ID: PMRREP16582| 185 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

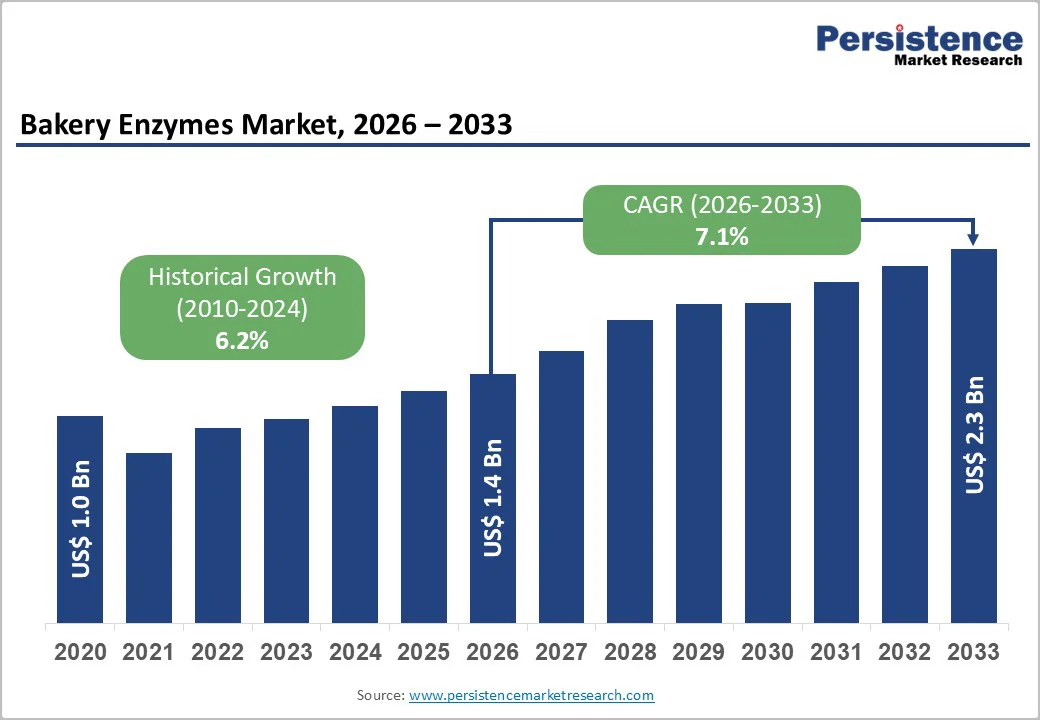

The global bakery enzymes market size is estimated to grow from US$ 1.4 billion in 2026 to US$ 2.3 billion by 2033, growing at a CAGR of 7.1% during the forecast period from 2026 to 2033.

A surge in performance-driven baking and the global push for cleaner, fresher, and more stable bakery products are reshaping how enzyme suppliers compete and expand. Innovation cycles are speeding up, and companies investing in advanced fermentation, regional customization, and freshness-extending solutions are gaining a visible edge.

| Key Insights | Details |

|---|---|

| Global Bakery Enzymes Market Form (2026E) | US$ 1.4 Bn |

| Market Value Forecast (2033F) | US$ 2.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.1% |

| Historical Market Growth (CAGR 2020 to 2024) | 6.2% |

A growing appetite for bakery items that stay soft, moist, and flavorful for longer periods is reshaping innovation across the bakery enzymes sector. Consumers expect breads, cakes, and snacks to maintain freshness despite busy lifestyles and longer storage intervals. This shift pushes manufacturers to adopt enzyme systems that enhance crumb softness, delay staling, and improve resilience during distribution.

Brands are reformulating to achieve cleaner textures without chemical additives, making enzymes a preferred tool for quality consistency. As retail bakeries, industrial producers, and quick-service chains expand premium fresh-bake offerings, demand accelerates for solutions that deliver extended shelf stability while preserving sensory appeal. This momentum positions bakery enzymes as essential performance enhancers in modern baking.

A knowledge gap continues to shape industry performance, as many small and mid-sized bakeries remain unaware of how specific enzymes influence dough handling, volume, crumb texture, and shelf-life stability. This limited understanding prevents them from optimizing formulations or replacing chemical improvers, resulting in inconsistent product quality and higher operational costs.

Smaller operators often rely on traditional baking practices, leaving little room for experimentation or technical upgrades. Without access to trained technologists or supplier-led training, they hesitate to integrate enzyme systems that could streamline processes and boost efficiency.

This hesitation slows overall market expansion, creating a clear divide between large industrial bakeries that fully leverage enzymatic solutions and smaller players still dependent on manual expertise and legacy methods.

A growing shift toward inclusive baking is turning gluten-free innovation into one of the most attractive opportunities for enzyme developers worldwide. As consumers demand bread, cakes, and pastries with textures closer to wheat-based products, the market is leaning heavily on enzyme systems that replicate elasticity, structure, and moisture retention lost in the absence of gluten.

Startups and established players are experimenting with tailored proteases, transglutaminase blends, and carbohydrate-modifying enzymes to build stronger crumb structures and improve dough handling.

The surge in celiac diagnoses, lifestyle-driven gluten avoidance, and clean-label expectations is pushing brands to offer enzyme solutions that enhance volume, softness, and stability in diverse gluten-free flours. This momentum is opening a profitable runway for formulation breakthroughs and cross-category expansion.

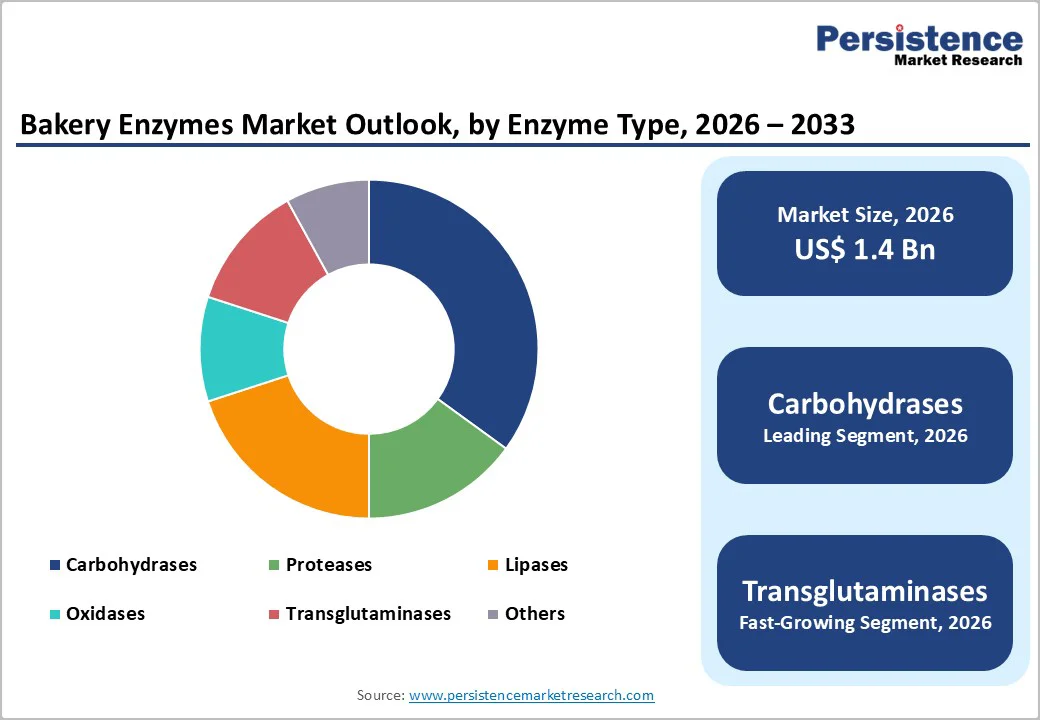

Carbohydrases holds approx. 41% market share as of 2025, reinforcing their position as the backbone of modern bakery processing due to their strong impact on dough handling, crumb softness, and overall product consistency. Bakers rely on these enzymes to improve fermentation efficiency, enhance sweetness naturally, and extend freshness without chemical additives.

Proteases play a meaningful supporting role by relaxing gluten networks to create smoother doughs for cookies and specialty breads. Lipases contribute to flavor development and help maintain softness during storage, making them popular in clean-label formulations.

Oxidases assist in strengthening dough structure, especially for high-volume industrial lines, while Transglutaminases are gaining attention for their role in improving elasticity and boosting protein cross-linking. Collectively, these enzyme groups elevate product quality across diverse bakery formats.

Cookies & biscuits are projected to grow at a CAGR of 8.4% during the forecast period, and this steady climb reflects how enzyme-enabled formulations are reshaping product innovation across the category. Brands are using enzymes to achieve consistent texture, sharper flavor release, and longer freshness capabilities that matter in a market where consumers expect crispness, clean labels, and low waste.

Cookie and biscuit manufacturers rely on carbohydrases to streamline dough handling, while proteases help refine bite and mouthfeel for premium formats. Lipase-based solutions are gaining traction in butter-style and indulgent SKUs, while oxidases support structural stability in thin and filled variants produced at high speed. As global snacking accelerates, enzymes give producers the functionality needed to scale quality.

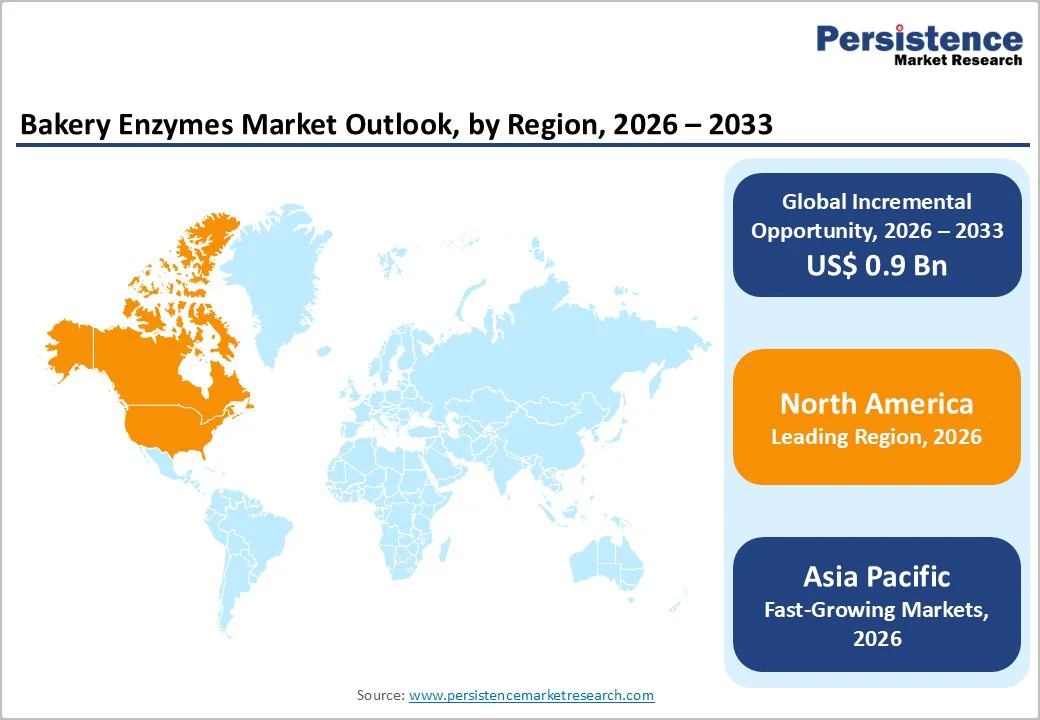

North America holds approximately 35% market share in the global Bakery Enzymes Market, and the region is moving toward a bakery landscape shaped by cleaner labels, precision formulation, and efficiency-driven enzyme adoption. In the United States, large commercial bakeries are pushing for enzyme blends that improve dough tolerance, reduce waste, and maintain softness across wider distribution networks.

Demand is rising for solutions that support high-protein, high-fiber, and low-carb bakery lines, prompting suppliers to engineer enzymes that stabilize challenging formulations. Canada is expanding uptake through premium artisanal and frozen bakery segments, where enzymes help secure consistent texture in varying climate conditions.

Across the region, sustainability goals, automation upgrades, and retailer pressure for extended freshness continue to accelerate innovation in enzyme-based bakery enhancement.

Asia Pacific bakery enzymes market is expected to grow at a CAGR of 8.6%, and this momentum reflects a fast-expanding bakery culture shaped by evolving lifestyles and ingredient innovation. India is seeing higher use of enzymes as industrial bakeries push for softer textures and improved dough tolerance to meet surging demand for packaged breads and snackable formats.

China’s large-scale bakery plants are adopting enzyme blends that enhance production speed and reduce waste, driven by rising preference for premium baked goods. Japan continues to lead in precision fermentation and clean-label enzyme applications tailored to artisanal breadmaking.

South Korea’s bakery cafés are sparking demand for freshness-extending enzyme systems, while Indonesia’s value-driven bakeries are using enzyme solutions to stabilize flour variability in hot, humid climates.

A moderately fragmented market characterizes the global bakery enzymes landscape, creating strong momentum for innovation-oriented companies to differentiate through technology and formulation science. Leading players are advancing enzyme engineering to improve dough handling, enhance crumb softness, and extend shelf life across diverse bakery formats.

Regulatory support for clean-label ingredients is pushing manufacturers to secure credible certifications and strengthen quality assurance systems. Collaborative projects with grain processors, flour mills, and bakery chains are accelerating the adoption of tailored enzyme blends designed for regional flours and climate conditions.

Companies are investing in precision fermentation, advanced processing technologies, and pilot-scale testing centers to refine performance. Expansions across Asia Pacific and Latin America reflect a strategic push toward high-growth baking hubs worldwide.

The global bakery enzymes market is projected to be valued at US$ 1.4 Bn in 2026.

Rising consumer demand for fresh, soft, and extended-shelf-life bakery products are accelerating global demand for bakery enzymes.

The global Bakery Enzymes market is poised to witness a CAGR of 7.1% between 2026 and 2033.

Expanding gluten-free bakery lines are unlocking strong opportunities for enzyme solutions that replicate gluten’s structure and elasticity.

Major players in the global Bakery Enzymes market include IFF, dsm-firmenich, Novozymes A/S, Kerry Group plc, Lallemand Inc., Lesaffre, AB Enzymes (Associated British Foods plc), and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Enzyme Type

By Form

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author