ID: PMRREP33034| 200 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Automotive & Transportation

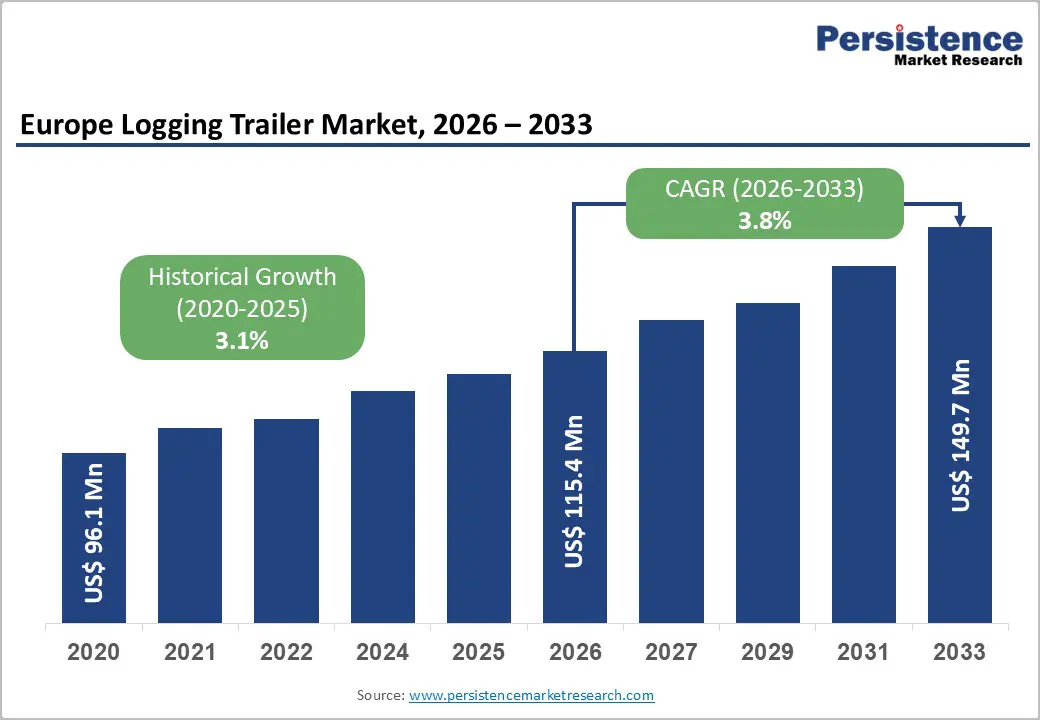

Europe logging trailer market is likely to be valued at US$ 115.4 million in 2026 and is projected to reach US$ 149.7 million by 2033, growing at a CAGR of 3.8% between 2026 and 2033.

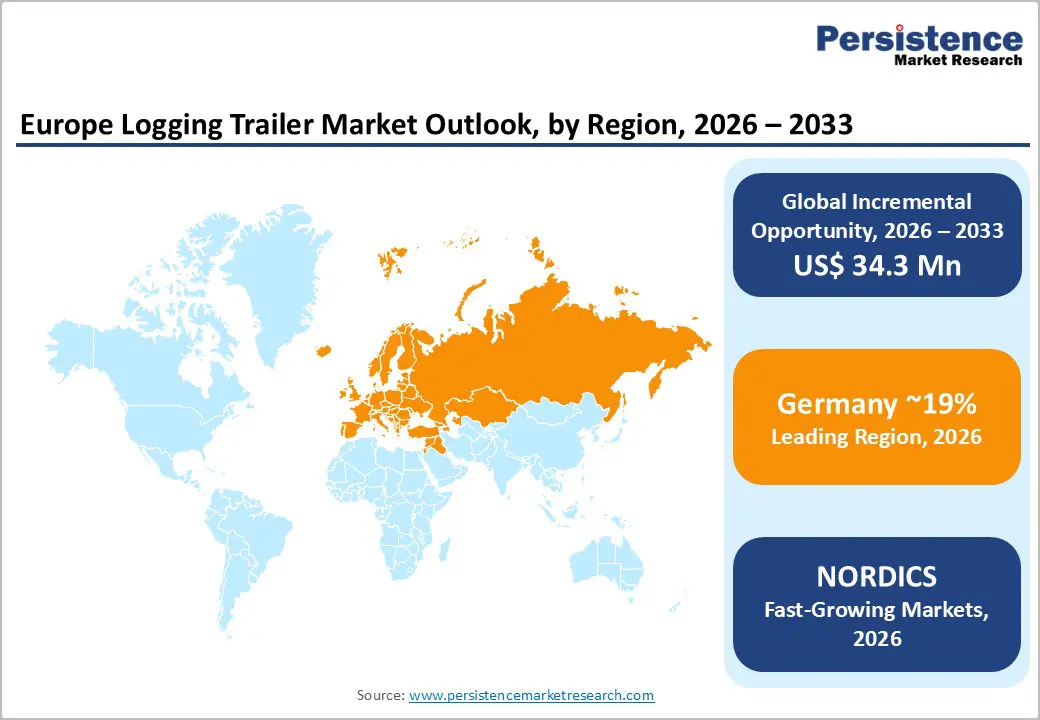

Market expansion is driven by sustained European timber demand supporting renewable construction materials adoption, advancing forestry mechanization requiring sophisticated trailer capabilities for complex terrain navigation, and progressive environmental regulations mandating low-carbon logistics solutions across timber supply chains. Germany maintains market dominance with 19% regional share, leveraging advanced manufacturing and premium vehicle production, while France and Nordic countries demonstrate strong momentum driven by sustainable forestry practices and electrification initiatives supporting decarbonization objectives across the continent.

| Key Insights | Details |

|---|---|

| Europe Logging Trailer Market Size (2026E) | US$ 115.4 million |

| Market Value Forecast (2033F) | US$ 149.7 million |

| Projected Growth CAGR (2026 - 2033) | 3.8% |

| Historical Market Growth (2020 - 2025) | 3.1% |

European sustainable forestry practices and rising demand for renewable construction materials are primary growth catalysts, as global wood production exceeds 2.1 billion cubic meters annually and European forestry generates nearly 80 million tonnes of raw materials transported each year, sustaining demand for specialized logging trailer infrastructure enabling efficient timber logistics. European Union circular economy initiatives, green building certification requirements, and shifting consumer preferences toward sustainable timber products are systematically increasing demand for certified wood transportation solutions. Forestry management emphasizing sustainable yield optimization, reforestation, and carbon sequestration ensures stable harvest volumes requiring advanced logistics capabilities. Major forestry regions across the Nordics, Germany, France, and Central Europe maintain extensive managed forest estates supporting commercial operations under balanced conservation policies. Investments in certified transportation assets are becoming competitive differentiators, with logistics providers adopting specialized trailers supporting traceability, load integrity, and supply chain movement.

European Union climate law mandating a 55% net emissions reduction by 2030 and decarbonization of heavy transport are creating opportunities for forestry trailer suppliers developing electric and hybrid propulsion solutions and low-carbon logistics capabilities. Nordic countries, Finland and Sweden, are advancing pilot electrification initiatives, with Sweden’s TREE program targeting 50% of new forest trucks to be electric by 2030 alongside charging network investments across timber regions. Scania’s deployment of electric logging trucks demonstrates technical feasibility, with pilot operations delivering annual CO2 reductions of around 170 tonnes versus diesel alternatives. European automotive suppliers and forestry equipment manufacturers are progressing electric and hybrid trailer concepts enabling the transition toward zero-emission logistics. Government innovation funding, including Swedish Vinnova support and EU-funded Accelerating Climate Efforts programs, is reducing commercialization risk. Corporate sustainability commitments from timber producers and logistics operators reinforce electrification as essential for EU compliance.

Logging trailer manufacturing and deployment involve high capital requirements, as specialized forestry trailers command premium pricing due to advanced engineering, reinforced structures, and features exceeding conventional highway trailer capabilities, constraining replacement cycles among cost-sensitive operators. Electric timber truck programs add further capital intensity, with Scania’s electrified logging truck requiring significant R&D and pilot investments that deter adoption by smaller forestry firms. Charging infrastructure for electrified timber transport presents additional cost barriers, lagging vehicle rollout. Financing constraints facing small contractors delay upgrades despite performance benefits. Supply chain disruptions and volatility in steel, hydraulics, and electronics elevate production costs, compressing margins and sustainability.

European logging trailer operations face complex regulatory frameworks covering transport rules, vehicle safety standards, environmental compliance, and forestry-specific protocols, creating high compliance burdens and limiting manufacturing flexibility across diverse markets. EU vehicle approval and homologation processes extend development timelines and raise engineering costs tied to regulatory adherence. National forestry regulations, timber transport restrictions, weight limits, and axle-load rules vary widely, forcing manufacturers to design multiple product variants. Environmental requirements covering emissions, noise, and fuel efficiency impose lifecycle compliance costs. Equipment standardization initiatives and industry technical specifications restrict differentiation, reducing pricing autonomy within increasingly commoditized market segments across European forestry logistics.

Forestry equipment manufacturers developing premium logging trailers with advanced suspension systems, automated loading mechanisms, telemetry capabilities, and specialized features addressing high-value timber operations and complex terrain challenges represent significant market opportunities supporting differentiated positioning and improved profit margins. Telematics and real-time fleet monitoring capabilities are emerging as value-added features supporting remote timber operations, improving operational efficiency, and enabling predictive maintenance, reducing downtime.

Automated securing and lashing systems represent feature differentiation opportunities, improving safety, reducing operator exposure to hazardous environments, and supporting competitive positioning among safety-conscious operators. Lightweight composite materials and advanced steel alloys enable weight reduction improving fuel efficiency and load carrying capacity without sacrificing structural integrity, creating performance differentiation opportunities. Specialized trailer configurations supporting specific timber types, regional harvesting patterns, and supply chain requirements enable customization supporting premium pricing and long-term customer relationships.

European timber trade expansion, driven by renewable construction material adoption and deeper cross-border supply chain integration, creates opportunities for logistics providers developing trailer solutions enabling international timber transportation, customs compliance, and multimodal logistics connectivity. Growing intra-European timber flows require trailers compatible with road, rail, and port handling systems, supporting efficient cross-border movement. German, French, and Central European timber regions, supported by extensive forest estates, sawmills, and processing infrastructure, represent major demand centers for specialized trailer suppliers serving regional supply chains. Compliance with EU Timber Regulation, including illegal logging prevention, chain-of-custody verification, and sustainable sourcing documentation, is increasing demand for trailers supporting traceability, digital documentation, and inspection readiness across distribution networks. These requirements favor modern trailer platforms enabling transparency, regulatory compliance, and reliable integration within increasingly complex European timber trade ecosystems. This dynamic supports investment and capacity expansion across logistics operators.

Medium capacity logging trailers representing 16 to 30 ton payload capacity command 46% of European market share, representing the dominant specification for diverse forestry operations balancing load capacity, terrain mobility, and operational flexibility across varied European forestry regions. Medium-capacity trailers enable efficient timber transport from forest harvesting sites to intermediate processing facilities, supporting standard forestry workflows and conventional forest road infrastructure. This capacity class demonstrates broad suitability across forestry operation scales from small family-owned operations to larger commercial timber producers, creating a substantial installed base and high replacement demand.

Large-capacity trailers exceeding 30-ton payloads are emerging as a key growth segment, expanding at 3.6% CAGR, driven by logistics efficiency gains, direct long-haul transport from forests to processing facilities, and cost pressures favoring higher payloads per trip. Expanding inter-regional timber trade and applications such as wood-chip transport and industrial processing further support demand for specialized ultra-high-capacity highway trailer configurations globally.

Highway logging trailers command 58% share, driven by emphasis on long-distance timber transport, integrated European timber supply chains, and highway infrastructure supporting efficient inter-regional wood product movement across the continent. Modern European forestry supply chains incorporate substantial long-haul transport components, with timber moving from regional harvesting operations toward central processing facilities and export terminals, requiring highway-capable trailers optimized for road infrastructure and regulatory compliance.

Off-road timber trailers expand at 3.7% CAGR, driven by forestry mechanization, growing use of specialized forest equipment requiring transport, and complex terrain forestry operations in Alpine, Scandinavian, and Central European regions requiring robust off-road capabilities. Sustainable forestry practices emphasizing selective harvesting and integrated forest management create sustained demand for mobile equipment transportation and specialized terrain navigation.

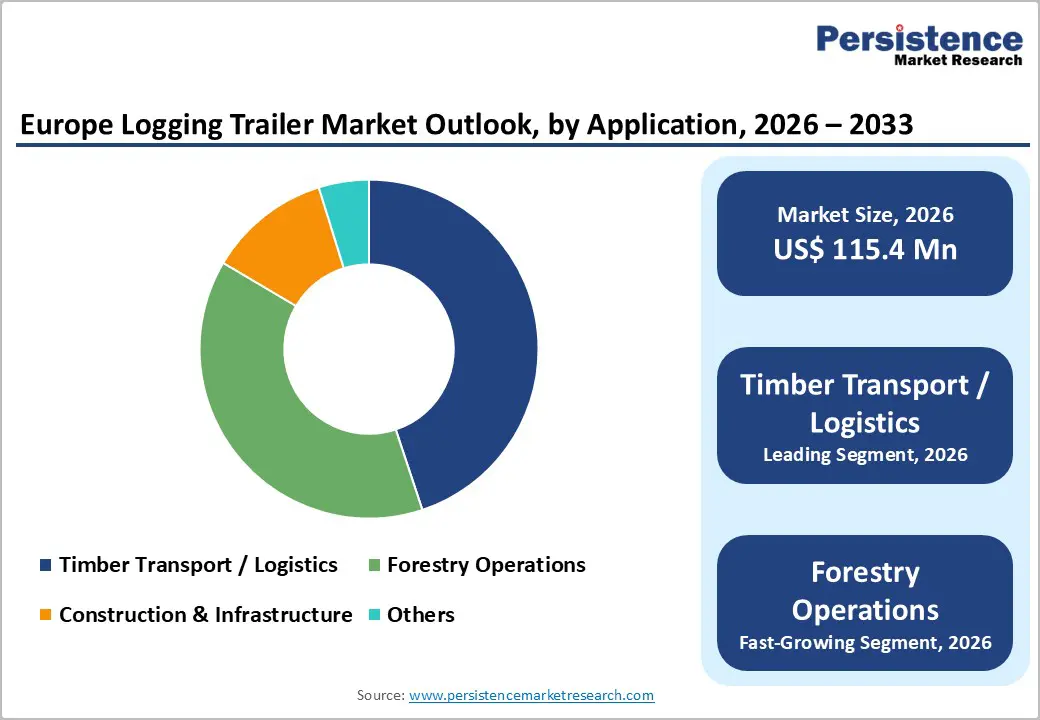

Timber transport and logistics represents the dominant application, commanding 45% volume, as the fundamental logistics function connecting forest harvesting operations with regional and international timber markets, sawmills, and processing facilities. European timber logistics infrastructure is systematically modernizing to support efficient supply chains, renewable material adoption, and cross-border trade facilitation, creating sustained trailer demand across diverse geographic regions.

Forestry operations represent the fastest-growing application segment, expanding at 3.4% CAGR, driven by mechanized forestry practices, equipment mobilization requirements, and specialized machinery transport supporting modern timber harvest and forest management operations. Advanced forestry equipment including harvesting machines, forwarding equipment, and specialized processing systems require specialized transport solutions supporting operational mobility and regional deployment flexibility.

Germany maintains a significant share within Europe's logging trailer market, driven by sophisticated manufacturing capabilities, premium vehicle production traditions, and substantial Central European timber supply chains supporting integrated forestry-to-processing workflows. German automotive and commercial vehicle manufacturers leverage precision engineering expertise and advanced manufacturing infrastructure supporting premium forestry trailer development. German timber processing industry, concentrated in Bavaria and other forest-rich regions, creates sustained demand for specialized logistics equipment optimizing supply chain efficiency. German regulatory framework emphasizing vehicle safety, environmental compliance, and equipment standardization supports premium product positioning for suppliers meeting rigorous German quality standards. Industry partnerships between forestry associations, equipment manufacturers, and logistics providers create collaborative ecosystem supporting technology advancement and market development. Investment in electrification initiatives and sustainable transport infrastructure positions Germany as innovation leader supporting emerging zero-emission forestry logistics technologies.

France holds approximately 15% of the European logging trailer market, underpinned by sustainable forestry management practices, extensive managed forest estates, and consistent timber production across regions such as Nouvelle-Aquitaine, Grand Est, and Bourgogne-Franche-Comté. The country benefits from a well-established forestry and wood-processing ecosystem encompassing harvesting, sawmilling, pulp, and bioenergy applications, supporting steady demand for specialized timber transport equipment. France’s domestic forestry equipment manufacturing and engineering capabilities strengthen local supply chains, reduce dependence on imports, and enable adaptation to national transport and safety regulations. Public policies emphasizing sustainable forest management, reforestation, and renewable construction materials reinforce long-term timber harvesting stability. Growing inter-regional timber flows within France and cross-border trade with neighboring European markets further support demand for high-capacity, highway-compliant logging trailers optimized for efficiency, traceability, and regulatory compliance, and resilient investment outlook across public and private forestry logistics stakeholders nationwide growth.

Nordic countries including Sweden, Finland, and Norway demonstrate the strongest growth momentum at 4.9% CAGR, supported by world-leading sustainable forestry practices, extensive managed forest estates, and high, stable timber harvest volumes. The region benefits from early adoption of mechanized harvesting, digital fleet management, and advanced trailer engineering tailored to harsh operating conditions. FTG Group, through its Moheda, Mowi, and Källefall brands, holds a dominant market position as the clear regional leader in forest trailers, serving domestic forestry operations and European export demand. Strong government backing further reinforces growth, with Sweden’s TREE program and Finland’s electrification pilot initiatives accelerating development of electric, hybrid, and low-emission forestry transport solutions. These coordinated policy, industrial, and innovation ecosystems position the Nordics as Europe’s primary testbed and commercialization hub for next-generation forestry logistics technologies, supporting long-term competitiveness and sustained capital investment across regional supply chains.

Europe logging trailer market shows moderate consolidation, led by Nordic specialists and supported by German and Central European manufacturers serving varied forestry applications. FTG Group dominates Nordic regions through strong relationships, broad portfolios, and technical expertise. German players leverage precision engineering, while independent regional manufacturers compete through customization, service excellence, and niche application specialization supporting diverse forestry requirements.

Europe logging trailer market was valued at US$115.4 million in 2026 and is projected to reach US$149.7 million by 2033.

Growth is fueled by sustainable forestry and renewable timber demand, increasing mechanization for complex forest operations, and EU climate policies accelerating low-emission and electric timber transport solutions.

The market is expected to grow at a 3.79% CAGR from 2026 to 2033.

Electrification-ready trailers, premium technology integration such as telematics and automation, and expanding cross-border timber trade offer strong opportunities for differentiation and margin growth.

The market is led by FTG Group in the Nordics, supported by German specialists like Kässbohrer and Schwarzmüller, with Scania and Volvo Trucks driving integrated and electric timber transport solutions.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Size/Capacity

By Trailer Type

By Application

By Country

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author