainability. France is witnessing increased demand for premium bakery applications, with Kerry Group offering specialized solutions. Regulatory support for eco-friendly practices across Europe further enhances market prospects.

Asia Pacific represents the fastest-growing market for organic bakery ingredients, driven by expanding food infrastructure, increasing health awareness, and rising investments in natural technologies. India remains a key growth engine, where rising wellness trends and government programs such as the Organic Farming Scheme boost demand for affordable, versatile ingredient solutions.

Domestic manufacturers such as Hain Celestial and General Mills cater to local needs with cost-effective supplies designed for both urban and rural baking settings.

In China, rapid expansion is supported by large-scale production upgrades, growing adoption of organic blends, and the presence of leading players such as Grupo Bimbo. Japan’s market is characterized by demand for high-precision natural tools used in specialty and health-focused baking, with companies such as Nature’s Path Foods gaining market share.

Across the region, increased food spending, digital platforms, and an emphasis on clean eating are collectively boosting adoption, making Asia Pacific a critical hub for future market growth.

The global organic bakery ingredients market is highly competitive, with industry players competing for market share through innovation, competitive pricing, and reliability. The rise of sustainable and functional ingredients intensifies competition, as companies strive to meet stringent regulatory standards and consumer demands. Strategic partnerships, mergers, and certifications are critical differentiators in this dynamic market.

The organic bakery ingredients market is projected to reach US$30.0 Bn in 2025.

Rising health consciousness, technological advancements in sustainable production, and government initiatives for organic agriculture are the key market drivers.

The organic bakery ingredients market is poised to witness a CAGR of 13.5% from 2025 to 2032.

Innovations in functional organic ingredients and e-commerce distribution present significant growth opportunities.

Cargill, Kerry Group, and ADM are among the leading market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Distribution Channel

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author