ID: PMRREP35696| 188 Pages | 8 Oct 2025 | Format: PDF, Excel, PPT* | Consumer Goods

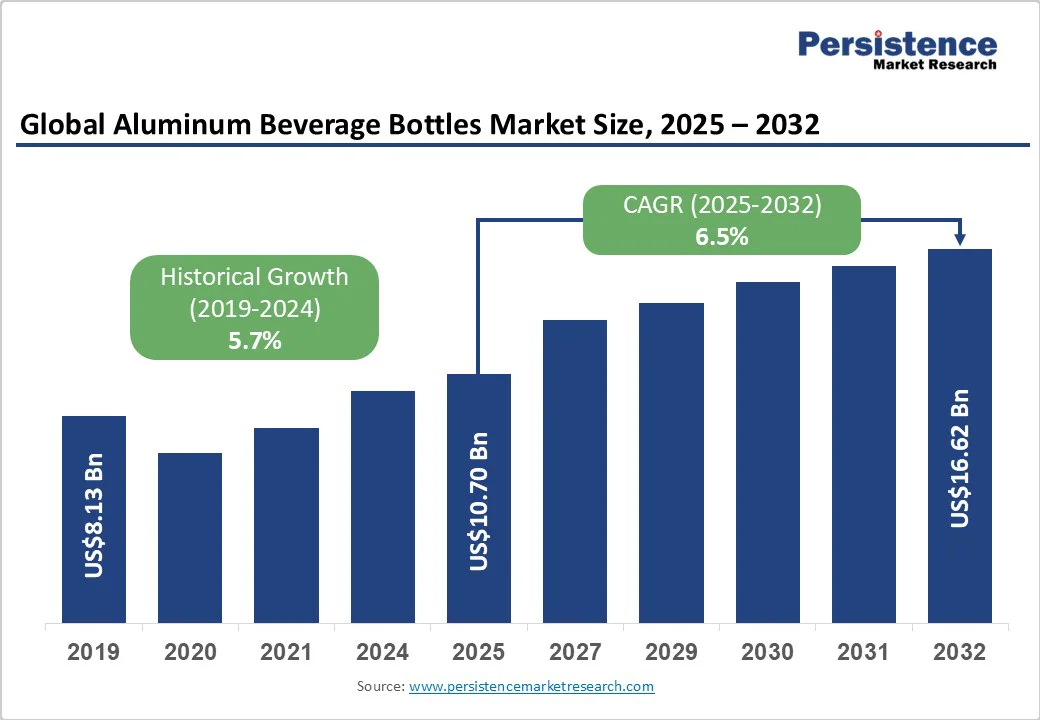

The global aluminum beverage bottles market size is expected to reach US$10.70 billion by 2025. It is expected to reach US$16.62 billion by 2032, growing at a CAGR of 6.5% during the forecast period from 2025 to 2032, driven by increasing sustainability mandates, consumer preference for premium beverages, and technological advancements in manufacturing and lightweighting.

Governments worldwide are emphasizing circularity and recyclability targets, favoring aluminum over PET and glass in beverage packaging. Urbanization and rising disposable incomes in the Asia Pacific are also driving demand for premium ready-to-drink (RTD) and bottled-water products packaged in aluminum.

Key Industry Highlights

| Key Insights | Details |

|---|---|

|

Aluminum Beverage Bottles Market Size (2025E) |

US$10.70 Bn |

|

Market Value Forecast (2032F) |

US$16.62 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.7% |

Governments and regulatory bodies are promoting circular economy principles, mandating higher recycled content and recyclability in beverage packaging. The EU’s Packaging and Packaging Waste Regulation (PPWR) exemplifies this trend, boosting demand for sustainable materials such as aluminum, which requires up to 95% less energy to recycle than to produce from raw materials. Mature markets such as North America and Europe support this shift with advanced recycling infrastructure and deposit-return schemes.

Aluminum bottles benefit from regulatory compliance and align with premiumization trends in segments such as bottled water, RTD tea, and alcoholic mixers. They offer a high-end tactile feel, superior branding potential, and strong thermal performance. RTD beverages are growing at mid- to high-single-digit CAGRs, with brands switching from PET and glass to aluminum for better shelf appeal and pricing power. Technological advances, including lightweighting, high-speed decoration, and improved coatings, combined with economies of scale in Asia, are lowering costs and driving widespread aluminum bottle adoption.

Aluminum price volatility, driven by global shifts in supply and demand, energy costs, and trade policies, poses a significant risk to beverage packagers. Tariffs can raise input costs, compressing margins, especially for smaller manufacturers unable to pass on price hikes due to competition. Additionally, adopting aluminum bottles often requires retooling filling lines to accommodate different closures and coatings.

For small and medium producers, this entails notable capital investment and operational downtime. Integration challenges across supply chains create structural barriers, with conversion costs forming low-to-mid single-digit percentages of plant budgets and payback periods extending over several months.

Aluminum’s recyclability creates opportunities for closed-loop value chains. Beverage brands and packagers can secure high-quality scrap aluminum, reduce energy consumption, and lower production costs while complying with evolving recycled-content mandates. Investments in recycling facilities and secondary smelters not only ensure regulatory compliance but also enhance margins and reduce exposure to volatile primary aluminum prices. The recycled aluminum segment represents a multi-billion-dollar growth opportunity and offers sustainable competitive differentiation for early adopters.

Wide-format printing, anodized finishes, and textured coatings expand aluminum bottle applications beyond standard beverages into premium water, spirits, and lifestyle beverages. Brands that adopt unique bottle designs and high-quality finishes can command premium pricing and improve brand recall. Adoption of reusable aluminum bottles for lifestyle segments and DTC distribution models presents further revenue upside. Market projections indicate that these premium and experiential SKUs are growing faster than mass-market segments, creating an attractive environment for aluminum packaging investment.

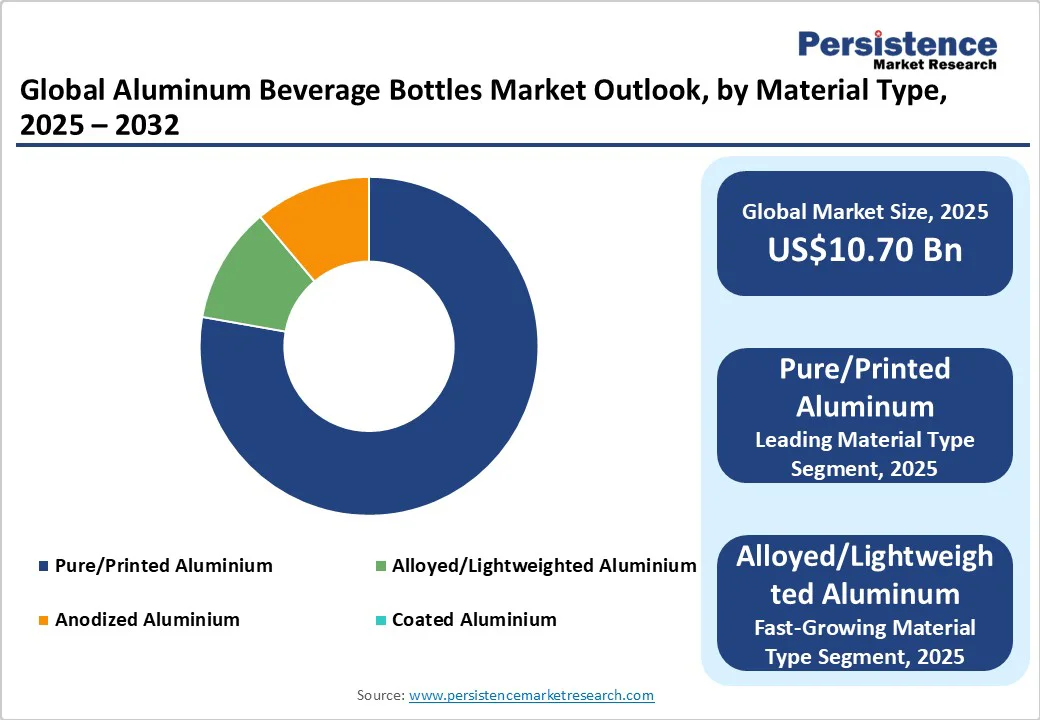

Pure aluminum and printed aluminum bottles dominate the market due to high brand visibility, premium perception, and full-coverage printing capabilities. Printed aluminum bottles are anticipated to account for over 70% of decorated bottle revenue in several key markets. Beverage brands prefer printed bottles to communicate quality, sustainability, and design differentiation. These bottles are prevalent in premium bottled water, craft RTD, and RTD alcoholic beverage segments, where brand premium and merchandising advantages drive adoption.

Alloyed and lightweighted aluminum bottles are gaining market share due to weight reduction, cost efficiency, and high performance. Lightweight bottles improve shipping efficiency and reduce raw material consumption, making them attractive to large-scale beverage producers. Technological advancements in internal coatings and structural integrity are enabling the adoption of these solutions across carbonated and acidic beverage categories. This segment is achieving a higher CAGR than pure aluminum bottles, particularly in high-volume, mass-market applications.

The single-serve segment is dominant in revenue due to its suitability for on-the-go consumption and high consumer adoption. Printed variants enhance brand visibility and allow beverage companies to differentiate their products on retail shelves. Single-serve bottles are widely used in RTD tea, bottled water, and alcoholic mixers, particularly in convenience channels such as stores, vending machines, and e-commerce platforms.

Premium insulated aluminum bottles and larger reusable formats are expanding rapidly, reflecting consumer demand for sustainability and lifestyle-oriented packaging. Refillable bottles and insulated SKUs capture higher margins and enhance brand perception, particularly in premium water and functional beverage categories. Growth is driven by direct-to-consumer channels, specialty retail, and lifestyle brand adoption.

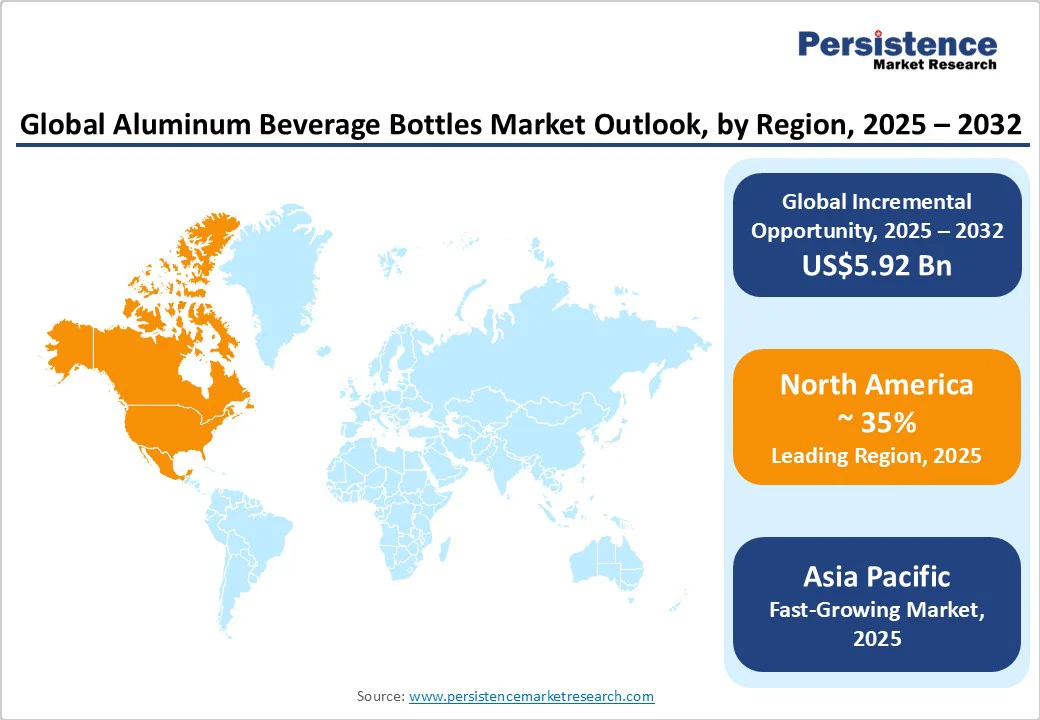

North America accounts for approximately 35% of the global aluminum beverage bottle market, making it one of the largest and most mature regions. This dominance is supported by strong consumer awareness of sustainability, a well-established recycling infrastructure, and evolving regulations aimed at reducing single-use plastics. Major manufacturers continue to invest in innovations such as lightweighting, decorative finishes, and advanced closures. However, cost pressures from aluminum tariffs, particularly in the U.S., pose a challenge, impacting downstream producers and potentially influencing material choices in packaging.

The U.S. leads regional demand, with regulatory support driving a shift from plastic to aluminum. A notable example is the federal government’s plan to phase out single-use plastics in procurement by 2035. In response, beverage giants such as Anheuser-Busch have expanded aluminum bottle production, such as at their Arnold, Missouri, facility. Yet, steep tariffs, reaching up to 50% on imported aluminum, have driven up costs, prompting concerns from companies like Coca-Cola about the long-term viability of aluminum packaging without policy reform.

In Canada, momentum is also building. Consumer preference, paired with supportive government sustainability initiatives, is accelerating the use of aluminum bottles, particularly in premium bottled water and craft beverages. Increased investment in local production and sustainability-aligned branding is further strengthening market growth.

Asia Pacific is the fastest-growing region in the aluminum beverage bottles market, fueled by rapid urbanization, rising disposable incomes, and increasing environmental consciousness. China and India are at the forefront of this expansion, driven by their large populations, growing middle class, and evolving consumer preferences. China leads the region, accounting for over 40% of market share, supported by its extensive manufacturing base and significant government investments in recycling infrastructure. Beverage brands, both domestic and international, are shifting to aluminum packaging, especially for premium and export-oriented products. Innovations in high-resolution printing and custom finishes are targeting younger, brand-conscious consumers, while strong demand from energy drinks and RTD tea segments is expected to drive continued growth through 2035.

India presents a high-growth opportunity, propelled by urbanization, expanding retail networks, and the rise of premium beverage categories. Aluminum bottles are gaining popularity for premium bottled water, functional beverages, and organic drinks, valued for their branding potential and sustainability appeal. While challenges remain in recycling infrastructure and logistics, favorable demographics and evolving policy support position India for long-term growth in aluminum beverage packaging. As environmental concerns rise across the region, aluminum bottles are increasingly viewed as a sustainable and high-impact solution for future beverage packaging.

Europe remains at the forefront of sustainable packaging, with aluminum beverage bottles gaining momentum as part of the region’s efforts to achieve its circular economy goals. Driven by regulations such as the EU Packaging and Packaging Waste Directive, manufacturers are increasingly turning to recyclable and reusable formats. Aluminum bottles are particularly prominent in the premium segment, including craft beers, sparkling waters, and functional drinks, due to their sustainability credentials and design versatility.

Germany leads the European aluminum bottle market, supported by a robust recycling infrastructure, high consumer environmental awareness, and alignment with the EU sustainability targets. Brands across the beverage and personal care sectors are leveraging aluminum bottles as eco-friendly branding tools. Innovations in decorative printing and customizable designs further support growth, particularly in premium product lines. With stricter packaging waste regulations on the horizon, aluminum is poised to replace less sustainable alternatives in several categories.

In the U.K., policies such as Extended Producer Responsibility (EPR) and growing concerns about plastic waste are accelerating the adoption of aluminum bottles. Brands are embracing aluminum not only for its environmental advantages but also for its premium, visually appealing packaging. Products such as mineral water, energy drinks, and hard seltzers are increasingly offered in aluminum bottles, especially in health-conscious and convenience retail channels. Regulatory backing and consumer demand are expected to drive steady market growth.

The global aluminum beverage bottles market is moderately fragmented, with competition driven by innovation in design, sustainability, and supply chain integration. Key players such as Ball Corporation, Trivium Packaging, Ardagh Group, and EXAL Corporation lead the market by offering high-quality, decorative, and recyclable aluminum bottles tailored to premium beverage segments. Upstream aluminum suppliers such as Novelis and Constellium SE play a strategic role by ensuring consistent material availability and supporting lightweight, low-carbon packaging.

Companies, including CCL Container and Amcor, are strengthening their positions through acquisitions and integrated packaging solutions that combine rigid and flexible offerings. Competitive differentiation is shaped by the ability to offer customization, meet regulatory requirements for sustainability, and maintain cost efficiency amid volatile aluminum prices. Regional and niche manufacturers, particularly in Asia Pacific and Europe, are also gaining ground by leveraging local market knowledge, agility, and cost advantages.

By Material Type

By Product Type

By End-user

By Region

The market size was valued at US$10.70 Billion in 2025.

By 2032, the aluminum beverage bottles market is projected to reach US$16.62 Billion.

Key trends include lightweighting technologies, premium reusable formats, sustainability-driven packaging adoption, and digital printing advancements.

Pure/Printed aluminum bottles lead the material type category, while the beverage industry remains the largest end-use sector.

The aluminum beverage bottles market is projected to grow at a CAGR of 6.5% from 2025 to 2032.

Major players include Ball Corporation, Crown Holdings, CCL Container, Ardagh Group, and EXAL Corporation.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author