ID: PMRREP32152| 213 Pages | 27 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

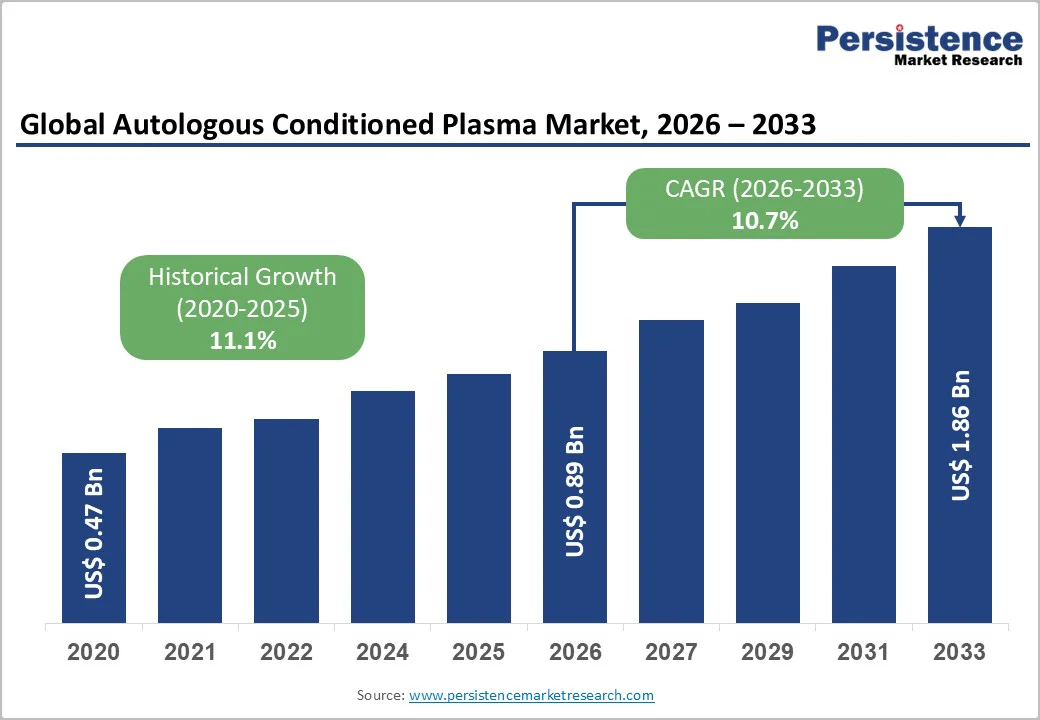

The global autologous conditioned plasma market is expected to reach US$0.89 billion in 2026. It is expected to reach US$1.86 billion by 2033, growing at a CAGR of 10.7% from 2026 to 2033, driven by rising utilization of orthobiologic therapies, increased sports injuries requiring regenerative solutions, and wider adoption of minimally invasive procedures.

Broader acceptance of autologous biologics in dermatology, orthopedics, and dental care supports market traction. Increasing patient preference for low-risk therapies and improvements in point-of-care processing systems contribute to sustained commercial growth.

| Key Insights | Details |

|---|---|

|

Autologous Conditioned Plasma Market Size (2026E) |

US$0.89 Bn |

|

Market Value Forecast (2033F) |

US$1.86 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

10.7% |

|

Historical Market Growth (CAGR 2020 to 2025) |

11.1% |

The greater prevalence of osteoarthritis, ligament tears, and tendon injuries is driving increased adoption of autologous conditioned plasma (ACP) as physicians emphasize non-surgical, regenerative therapies. Orthopedic associations report rising treatment volume for degenerative joint diseases among aging populations, influencing clinical preference for autologous plasma applications. ACP injections are frequently used in knee osteoarthritis, which is estimated to affect more than 600 million individuals worldwide. Increased participation in competitive and recreational sports has raised procedural volumes in sports medicine clinics. As more studies assess outcome improvement and pain reduction in select indications, demand for plasma-based therapy continues to expand across outpatient settings.

Healthcare systems are prioritizing minimally invasive interventions that offer shorter recovery times and reduced complication risk. ACP therapies align with this shift as they use patient-derived components with low immunogenicity. Clinics have expanded their regenerative portfolios by incorporating ACP as a complementary modality for hair restoration, facial rejuvenation, chronic tendinopathies, and periodontal procedures. As point-of-care centrifugation platforms become more efficient in separating platelet-rich fractions with consistent concentration profiles, physicians increasingly rely on ACP for targeted tissue healing. Improved device automation enables faster sample preparation, improving treatment throughput and adoption.

Aesthetic practitioners continue to integrate autologous biologics for skin rejuvenation, scar management, under-eye volume enhancement, and hair regrowth therapies. Androgenic alopecia affects a significant share of adult males, generating steady procedural demand. Clinics offering combination protocols with microneedling and laser resurfacing have reported increased adoption due to improved patient satisfaction. Rising consumer preference for natural-origin treatments supports the adoption of autologous options in cosmetic care. Expanding dermatology clinic networks in urban regions further strengthens ACP utilization in aesthetic applications.

Outcome differences associated with platelet concentration, leukocyte levels, and preparation techniques create concerns for consistency, especially across orthopedic and dermatology practices. Variability in centrifuge efficiency and sample handling increases the risk of inconsistent therapeutic efficacy. Different formulations, leukocyte-rich vs. leukocyte-poor, are not universally standardized, limiting comparability across clinical settings. This inconsistency affects physician confidence and can slow wider institutional adoption.

Insurance programs in many markets classify autologous plasma treatments as elective or experimental, depending on the indication. Patients often bear full procedure costs, which may range from modest fees to significantly higher expenses across multi-session treatment cycles. Lack of unified reimbursement frameworks reduces accessibility, particularly in lower-income demographics. High capital cost for advanced centrifuge systems also affects smaller clinics and constrains penetration into emerging healthcare regions.

Emerging economies are witnessing rapid growth in sports medicine procedures, dental implant treatments, and dermatology services. Increasing disposable income and strengthening private hospital networks create favorable adoption conditions for ACP systems. Clinics in Southeast Asia, Latin America, and parts of the Middle East are investing in compact centrifuges and point-of-care biologic devices. This creates potential for multi-million-dollar incremental revenue pools as adoption widens across outpatient and day-surgery centers.

Newer plasma separation devices deliver higher platelet concentration consistency, reduced manual handling, and improved reproducibility. Automated closed-system platforms reduce contamination risk and streamline clinical workflows. Manufacturers developing digital-enabled systems with integrated quality-control analytics can access expanding demand from large orthopedic chains and dermatology networks. This opportunity is expected to create notable annual equipment sales growth across high-utilization clinical centers.

Combination approaches pairing ACP with biomaterials, scaffolds, microneedling tools, or low-energy laser systems provide improved therapeutic outcomes in dermatology and wound healing. Hospitals adopting multimodal regenerative protocols can offer differentiated care pathways. Bundled therapy packages create revenue opportunities across consumables and service cycles, strengthening long-term market demand.

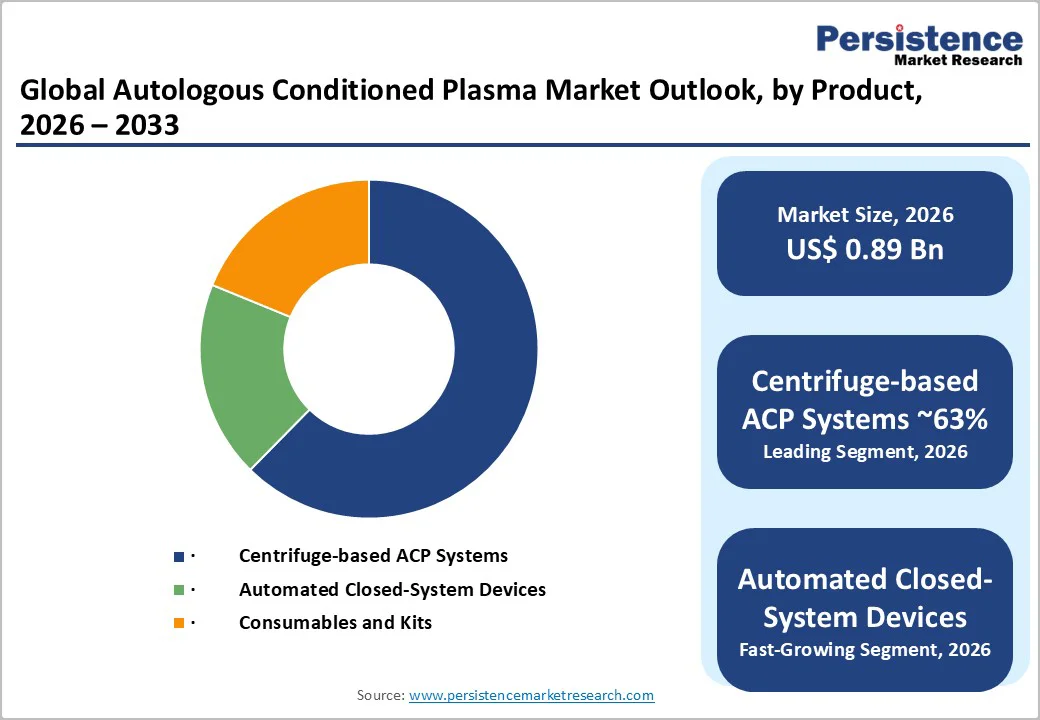

Centrifuge-based ACP systems account for approximately 63% of the global product-type market, making them the largest revenue-contributing segment. These systems maintain a strong position due to their widespread use in orthopedic, dermatology, and dental practices. Adjustable spin protocols allow clinicians to tailor plasma concentration for tendon repair, joint injections, and skin rejuvenation. Compact bench-top centrifuges with sealed rotors enhance safety and workflow efficiency. For example, orthopedic day-care centers frequently operate multiple centrifuge units to manage high procedure volume for lateral epicondylitis and rotator cuff tendinopathy. Consistent purchasing cycles among multi-specialty clinics keep this segment structurally dominant.

Automated closed-system ACP devices represent the fastest-growing product segment. These systems appeal to hospitals adopting standardized regenerative pathways as they reduce operator-dependent variability. Automated devices integrate digital processors that optimize extraction and concentration parameters for consistent platelet yields. Their closed design reduces contamination risks and shortens preparation time, making them ideal for dermatology chains offering high-volume facial rejuvenation and hair restoration programs. For example, large hospital networks are deploying automated units across satellite clinics to unify treatment outcomes, accelerating penetration in Tier-1 urban markets.

Orthopedics and sports medicine command an estimated 49% share of the total application market, placing this segment at the forefront of ACP utilization. This is driven by extensive use of autologous plasma in osteoarthritis management, ligament injuries, and chronic tendinopathies. Outpatient orthopedic centers routinely administer ACP injections as part of conservative management to delay or reduce reliance on surgical interventions. For instance, sports rehabilitation centers integrate ACP into treatment pathways for ACL sprains and Achilles tendinopathy, supported by rising participation in organized sports and an aging population requiring joint preservation therapies.

Dermatology and aesthetics are the fastest-expanding application areas. Adoption continues to rise due to ACP’s expanding clinical utility in hair restoration, facial rejuvenation, acne scar improvement, and post-laser recovery. Cosmetic clinics increasingly position ACP as part of bundled enhancement packages alongside microneedling or fractional laser procedures. For example, metropolitan aesthetic centers report a surge in younger patients seeking non-surgical rejuvenation options that incorporate autologous components. Growing chains of dermatology clinics in Asia and the Middle East further accelerate demand for ACP-based treatments.

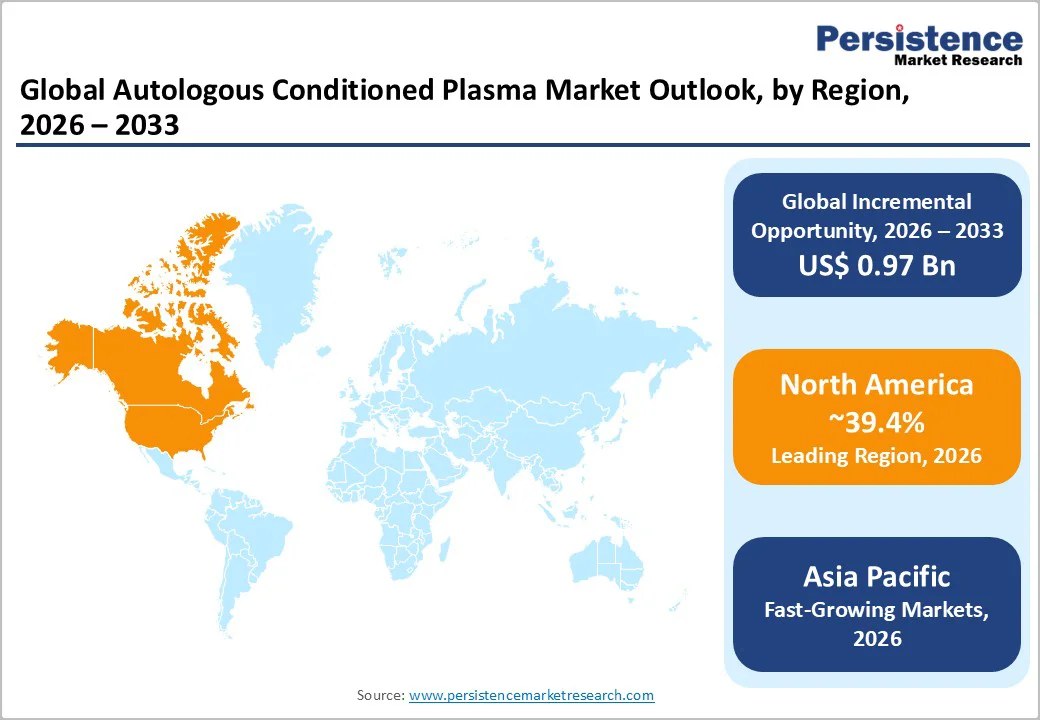

North America accounts for 39.4% of the market share, with the U.S. anchoring regional leadership due to high procedural demand across orthopedic, sports medicine, and aesthetic dermatology practices. Uptake remains strong in clinics specializing in osteoarthritis management, chronic tendinopathies, and non-surgical aesthetic rejuvenation. Regenerative solutions are increasingly incorporated into outpatient conservative treatment pathways for conditions such as rotator cuff injuries and knee cartilage degeneration.

Canada shows rising utilization in sports injury centers and expanding dermatology networks, particularly within private multispecialty chains integrating combination-based biologic therapies. Regulatory oversight in North America ensures rigorous device-quality compliance for autologous biologics. Clinical guidelines emphasize standardized processing protocols, which strengthen demand for automated and closed-system ACP devices. The presence of multiple established device manufacturers supports rapid product availability, strong after-sales service, and frequent technology upgrades.

Recent market activity includes product enhancements focusing on contamination reduction features and digital workflow integration. For example, in early 2025, a U.S.-based manufacturer introduced an upgraded ACP preparation system designed with automated cycle calibration, enabling improved consistency for orthopedic day-care centers. Similarly, several regional distributors expanded their supply networks in mid-2024 to support aesthetic chains scaling ACP-based treatment portfolios.

Europe maintains a stable and mature adoption landscape for autologous conditioned plasma, with wide application in orthopedics, dermatology, and dental regenerative procedures. Germany leads the region due to high outpatient musculoskeletal treatment volumes and broad acceptance of biologics in chronic injury management. The United Kingdom and France demonstrate consistent demand, supported by large aging populations seeking non-surgical therapy options. Spain continues to experience growing utilization in regenerative orthopedic clinics, especially for knee osteoarthritis and post-injury rehabilitation.

Pan-European regulatory initiatives emphasize harmonized safety and quality standards for ACP preparation systems, contributing to uniform adoption across hospitals and private clinics. Training programs hosted by orthopedic associations and dermatology academies have strengthened practitioner familiarity with standardized ACP protocols. Market developments in the region include expanded partnerships between hospital networks and device suppliers to ensure consistent consumables access.

For example, in late 2023, a major European orthopedic group partnered with a device developer to introduce an advanced centrifuge line across its outpatient facilities. In 2024, several aesthetic clinics in France integrated newer closed-system devices featuring enhanced sterility controls to support growing demand for ACP-based facial rejuvenation and hair restoration services.

Asia Pacific continues to register the fastest growth globally, driven by expanding orthopedic procedure volumes, increasing demand for aesthetic medicine, and a surge in sports-related injuries. China records significant traction, supported by the widespread availability of dermatology and regenerative clinics offering ACP-based hair regrowth, scar revision, and joint injection services.

Japan sustains strong utilization supported by advanced healthcare infrastructure and widespread adoption of biologics for knee osteoarthritis and tendon repair. India and ASEAN markets are rapidly expanding as dermatology chains and sports rehabilitation centers introduce ACP into minimally invasive care pathways.

Cost-efficient regional manufacturing capabilities enhance accessibility by lowering equipment and consumables costs. Rising disposable incomes and strong private hospital expansion further support adoption. Educational programs across South Korea, India, and Singapore continue to increase practitioner competency in plasma-based regenerative care. Recent developments include the introduction of compact ACP centrifuge models by regional manufacturers in 2024, targeting mid-sized clinics seeking affordable solutions. In early 2025, a leading aesthetic clinic chain in Southeast Asia announced the rollout of ACP-based combination therapy packages across its centers, which contributed to a spike in demand for closed-system devices with digital processing features.

The global autologous conditioned plasma market is moderately fragmented, comprising established medical device firms and emerging regenerative therapy companies. Leading players hold a significant share through broad distribution networks and robust product portfolios. Competition focuses on automation, processing consistency, and ease of use in hospitals and clinics.

Companies differentiate via compact designs, closed-loop separation, and integrated safety features. Market leaders prioritize innovation in automated systems, expansion into aesthetic and orthopedic centers, cost-efficient devices for outpatient clinics, workflow optimization, clinical education, consumables-based recurring revenue, and integration into broader regenerative treatment offerings.

The autologous conditioned plasma market size in 2026 is estimated at US$0.89 Billion.

By 2033, the autologous conditioned plasma market is projected to reach US$1.86 Billion, supported by the accelerating adoption of regenerative therapies across clinical specialties.

Key trends influencing market expansion include a shift toward automated and closed-system ACP devices for improved sterility and consistency, and rising adoption in aesthetic dermatology, especially for hair restoration and facial rejuvenation.

Centrifuge-Based ACP Systems represent the leading product segment, holding approximately 63% of total market share due to broad use in orthopedic, dermatology, and dental practices.

The autologous conditioned plasma market is expected to grow at a CAGR of 10.7% between 2026 and 2033, reflecting rising clinical adoption of regenerative therapies and expanding availability of advanced ACP processing systems.

The key players include Zimmer Biomet, Terumo Corporation, Arthrex Inc., EmCyte Corporation, and Johnson & Johnson (DePuy Synthes).

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author