ID: PMRREP3544| 198 Pages | 30 Sep 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

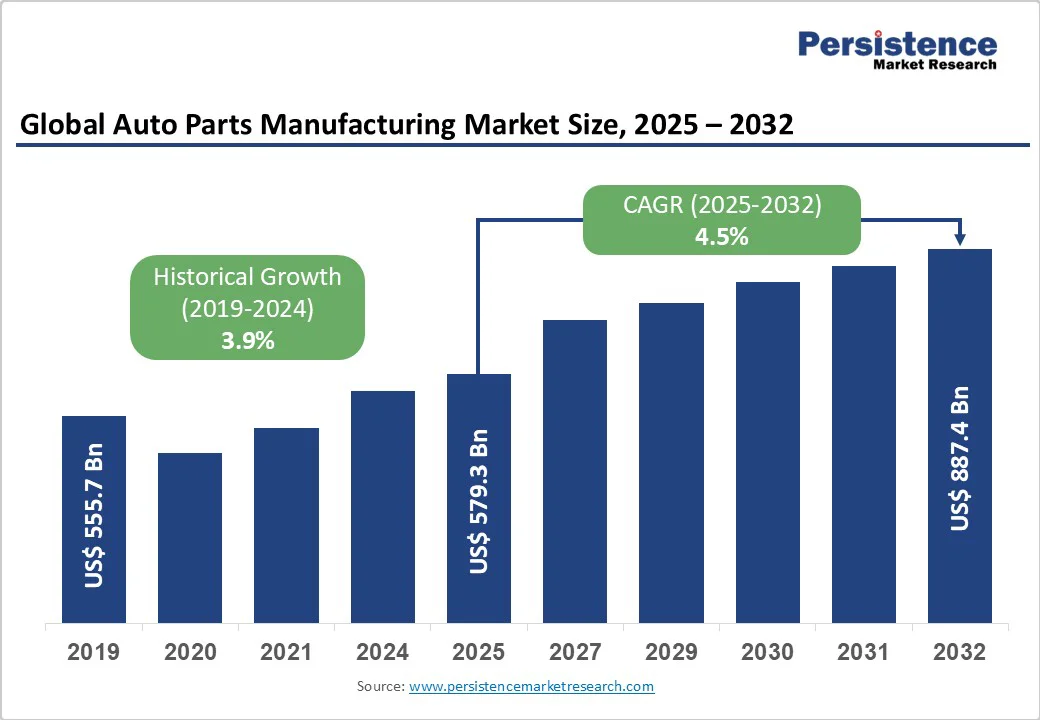

the global automotive components manufacturing market size is likely to value at US$ 579.3 Bn in 2025 and is projected to reach US$ 887.4 Bn by 2032, growing at a CAGR of 4.5% between 2025 and 2032. Rapid electrification of vehicles and increasing consumer demand for advanced safety and infotainment systems are fueling expansion.

| Key Insights | Details |

|---|---|

|

Auto Parts Manufacturing Market Size (2025E) |

US$ 579.3 Bn |

|

Market Value Forecast (2032F) |

US$ 887.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.9% |

Global EV registrations climbed from 2.1 million in 2019 to over 10 million in 2024, marking a CAGR above 45% and driving unprecedented demand for power electronics, battery-management systems, and high-voltage cabling. Between 2021 and 2024, Tier-1 suppliers saw 30% revenue growth in Electrical & Electronics Components, the fastest among all categories. At the same time, OEM collaborations with semiconductor and software firms are accelerating ADAS and infotainment integration, achieving up to 12% unit cost reductions through modular platforms. This electrification wave positions electrical and electronics systems as the most dynamic growth driver in automotive component manufacturing.

Stringent global CO? reduction mandates of 50% by 2030 in the U.S. and 55% by 2035 in the EU are a key driver of the auto parts manufacturing market. Automakers are increasingly adopting lightweight materials like aluminum, high-strength steel, and composites, alongside optimized powertrain systems, to meet compliance standards. In 2023, investment in chassis and body materials rose 18%, reducing average curb weight by 5%. At the same time, mandatory Level 2 ADAS fitment expanded sensor, camera, and radar module demand by 25% annually. Combined with tax incentives for low-emission vehicles, these measures boost supplier order books and justify rising R&D investments.

Raw material price volatility poses a significant restraint in the auto parts manufacturing market. Between 2020 and 2023, high-grade steel prices surged by 25% and aluminum premiums by 18%, compressing Tier-1 supplier margins by 150–200 basis points. While larger firms mitigate risks through hedging and long-term contracts, unpredictable price swings often require cost pass-through to OEMs, raising the risk of order delays or renegotiations. Smaller suppliers lacking hedging strategies face margin erosion of up to 10%, reducing financial flexibility and hindering investments in advanced technologies, capacity expansion, and competitive innovation, thereby impacting overall market growth.

The global semiconductor shortage of 2021–2022 severely constrained the auto parts manufacturing market, resulting in a 7.7-million-unit production shortfall and deferring around US$ 210 billion in component demand. Although new fabrication capacity is gradually easing the crisis, lead times remain extended at 28 weeks compared to the pre-pandemic average of 12 weeks. This persistent supply bottleneck hampers production of electronics-intensive modules and disrupts new-model launches. OEMs and Tier-1 suppliers are often compelled to redesign vehicle architectures based on chip availability rather than performance requirements, reducing innovation, delaying rollouts, and restricting market growth momentum in the short to medium term.

The rapid expansion of the global EV parc, projected to surpass 200 million units by 2030, presents a significant aftermarket opportunity in electrification services. Retrofit battery upgrades, modular powertrain kits, and advanced charging components are expected to generate US$ 45 billion by 2028. Suppliers entering this space can capture 12–15% of the spend by collaborating with certified service centers and deploying predictive maintenance platforms that enhance vehicle efficiency and lifecycle value. Early movers securing robust distribution networks across Europe and North America gain a competitive edge, achieving break-even in as little as 18 months, reinforcing long-term market leadership.

The growing regulatory push for fuel efficiency and emissions reduction is creating a strong opportunity in lightweight materials for commercial vehicles. With heavy commercial vehicles contributing 16.8% of market revenues in 2025, replacing conventional steel with high-strength alloys and composites can reduce vehicle weight by 20%, boosting fuel economy by 5–7% and cutting CO? emissions by up to 10 tons per unit annually. This shift is expected to drive the lightweight CV components market to US$ 65 billion by 2027. Early-adopter suppliers offering innovative materials stand to capture premium margins and strengthen partnerships with OEMs focused on sustainability compliance.

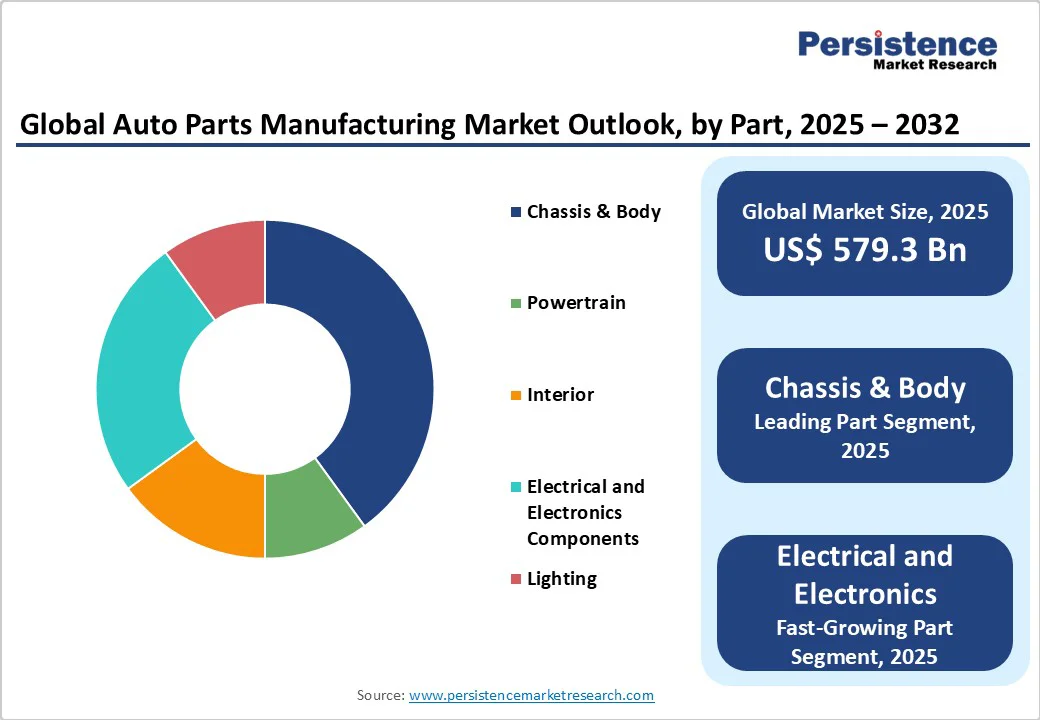

In 2025, the Chassis & Body (C&B) segment dominated with a 35.4% share, supported by stricter crashworthiness standards and the industry’s pivot toward lightweight alloys and composites. OEMs raised investment in aluminum casting and composite stamping by 18% in 2023 to comply with CO? reduction targets, cementing C&B as the top revenue generator.

Electrical & Electronics Components are the fastest-growing segment, forecast to grow at a 7.2% CAGR (2025–2032). Rising adoption of ADAS, electrification, and infotainment systems across passenger and commercial vehicles underpins this expansion, making electronics integral to the future of automotive component manufacturing.

The passenger vehicle segment led the market with 55.9% share in 2025, supported by strong global demand, continuous model refresh cycles, and integration of advanced comfort and safety features. The passenger car segment is driven by the augmenting demand for personal transportation and increasing consumer preferences for comfort, safety, and advanced features.

Auto parts manufacturers cater to this segment by supplying components such as engines, transmissions, suspension systems, electrical systems, and interior accessories. In contrast, the Electric Vehicle (EV) segment is the fastest growing, projected at a leading CAGR, fueled by stricter emission norms, government incentives, and rapid battery cost reductions. Suppliers investing in EV-focused components like power electronics and thermal management systems stand to capture significant value.

The OEM segment dominated the automotive components manufacturing market with 83.6% revenue share in 2025, supported by continuous vehicle launches, platform upgrades, and deeper OEM-supplier integration strategies. Automakers are allocating nearly 40% of CAPEX toward next-generation component sourcing through 2027, reinforcing OEM channel strength. Meanwhile, the Aftermarket segment is projected to grow at 6.1% CAGR (2025–2032), driven by rising demand for collision-repair parts, retrofit solutions, performance enhancements, and digital service subscriptions. This growth is most pronounced in North America and Europe, where aging vehicle fleets sustain long-term aftermarket opportunities.

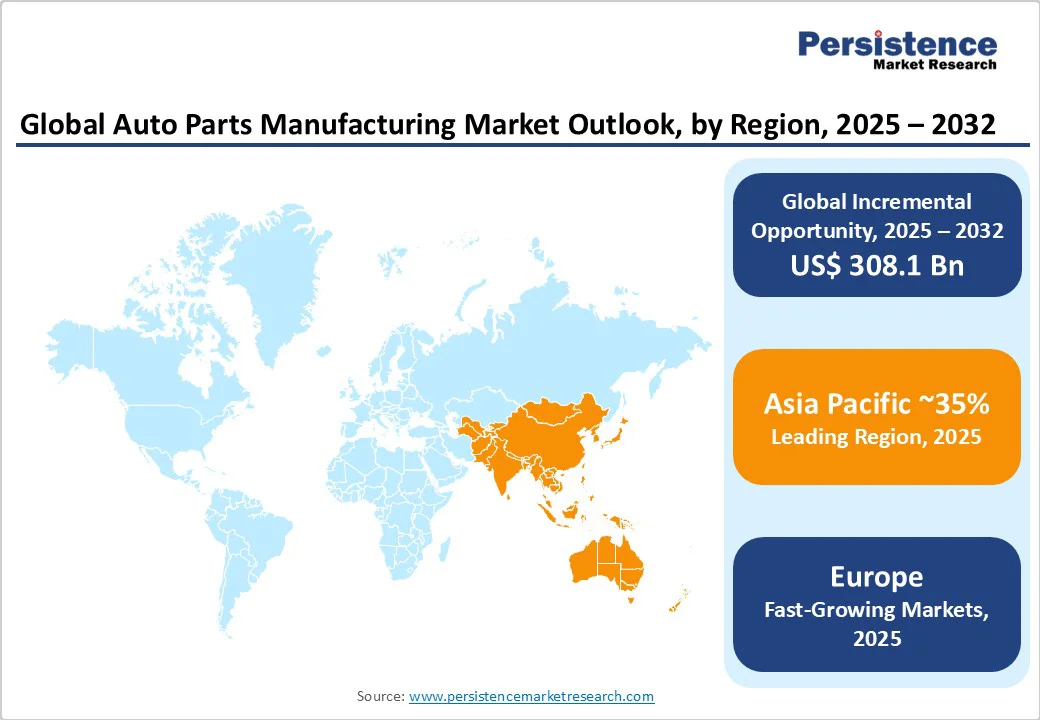

North America represented 19.6% of the global auto-parts market in 2025, with the U.S. market valued at US$ 142.8 billion. The region benefits from strong R&D ecosystems, advanced manufacturing incentives, and robust consumer demand for SUVs and light trucks. The Inflation Reduction Act’s tax credits for EVs and battery manufacturing have driven US$ 4.5 billion in new Tier-1 and Tier-2 investments since 2023, focusing on advanced power electronics and lightweight chassis modules. Regulatory drivers include California’s Advanced Clean Vehicles rule and federal fuel-efficiency standards. Competitive dynamics feature consolidation among incumbents and partnerships with semiconductor and software firms to accelerate ADAS and electrification rollouts.

Europe held a 26.6% market share in 2025, led by Germany (US$ 97.4 billion). The region is underpinned by the EU Green Deal’s emissions targets and the EU Battery Regulation. Harmonized type-approval processes across member states streamline chassis, powertrain, and electronics homologation, reducing time-to-market by up to six months. Funding mechanisms including a €2.1 billion raw-materials initiative and a €1.4 billion lightweight-materials grant program are spurring R&D in high-strength steel and composite structures. European OEMs and suppliers are forming consortia to localize semiconductor wafer fab capabilities, enhancing resilience and reducing dependency on Asian foundries.

With 37.1% share in 2025 (US$ 215.1 billion), Asia Pacific is the largest and fastest-growing region. China leads at US$ 118.7 billion, followed by Japan, India and ASEAN. Competitive advantages include low-cost manufacturing, scalable stamping and casting operations, and vertically integrated supplier networks. Government incentives such as China’s NEV credits and India’s Production Linked Incentive (PLI) scheme have driven component localization ratios above 65%. FDI flows of US$ 6.8 billion in 2024 targeted capacity expansions for next-gen powertrain modules and semiconductor-electronics integration. Major opportunities arise from domestic OEM joint ventures, cluster-based manufacturing parks, and emerging EV supply chains in Vietnam, Thailand, and Indonesia.

The global auto parts manufacturing market reflects a moderately consolidated structure, where global Tier-1 suppliers compete alongside regional specialists and niche innovators. The top 10 players account for approximately 48% of global revenues, with leading firms individually holding 4–7% market share.

Market leadership is sustained through diversified product portfolios, global production networks, and strategic collaborations with OEMs. Tier-1 suppliers focus on scaling advanced manufacturing technologies, while smaller firms carve out opportunities in niche areas such as solid-state lighting, lightweight composites, and additive manufacturing.

The Auto Parts Manufacturing market is estimated to be valued at US$ 555.7 Bn in 2025.

A key demand driver for the Auto Parts Manufacturing market is the Lightweight Materials and Advanced Techniques Propel Efficiency Goals, and Electric Vehicle Components Drive Market Evolution.

In 2025, the Europe region will dominate the market with an exceeding 25% revenue share in the global Auto Parts Manufacturing market.

Among the Part Type, Chassis & Body hold the highest preference, capturing beyond 35.4% of the market revenue share in 2025, surpassing other parts.

The key players in the Auto Parts Manufacturing market are Robert Bosch GmbH, ZF Friedrichshafen AG, Magna International Inc., Denso Corporation, and Hyundai Mobis.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Part Type

By Vehicle Type

By End -user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author