ID: PMRREP35623| 188 Pages | 17 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

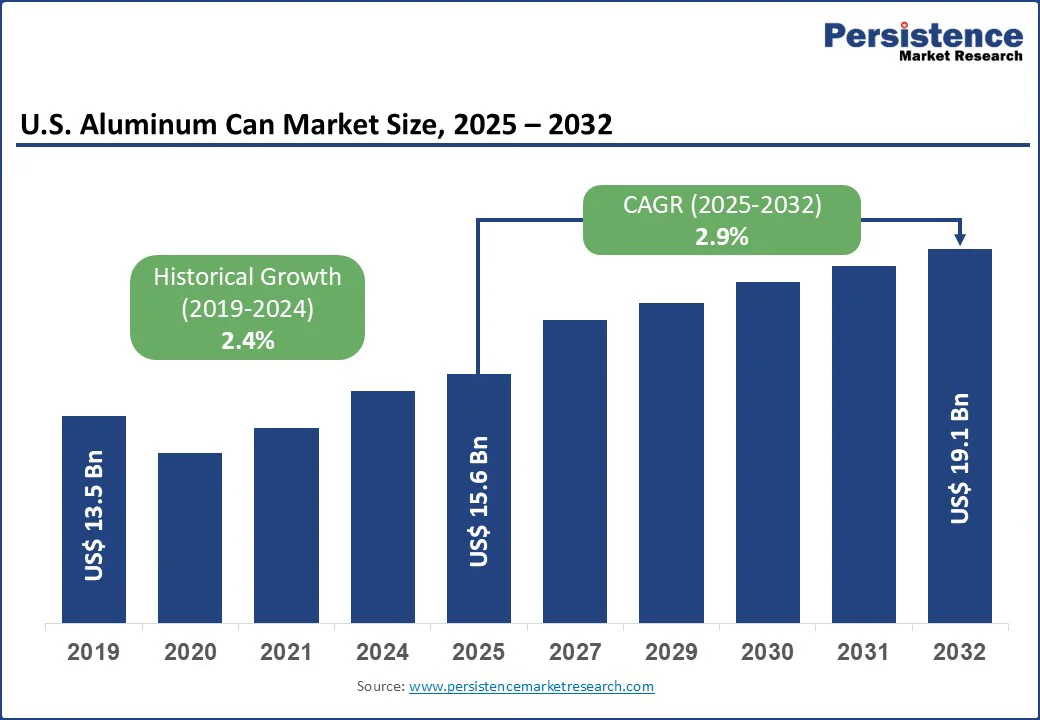

The U.S. aluminum can market size is expected to be valued at US$15.6 Bn in 2025 and is projected to reach US$19.1 Bn, growing at a CAGR of 2.9% during the forecast period from 2025 to 2032 due to the ever-increasing need for sustainable, cost-effective, and versatile packaging solutions across the food and beverage sector.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Market Size (2024A) | US$ 15.2 Bn |

| Estimated Market Size (2025E) | US$ 15.6 Bn |

| Projected Market Value (2032F) | US$ 19.1 Bn |

| Value CAGR (2025 to 2032) | 2.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 2.4% |

Sustainability has become the most powerful force shaping the U.S. packaging sector, with aluminum standing out as a circular economy material. The U.S. Environmental Protection Agency reports that recycling this metal conserves up to 95% of the energy used in primary smelting, which directly reduces greenhouse gas emissions and landfill volumes.

This unmatched efficiency positions it as a critical solution for brands seeking eco-friendly consumer packaging and climate-focused commitments.

The chemical industry advances this transition by developing smelting technologies that enable secondary aluminum to dominate U.S. production, now representing more than 80% of the domestic supply.

Beverage and food companies leverage this closed-loop recycling system to meet corporate sustainability goals, while high recovery rates enhance the value chain’s carbon reduction strategies. With more than three-quarters of all aluminum ever produced still in use today, the U.S. market benefits from a proven model of resource efficiency that delivers environmental, economic, and industrial resilience.

Fluctuating raw material costs present a significant restraint for the U.S. Aluminum Can market, affecting production stability and supply chain efficiency. In 2023, domestic primary aluminum production declined by 13% due to reduced operational capacity across three smelters, while two operated at full capacity.

The permanent closure of a Ferndale, WA smelter and temporary shutdown of the Hawesville, KY facility further tightened domestic supply. This constrained availability, combined with the 15% decrease in average annual U.S. market price, created uncertainty for manufacturers relying on consistent aluminum feedstock.

The volatility in primary aluminum prices directly impacts packaging production costs, including cans, where aluminum forms the core material. Secondary production from recycled scrap remained stable, but it could not fully offset primary supply shortages.

Transportation and operational expenditures also increased pressure on manufacturers, as packaging accounted for 22% of domestic aluminum consumption. Technological adjustments in smelting and recycling helped mitigate some supply gaps, but cost fluctuations continue to challenge market stability and profitability.

Uncertainty in raw material prices hinders strategic planning and investment in new production capacities for U.S. packaging manufacturers. The market faces pressure to balance production efficiency with material cost management, limiting long-term stability and growth opportunities.

The U.S. beverage sector is experiencing a significant shift driven by consumer preference for Ready-to-Drink (RTD) beverages and specialty drinks such as craft beers, hard seltzers, energy drinks, and sparkling waters. This evolving demand has intensified the need for innovative and versatile packaging solutions, positioning Aluminum Cans as a sustainable and high-performance option.

Market developments, including Ardagh Group introducing a 19.2 oz. single-serve cans in North America demonstrate the growing opportunity for beverage manufacturers to differentiate their offerings through unique can sizes while leveraging high recyclability and shelf appeal.

Technological advancements in internal coating and production efficiency are enhancing beverage shelf life, taste preservation, and packaging durability, supporting the adoption of Aluminum Cans for premium and functional beverages.

Strategic supply agreements, such as Novelis providing high-quality aluminum sheet to North American producers, ensure consistent material availability for beverage can production. These trends reflect the potential for Aluminum Cans to capture increasing demand in specialty and RTD segments, reinforcing their role in sustainable packaging solutions. The opportunity lies in aligning innovative can formats with consumer-driven product diversification, ensuring both performance and environmental compliance.

The U.S. aluminum can market is increasingly focusing on lightweighting and advanced can design innovations to enhance sustainability, recyclability, and operational efficiency. Beverage companies are adopting high-performance aluminum alloys, eco-design, and digital printing technologies to create lighter, durable cans that reduce material usage and lower carbon emissions.

Programs such as Twenty by 30 emphasize circular economy solutions, energy-efficient manufacturing, and measurable sustainability goals, positioning Aluminum Cans as both environmentally responsible and high-performance packaging solutions. Technological advancements in lightweight construction, recyclable materials, and smart can designs are transforming production and supply chain efficiency.

Collaborative initiatives such as the Global Aluminium Can Sustainability Summit and partnerships with the Aluminium Stewardship Initiative (ASI) and Metal Packaging Europe accelerate eco-friendly solutions.

Regulatory measures such as the European Packaging and Packaging Waste Regulation (PPWR) and Deposit Return Schemes (DRS) further promote recycling efficiency and material optimization. Lightweighting and design innovation now form the core of U.S. beverage packaging strategies, ensuring Aluminum Cans deliver energy-efficient production, high recyclability, and strong sustainability credentials while supporting brand differentiation and circular manufacturing goals.

Two-piece Aluminum cans dominate the U.S. Aluminum can industry likely to account for 75% share due to their high durability, lightweight construction, and suitability for high-speed beverage can production lines.

These two-piece beverage cans are widely used for carbonated soft drinks, craft beers, energy drinks, and ready-to-drink beverages, making them the preferred choice for major U.S. beverage manufacturers seeking operational efficiency, cost-effective aluminum packaging, and sustainable material usage.

Innovations in precision can forming, high-speed can assembly, and lightweight can technology have strengthened the adoption of two-piece cans while minimizing production waste and material costs.

Three-piece cans account for approximately 20% of the market, primarily in specialty food and beverage applications requiring shelf stability and extended storage life, while one-piece cans represent about 5%, catering to niche beverage and food packaging needs.

Regional investments in Midwest aluminum can manufacturing hubs enhance production capacity, logistics efficiency, and supply chain robustness, reinforcing the two-piece segment’s leading position in the U.S. market.

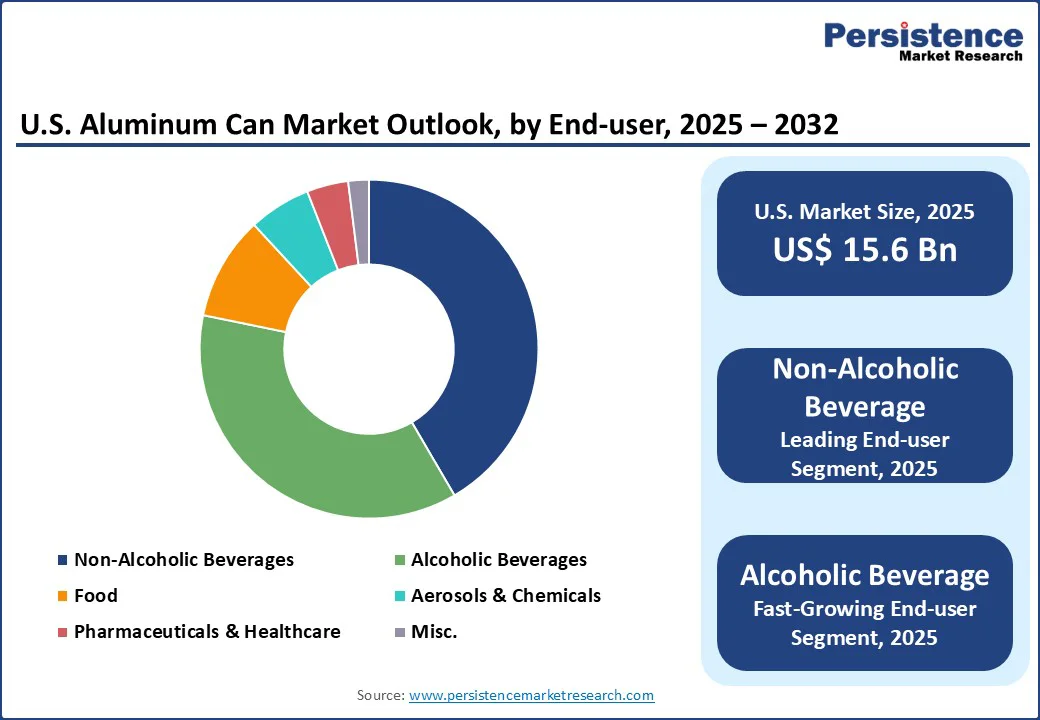

The non-alcoholic beverage segment holds a share of around 42% in 2025, driven by growing consumer preference for wellness drinks, sparkling beverages, and low-alcohol options packaged in recyclable aluminum. Zooz, entering the U.S. market with its mushroom-based wellness drinks in this format, exemplifies the rising trend toward functional soft drinks.

The use of high-recycled content material, such as Novelis evercan™ with 90% recycled input, further enhances sustainability, positioning the packaging as a preferred solution for eco-conscious consumers. Beverage manufacturers are leveraging lightweight, durable, and portable cans to meet evolving consumer demands while ensuring operational efficiency and environmental compliance.

TÖST Beverages introduction of ready-to-drink 250-ml cans highlights the shift toward versatile, single-serve formats. Despite fluctuations in demand, reflected by Ball Corp’s temporary production halts in Phoenix and St. Paul, the segment benefits from strategic regional production hubs and a resilient supply chain, underlining the pivotal role of this packaging in supporting the U.S. non-alcoholic beverage industry.

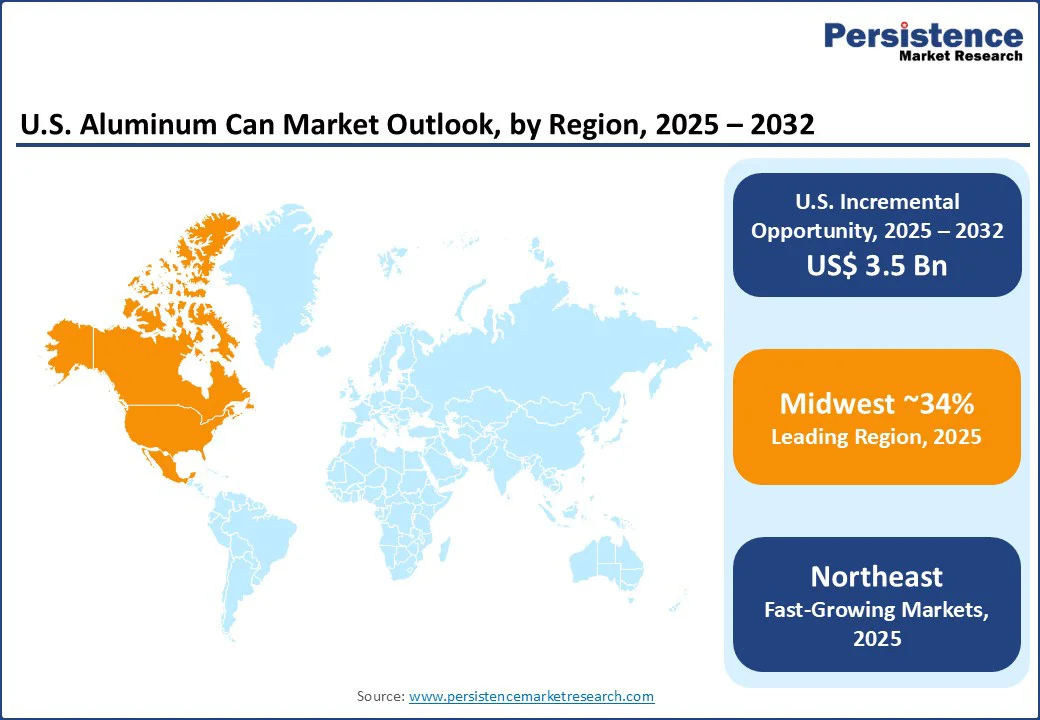

The Midwest region holds a market share of around 34.5% in the U.S. Aluminum Can market, driven by its strong presence in beverage manufacturing, food processing, and beverage packaging industries.

The region is a major hub for high-volume aluminum can production, supported by advanced can manufacturing facilities, precision forming technologies, and efficient supply chain networks. Import tariffs and regional aluminum premiums, currently around USD 850 per tonne, influence procurement strategies and just-in-time inventory management for beverage and food producers.

The Midwest’s logistical advantages, proximity to large consumer bases, skilled labor pool, and strategic production capacity reinforce its role as a dominant center for aluminum beverage cans, craft beer cans, carbonated drink packaging, and ready-to-drink beverage cans.

The Northeast region holds a market share of around 23.4% in the U.S. Aluminum Can market, driven by strong demand from beverage manufacturing, craft breweries, and food and beverage processing industries.

The region has faced supply challenges due to high demand, particularly impacting small-scale and mid-sized beverage producers. The new production facility in Nashua by KJ Can USA, supported by G3 Enterprises, is expected to produce hundreds of millions of cans annually, ensuring a stable supply for regional beverage companies.

Strategic advantages such as proximity to major urban markets, logistics efficiency, and domestic aluminum sourcing further strengthen the Northeast as a key hub for beverage packaging, carbonated drink containers, and craft beer cans.

The U.S. Aluminum can market is oligopolistic, dominated by a few leading manufacturers controlling substantial production capacity and market influence. Crown Holdings Inc., Ball Corporation, Ardagh Group S.A., and Silgan Containers LLC lead the sector with expertise in multiple can technologies and packaging formats, serving major beverage and food companies across the country.

Mid-tier companies such as Can-Pack Group, Toyo Seikan Co., Ltd., Nampak Ltd., CCL Industries Inc., and CPMC Holdings Inc. operate in regional markets, providing specialized production and supporting mid-sized beverage and food producers. Smaller manufacturers, including Tecnocap S.p.A., SAPIN K.S.A., Massilly Holding SAS, Casablanca Industries, and Al-can Exports Pvt. Ltd., focus on niche applications with limited production and distribution reach.

The U.S. Aluminum Can market is projected to be valued at US$15.6 billion in 2025.

The Non-Alcoholic Beverage segment is projected to capture 42% of the U.S. Aluminum Can market in 2025, driven by rising demand for carbonated soft drinks, energy drinks, and ready-to-drink products.

The market is poised to witness a CAGR of 2.9% from 2025 to 2032.

A strong sustainability push drives aluminum can demand in the U.S., as brands embrace high recycling efficiency, circular economy benefits, and climate commitments to make it the preferred packaging choice.

Ready-to-Drink (RTD) and specialty beverages create major opportunities in the U.S. Aluminum Can market, as demand for craft beers, hard seltzers, energy drinks, and sparkling waters drives the need for innovative, sustainable, and versatile packaging solutions.

Key players in the U.S. Aluminum Can Market include Ball Corporation, Crown Holdings Inc., Ardagh Group S.A., Silgan Containers LLC, and Can-Pack Group. and others

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available for | 2019 to 2024 |

| Market Analysis | US$ Million for Value |

| Key Regions Covered |

|

| Key Companies Covered |

|

| Report Coverage |

|

By Can Type

By Volume Capacity

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author