- Executive Summary

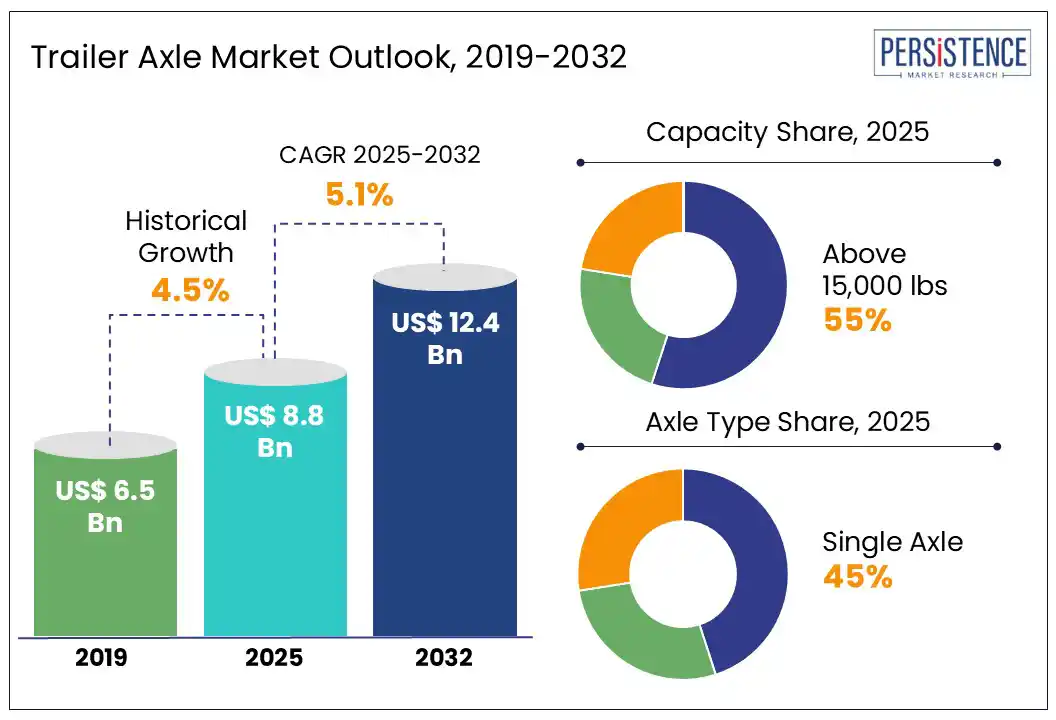

- Global Trailer Axle Market Snapshot 2025 and 2032

- Market Opportunity Assessment, 2025-2032, US$ Bn

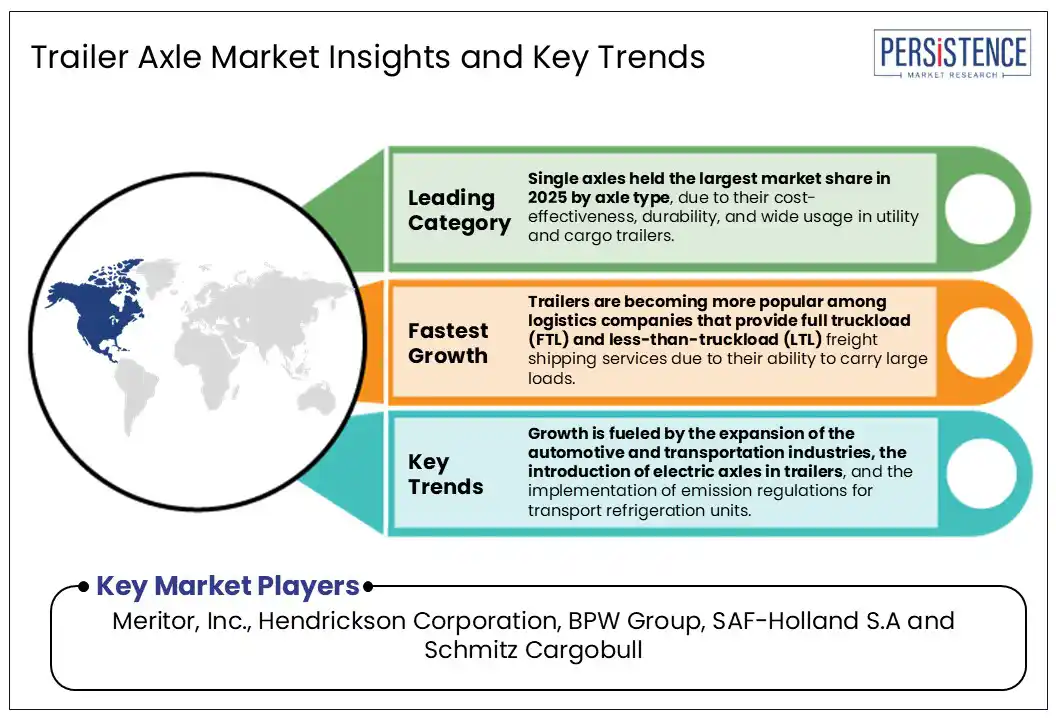

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Automotive Industry Overview

- Global Construction Industry Overview

- Forecast Factors - Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 - 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Global Trailer Axle Market Outlook: Capacity

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Capacity, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- Market Attractiveness Analysis: Capacity

- Global Trailer Axle Market Outlook: Axle Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Axle Type, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- Market Attractiveness Analysis: Axle Type

- Global Trailer Axle Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Application, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- Market Attractiveness Analysis: Application

- Global Trailer Axle Market Outlook: Sales Channel

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Sales Channel, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- Market Attractiveness Analysis: Sales Channel

- Global Trailer Axle Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Region, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- U.S.

- Canada

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- Europe Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- East Asia Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- South Asia & Oceania Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- Latin America Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- Middle East & Africa Trailer Axle Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Capacity, 2025-2032

- Upto 8,000 lbs

- 8,000 - 15,000 lbs

- Above 15,000 lbs

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Axle Type, 2025-2032

- Single Axle

- Tandem Axle

- Three or more than Three Axle

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Application,2025-2032

- Lightweight Trailers

- Medium-Weight Trailers

- Heavy Trailers

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Sales Channel, 2025-2032

- OEM

- Aftermarket

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Meritor, Inc.

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Hendrickson Corporation

- BPW Group

- SAF-Holland S.A

- Guangdong Fuwa Engineering Group Co., Ltd.

- Schmitz Cargobull

- Gigant - Trenkamp & Gehle GmbH

- Guangzhou TND Axle Co., Ltd.

- Redneck Trailer Supplies

- JOST Axle Systems

- York Transport Equipment (Asia) Pte Ltd.

- H D TRAILERS PVT LTD

- Rogers Willex

- Dexter Axle Company

- Meritor, Inc.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment